The Art Basel and UBS Global Art Market Report 2024: Key Insights and Trends

A Comprehensive Overview of the Global Art Market in 2023, with Implications for the Luxury Watch Market

The Art Basel and UBS Global Art Market Report 2024, authored by economist Dr. Clare McAndrew, offers a comprehensive look at the performance of the global art market in the last year. I previously covered art market insights which seemed to go down well; Based on that, I decided to run with this now, despite it being a couple of months old. It took a while to parse, but I think the insights remain valuable!

We will cover some high-level insights and key messages first, then go into the implications for the watch industry, and finally move on to two deep-dive sections -dealers and auctions - for those who want to get into more detail.

Despite facing various challenges, including high interest rates, inflation, and political instability, the art market demonstrated remarkable resilience, with global sales reaching an estimated $65 billion, surpassing pre-pandemic levels ($64.4bn).

Key Findings and Market Performance

The report highlights several key findings, including the decline in sales value by 4% year-on-year, primarily due to slower trading at the high end of the market. However, the volume of transactions grew by 4%, driven by the relative buoyancy of lower-priced sales. Both public auction and dealer sales decreased, with auctions experiencing a more severe decline of 7% compared to a 3% drop in dealer sales.

One of the most striking findings of the report is the dramatic shift in the balance of power among the world’s leading art markets. China, once trailing behind the United States and the United Kingdom, made a stunning comeback in 2023, solidifying its position as the second-largest art market globally with its share of sales by value rising to 19%, behind the US at 42%. This resurgence was fueled by the eagerness of post-lockdown buyers, who enthusiastically hoovered up postponed auction inventories from the previous year. As Dr. McAndrew notes, “China’s art market rally against the declining trend, increasing by 9% to an estimated $12.2 billion, is a testament to the enduring passion and resilience of Chinese collectors.”

The report did caution the sustainability of China’s art market growth remained uncertain, as the second half of 2023 saw a noticeable slowdown in activity. Experts cite concerns over weaker economic growth projections and the persistent real estate slump as potential factors weighing on demand.

Regional Market Performance

After a robust recovery to reach a record high of $30.2 billion in 2022, the US market declined by 10% to $27.2 billion in 2023. The US remained the key center worldwide for sales of the highest-priced works of art, and while 2022 was a record year for high-end auction sales, the decline in 2023 reflected thinner trading at the top, leaving the market just below its level in 2019.

The United States and the United Kingdom experienced declines in their art market sales, primarily due to the cooling of the high-end segment. The report reveals that sales of works priced over $10 million thinned out considerably, leading to a 10% drop in the US market and an 8% decrease in the UK. This shift in dynamics underscores the vulnerability of these markets to the whims of wealthy collectors and the concentration of value in a relatively small number of high-profile transactions.

France, on the other hand, managed to maintain its position as the fourth-largest art market, showcasing the enduring appeal of its cultural heritage and the strength of its institutional framework.

Online Sales Growth

One of the most exciting developments highlighted in the report is the continued growth of online sales, which defied the overall market downturn and surged by 7% to reach an estimated $11.8 billion in 2023. This impressive growth underscores the increasing importance of digital channels in the art world, as collectors embrace the convenience and accessibility of online platforms. As McAndrew points out, “The art market’s digital transformation is no longer a mere trend, but a fundamental shift in how collectors engage with and acquire art.”

Art-Related NFTs

The report also sheds light on the evolving landscape of art-related non-fungible tokens (NFTs), which have captured the attention of the art world and beyond. While sales of art-related NFTs on external platforms experienced a significant decline, dropping by 51% year-on-year to $1.2 billion, this figure still represents a 60x increase from the mere $20 million recorded in 2020. This volatility in the NFT market highlights the speculative nature of this circus sector and the challenges of sustaining long-term value in a volatile market like this one.

Dealer Performance and Representation

The dealer sector analysis reveals that smaller galleries with turnover of less than $500,000 saw an 11% increase in average sales, while the largest dealers with turnover exceeding $10 million reported average declines of 7%. The average number of artists represented by dealers in the primary market increased to 23 in 2023, up from 19 in the previous year. Despite this increase, there was evidence of greater concentration of sales around top artists, with dealers reporting that one-third of their sales came from their single highest-selling artist.

