SDC Weekly 75; John Lennon's Patek Saga, How Real Journalism Works, & The Psychology of Collector Self-Talk

GPHG Awards Wrap, Swiss Watch Industry October Update, Universal Genève Revival, Eluxum Auction Amateurs, Clymer Dumps Watches, Blue Ocean Thinking, Bitcoin and more!

🚨 SDC Weekly again! Estimated reading time: ~50 mins

This week, we tuck into the legal battle over John Lennon’s Patek 2499 and examine how proper journalism maintains independence while watch media struggles with conflicts of interest. We’ll also analyse October’s troubling export figures from the Swiss watch industry, unpack the GPHG’s credibility issues, and explore the fascinating psychology behind collectors’ internal dialogues. Plus, we’ll look at Universal Genève’s comeback strategy, scrutinise a new auction house’s questionable practices, and ponder the future of watch media ethics. There’s also some ‘blue ocean thinking’ to finish off 😉

If you’re new here, welcome! Take a look at the older editions of SDC Weekly here.

🎈 Small stuff

John Lennon Watch Saga Continues

The Swiss Federal Court issued this final ruling, on what is currently horology’s most infamous custody battle; declaring Yoko Ono the rightful owner of John Lennon’s Patek Philippe 2499. But like most things in the watch world, what seems straightforward on paper is anything but, in practice.

@watchesinrome posted this video featuring Julian de Simone, with the caption below:

Good morning from Rome, after a decade we are finally here to reveal, step by step, to stop all the rumours and misleading information about the legendary John Lennon’s Patek Philippe 2499. The full story will be posted soon. Thank you for your attention.

This was followed up with a longer YouTube video:

What is he on about? Let’s start from the beginning… The story reads like a Netflix crime drama: A chauffeur (Koral Karsan), a Turkish ‘friend’ (Erhan G), a dodgy auction house (Auctionata), and an Italian collector (DeSimone) walk into a bar... except the punchline is a multi-million dollar watch that’s been playing hide and seek since 2005.

The original ruling provides the most detailed account yet of how Lennon’s Patek travelled from New York to Geneva through a series of questionable transactions.

In 1980, Yoko Ono purchased the watch from Tiffany & Co. in New York and had it engraved. After his murder, the watch was meticulously catalogued in an:

“inventory of nearly a thousand pages drawn up by [notary] and bound in two volumes dated January 1982.”

Koral Karsan, Ono’s chauffeur from 1995-2006, had access to the apartment where the watch was kept. After being convicted of attempting to extort Ono in 2006, he was deported to Turkey - taking the watch with him. The court found it significant that:

“In 2010, [Karsan] presented the Watch to a certain Erhan G, also a Turkish national. He also gave him 86 objects that had belonged to the late [Lennon].”

This is where the story gets super interesting. When Erhan G approached Auctionata to sell the watch, he explicitly acknowledged potential ownership issues. The court notes:

“[Erhan G’s] lawyer had specified, in a letter dated November 4, 2013, that he could not give a guarantee of a right of ownership with an unlimited right of disposal.”

Most damning for DeSimone’s case, is that the agreement signed when buying the watch explicitly stated:

“the sale is subject to the written acceptance of the current owner. Once this acceptance has been received, a formal sales contract and invoice will be prepared. The contract of sale will be signed by [Auctionata] and the buyer and will contain more detailed information about the transaction and the watch itself, specifically the fact that [Ono] has not confirmed the provenance of the watch, a fact known to all parties involved in this transaction”

The court was unequivocal: Under German law (which applied to DeSimone’s purchase), the protection of good faith purchasers does not apply to stolen goods. As the ruling states:

“It follows that the appellant would not be able to rely on the protection of the bona fide purchaser under § 932 para. 1 BGB, insofar as it was held that the Watch had been stolen and therefore § 935 para. 1 BGB precludes the protection of the bona fide third party in such cases. The appellant does not contest this in law, but merely repeats over and over again that, in his opinion, the Watch had not been stolen, which has been denied above.”

