Morgan Stanley's Q4 2025 Swiss Watch Market Report

Analysis of Key Trends, Challenges, and Opportunities for Watch Brands and Watch Collectors from Q4 2025

I always wonder how to start these “market report” posts, and I inevitably go back to the prior edition for inspiration… and then I end up following roughly the same format. That said, I have noticed since I started doing these summaries, that more people have access to this report as a primary source...1 so I’m trying something different this quarter - less summary, more analysis. Feedback is welcome.

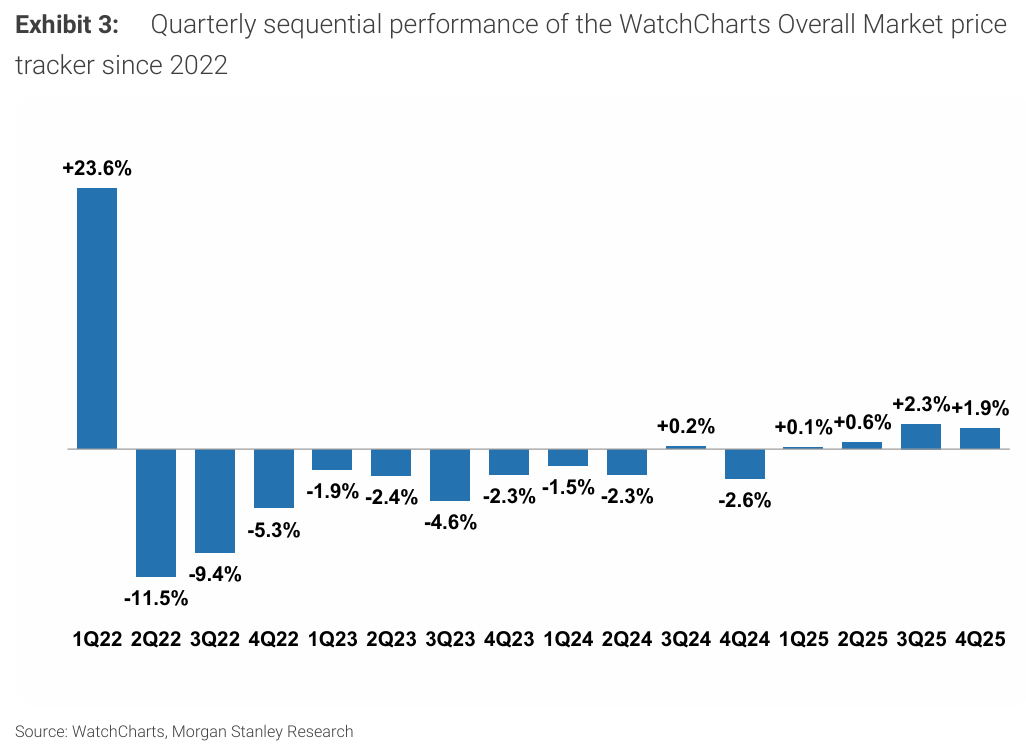

Regarding Q4 2025, how shall I put this… if Q3 was a kind of tentative step away from the cliff edge, Q4 was perhaps the market deciding it might now be safe enough to look down. For the first time in a while, the report is not just talking about “stabilisation” or “slowing declines” and instead talking about growth. 🤔

So here’s riddle for you - if secondary market prices rose +4.9% in 2025, and this marked the first annual gain since the bubble popped in 2022, this must be good news, right? It means your collection is finally appreciating again, right?

Well, no!

Brands raised retail prices by roughly +7% on average last year. So while your watch might be worth more in absolute terms, it’s actually worth less relative to what it would cost you to replace it. You’re technically richer but let’s say, functionally poorer. This so-called retail paradox, is probably going to play a big role in how people think about watch buying and selling in 2026.

