SDC Weekly 43; Optionality; Construal Level Theory

Daniel Kahneman, GPHG update; New Rolex bracelet, Managing Dopamine and how the world's most expensive swords are made.

Who was Daniel Kahneman? How Did Jelly Beans Become an Easter Candy? What could the new Rolex bracelet look like?

Hello 👋 and welcome back to the SDC Weekly. Today, you’ll find answers to the questions posed above. If you’re a new subscriber, take a look through the older editions of SDC Weekly here.

Small talk

Daniel Kahneman

Daniel Kahneman, the father of behavioural economics, died last week at 90 years old. He was best known for applying psychology to economics and uncovering biases and mental shortcuts which make people behave irrationally - regular SDC readers will know how much I enjoy his work; I even posted a couple of book reviews, as well as entire posts underpinned by his work:

Kahneman, and his mate Amos Tversky, developed “prospect theory,” or loss-aversion theory, which earned him the Nobel Prize in Economics in 2002. The idea is something we all inherently know; people feel worse about losing a sum of money, than they feel good about making the same amount.

Kahneman primarily applied this theory to investors, who had previously been considered rational decision-makers. But his work does shows up in other fields - for example, golfers putt better when they’re facing the loss of a stroke than when they might gain one.

A few other biases he identified that are probably buried in your brain somewhere:

The “peak-end rule” - people remember an experience primarily based on how they felt at its most intense moment and the final part of it. This is why you consider a whole vacation good if the last day was good - ad vice versa.

The conjunction fallacy where people incorrectly believe the probability of two things being true is more likely than just one thing. This is illustrated by the famous “Linda the Bank Teller” problem.

Kahneman and Tversky were also the subject of Michael Lewis’s 2016 book, The Undoing Project. This 2021 FT interview with Kahneman is a charming testament to his genius. RIP.

GPHG updates - previously shared as a note

Last week there were some updates and changes to the operations of the Grand Prix d'Horlogerie de Genève (GPHG) - the biggest circle-jerk in the watch world.

First off, they are expanding the GPHG Academy to 960 people - the community of experts and enthusiasts who nominate timepieces for competition categories and select winners.

They will also feature new prize categories and adjustments to existing ones. For instance, instead of the Innovation Prize, there will be a focus on sustainability, with the new Eco-Innovation Prize, awarded to timepieces emphasising sustainable and traceable watchmaking developments.

Additionally, the Time Only category will highlight classic watches with two or three hands and no complications, while the Mechanical Clock category has been temporarily suspended to allow watchmakers “time to innovate.” *eye roll*

The most interesting one is the adjustment to price ranges for certain categories; the Petite Aiguille category now includes watches priced between CHF 3,000 and CHF 10,000, and the Challenge category is now reserved for watches costing less than CHF 3,000, instead of 2,000 - makes sense, as they’re all raising prices, sub-2k is somewhat pointless now.

Watch Auctions

A couple of auctions coming up or ending in the next week. Christie’s HK has an online auction ending on 9th April with a few interesting pieces such as this Patek 3417. Sotheby’s HK has a live auction on 7th April featuring this Patek 2499 and 5950 in steel, as well as a 38mm Journe Tourbillon to name a few. If the previous recent auctions I shared were anything to go by, might be worth a cheeky punt if you’re keen on a lucky bargain!

Watches and Wonders

The 2024 event is starting next week, from the 9th to 15th of April - and unfortunately I will not be making it. I am in South Africa to celebrate Eid with my family, so all things considered, I can’t complain. The “public days” for this event are the final three days, so 13-15th April - and you can buy tickets here. I have a number of friends attending, and have asked them to keep me posted, so stay tuned. By the way, in case you were wondering… Rolex’s new collection will drop at 08:30 CET (Geneva Time) on Tuesday 9th April, which is 02:30 on the U.S. East coast, 11:30 in Dubai, 14:30 in Hong Kong and 15:30 in Tokyo.

That’s it for the small talk… Let’s dig in.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Paid subscribers get access to this newsletter when it drops. Free subscribers usually get it two weeks later.

