Morgan Stanley's Q1 2024 Swiss Watch Market Report

A Comprehensive Analysis of Key Trends, Challenges, and Opportunities for Collectors and Enthusiasts

It’s here… Morgan Stanley’s update for the first quarter. Thanks to Hamza Masood from WatchCharts for sharing - WatchCharts provides all the data and analysis in the report, hence the link; thought that was worth mentioning upfront. Let’s get into it.

Executive Summary

The secondary luxury watch market showed some signs of stabilising in in the first quarter of 2024, with overall prices declining at the slowest rate since the downturn began in mid-2022. That said, the market still faces significant challenges, including softening demand, rising inventories, and falling prices across most brands. The “Big Three” brands - Rolex, Patek Philippe, and Audemars Piguet - were less of a drag on the overall market compared to previous quarters, but still saw significantly weaker year-over-year demand and increasing inventories.

Among the major luxury groups, Richemont’s watch brands struggled the most in Q1, with the notable exception of Cartier, which remained a top performer. The Swatch Group continues to be weighed down by the Swatch brand’s woes, as the hype around the MoonSwatch collaboration fades. Value retention, supposedly a key barometer of brand desirability, declined for most brands beyond the Big Three, presenting potential opportunities for savvy collectors.

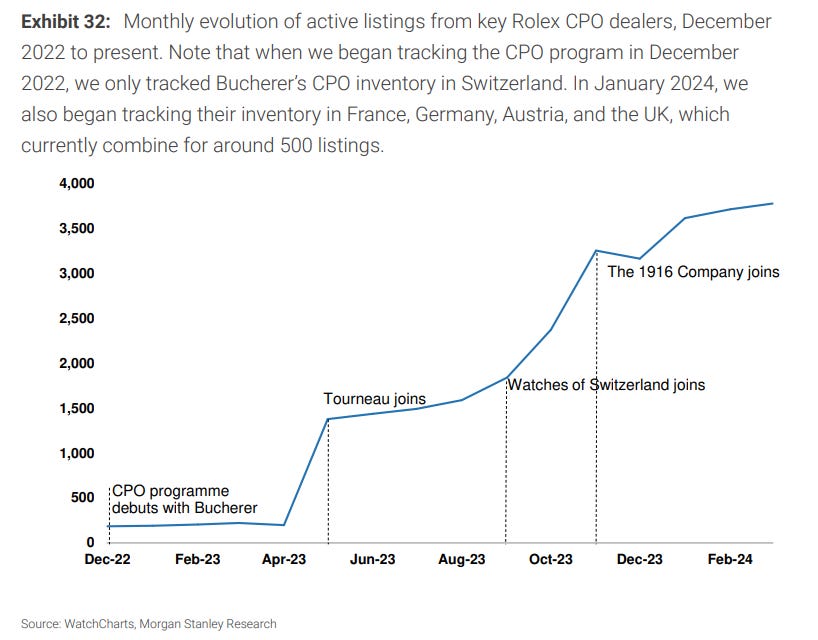

The Rolex Certified Pre-Owned (CPO) program continues to expand but still represents a small portion of the secondary market, with prices remaining substantially higher than comparable non-CPO dealer inventory.

Key Takeaways:

Secondary market prices declined at the slowest rate since the downturn began, but “it looks premature to conclude that the secondary watch market is headed towards imminent recovery.”

Softening demand and rising inventories, especially for the “Big Three” brands, signal further challenges ahead.

Cartier remains a bright spot among Richemont’s watch portfolio, while the Swatch brand’s slump weighs on the Swatch Group.

Falling prices and value retention present potential buying opportunities for collectors, particularly among brands beyond the usual top performers.

The Rolex CPO program is gaining traction but still represents a small slice of the secondary market, with higher prices than non-CPO dealers.

Next, I’ll go through the key sections, messages and insights from each.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Secondary Market Price Trends

Overall secondary market prices declined for the 8th straight quarter, but at the slowest rate (-1.6% QoQ) since the downturn began in Q2 2022. Sequential price declines have moderated from -13.5% YoY in Q4 2023 to -12.5% YoY in Q1 2024.

The “Big Three” brands - Rolex, Patek Philippe and Audemars Piguet - were less of a drag on the overall market compared to prior quarters. Rolex prices fell -0.8% QoQ vs -2.6% for Richemont brands, -1.3% for Swatch Group, and -1.6% for LVMH.

“Despite these encouraging signs, it looks premature to conclude that the secondary watch market is headed towards imminent recovery” due to weaker YoY demand for the Big Three, high inventory levels, and potentially temporary factors boosting Q1 like new product anticipation.

Note the above comparison between QoQ and YoY changes. Basically, while the bleeding has slowed, the secondary watch market remains on shaky ground. Bargain hunting collectors may spot some deals, but prices likely have further to fall. Don’t be fooled by any temporary Q1 boost from Watches & Wonders hype.