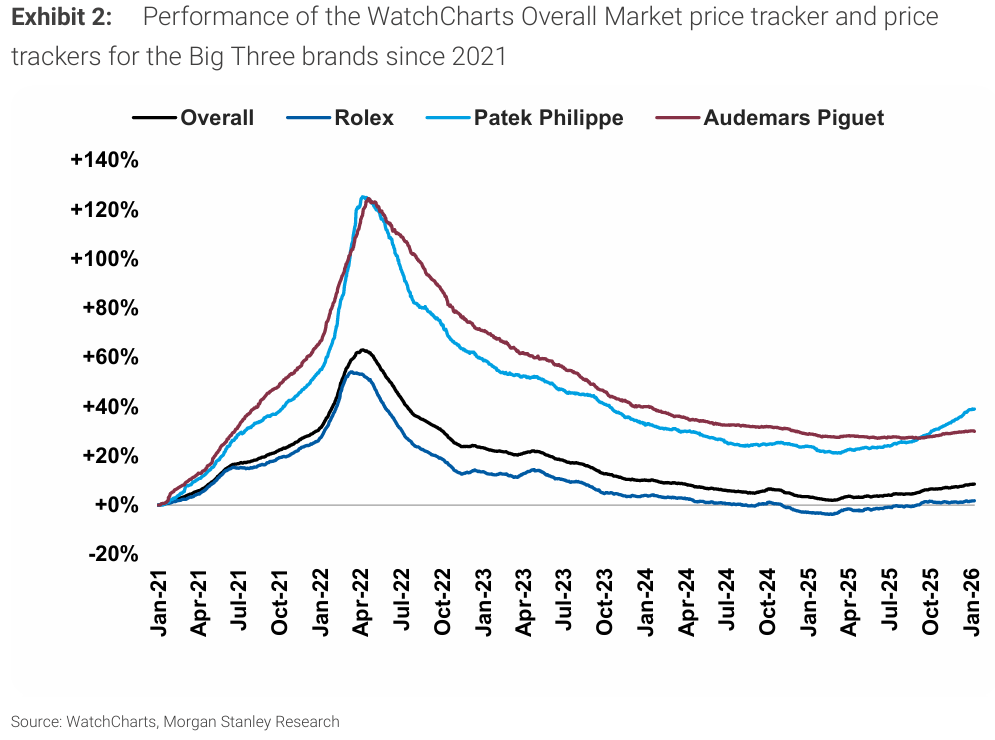

Let’s back up a bit… For three years (between Q2 2022 through the first half of 2025) secondary prices did nothing but fall - as you can see in the chart above. The bubble deflated, speculators fled, and everyone pretended they had bought watches “for the love of horology” all along.

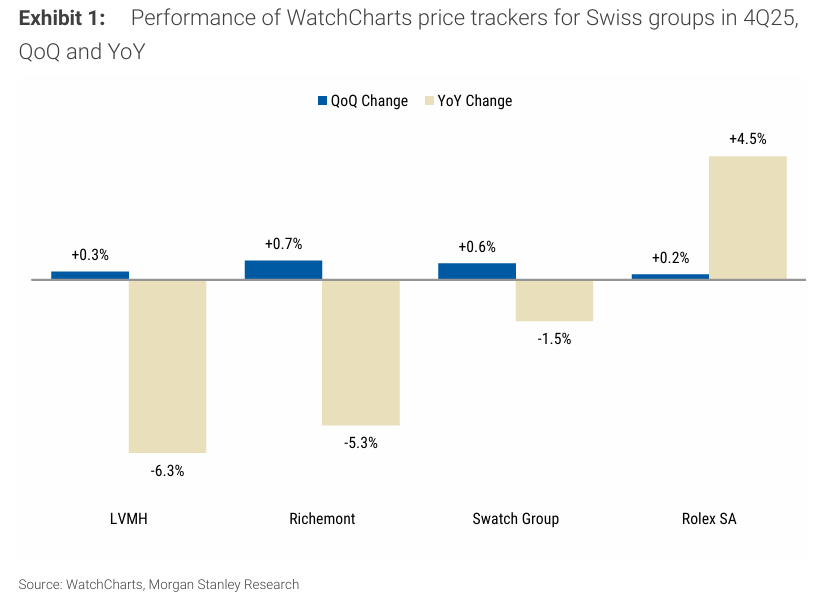

Then in Q3 2025 prices ticked up by a larger-than-usual +2.3% and Q4 added another +1.9%. The WatchCharts Overall Market tracker finished the year up +4.9%, compared to declines of -6.1% in 2024 and -10.7% in 2023.