Rising costs were a significant challenge for dealers in 2023, with rapidly escalating inflation driving up operating expenses. Maintaining relationships with existing collectors and the costs of participating in art fairs were also among the top concerns. Dealers emphasized the importance of long-term relationships and repeat business with collectors for generating positive experiences and financial returns.

We will explore the dealer section of the report in more detail, in a separate section below.

Auction Sector Performance

The auction sector analysis reveals that the decline in values was primarily driven by the contraction in sales of the highest-priced works, particularly those sold for over $10 million. The Post-War and Contemporary art sector continued to dominate the fine art auction market, accounting for 53% of global sales by value. However, this sector experienced a 16% decline in sales compared to 2022.

We will explore auctions in more detail, in a separate section below.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Implications for Luxury Watches

I think the report offers insights which extend beyond fine art, and potentially speak to trends and dynamics in the world of watches too. Most will argue the luxury watch market is fairly nascent compared to the art market, but there are definitely overlaps in the clientele and the factors influencing collector behaviour.

One of the key findings of the report is the cooling of the high-end art market, with sales of works priced over $10 million experiencing a sharp decline. This trend could have implications for the luxury watch market, particularly for the rarest and most sought-after watches. As wealthy collectors become more cautious in their spending on high-value items, the demand for ultra-rare and highly priced watches may experience a similar slowdown.

The report also highlights the resilience of the lower-priced segments in the art market, with sales of works under $50,000 showing some upside. This suggests there may be opportunities for growth in the more accessible tiers of the luxury watch market, as collectors seek out decent watches at more manageable price points.

The increasing importance of online sales in the art market, which grew by 7% to reach an estimated $11.8 billion in 2023, also has relevance for the luxury watch industry. As collectors become more comfortable with digital platforms and online transactions, there may be a growing demand for e-commerce solutions and virtual showrooms in the watch market. You need not look further than the success of Loupe This to see evidence of this playing out in the watch market. As you will see, later in the ‘Dealer Costs and Margins’ section below, this online shift makes sense given how large a role overheads play in this equation.

The report’s findings on the concentration of sales around top artists in the art world may also have parallels in the watch market. Just as a small number of highly sought-after artists command a disproportionate share of the market, certain iconic watch brands and models may dominate the high-end segment. We see recent evidence in the watch market to support this too. This concentration of value and demand will, in my view, pose huge challenges for emerging and lesser-known independent watchmakers, as they struggle to gain visibility and market share in an increasingly competitive landscape; this is especially true in price ranges above ~ 20k, and becomes less true as you reach and exceed 6 figures.

Similarly, note in the buyer section below, how the highest value sales make up a huge proportion of sales value despite being a tiny proportion in number. It is worth considering the watch game in this regard - most of the buyers who tend to make hollywood purchases at auction are not as sensitive to difficult economic conditions. This means we may not see as much of a decline as people think.

Finally, the report’s insights on the challenges faced by art dealers, including rising costs and declining profitability, probably resonates deeply with players in the watch market. As the industry settles into this uncertain economic landscape, watch brands and retailers will, as we’ve already discussed, need to adopt new strategies to optimise their operations, manage costs, and maintain profitability. This may involve rethinking traditional distribution models, leveraging technology to streamline processes, and exploring new partnerships and collaborations to spread the burden and share the gains.

What did I miss?

You’ve reached the end of the highlights - below is a deeper dive into two sections: dealers and auctions.

The Dealer Sector

After two years of growth and recovery, sales in the dealer sector slowed in 2023, with aggregate values estimated to have fallen by 3% year-on-year to just under $36.1 billion. The performance varied between different segments of the market, with the high end experiencing a more significant decline compared to their smaller peers.