Brand & Group Performance

Most Richemont watch brands struggled in Q1, with IWC, Vacheron Constantin, Panerai and Piaget all losing nearly 3%. The exception was Cartier, whose prices were flat QoQ and up 1.6% over the past 6 months - clearly a top performer.

Swatch brand continues to lead the market declines, down -5.5% QoQ and -18% in 2023 as MoonSwatch prices approach retail. Other Swatch Group brands fared better.

LVMH watch brands fell -1.6% QoQ on average. “LVMH will report 1Q results next Tuesday (16th) and we expect a relatively soft start for the Watches & Jewellery division (OSG down -2% YoY).”

So Cartier is still the crown jewel of Richemont’s watch portfolio, with its more accessible pricing and strong brand insulating it from the broader luxury watch slump. As for the Swatch Group, the MoonSwatch mania has clearly fizzled out despite their attempt to boost it with Snoopy drops. Investors will be closely watching how the Swatch brand’s woes impact the group's Q1 results.

Demand & Inventory

The Big Three, especially Rolex, saw significantly weaker demand in Q1 2024 vs Q1 2023. Sales volumes declined an estimated -19% YoY for Rolex, -8% for Patek Philippe and -10% for Audemars Piguet across major secondary market platforms.

Secondary market inventory for Rolex increased 8% QoQ, while Patek Philippe and AP inventories grew about 1%.

Most importantly: Inventory age remains near all-time highs.

Softening demand and ballooning inventories spell more trouble ahead for the Big Three. Collectors who have been eagerly waiting for a coveted Rolex may finally get their chance as supply outpaces demand. You may have stories of your own, but I have seen an unprecedented flurry of collectors announcing new watch alerts in the first quarter, which seems to back up what the report suggests.

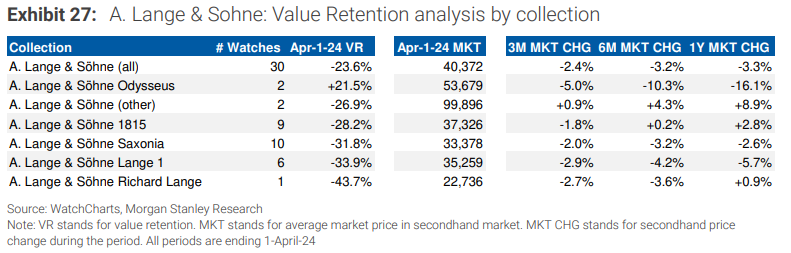

Value Retention & Market Performance

The Big Three continue to command secondary market premiums, while other brands covered in the report trade well below retail, on average. That said, Vacheron Constantin and Patek Philippe saw significant declines in value retention.

Cartier and Tudor were the only brands beyond the Big Three to see value retention improve in Q1.

Value retention provides a good barometer of brand desirability and equity, at least in terms of how they compile this report. With prices and value retention falling for most brands, we seem to find ourselves in an opportune moment for collectors to expand beyond the usual suspects and pick up a Lange, Vacheron or JLC at a relative bargain. Be careful with Lange though, as they do not tend to honour warranty claims in a hurry, and their service costs are egregious.

Rolex Certified Pre-Owned (CPO)

The Rolex CPO program continues to expand, with nearly 5,000 listings across 40+ retailers as of April 1st. Inventory is concentrated among a few big players like Bucherer, Tourneau, Watches of Switzerland and The 1916 Company.

Rolex CPO prices remain substantially higher (20-40% on average) than comparable non-CPO dealer inventory.

The Rolex CPO program is gaining traction but still represents a tiny slice of the broader secondary market. Collectors will usually find better deals from established non-CPO dealers, but the CPO route provides added peace of mind and authenticity guarantees for those willing to pay a premium. Personally, this is still a stupid state of affairs, and the CPO dealers should make more of an effort to close this gap.

I ended up copying this summary section into the executive summary at the top, so if you made it this far, please bear with me! The overall message from the report is fairly predictable… the secondary luxury watch market has shown some signs of stabilising in Q1 2024, but still faces significant challenges with softening demand, rising inventories and falling prices.

Collectors will probably find some attractive buying opportunities in this environment, but should remain disciplined and focus on long-term value rather than chasing short-term hype.

It goes without saying… buy what you love and can afford - not just what the market dictates as hot.

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know by sharing or restacking it. Thanks for reading!

Lies! All lies! How dare you?!? You have stolen my dreams and my childhood with your empty words!

- Greta Thunberg. Rolex AD -

Where is the actual report showing their methodology towards these resulted towards these figures? Is it not suspicious in the least that no one can find an actual copy of the entire report in PDF format? We are all just taking "their" word and "your" word for it.