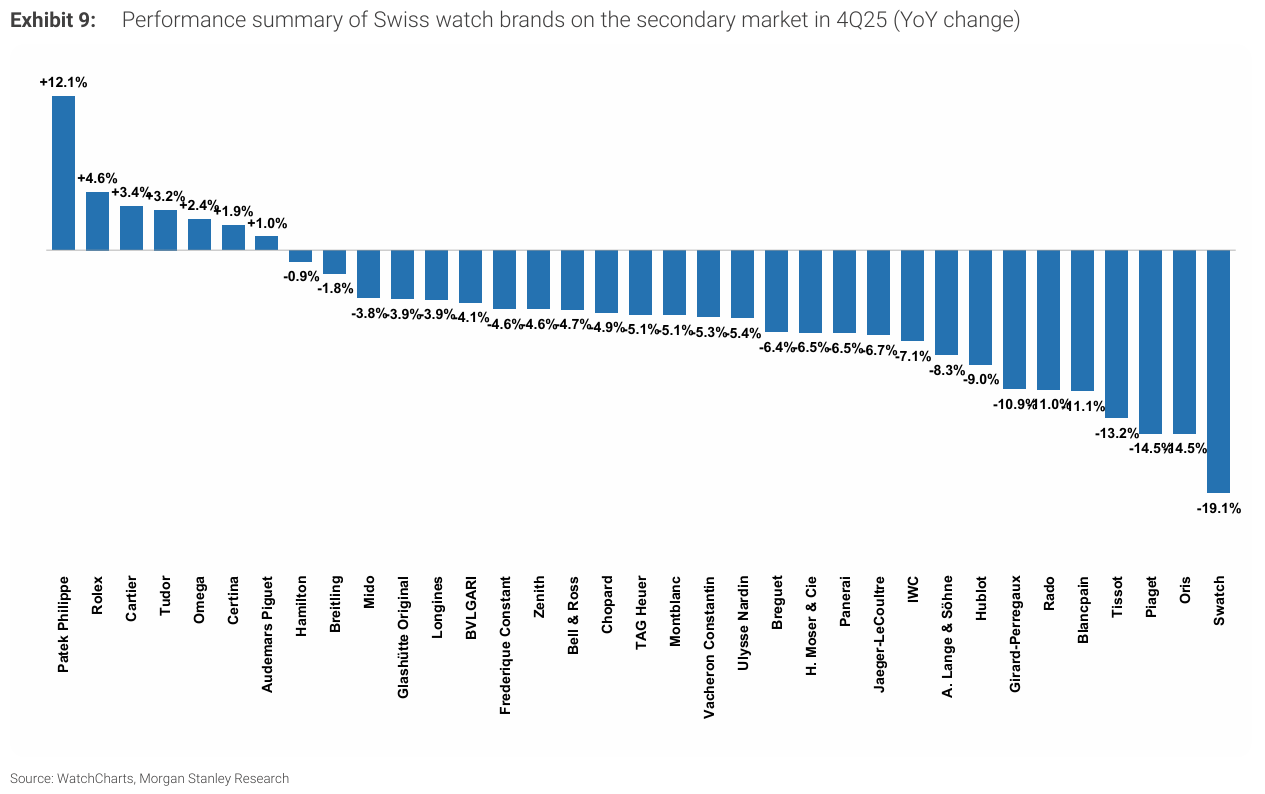

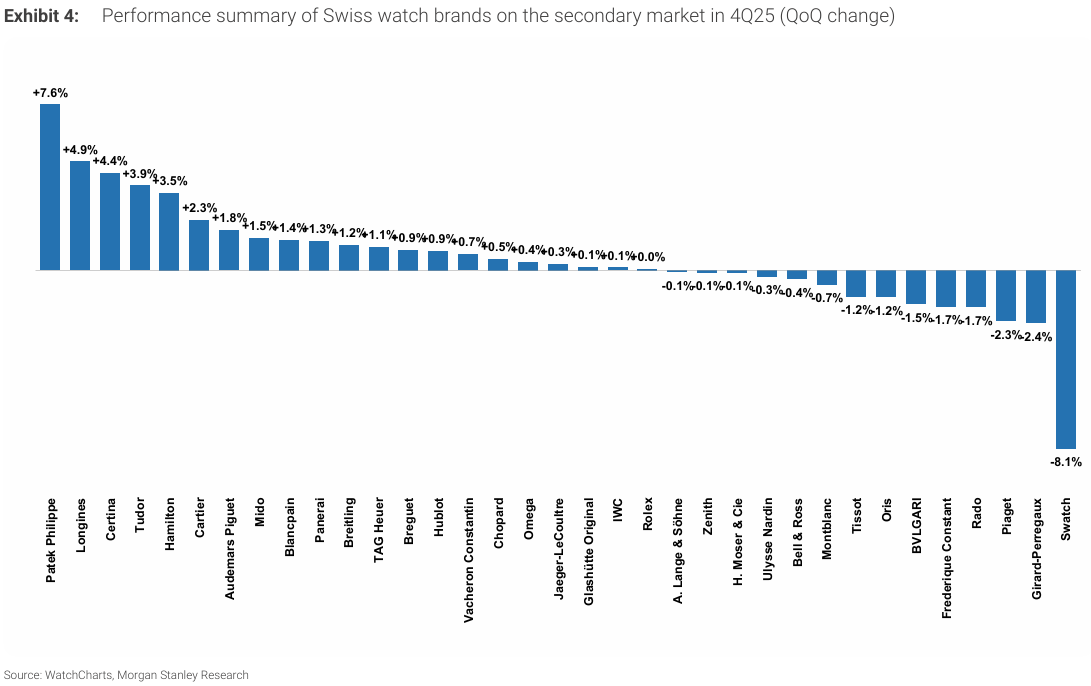

So we’re back, baby! Except... as I said earlier, we’re not - mainly because that +4.9% gain was driven almost entirely by a handful of brands. Specifically: Patek (+12.1%), Rolex (+4.6%), Cartier (+3.4%), Tudor (+3.2%), Omega (+2.4%), Certina (+1.9%) and AP (+1.0%). Everyone else, meaning 28 out of 35 tracked brands still declined.

“…we believe improving secondary conditions are unlikely to translate directly to the primary market and may, in some cases, come at its expense. Although leading brands remain well positioned, most continue to face challenges in rebuilding broad-based appeal and value retention” is how the Morgan Stanley reports rather diplomatically put it. This is a wild statement, and we will come back to it at the end.

Secondary Prices

We needn’t dwell on this too much, but one thing I found rather unusual was that while Patek was busy accelerating (+7.6% QoQ), Rolex was completely flat in Q4. You can see it in the chart… literally +0.0% QoQ. The report does address this:

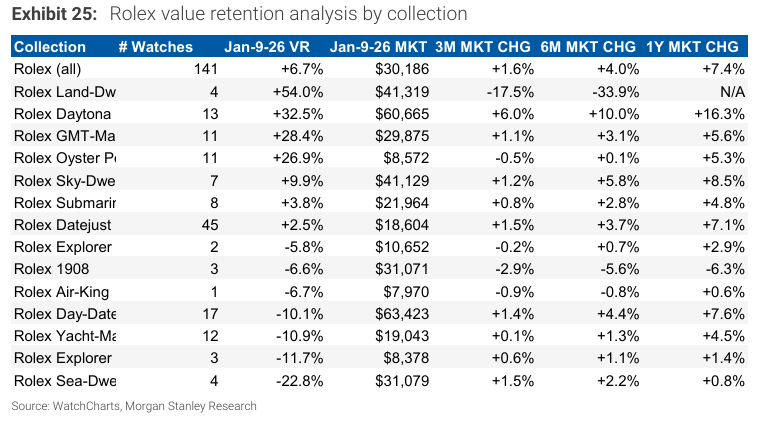

“Despite the flat headline result, secondary prices increased across most Rolex collections, with Datejust (+0.9%), Day-Date (+1.1%), Daytona (+1.1%), and Oyster Perpetual (+1.4%) each rising by roughly one percent QoQ.

The divergence between overall brand performance and individual collection trends reflects the construction of the WatchCharts price trackers. While the top 30 references were flat during the quarter, the broader universe of watches within each collection appreciated. On a YoY basis, Rolex ranks second among the brands we track, with prices up +4.6%, trailing only Patek Philippe.”

So whether this is Rolex hitting some kind of natural ceiling, or just statistical noise, or the calm before another leg up… I honestly don’t know, but I suppose it’s worth watching.

Value Retention

Note: Morgan Stanley has updated its VR methodology to reflect a global average of five key markets (US, UK, Germany, Japan, Hong Kong) rather than just the US - and all historical VR figures in the report were retroactively recalculated using the updated methodology.