⚠️ NOTE TO SUBSCRIBERS:

Some email applications may truncate this post. You can read it all online here or click on “View entire message” at the bottom.

Thanks for reading!

💹 Optionality

Money can serve many purposes.

Medium of exchange: Money facilitates the exchange of goods and services, eliminating the need for barter systems. It acts as a universally accepted intermediary for all transactions.

Unit of account: Money provides a standard measure of value, allowing for the comparison of the worth of different goods and services. Prices are expressed in monetary terms.

Store of value: Money allows individuals to save purchasing power for future use. By holding money, individuals can defer consumption and preserve wealth over time1.

Standard of deferred payment: Money enables transactions to occur over time, allowing individuals to borrow, lend, or make payments for goods and services at a later date. Contracts and financial agreements often stipulate payments in monetary terms.

Measure of wealth: Money can serve as a way of keeping score, in that it serves as a measure of an individual’s or nation’s wealth. Wealth is often quantified in terms of monetary assets, including cash, savings, investments, and property.

Facilitator of economic growth: Money provides the necessary lubricant for economic activity, promoting investment, entrepreneurship, and innovation. It enables businesses to finance operations, expand production, and create jobs, fostering economic development and prosperity.

Means of settlement: This is perhaps a derivative of the above, but money allows for the settlement of debts, obligations, and financial transactions between individuals, businesses, and financial institutions.

Communication tool: Money can be converted into objects which convey status (Luxury watches, cars, homes etc).

While money can serve many purposes, what it does for each person will be a function of every person’s values and the choices they make. There is one intangible use of money which many overlook: Optionality.

Quick tangent on GDP vs savings

People get too hung up on income, and forget about reserves for the future. Just like politicians get hung up on GDP while forgetting about net savings.

Genuine saving, also referred to as adjusted net saving or comprehensive investment, offers insight into changes in wealth over time. When a country’s genuine saving is negative, it signals that the nation is using up more resources than it is replenishing, which erodes its capital reserves. Conversely, a positive genuine saving indicates that the country is increasing its wealth and potentially enhancing its future opportunities.

This chart reflects political and social developments in the 20th century; you can see how the Great Depression and World War II caused genuine saving to dip despite GDP growth2. Additionally, it highlights the emergence of GDP as a primary measure of the economy during the interwar period, primarily due to wartime pressures.

GDP was originally devised by Simon Kuznets and Colin Clark to inform about welfare, but wartime priorities shifted its focus towards measuring the extent of resources diverted to war efforts3. Kuznets4 cautioned that GDP would overlook crucial distinctions such as the difference between the “quantity and quality of growth, between its costs and returns, and between the short and the long term.”

I encourage you to read more about this here if you are interested; tangent over!

Moving on…

Having clarified savings, here’s the point: When you have enough money in reserve, you will have more optionality in life.

If there’s suddenly a pandemic and you’re being forced to work from home while your kids are eating you alive and your productivity is at an all-time low, you will have the option to walk away and just enjoy the free time with your family.

In the event of a serious medical issue and facing a lengthy wait times for essential treatment, you can pursue the best available care without constraints imposed by others who control the purse strings.

If you are unexpectedly laid off due to circumstances beyond your control, you have the freedom to take your time and seek a new job that aligns with your long-term goals; instead of settling for a short-term position “because your mortgage won’t pay itself.”

Having reserves gives you options - and this applies to all levels of income - the options of course, are relative.

Why am I writing about this on a watch-related blog?

Simple: buying an expensive timepiece erodes your reserves and therefore, your options.

My guess is many of you already think in this way, and only use ‘excess capital’ to buy watches (after allocating resources to necessities, family luxuries, and reserves)… but on the off chance this gives someone food for thought, I figured it was valuable enough to include… even if only for posterity.

🤔 Construal Level Theory (CLT)

Here’s a link to an interesting paper - it provides a comprehensive overview of Construal Level Theory (CLT). CLT is basically the idea that we think about things differently depending on how close or far away they feel from us.

Imagine you’re planning a trip to a theme park. A year before the trip, it feels far away (psychologically distant). You’ll probably just think about it in a general, abstract way - the thrills, the fun, the adventure! This is thinking about it with a “high-level construal.”

