Happy Thanksgiving 🦃 to those who are celebrating! Here’s something to pass the time while your uncle is talking nonsense in the living room…

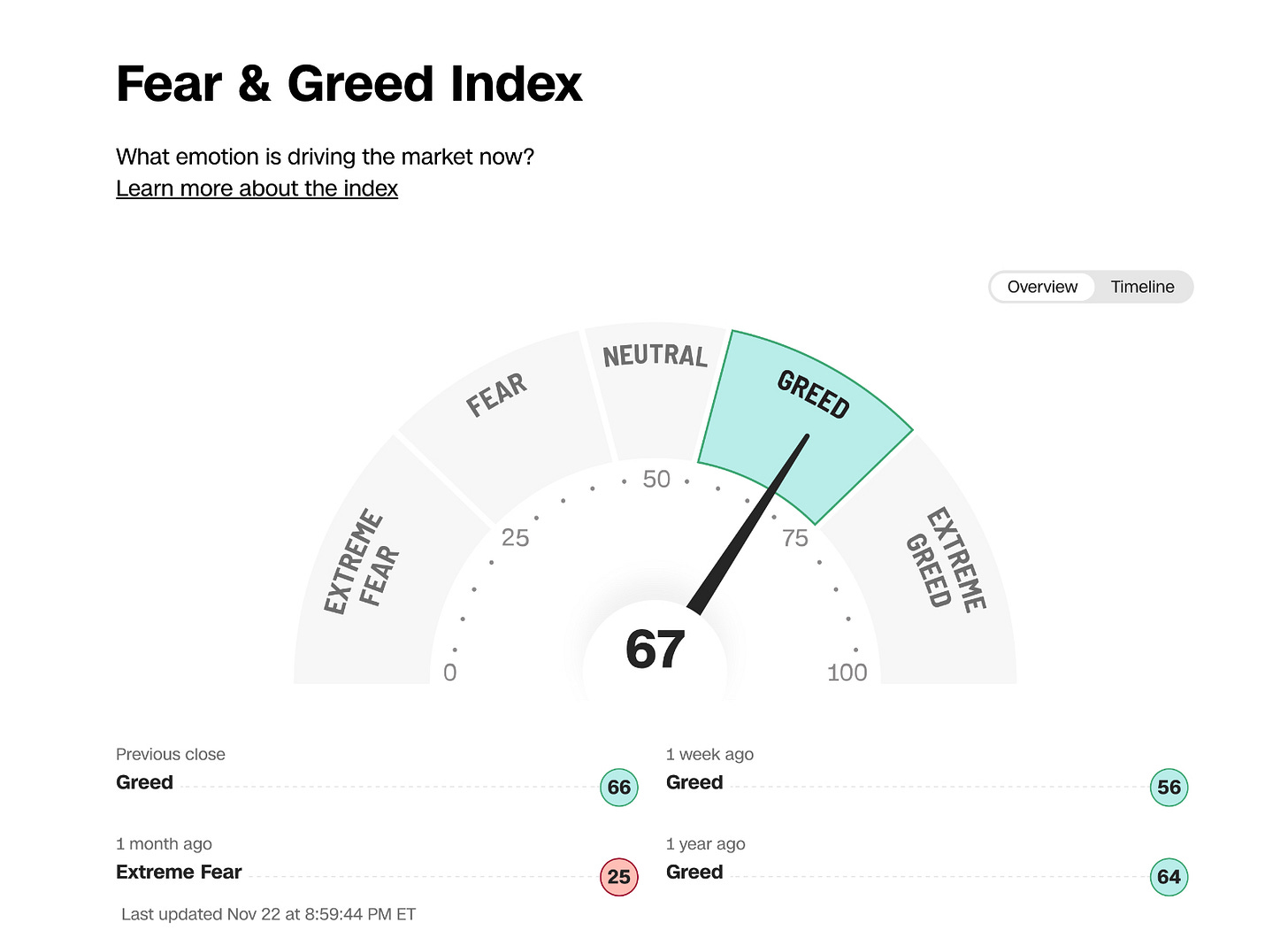

The Fear & Greed Index was developed by CNN Business to measure investor sentiment and gauge the mood of the stock market. It indicates how biases and emotions influence investors. The Fear & Greed index (calculated daily, weekly, monthly, and yearly) is based on the logic that excessive fear will drive share prices down, and too much greed will drive prices up1.

