SDC Weekly 52; One year of SDC Weekly; Die With Zero; The Prix Gaïa

Cartier's Cost Cutting, Does Rolex Own a Newspaper?, China Update, Watch Deposits, Hypercars and Investment, Rolex Price Lists and Increases, Surveillance Capitalism, 10,000 year clock and much more!

Today’s edition marks exactly 52 uninterrupted weeks of SDC weekly; That’s right, it’s been a whole year already. I would never have made it to this point without the constant engagement, support, and feedback from you, the readers.

So… Thank you, truly, for helping me sustain this habit of living in the rabbit hole of watch collecting with some sort of purpose which satiates my natural tendency to overthink, study, connect random dots, and, above all, be opinionated!

In an unexpected twist of fate, I got this email on Sunday, which was a wonderful surprise to wake up to:

How cool is that?! Every time I get a new paid subscriber, I aim to email them personally with a note of thanks1 - and I openly admit that seeing a New Paid Subscriber email is incredibly gratifying. I also remember turning on paid subs as a way to motivate myself to be disciplined about doing SDC every week, and I am happy to report this tactic worked!

There have been many weeks where I had work deadlines, travel, holidays and illness which made the weekly edition seem impossible; Yet, they always went out on time, and I like to think the standard remained relatively stable (though I am curious to hear if you disagree!). I wrote a draft edition one time, where it simply said something along the lines of “sorry no SDC this week because I have been in bed all weekend and sleeping 16 hours a day;” Yet, somehow, I felt a lot better on Tuesday and ended up sending out one of the most popular editions to date! Funny how things work out.

I guess what I am saying can be summarised in two points. First, I am proud of this achievement, and I hope to keep putting together something which seems worth your time as a reader. Second, I am immensely grateful to you, the readers, who take the time not only to read, but actually internalise some of the content and bother to comment, engage, and even show further support by taking out a paid subscription.

I consider the growth of paid subscribers to be a helpful litmus test too; Both for me, as the writer, and for readers, new and old. If I suddenly notice a decline in paid subscribers every week, this would serve as the most useful feedback that the writing is simply not as valuable as it ought to be. Conversely, if this keeps growing, it serves as a reminder to me, that it is valued by many, and I must ensure my standards meet the expectations set by everything I’ve written in the past.

So while I don’t do this for a living, and I fortunately don’t rely on paid subscriptions to make a living, I thought I would spell out what a wonderful tool they are, and reiterate my gratitude for paid subscribers given how large a role they play in keeping me motivated.

With that, I will finish off this section by saying if you were ever on the fence, just know that each paid subscriber means so much more to me than the price itself.

Anyway, you can catch up on the older editions of SDC Weekly here.

Small stuff

Christie’s Hack

Turns out, Christie’s was hacked by a group called RansomHub. The cybercriminals claimed to have accessed sensitive information about some of the world’s wealthiest collectors, threatening to release the data if ransom demands were not met by the end of May.

According to The New York Times, Christie’s acknowledged the breach, stating, “… an unauthorized third party had managed to gain access to Christie’s IT network...”

While the auction house maintains no financial records were compromised (see below), the hackers allege that Christie’s “ceased communication” during ransom negotiations, and now risks “heavy fines” under the EU's strict data protection laws.

This incident raises concerns about the security of client information and Christie’s reputation. Initially, they had a webpage stating it was down for maintenance. In the days following the incident, they downplayed it all and didn’t even bother apologising.

Here’s the communication from Christie’s to clients: (Thanks R!)

Federation of the Swiss Watch Industry - April Update

Swiss watch exports experienced a surprising upturn in April 2024, following a significant decline in the previous month. That’s according to the usual monthly data released by the Federation of the Swiss Watch Industry (FH). Exports reached 2.1 billion Swiss francs ($2.3 billion), a 4.5% increase compared to April 2023, despite ongoing challenges such as high interest rates, economic instability, and geopolitical conflicts.

The recovery was mainly driven by strong demand from the United States and Japan, which offset the continued weakness in China. Exports to the US, the largest market for Swiss watches, jumped 11.6% in April, reversing the fall experienced in March. Japan also saw a substantial increase of 13.6%, supposedly due to the weak yen which has been attracting tourists and boosting sales.

Worryingly, China (the second-largest market for Swiss watches) remained sluggish, with exports falling by 7.5% in April. Hong Kong, another key market, saw a modest 0.2% growth.

The FH data revealed that high-end watches, particularly those priced above 3,000 Swiss francs (export price), continued to outperform, with a 7.8% increase in value and a 6.1% rise in units sold. Conversely, shitters in the 500-3,000 Swiss francs category suffered a decline of 10% in value.