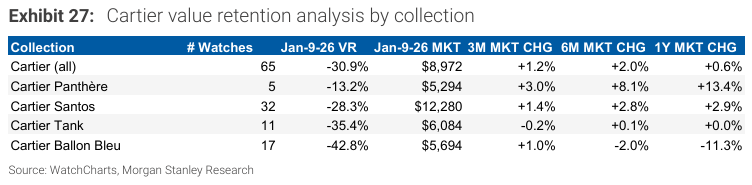

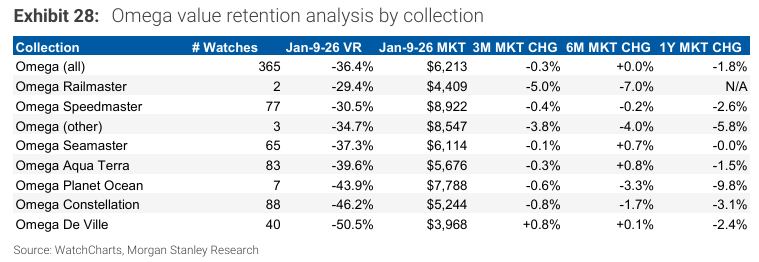

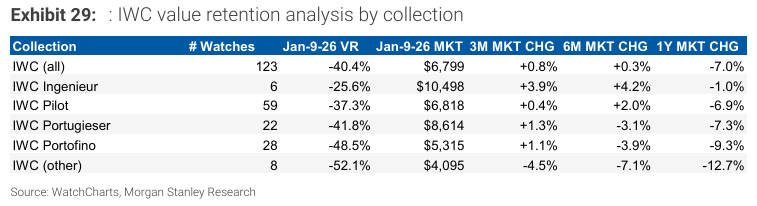

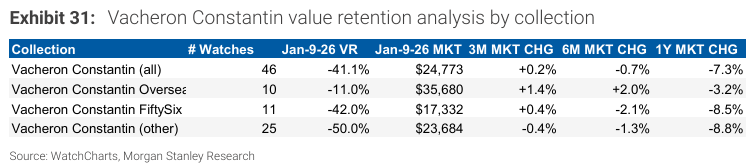

This is a topic which will feel grim if you’re not wearing something with a crown or a Calatrava cross on the dial. Except for Patek, Rolex and AP, every tracked brand (for value retention) now trades at discounts exceeding -30% below retail.

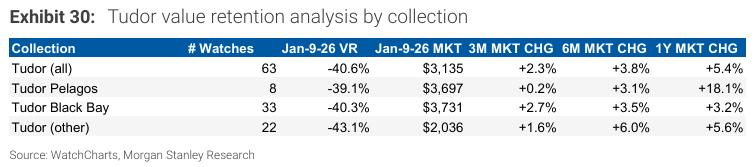

The worst offenders are Vacheron (-41.1%), Tudor (-40.6%), IWC (-40.4%), Omega (-36.4%), and Cartier (-30.9%). Vacheron’s Overseas collection still holds up reasonably well (-11%), but everything else is in freefall. Tudor is in something of an existential pickle. The whole value proposition was “Rolex quality without the Rolex price,” but that only works when Rolex trades at premiums. If a Black Bay sells for 40% below retail, why wouldn’t you just... buy a Rolex on the secondary market instead?

I reckon Tudor’s problem is not that Black Bays are bad watches… It’s more that their value proposition requires Rolex to be ‘more unobtainable’. If Rolex CPO keeps growing at 60% a year, Tudor’s entire market positioning gets squeezed from both ends!