Many financial investors are emotional and reactionary; the fear and greed sentiment indicators can alert savvy investors to possibly irrational emotions and biases which might influence their decisions.

If you think about it, this sort of sentiment exists in the watch market too. 2021 was a black swan year, and the perfect storm of COVID-19 lockdowns, stimulus payments, low interest rates and lack of other options for discretionary spending (holidays, partying etc) led to many unforeseen outcomes - one of which was the watch market ‘boom’; have a look:

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems. Both free and paid subscriptions are available.

Of course, the market has since fallen from those dizzying heights… and in my opinion, will continue to fall below pre-2021 levels simply because money is more expensive now than it was back then. In addition, this phenomenon made me think about how the fear and greed index would apply to the watch market, and serve as supporting evidence to my hypothesis that the market will continue to drop. I think there are many parallels, but instead of “greed”, I would describe it as hubris when applying it to the watch market.

To make the point clear, I am saying it was hubris (more than greed) which led people to pile their money into the watch market, thinking they could make excellent returns while enjoying their money by wearing and enjoying the watches. If it was pure greed, they wouldn’t bother owning, wearing and flaunting the watches - they would simply make their money and move on. The hubris, is what made them stay2.

All hubris in the watch market starts with people believing they deserve to be right about something, that they are owed something or deserve a prize for their efforts or intellect. This could be anything, such as buying a Yacht-Master and people agreeing with the new owner that Yacht Masters are underrated. It’s an understandable feeling, and fairly typical too. Most people will look for such reasons to buy a watch, beyond just ‘liking it’, because these are, strictly speaking, useless purchases… and as humans, we must find (or invent) reasons to to waste our money on multiple watches w do not need3.

With that in mind, there are three things which can’t be ignored in the watch market: zero-sum games, adaptation, and social comparison.

The zero-sum game defines the watch market. This is a mathematical representation in game theory and economic theory of a situation that involves two sides, in this case a buyer and seller. The result is an advantage for one side and an equivalent loss for the other. As a result, ‘picking winners’ is hard. Just because you bought your Vacheron Overseas at a discount, and now believe it to be amazing value, does not make your view ‘correct’. Even if you think you are right, the market does not - after all, the dealer who sold it to you still made a profit, right?

Adaptation relates to the idea of watch collectors being unable to have enough. Finding a ‘good-value’ purchase is hard. Getting allocations is hard. So it follows naturally, that people who do manage these things, will inevitably feel special. The problem is the addiction simply grows, and as these ‘rewards’ are attained, the bar of ‘enough’ indefinitely moves upward. After you get allocated every variation of Daytona, the guy getting allocated a Rexhep Rexhepi seems to have way more status than you, even though you may have spent ten times more money. It’s a fickle world after all.

Social comparison ensures all the moves you make as a collector will be measured relative to other collectors in the market. This concept is something you will be familiar with if you’re a long-time reader of this website… very rarely will the perceived value of a watch hold true in a vacuum - these things are worthless pieces of metal, rubber and plastic…. the value attributed to them, like any other luxury goods, is down to branding and perception. It naturally follows therefore, that our own progress in the watch market must be measured relative to other people who we can compare ourselves with. How can anyone claim a particular watch is “really great value” without offering some reference point to validate the claim? A Patek Nautilus at retail price is great value when you compare it to the grey-market price; but may well be terrible value when you are talking to a mountain climber who requires a £500 Garmin watch, or to a woman who thinks they can get 3 Birkin bags instead.

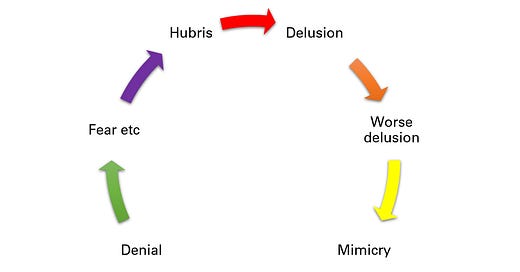

So here’s how it works…

The feeling you deserve recognition, after you’ve won the zero-sum game with the seller, despite having adapted to the feeling of winning, and in the face of all other comparable collectors in your social circles… is the early seed of hubris forming. This tends to drive people to seek out more ‘winners’, but it also leads to decreasing satisfaction each time they achieve more. On decreasing satisfaction - you can imagine a wealthy guy who has just bought their 5th Greubel Forsey, not feeling as elated as the young professional celebrating their promotion with a GMT-Master or Daytona.