But as the trip gets closer (psychologically near), let’s say a week away, you’ll start thinking about the specifics - what rides to go on first, what snacks to pack, what time to arrive. The trip starts feeling more real and concrete. This is thinking with a “low-level construal.”

The same idea applies beyond just time. We use high-level construals (the big picture) for anything that feels psychologically far away, like faraway places, other people’s experiences, or unlikely events. We use low-level construals (the details) for stuff that feels psychologically close, like familiar places, our own experiences, and likely events.

CLT says psychological distance (how close or far something feels) affects our mental construals (how abstractly or concretely we think about something), and this, in turn, impacts how we imagine, evaluate, or act in any situation.

It’s a simple idea, but it can explain a lot about how we perceive and navigate the world around us.

The paper’s main ideas:

Psychological distance refers to the subjective experience that something is close or far away from the self, here, and now. It includes temporal, spatial, social, and hypothetical distance dimensions.

Mental construal refers to the representation of information along a continuum from concrete, low-level construals to abstract, high-level construals. Low-level construals capture concrete features while high-level construals extract the gist and core meaning.

As psychological distance increases, construals become more abstract, and as level of construal becomes more abstract, targets seem more psychologically distant.

These relationships impact prediction, evaluation, and behaviour:

Psychologically distant events are construed more abstractly and evaluated in terms of high-level features

Psychologically near events are construed more concretely and evaluated in terms of low-level features

High-level construals lead to greater temporal, spatial, social and hypothetical distance

Values and ideals better predict distant than near intended behavior

The paper goes through considerable evidence to reach these conclusions but I won’t bore you with that. Instead, let us consider how can we apply CLT to watch collecting!

For an experienced collector considering a rare vintage Patek Phillipe at auction next year, the watch might feel psychologically distant. They might focus on the prestige, the investment value or the historic significance (high-level construal). As the auction date approaches, they will likely start considering the specifics more carefully - the exact condition, service history, authenticity papers and their own funding for the piece (low-level construal). The advice here would be to not let the abstract allure blind you to the concrete details that truly determine the value of a watch. Moreover, it may be worth recognising the high-level construal early and investigating the piece in advance.

On the other hand, a newer collector saving up for their first “luxury” watch may initially focus on the specifics like size, colour or complications (low-level construal). It is however also important to step back and consider the bigger picture - the brand’s reputation, the watch’s versatility with one’s wardrobe or its potential to mark a special life achievement (high-level construal). The advice here would be to balance the details with the overall meaning the watch might hold for you.

When considering selling a watch, a collector might be torn. On the one hand, they have a concrete attachment to that specific watch and its associated memories (low-level construal). On the other hand, the idea of selling might feel abstractly positive - generating funds for future purchases or making space in the collection (high-level construal). The advice would be to reconcile the specific sentimental value with the general strategic value in your collection - and then attribute the appropriate value to each pro and con.

Most collectors have “grail watches” - highly coveted, often rare and expensive pieces that they aspire to own one day. From a distance, these grails are viewed abstractly - the ultimate expression of craftsmanship, prestige or personal taste (high-level construal). As a collector gets closer to actually acquiring their grail, they must shift to a more concrete view - considering the real financial implications, the practical challenges of finding and verifying the specific watch, the responsibilities of ownership (low-level construal). CLT advises tempering dreams with doses of reality as they get closer.

On the other end of the spectrum, we have “daily beaters” - watches worn frequently in a variety of situations. When choosing a daily wearer, a collector might initially focus on the abstract qualities they want - versatility, comfort or style (high-level construal). Thing is, they also need to consider the concrete details - the actual case diameter, the legibility of the dial or the durability of the movement (low-level construal). A good daily wearer finds a sweet spot between the aspirational and the practical.

When building a collection over time, collectors often have an abstract vision - a certain theme, a balance of styles or some story they want to tell about their collection (high-level construal). The actual process of curation, however, involves a series of concrete decisions - which specific watches to acquire or let go, how to allocate budget and how to physically store and maintain the watches (low-level construal). Effective curation requires regularly zooming in and out between the big picture and the small details.