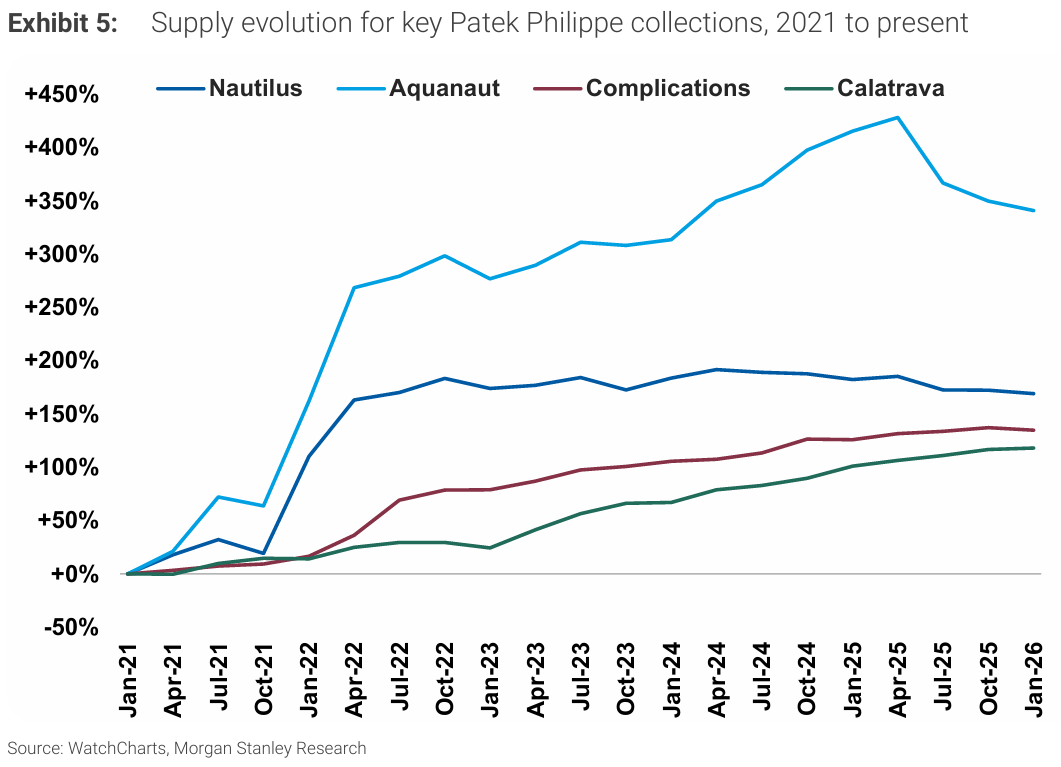

Thierry Stern is probably feeling like a genius right now. While everyone else was scrambling to navigate a declining market, Patek seems to have executed a supply squeeze on its entry-level stainless steel sports models. Supply for many Nautilus and Aquanaut references has fallen to multi-year lows as they have systematically discontinued the more ‘accessible’ references.

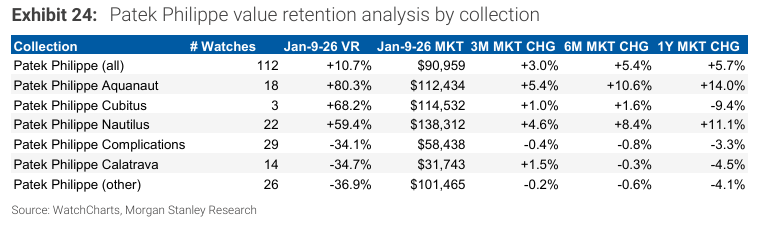

You can see the supply drop in the data; Nautilus and Aquanaut supply drops off mid 2025 and Complications and Calatrava inventory has actually risen. The result is that Patek’s prices were up +12.1% for the year, with momentum accelerating in Q4 (+7.6%). They’re also back to commanding a +10.7% premium over retail on average. The Aquanaut and Nautilus collections are trading at +80% and +59% premiums respectively.

The really obnoxious bit is how Patek also jacked up retail prices by +22.3% in the United States (tariff-related) and +7.5% in China. Normally, aggressive retail price increases would tank secondary market premiums, but by choking supply at the same time, Patek managed to raise both retail and secondary prices - and recently lowering retail prices will likely not harm this balance.

Also, transaction volumes for Patek rose by more than +25% in 2025, which means they are converting scarcity into sales velocity, which is basically brand management as blood sport.

Value retention trends for Patek remain consistent with prior reports. Sports collections continue to trade at significant premiums, led by Aquanaut (+80.3%), Cubitus (+68.2%), and Nautilus (+59.4%), while the remainder of the catalog trades at average discounts exceeding -30% to retail. Patek and Rolex remain the only brands with multiple collections trading above retail, with 41 of 112 in-production Patek models (37%) currently at a premium, versus 46 of 119 (39%) a year ago

But the truth is, Calatravas and Complications are fvcked … so while Thierry might feel like a genius now, I’m not sure how good this is for Patek in the long run. Are they on track to follow in AP’s footsteps and stay afloat due to the sports models?