Morgan Stanley's Q2 2024 Swiss Watch Market Report

Analysis of Key Trends, Challenges, and Opportunities for Watch Brands and Watch Collectors

You’ve seen a summary like this before, and it’s always a treat when Morgan Stanley and WatchCharts cook up another quarterly update. Thanks to Hamza Masood from WatchCharts for sharing this quarterly update.

Disclosure: WatchCharts provides all the data and analysis in the report. They don’t pay SDC for advertising, and SDC does not pay WatchCharts for this report. Since they’re kind enough to share, and I enjoy bringing readers fresh info - I am happy to recommend you check out their website here. Or don’t. 😂

Executive Summary

The luxury watch industry is experiencing a hangover of epic proportions. Nine consecutive quarters of decline have sobered up even the most intoxicated brands. The WatchCharts Overall Market Index, once the life of the party, now clings to a measly 2.6% gain since December 2020 – a far cry from its peak in May 2022 when it was basically high on coke paid for by bitcoins.

Amid this collective headache, some nuances are still worth analysing. The Big Three – Rolex, Patek Philippe, and Audemars Piguet – are showing an unexpected resilience. They’re not leading the conga line, but they’re not face down on the floor either. Their market share has shrunk to 65%, a low not seen since 2021. It’s as if they’ve lost weight, but in all the wrong places lol.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Secondary Market Trends

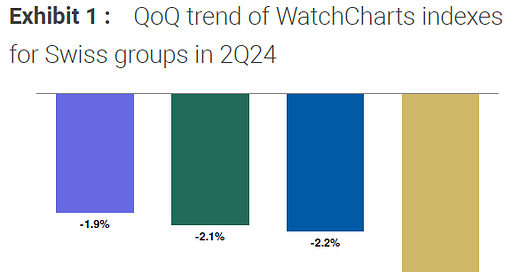

Q2 saw the WatchCharts Overall Market Index stumble 2.1% quarter-on-quarter, outdoing Q1’s 1.6% drop. This isn’t just a temporary loss of balance; it would appear the market correction is running a marathon, and we’re not close to near the finish line.

Brand Performance

Rolex saw a -2.2% decline in Q2 (-2.6% YTD). Patek Philippe and Audemars Piguet followed suit with -1.8% (-3.2% YTD1) and -1.0% (-4.1% YTD) drops respectively. They’re not in freefall, but they’re feeling gravity’s pull.

LVMH’s watch portfolio, on the other hand, is having a full-blown crisis. Down 3.6% QoQ2, with TAG Heuer leading the descent at -5.1%. Richemont and Swatch Group are doing marginally better, but that’s like being the best-dressed person at a Beverley Hillbillies festival.

One thing I’d never have bet on, is the Swatch brand emerging as an unlikely hero. It posted a 1.7% increase in Q2, bucking the downward trend. Is this the MoonSwatch finding its orbit after a year of turbulence, or just a temporary boost which will revert to the (negative) mean in Q3? Given their shares have just fallen off a cliff as reported today, you can take a wild guess for yourself.

Morgan Stanley, playing the role of the grim reaper, projects a 5% annual contraction. This isn’t just a secondary market flu; it’s an industry-wide pandemic. Here’s the QoQ vs YoY3 numbers for each brand:

Value Retention Analysis

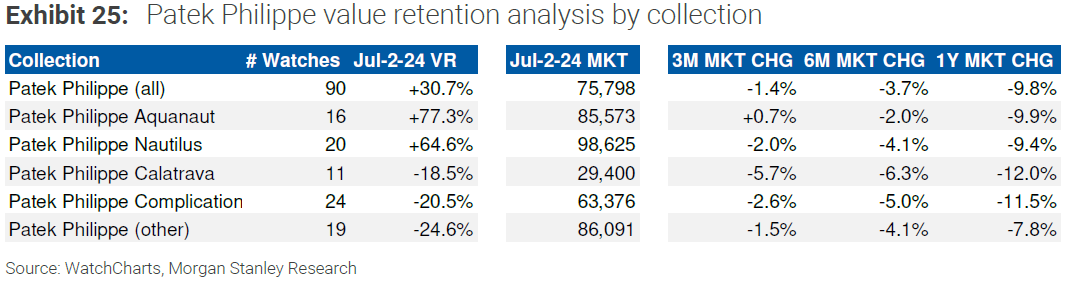

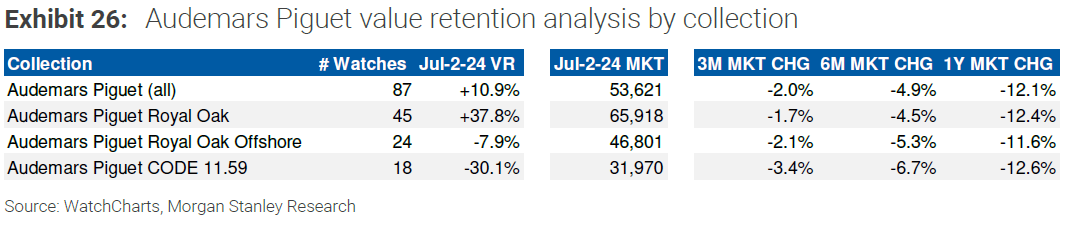

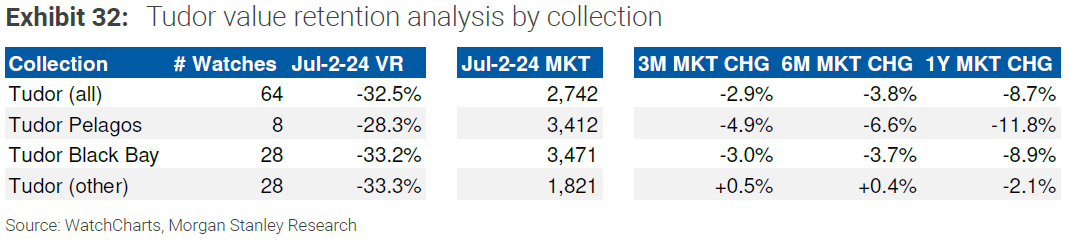

Q2 2024 saw value retention figures take a nosedive, but not all brands are created equal in this free fall:

Patek Philippe: +30.7% (down from +33.3% in April 2024)

Rolex: +19.6% (down from +21.4% in April 2024)

Audemars Piguet: +10.9% (down from +14.9% in April 2024)

The Big Three are still commanding premiums that would make a tech startup blush

Meanwhile, other luxury brands remain underwater:

Cartier: -22.0% (down from -20.4% in April 2024)

A. Lange & Söhne: -23.8% (down from -23.6% in April 2024)

Omega: -29.0% (down from -28.5% in April 2024)

This isn’t just a correction… it’s a harsh reality check. The luxury watch market isn’t one monolithic entity; it’s more like a high school cafeteria where the cool kids (Big Three) still get the best seats, while others are relegated to the corner table.

Primary Market Dynamics

As the secondary market sobers up, the primary market is experiencing an interesting phenomenon: demand pressures are easing, especially for Rolex sports models. It’s as if the market has finally remembered that watches are for telling time, not for flipping.

Several factors are at play: speculation has lost its lustre, manufacturers have ramped up production like they’re printing money, and the macroeconomic headwinds are giving even the most ardent luxury consumers pause.

The implications?

Accessibility is improving. The Submariner’s median wait time has shrunk from 105 to 68 days year-over-year. The Explorer? From 90 days to 30. Almost like Rolex discovered same-day shipping.

The narrowing gap between retail and secondary prices might force brands to do the unthinkable: moderate or even reduce prices (we can dream!)

Inventory management strategies need a complete overhaul. The artificial scarcity game is wearing thin. Even Audemars Piguet’s new facility in Le Brassus is going to be sitting partially idle – a monument to overambitious production plans (Or so I heard on my recent trip to the region).

Market stratification could intensify. Only the rarest pieces will maintain their premiums, while others might find themselves in the bargain bin.

These trends are in their infancy, but they’re growing pretty fast.