The Swiss Federal Court’s dismissal of DeSimone’s appeal hinged on a couple of key points:

The “Chain of Custody” argument: The court examined each transfer chronologically, applying the law of whatever jurisdiction the watch was in at the time - New York law for Karsan’s acquisition, Turkish law for the transfer to Erhan G, and German law for DeSimone’s purchase.

Under New York law, proving a gift requires three elements: “the intention to transfer of the donor, the acceptance of the gift by the donee and the delivery of the thing in accordance with the intention of the donor.” The court found that DeSimone failed to prove Ono had gifted the watch to Karsan.

Most critically, under German law (§935 BGB), “the acquisition of ownership... does not occur if the thing has been stolen, lost or otherwise taken from its owner.” Even a good faith purchaser cannot acquire title to stolen property.

The court seemed to be particularly scathing about DeSimone’s credibility, noting:

“His own qualities, praised by him on his personal website, according to which he is a “world specialist in collector’s watches”, allow us to doubt this, even though he acquired a watch, which he claims in proceedings would be worth between 200,000 and 400,000 francs, for the sum of 600,000 francs, the estimates of specialized auction houses estimating its value at an amount of around 4,000,000 francs.”

The watch remains in Geneva with the lawyers for now. The court’s ruling requires it be returned to Ono, though DeSimone’s recent social media activity suggests he may still try to resist this outcome.

With both the initial ruling and appeal confirming Ono’s ownership, his legal options appear exhausted. The irony here is that while DeSimone claims he merely wanted to contact Ono about the provenance of the watch, the agreement he signed with Auctionata explicitly acknowledged she might claim ownership - obviously he knew the risks all along!

In the YouTube video, Julian claims his father approached Christie’s Geneva simply to ‘get in contact with Yoko Ono’ about the inscription on the caseback. Of course, this fairy tale conveniently ignores why anyone would need to physically transport a watch to Geneva just for them to make a phone call to New York, or why the watch somehow ended up in Christie’s Patek 175 auction catalogue layout before being pulled.

I’ve spoken with a collector who personally saw this watch in the catalogue layouts prior to it being pulled. Unfortunately, it was viewed on a screen, so this fun fact can simply join the list of ‘stories’ being told on the matter 😁

For what its worth, this isn’t the first time the watch world has seen high-profile ownership disputes. Christie’s dealt with the saga of Emperor Haile Selassie’s Patek 2497 - that watch was pulled mid-auction in 2015 due to ownership questions, only returning to market in 2017 after proper title was established. The difference is, those involved accepted the legal process rather than taking their case to YouTube.

Either way, as the inscription on the watch says: “JUST LIKE STARTING OVER” - perhaps it is time for everyone involved to do just that. Whether we’ll ever see this mythical piece surface at auction remains to be seen, but I’m sure Aurel and his team at Phillips are already working on it! After all, it was Phillips executive Arthur Touchot who first announced on his Instagram that the watch had been found.

Federation of the Swiss Watch Industry - October Update

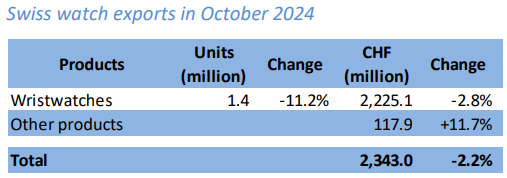

Remember when we thought September’s -12.4% decline was grim? Well, October managed to be slightly less terrible, but we’re still in negative territory with exports down -2.8% compared to October 2023, totalling 2.3 billion Swiss francs. This brings the year-to-date figure to 21.5 billion francs, down -2.6% compared to the same period last year. At this point, even the most optimistic projections for 2024 are looking rather... ambitious.

October’s data reveals some interesting disconnects between unit shipments and value. Precious metals showed resilience, because while unit shipments fell -4.7%, the value decline was much smaller at -1.2% - so it seems higher average prices are helping cushion the impact.