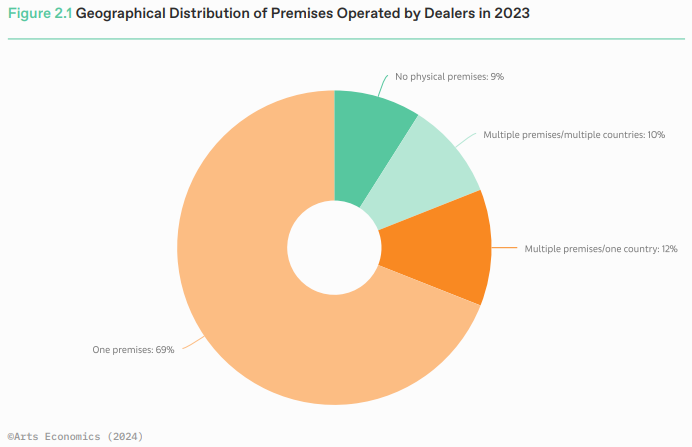

The majority of the dealers surveyed (77%) operated from a traditional, physical gallery premises with a dedicated space for exhibitions, down by 3% year-on-year but still above the 75% reported in 2021. The remaining dealers ran their businesses from alternative premises, including shops, warehouses, offices (14%), or online-only businesses (9%).

Dealer Sales

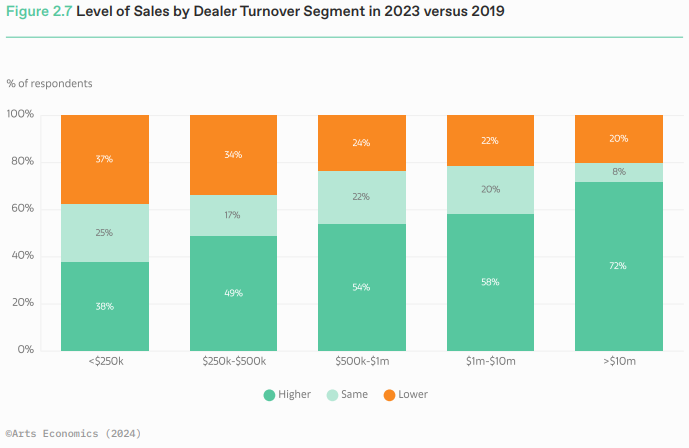

While the high end of the market was crucial in driving sales upward since 2020, there was a distinct change in trend in 2023. Dealers with turnover of less than $250,000 had the largest increase in sales (11%), while those at the top of the market with turnover of greater than $10 million saw averages decline by 7%. Many dealers at this level found that their sales were thinner at the top than in previous years, and buyers were more cautious about spending larger sums, unlike in 2021 and 2022.

Despite not showing the strongest relative performance in 2023, the highest-turnover dealers were still much more likely to have seen an improvement in their sales over the longer period, with 72% of those in the $10 million-plus segment reporting an increase against the 2019 benchmark compared to 38% in the sub-$250,000 segment.

Artist Representation

The average number of artists represented by dealers in the primary market increased to 23 in 2023 from 19 the previous year. For businesses operating in both the primary and secondary markets, the number was even higher at 39, up from 31 in 2022, as some galleries attempted to diversify their programs to generate sales and appeal to wider audiences in the flatter and more difficult market context.

Despite the increase in representation, there was evidence of more concentration of sales around top artists, with dealers reporting that one-third of their sales in 2023 came from their single-highest-selling artist, up by 2% year-on-year, although still below the peak of 43% in 2019. The share from their top three artists also rose by 2% year-on-year to 53%.

Gender Imbalance in Artist Representation The surveys revealed a persistent underrepresentation of female artists by galleries, despite some improvements. Across all dealers working in the primary market or both the primary and secondary markets, the share of female artists represented inched up to 40%, an annual increase of 1%, but having seen a more significant rise from 35% in 2018.

Galleries operating in the primary market drove this increase in 2023, with a substantial rise in share to 46% from 42% in 2022, now the highest level recorded, surpassing 44% in 2019. However, those operating in both the primary and secondary markets saw a fall of 2% year-on-year to 36%.