Rolex CPO Program Evolution

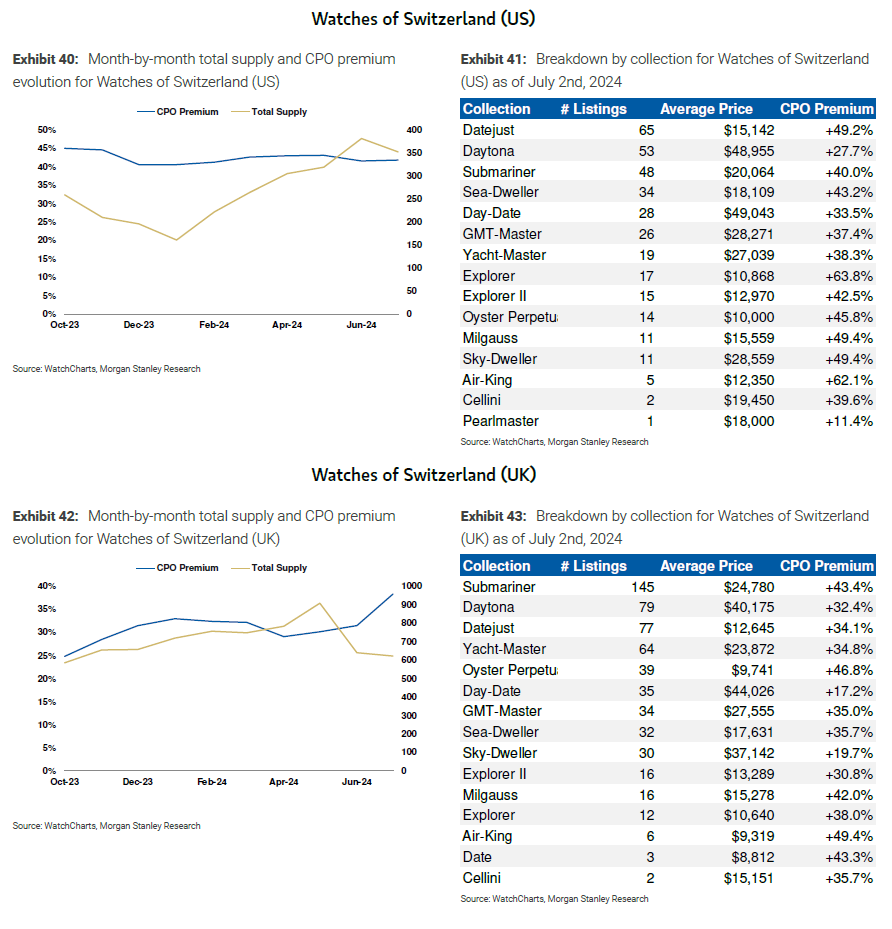

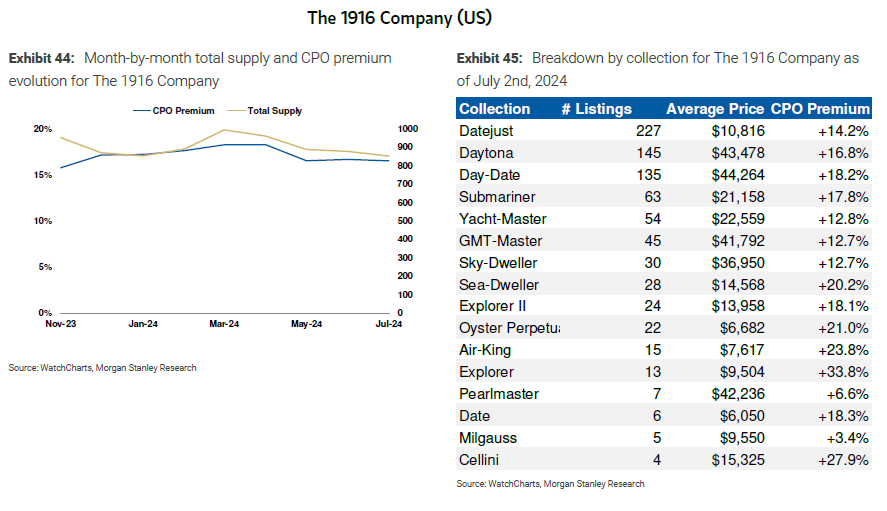

Rolex’s Certified Pre-Owned (CPO) program represents about 1% of the total secondary Rolex market, but it’s making waves and growing fast. With 5,500 active listings across 61 authorised retailers (up from 4,800 listings and 41 retailers in April), the program is gaining momentum. Four key players – Bucherer, Tourneau, Watches of Switzerland, and The 1916 Company – are holding ~60% of the total Rolex CPO inventory.