Let’s also not forget, collecting is a social hobby, and collectors are always engaging with fellow enthusiasts online and in-person. During these interactions, collectors often discuss watches in abstract terms - their historical significance, their aesthetic merit or their collectible value (high-level construal). That said, they also bond over concrete shared experiences - a particular watch hunt, a memorable wearing occasion or even a cherished interaction with a brand or brand executive (low-level construal). The most meaningful community engagement involves both levels - connecting over high-level ideals and low-level realities.

For serious collectors, watches can become a significant part of their estate and legacy too. Thinking long-term, they may have abstract goals for their collection - to preserve it, to bequeath it to heirs or to donate it to a museum (high-level construal). Despite this, they also need to grapple with actual logistics of it all - how to properly document the collection, how to establish legal provenance, how to ensure physical security (low-level construal). Responsible legacy planning means aligning the long-term vision with the short-term practicalities.

Finally, when advising fellow collectors, we often speak in broad strokes - “buy what you love”, “invest in quality or condition” or “follow respected brands” (high-level construal). While this advice is helpful, it is also important to help them grapple with the nitty-gritty stuff - how to spot a fake, how to negotiate price or how to assess condition (low-level construal). The best collectors’ advice combines the forest and the trees.

To conclude, CLT essentially suggests collectors will naturally construe watches differently based on psychological distance (time to acquisition, personal connection, hypotheticality of ownership, etc.). The key is to consciously traverse these different levels - balancing the abstract with the concrete, the general with the specific or the aspirational with the operational. Such balance will help collectors make wiser decisions, build more meaningful collections, and form better connections with the watches they love at every level5.

📌 Links of interest

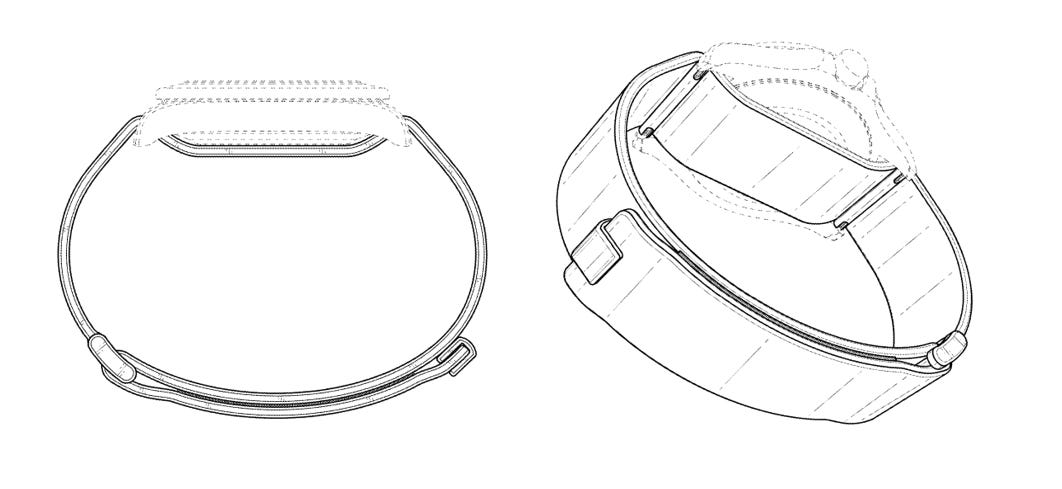

⛓ Rolex is considering a magnetic mesh Milanese bracelet according to patent filings.

🕵️♀️ Inside The Watch Culture Of CIA Paramilitary Officers.

⚰ Historian doubts Nazism allegations against Rolex founder Hans Wilsdorf.

📊 Navigating growth through the first six months of The 1916 Company with new chief executive officer John Shmerler.

🐶 Looks like a second Snoopy MoonSwatch is on the way… but apparently there are lots of fake MoonSwatches on eBay which threaten to kill the hype.

📶 'Wi-Fi' Doesn't Mean What You Think It Means.