Dealer Costs and Margins

Rising costs were a key challenge for dealers in 2023, as rapidly escalating inflation continued to drive up operating expenses, including rent and payroll. In the face of slower sales and more variable demand, more businesses reported declining profitability, with 40% less profitable than they were in 2022 (up by 8% year-on-year), 31% around the same, and 29% more profitable (down by 10% versus 2022).

The largest two elements of dealers’ cost bases remained payroll (30%) and rent or mortgage payments (29%), accounting for close to 60% of operating business costs in 2023. Both components slightly reduced their share in 2023, making way for rising costs elsewhere.

Employment in the Dealer Sector Despite the challenging environment, employment in the sector remained relatively stable in 2023:

67% of businesses maintained the same level of employees

24% increased employees by an average of three people

9% reduced numbers employed by an average of two people

The largest businesses were the most likely to have expanded, with 65% of respondents in the $10 million-plus segment taking on new full-time, part-time, or contractual hires in 2023.

Buyers

The pandemic limited dealers’ opportunities to reach new clients, and the average number of individual buyers they sold to declined to 50 in 2021 from 64 in 2019. In 2022, the resumption of art fairs and a more regular schedule of events helped to expand this to 57. In 2023, the buying base widened again to a new high average of 83, influenced by some larger businesses that operate across multiple locations.

Art fairs were the most popular choice (30%) for dealers when asked about their greatest source of new buyers in 2023, followed by walk-ins at the gallery (21%), underlining the importance of in-person viewing and communications for making sales.

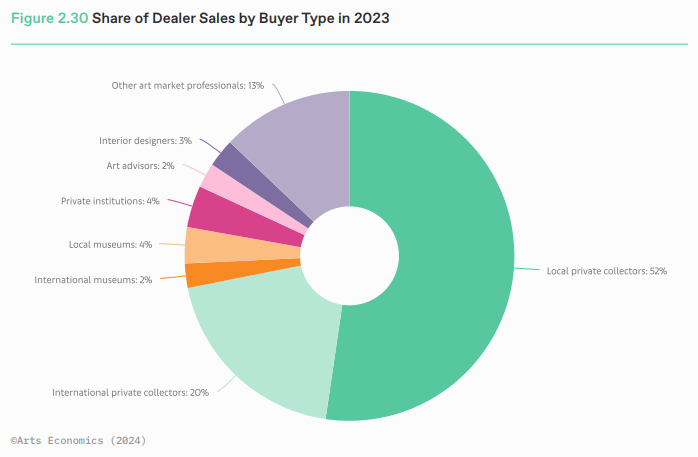

Most sales by value continued to be to private collectors, accounting for a stable 72% year-on-year, with a slightly higher share of 52% to local or national private collectors versus 20% to those from outside their region.

Sales Channels and Art Fairs

Transactions made in person through a gallery or dealers’ premises accounted for the largest share of sales by value in 2023 at 44%, down slightly on 2021 and 2022 (both 47%). Considering the period from 2019, before the pandemic, to the present, the biggest gain in share has been the shift back to direct sales by galleries: including sales made online or in-person, these have risen from 48% in 2019 to 64% in 2023.

The share of sales made at live events declined year-on-year, falling by 6% to 29% of total sales, higher than in 2021 (27%) but below pre-pandemic 2019 (42%). Dealers turning over more than $10 million reported the biggest drop in share year-on-year (from 40% in 2022 to 30% in 2023), while those in the middle market were more stable.

Online Sales and Strategies

Total online sales, including those made directly as well as through third parties, accounted for 23% of dealers’ total sales in 2023, up by 7% in share year-on-year and on par with 2021. The biggest growth has come from the increase in the share of sales through dealers’ own online channels and websites, which accounted for 20% in 2023, up from 12% in 2022.

Looking ahead, just under half (48%) of the dealers surveyed predicted that their online sales would increase in 2024, with a further 45% forecasting that they would stay around the same. Only a small minority of 7% anticipated a decline, confirming the importance of online channels in dealers’ business models.

Dealer Challenges and Priorities

When asked about the biggest challenges for their businesses in 2023 and beyond, the prevailing context of political and economic volatility and the effects this could have on demand was ranked highest by most dealers. Maintaining their relationships with existing collectors was the second highest and was also identified as a key priority from 2020 through 2022.