CPO prices command a 20-40% premium over comparable non-CPO inventory – remember, this is basically Rolex selling used watches for more than new ones. This isn’t just disruption; it’s a full-scale invasion of the secondary market.

New Market Health Assessment Methodology

In a move that screams “we need better data,” WatchCharts has introduced a new approach to assessing market health:

Supply: Total inventory value in the market

Absorption Rate: How fast inventory is turning over

Age of Inventory: How long pieces are collecting dust

This new approach reveals stark differences between the Big Three and mid-level brands. For the Big Three, inventory values are bloating, absorption rates are crawling, and inventory is aging like fine wine (or maybe more like milk). Mid-level brands, meanwhile, are showing more balanced dynamics - see for yourself in the charts below.

This shift from monthly to quarterly analysis promises a more nuanced understanding of market dynamics. But let’s be real… In a market that can change faster than you can say “Biver Cheese,” quarterly data might miss some of the action.

Mid-level brands like Omega, Cartier, and IWC seem to be the voice of reason. These brands have seen increased inventory value, higher absorption rates, and stable or decreasing inventory age, which suggests a relatively balanced, gradually growing secondary market for mid-level brands, even as prices soften slightly. Who knew being distinctly average could be so advantageous?

Looking Ahead: Market Trajectory and Long-term Implications

As we peer into our cloudy crystal ball, a couple of trends emerge:

The market cool-down isn’t just a phase; it’s here to stay. Expect more price corrections, especially for brands which think they’re too big to fail.

Brand divergence will intensify. Some luxury marques will continue their descent, while others might find opportunity in the chaos.

The primary market’s gradual move to equilibrium will force brands to rethink everything. Production, distribution, pricing – nothing is sacred.

Macroeconomic factors will continue to play puppet master with luxury watch demand. Inflation, interest rates, economic sentiment – they’re all pulling the strings.

CPO programs could rewrite the rules of the secondary market. Traditional dealers might find themselves competing with the very brands they’ve championed.

For the grey market, this spells trouble - with a capital T. As CPO programs gain traction, they’re not just adding a new sales channel; they’re carpet-bombing the existing one. Dealers face inventory droughts, margin squeezes, and an exodus of clients to the promised land of manufacturer certifications.

The future secondary market might look like a caste system: CPO at the top, traditional dealers scrapping for leftovers at the bottom. Adaptation isn’t just key; it’s the only way to survive. Savvy dealers will need to pivot, finding niches that complement rather than compete with CPO.

Conclusion

The luxury watch market isn’t just at a crossroads; it’s in the middle of a multi-car pileup on an 8-lane Dubai motorway. As far as I can tell, this Q2 2024 data paints a picture of an industry grappling with reality.

For collectors, investors, and industry observers, this volatility is both terrifying and exhilarating. Success will depend on the ability to spot value in the noise, to see trends before they’re trending, and to navigate the shifting sands of brand-retailer-consumer relationships.

What’s new? Nothing, I suppose. The only constant is change. Right now, change is happening faster than brands have ever been known to compute. The luxury watch landscape of tomorrow will be as familiar as a smartwatch to Breguet himself. Those who can adapt, anticipate, and act will ride the next wave. The rest? 🤷♂️

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know by sharing or restacking it. Thanks for reading!

Year-to-date

Quarter-on-quarter

Year-on-year

Excellent article.

Really appreciate you taking such a holistic look. There’s a lot of data out there and taking all of it into account here really helps paint a snapshot picture. I agree with your thought that for collectors it’s two-fold. We’re wondering if this could spell the slow death for some favorites while hoping for better deals on some favorite pieces. The market curveball is that the conglomerates have some built in safety nets by owning economies of scale. we already hear about layoffs from certain brands and that’s going to happen in any market. The people who are way off base are the ones selling clicks saying watches are a dying market. Clearly a major correction is taking place but it’s far from dying. Thank you for another wonderful article!