Bloomberg referenced Vontobel analyst Jean-Philippe Bertschy who described the monthly statistics as “surprisingly strong,” highlighting the positive performance of luxury brands such as Rolex, Patek Philippe, and Cartier. Bertschy noted “The other brands, especially in the lower segments, are still in a reset mode after an extravagant post-Covid period.”

The FH report aligns with the better-than-expected quarterly watch sales reported by Richemont. Richemont recently announced a 4% drop in quarterly sales at its specialist watchmaker division compared to the previous year.

In terms of watch materials, precious metal watches (+5.9% by value), bimetallic watches (+4.9%), and those made from other metals (+23.7%) and other materials (+16.2%) performed well. Interestingly, steel watches saw a 2.0% decline in value, despite the number of units remaining stable.

Overall, the performance data for April 2024 seems to (surprisingly) demonstrate some resilience in the face of global economic challenges. The strong demand from the US and Japan, coupled with the continued appeal of high-end watches seems to be propping things up for now. Still, the ongoing weakness in the Chinese market and the slower recovery of lower-priced segments remain concerns for near future.

You can review the FH data here.

China update

You’ve just read how China is tailing off, so let’s pull on the China thread some more. This section is a tad heavy on economics, so if you don’t care, skip to the next section. The first bit is about the luxury market in China, and the second is about the overall market and economy.

In general, it seems the once-booming Chinese luxury market - a major growth driver for luxury peddlers over the past two decades - is now facing an uphill battle. According to a recent article by Miss Tweed, industry experts and executives predict demand for luxury goods in China is unlikely to rebound in the near future, and brands should brace themselves accordingly.

Sales of major luxury brands such as Gucci and Chanel have declined by more than 35% and 25% respectively, since the beginning of the year. This slump has resulted in luxury groups pausing plans for boutique openings and major events in China.

One expert predicts many western brands will exit the Chinese market in the next three to five years due to the increasing costs and complexity of operating in the country. Another expert expects the Chinese market to remain quiet for between 9 and 18 months, noting that many wholesalers are still selling but not re-ordering stock… which hurts their partner brands.

There is also the not-insignificant problem of the Chinese government’s recent crackdown on social media influencers; Reprimanding those who flaunt lavish lifestyles while the economy is slowing and unemployment is on the rise. This cultural shift and government-imposed restraint may also have lasting effects on the appetite of Chinese luxury buyers.

In the beauty sector, global brands such as Estée Lauder and L’Oréal are supposedly losing market share to home-grown Chinese brands, which appear to be better adapted to local consumers’ needs and expectations. L’Oréal has been building a portfolio of Chinese beauty brands to tap into this growing preference for domestic products.

While some industry executives believe the Chinese market will eventually improve, they also acknowledge that brands need to adapt to the new reality. Miss Tweed does seem to think big brands like Louis Vuitton, Loewe, Hermès, and Moncler are likely to maintain resilient demand, as no major Chinese brand is in that league... but even these megabrands need to adjust their strategies to ensure they don’t find themselves pushed out of China’s luxury market over time.

Considering the luxury watch market specifically, I suppose the ‘local alternative’ angle is less of a threat; But the general appetite of luxury buyers being suppressed is definitely cause for concern. Without trying to turn this into an economics blog, I thought this commentary was generally interesting.

That said, Gavekal Research has more to say on China. This article discusses the recent changes in China and their potential implications for global markets, focusing on the direction of the Japanese yen. They highlight five major changes in China over the past five years:

Improved infrastructure in non-first-tier cities

Digitalization of everyday life

Increased English proficiency among the population

Growth in the number of cars, particularly electric vehicles

Reduction in urban air pollution

Apparently China has become more affordable for tourists and has shifted its focus from real estate to industrial investments - this has led to increased exports of cars, solar panels, telecom switches, and railroad equipment. This shift has raised concerns about China becoming a deflationary drag on global growth.

They suggest the direction of the Japanese yen will be crucial in determining market performance; this is an angle I hadn’t given much thought until now. A higher yen could lead to a Chinese deflationary boom, causing emerging markets to outperform developed markets. Conversely, a lower yen could result in Japan “stealing” growth from other countries, benefiting US growth stocks and Japanese exporters.

It feels like they think the Chinese equity market rally will continue, which will attract foreign capital into the country. At the same time, they also acknowledge risks such as policy tightening, business crackdowns, and geopolitical tensions (particularly with the US) which may stop this from happening.

The conclusion of this article is extremely interesting; they advise investors to stay long on Chinese equities while also purchasing out-of-the-money puts on the euro in case the yen devalues further - basically saying if the Japanese yen drops too low, the Euro will also drop because of this. What a puzzle!

Cartier’s Cost Cutting

Despite being posted on April 15th the above post came up on my Instagram feed this week. I don’t pay such close attention to individual releases in this way, unless they are of interest to me, but this fellow raises a good point.