The costs of traveling to and participating in art fairs was ranked the third-biggest challenge for dealers in 2023 and 2024. While the maintenance of current relationships was key for dealers in the short term, this became less of a priority when considering the longer term, outpaced by the importance of widening their geographical reach in terms of new buyers.

Auctions

In 2023 Following some record-breaking sales at the high end of the market in 2022, public auction sales fell by 7% in 2023 to $25.1 billion, as transactions at prices exceeding $10 million thinned out considerably, leading to a sharp decline in value, while sales in some of the middle and lower-priced segments continued to grow.

Private sales by auction houses bucked the declining trend and grew by 2% to an estimated $3.9 billion. Including both public and private sales, total sales conducted by auction companies were down by 5% year-on-year at $28.9 billion, although still above their level in pre-pandemic 2019.

Regional Market Performance

The US, China, and the UK were still the largest auction markets worldwide in 2023, with a combined share of 74% of public auction sales by value, down by 3% year-on-year. With an uplift partially driven by postponed sales from 2022, China’s market shifted up from second place to equalize with the US, with each having a 31% share of public auction sales (excluding private sales). The UK was the third-largest auction market, with a stable share of 12%.

After a challenging year in 2022, pent-up supply and demand in early 2023 caused a boost in auction sales in China, with values increasing by 14% year-on-year to $7.9 billion. These results include postponed sales from China’s 2022 autumn auction season that were held early in 2023, creating a spike in activity. The second half of the year was significantly slower, with a weaker economic growth outlook, rising debt, continuing issues in the real estate market, and more sluggish global demand among the factors weighing on vendor and buyer sentiment.

Although the US lost significant share in 2023, it continued to be the key center for sales of the highest-priced works at auction worldwide, with eight of the top 10 lots sold in New York, and all but one of the six lots sold for over $50 million (with one sold in London). 34 of the top 50 fine art auction lots of the year were sold in New York, and US sales accounted for 74% of the top 50’s value.

Price Segmentation in Fine Art Auctions

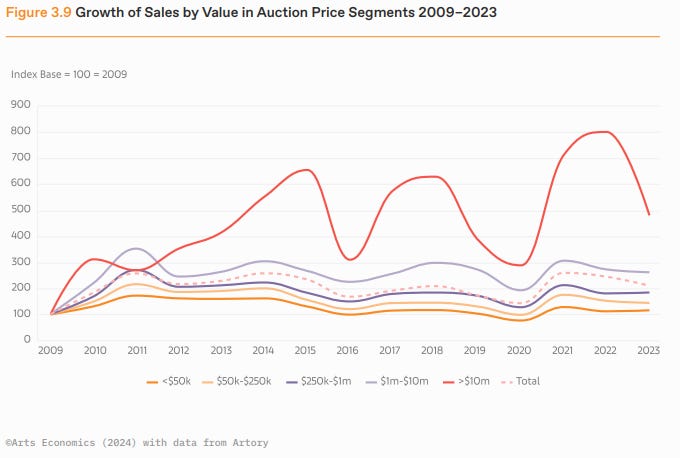

One of the key drivers of the slowdown was a contraction in sales of some of the highest-priced works at auction, notably those selling for over $10 million. After being the fastest-growing segment in 2021 and 2022, it had the lowest growth of all in 2023, as the number of lots surpassing $10 million sold at auction fell by 25% and values decreased by 40% year-on-year, versus low, positive growth in the market under $50,000.

Even with this decline, the $10 million-plus segment has still shown the most growth over time, advancing by 380% from 2009 through 2023 versus just 16% for the market under $50,000. If inflation is taken into account over this period, the $10 million-plus segment has grown to over 2.5 times its size, even with the downward adjustment in 2023, while sales priced under $50,000 have contracted in value.

You can clearly see the ‘rich’ cycle in the red line. And note how this tier dominates in terms of value, and is negligible in terms of volume:

Fine Art Sectors

This went on in some detail within the report, and I have avoided getting too far into the weeds here - so if this is of interest, check out the report.