🥘 A ranking of the world’s best condiments.

🧒 A neat twitter thread on what to teach your kids.

🍭 How Did Jelly Beans Become an Easter Candy?

🧠 Researchers found brain inflammation is essential in creating long-term memories.

⚽ TacticAI: an AI assistant for football tactics - a collaboration between the Google DeepMind team and Liverpool FC.

🤓 This video maps out Wikipedia, identifying the strangest parts of a site you probably use regularly. (20 mins)

☠ 3 Body Problem: Lawyer sentenced to death for Lin Qi murder.

⭐ After more than a decade with the axe of imminent closure hanging over the school’s head - Kelloseppäkoulu, the renowned Finnish School of Watchmaking, located in Espoo, west of Helsinki, is back on track.

👗 Harvard Business Review breaks down the numbers for Shein, the $70B Chinese Fast Fashion app.

😊 Dr. Andrew Huberman’s Tools to Manage Dopamine and Improve Motivation & Drive.

💰 He Emptied an Entire Crypto Exchange Onto a Thumb Drive. Then He Disappeared.

🤡 April Fools’ Day 2024: the best and cringiest pranks. Tinder’s VP of Ghosting gag was hilarious!

✈ The World's First Electric-Adaptive Jet Engine - (90 min video, only for the extreme aero-minded geeks!)

End note

This was a strange issue to compile... My usual routine for SDC involves preparing for each newsletter on Friday, and then getting it 80-90% done on Monday. After this, unless something drastic happens on Tuesday, the final editing is done on Tuesday, more links are added and it is then scheduled to go out early on Wednesday morning.

This week, both Friday and Monday were public holidays due to Easter, which involved a lot of family admin and no time for anything else. Today, as I sat down to start this, I kept getting distracted with random teasers coming out from Tudor and other brands, reminding me that the warm-up for W&W was well underway - this made this issue feel a bit pointless, in the sense that it was going to be sharing nothing meaningful with regards to what is on everyone’s collective minds.

As a result, I went with a couple of ‘abstract’ topics instead, unrelated to the usual news cycle, since I figured you would be seeing that everywhere else! I hope this issue didn’t disappoint; but if it did, please do add your feedback in the comments on what sort of topics you’d rather see instead. I will keep those suggestions handy for next time.

By the way, if this issue has more typos than usual, I was unable to review and edit it at all - I debated delaying the release, and reviewing tomorrow morning, but my gut felt that being on time was better than being perfect… hope that lands well with you too!

Until next time,

F

🔮Bonus link: How the Most Expensive Swords in the World Are Made

This is a submission from a subscriber and friend, and it is absolutely epic; a 25 minute video about how Japanese samurai swords are made – from the gathering of the iron sand, to the smelting of the steel, to the forging of the blade. Enjoy!

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

Yes, inflation and other factors can affect the value of money over time. Keeping it simple here!

Incidentally - Switzerland’s data stands out as an anomaly, showing periods of significant saving during the World Wars, highlighting its role as a capital haven.

Coyle, D., 2015. GDP: A brief but affectionate history. Princeton University Press.

Simon Kuznets in: Herbert David Croly eds. (1962) The New Republic Vol. 147. p. 29: About rethinking the system of national accounting

Excluding sh*tters :)

I'm so late to this...much of my long weekend list had to be postponed. Just wanted to say that mixing it up from time to time regardless of reason is totally fine for me. Thanks again for putting it together even though life was trying to get in the way. PS- there are no grails. ;-)

Another great issue….hard to downplay the importance of Kanneman’s contributions and most worthy of your “tribute” to him and his work🙇♂️‼️💯…..CLT most interesting 🤨 from many aspects one of which was my very recent ( this week 😳) realization that my watch collection will outlive me and what should become of it (as relatively insignificant as it may be) or where do I want it to go,? …was brought on by looking at my/our domicile and realizing it will likely be here for quite some time after we have gone. Of course I/we know this intellectually (high level construct) but the stark reality (low level construct) is quite a contrast!

On to the links! …… hopefully soon 🔜 ( really need to make time for the samurai sword video 😰)