Either way, as you enjoy the sweet taste of rewards, you start to become more delusional. The reward can be anything from prices rising in the secondary market, to a certain celebrity wearing the watch which leads to owners receiving praise from their peers. The delusions arise because people start to frame their luck as skill, and they hold an inflated sense of relevance or worth… and worst of all, the delusions lead to them being confident in their own ability to pick the next winner.

This delusional tendency only gets worse over time, because recognition and attention feels good. If you managed to get your hands on a Urwerk 102, a Simon Brette, and some other popular piece in the last year, the praise from your peers can become addictive. As a reminder, this ties back to initial point about hubris; People want to be right, doing well, and owed something for their efforts.

As a result, people race ahead in their journey… demanding more allocations, selling other assets to buy more watches, and these pursuits get more insane with time. Like any drug, an increasingly larger dose is required to satisfy every urge, and this vicious circle just gets worse over time.

Hubris leads people to delusionally justify their willingness to go too deep into the hobby, just to get back less than they put in - in the form of false rewards. The belief that they are worth it, drives this behaviour, despite the signs in the market that this is a fool’s errand.

Then, of course, it spreads… because humans are great at mimicry. The actions of some, drive the actions of others… and everyone thinks they are worth it, so of course they believe they also deserve similar rewards and praise… this changes irresponsible behaviour into something which everyone is doing… so it must be fine!

A psychopath knows what they do is unacceptable, and they do it anyway because they do not care. Collectors with hubris actually believe the crazy stuff they do, and this makes it justifiable. Collectors with hubris are totally blind to the risks they are taking, as well as the collateral damage their behaviour can have.

Of course, in any market, supply and demand drive everything. As the world turns against these folks with hubris, they initially react with arrogance. They defiantly forge ahead because they know nothing else, and because they still have blind faith in their own abilities to pick winners and get their reward.

That never lasts, and the next thing is denial and victimhood. The watch dealers manipulated the markets, or the brands flooded the market with supply, or the auction houses held poor sales… it is going to be someone else’s fault. Clearly, all the previous reasons for ‘reward’, are no longer valid. The hyped watches are not hyped, the allocations you got are not worthy of praise… the valuation of course, is in the gutter.

Slowly but surely, the hubris caves in, and fear takes root. No longer a victim, and self-confidence dropping each day, you’ll start to question what you missed along the way. Ignorance is the best defence, and when people ask about watches or collecting, you would rather change the subject.

Humans have evolved to respond to threats faster and more seriously than opportunities, so as you come to terms with reality, doubt spreads rapidly. The honest realisation that your own abilities weren’t the real cause for reward, will lead you to try and fix the problem as quickly as possible.

So how can the problem be fixed? Sell some of the watches? Apologise to the Mrs., sell the car to pay off the loans… whatever it is, you know you’ve screwed up, but have full confidence you can fix it. The problem is, this is too far gone, and any remaining optimism dies soon enough.

Next comes survival mode, and at this point it’s about not losing the house too, and instead of trying to make money elsewhere, the focus moves to not losing more. As this unfolds, people have immense doubt about their own value and knowledge. Was this a scam all along? Are MB&F machines not worth several hundred grand? Does this mean I have to start from scratch?

Now it is just plain embarrassment… you avoid people altogether, and this prevents you from getting any feedback from others, or even seeking help where appropriate. In your head, there is a new cycle of fear and doubt which never stops.

As you consider your peers and friends, it dawns on you… they are not all suffering as much as you, does that mean they are smarter? What do they know, that I don’t? This amplifies the fear, as you become uncertain about what else you should be fearing, but simply do not know about!?

Your hubris is now 100% reversed, and instead of taking risks you should never have taken, you are now avoiding opportunities which you should have taken. Like anything in life… this too, shall pass. All the mistakes seem rather obvious as you reflect on them.

Further reflection highlights your own faults and misjudgment, to the extent you are absolutely sure you will never be so stupid again. In future, you will be hyper rational, because you’re smarter through experience. You will be right next time.

That’s because… you deserve to be right… don’t you?

Welcome to hubris.

If you enjoyed this post, please do me a favour and hit the heart button below; thank you!

By them, I mean the ‘COVID collectors’

I feel attacked 😂

Psychopath or delusional idiot full of hubris... great. 😂