Steel watches declined both in units (-9.2%) and value (-7.6%), which tracks, as we have not seen steep price hikes on steel pieces, and you’d expect aligned movement between volume and price.

As for bimetallic watches, despite a dramatic -20.5% drop in units shipped, they actually managed a slight value increase of +0.6%! This suggests the price increases in this category seemed to have worked well for now. The “Other metals” category saw the largest volume decline (-30.2%), though its value drop was less severe (-7.3%), again pointing to a shift toward higher-value pieces and/or higher prices.

The “Other materials” category got me thinking… Despite units falling -6.8%, value went up by +19.2%. This category, which includes materials like ceramic, carbon fibre, and bioceramic (think MoonSwatch), seems to indicate something important about market dynamics.

Looking at the trend - In July, units were up +13.7%, value up +9.6%. In August, Units down -11.2%, value down -1.5%. In September, Units down -19.3%, value down -8.9%. Now in October: Units down -6.8%, value up +19.2%. Why?

Either brands are successfully moving “alternative materials” upmarket, new premium releases in materials like ceramic and carbon fibre are hitting their mark, or the category is no longer just about high-volume, lower-priced products like the MoonSwatch. What else could it be?

This mirrors a broader industry shift we’ve been tracking - even in the “alternative” materials, brands are finding ways to push prices up. It’s particularly noteworthy that this value growth comes despite continued unit decline, which suggests that for now, consumers are accepting higher prices for the right products. This surprises me, so I’d welcome alternate explanations!

Does this success imply we might start to see more luxury brands experimenting with non-traditional materials? I mean, there’s clearly money to be made when you get the proposition right!

The price segmentation tells an interesting story too. Entry-level watches (under CHF 200) saw exports decline -8.8% by value, while the CHF 200-500 segment dropped even more sharply at -12.0%. The crucial 500-3,000 francs segment took the biggest hit with a -21.0% decline. The only silver lining seems to be watches over 3,000 francs, managed a modest +1.7% growth. This polarisation between high-end and everything else continues to deepen.

The geographical split is becoming almost comical in its predictability:

USA remains the reliable workhorse (+11.3%)

Japan is the surprise star performer (+20.4%)

UK holding steady (+2.8%)

China’s free-fall continues (-38.8%)

Hong Kong still can’t catch a break (-14.8%)

Remember when we thought China’s -32.8% decline in July was bad? Or when September's -49.7% seemed like it couldn't get worse? The -38.8% October figure suggests China feels nowhere near finding the bottom. At this point, the Chinese market is giving new meaning to the phrase “what goes up must come down.” 😂

Looking at the cumulative data for January-October 2024, we’re seeing some other shifts:

The Americas region is up +5.8% overall, carried almost entirely by North America's +5.2% growth

Europe is barely keeping its head above water at +0.3%

Asia (excluding Middle East) is down -11.4%

The Middle East is somewhat stable at -0.6%

A few trends we’ve been tracking all year appear to be crystallising:

Rebalancing: Remember when China was the promised land and Hong Kong was immovable as the industry’s key export hub? Well, October’s figures confirm what we’ve suspected all year - the map is being redrawn. The US continues its role as the industry’s backbone, while Japan has emerged as the surprise star performer. Meanwhile, China’s plummet has moved beyond ‘concerning’ to ‘structural’, and Hong Kong continues its steady decline into irrelevance. Europe, interestingly, is holding its ground - not thriving, but surviving - with the UK managing mediocre growth. I think this is more than just a temporary shift in buying patterns, and represents a permanent redrawing of the industry’s geographic dependencies in real time.

Volume-Value Divide: If there’s one trend screaming for attention in the October data, it is the growing chasm between volume and value metrics. Total export units dropped by -11.2%, yet value only declined -2.8%. This pattern repeats across almost every category: precious metals saw units fall -4.7% but value only dipped -1.2%, while the “Other materials” category pulled off the magic trick of turning a -6.8% unit decline into a +19.2% value increase. The industry is clearly trying to defy gravity through pricing, but the question remains: How long can they maintain value while bleeding volume?