Post-War and Contemporary art continued to be the largest sector of the fine art auction market in 2023, with a share of 53% of the value of global sales and 55% by volume. Aggregated sales in the sector reached $6.5 billion, down by 16% on 2022 and their second year of decline from the peak in 2021 of $7.8 billion. In 2023, the majority of sales by value (66%) were in the older Post-War subsector, with Contemporary art accounting for 34%. Following a strong recovery in 2021, Contemporary art fell for two consecutive years, including a 10% drop in 2023 to $2.2 billion. Post-War art was stable in 2022, but also fell by 18% to $4.3 billion in 2023.

Modern art accounted for 24% of fine art auction sales by value, up by 2% year-on-year. Following their post-pandemic recovery, the last two years have been marked by slowing sales, with a decline of 8% in 2022 and a further 6% in 2023, leaving the market at $3 billion and just below 2019.

Impressionist and Post-Impressionist art accounted for 14% of the value of fine art auction sales in 2023, down by 4% year-on-year. This sector had one of the strongest recoveries, with an uplift in value of 160% over two years to $2.6 billion in 2022, its highest level recorded. However, sales slowed in 2023, falling by 35% in value to $1.7 billion despite 6% more lots being sold, just below their pre-pandemic level in 2019.

In the Old Masters segment, China’s rebound in 2023 helped boost sales, with a 15% rise in values to $1.1 billion, just below the level in 2019. In the European Old Master sector, however, there was a decline of 17% to $481 million, above 2019 but down by 32% in the 10 years since 2013.

Top-Tier Auction Houses

After achieving some of their best-ever results in 2022, sales at some of the largest top-tier international auction houses declined in 2023, as buyers spent less and collectors held back on selling at the top of the market. There was mixed performance, however, including a rise in sales at Bonhams and the largest houses in Mainland China.

Sotheby’s reported gross sales across all categories of $7.9 billion, down from $8 billion in 2022, which was the highest-ever total in the company’s history. Sales were higher than pre-pandemic 2019 ($5.8 billion) and the second highest on record.

Christie’s reported total sales of $6.2 billion over all channels and segments, down by 25% on 2022, when the company had reached their highest-ever gross sales at $8.4 billion. Despite being lower than both 2022 and 2021, values were still double their revenue in 2020 and exceeded their pre-pandemic total of $5.8 billion.

Phillips achieved sales of $1 billion through all channels in 2023, down by 23% on their peak year in 2022 ($1.3 billion), but remaining above their level in pre-pandemic 2019 at $908 million.

Going against the downward trend, Bonhams posted a substantial rise in sales of 14% year-on-year to $1.4 billion in 2023, its highest-ever annual result. Bonhams acquired four other auction houses in 2022, significantly increasing the company’s international reach and sales capacity, with close to 1,000 sales held in 2023 (40% live and 60% online-only).

The top-tier auction houses in China also reported very positive results in 2023, following a challenging period for most in 2022. Poly Auction was the largest auction house in Mainland China in 2023, reporting sales of $993 million, more than double their total of $450 million in 2022, but still below their previous level of $1.4 billion in 2019 before the pandemic.

Here’s the full report in pdf format, if you can’t access the link above:

The end!

Not sure this is useful to you, but this was a 256 page report, and I thought it had some interesting food for thought when it comes to evaluating the watch market - both for dealers and collectors. Let me know whether you care about this sort of thing, and if not, I assure you I will not bother you with it again! 😂

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

Pareto is alive and well in the art market, as he is in many if not most things. As your mentioned certain popular artist, like watch makers, gain a huge following, the lions share of attention of buyers and collectors. We came see the Mathew principle at play here and how this principle was present in a previous post where it was notes that opportunity begets opportunity.

A well-written article with a lot of insights. Thanks for sharing it.

A long time ago, I had some of Sotheby's shares. It was a great way to get exposure to a booming art market.

PS: Obscure watches by PP or AP are making a solid comeback on the market. Another niche topic is 90s cars, especially pre-merger Bentleys, AMGs, or late Rollers with turbo engines.