Essentially, he explains how Cartier is using a version of Sellita’s SW330 in their new Santos De Cartier Dual Time which was released at Watches and Wonders 2024, and retails for $9,150.

There were two amusing aspects to this story. First, it was the Hodinkee post linked above, which had the most transparency on this story, clearly stating this was a modified Sellita. Bravo chaps!

Second, the post shared by A Blog to Watch - which is owned by Ariel Adams - said the following: “Cartier has modified an outsourced movement to accommodate the dual-time complication rather than create an entirely new one.” No mention at all, about the SW330!

Granted, Ariel didn’t write this article himself, but given he makes disparaging remarks about independent writers, and is outspoken about the value of the content on ABTW, one would think his site would be among those which are transparent about something which isn’t even a secret, and which readers might like to know about! Come on Ariel, if Hodinkee can, everyone can 😂!

Watch Deposits

A friend told me he knows a guy who put down a 45% deposit on a piece, and was told he would wait 20 years. Twenty years! I have no idea whether this is the ultimate version of under promising and overdelivering but it raised some interesting questions and calculations.

To start, let’s assume a 100k retail price - assume this price is frozen once the deposit is paid - so you’d pay 45k today, and 55k in 20 years from now. At a 5% discount rate, and assuming you could earn 5% on your 45k every year - the total price you’d pay in today’s money is 103k. That’s 45k, plus the present value2 of the 55k balance in 20 years’ time, plus the ‘opportunity cost’ of 5% per year on the 45k, compounded (adding the 5% per year to the growing balance each year)3.

That doesn’t sound bad at all, right? Now, if you increase your discount rate to 10%, and you leave the ‘opportunity cost’ at 5% it goes down to 76k. If you keep them both at 4%, you pay almost the same 100k in 20 years’ time. But that doesn’t make much sense. Instead, we know the average yearly return of the S&P 500 is 10.47% over the last 30 years, as of the end of April 2024. So let’s use that as the opportunity cost to the buyer, and then the 30 year US Treasury rate - generously - averages below 3% but let’s call it 4% for the hell of it.

With these parameters, opportunity cost of 10.47%, and discount rate of 4%, that 100k watch ends up costing 207,582! Now of course, we’re talking in ‘today’s money’ - ultimately, it is true that if you use an inflation rate of 3.5%, 100k today is worth about 200K in 20 years from now - but the whole calculation is about today’s money! That’s the point; this watchmaker is getting ‘today’s money’ value of 182k via the deposit and the opportunity cost over 20 years, and the 55k balance is only worth about 25k when it is paid to them in 20 years.

In short, a 100k watch actually costs a buyer 207k. That is made up of 45k (deposit) + 137k (opportunity cost) + 25k (final payment of 55k in today’s money)

This is genius 😂

Yes, the watchmaker takes the ‘risk’ of costs rising and so on, but remind yourself, they are taking deposits all the time. They may have 20-50 clients all on different waiting periods, and so they can easily raise the prices of the same watch each year, for delivery in 21, 22, 23, and future years, which will be a sufficient hedge against the cost creep - not to mention they don’t need the cash today so they can (and probably do) invest it so that 10% return is going to them instead of the client.

Hopefully this adds some useful perspective on deposits coupled with prolonged waiting periods. A nominal deposit is fine to filter out ‘tyre kickers’ but taking a huge chunk of money, especially when the watchmaker or brand is an established business, is, to me, a real piss take4. Thankfully, the days of using clients’ money in lieu of working capital are behind us for the time being.

Stallone Defends Selling

I found this amusing. Sly tells a story about a necklace he was gifted, reminiscing how the gift giver had said “it’s time for you to enjoy it” before handing it to him for free. He then uses this as an analogy to explain how he is now ‘giving’ this watch to someone else to enjoy. Rich stuff I tell you.

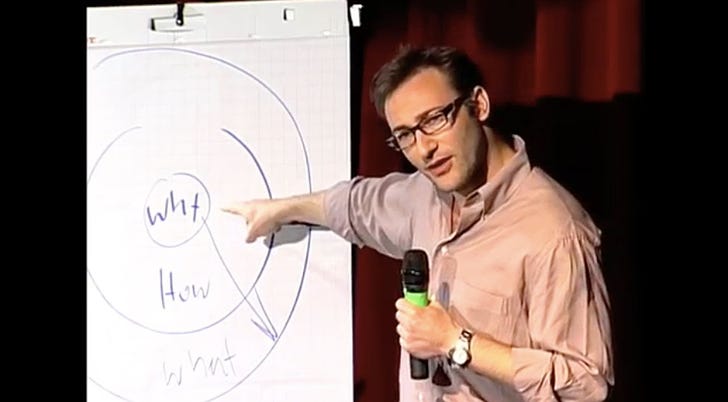

Authentic Content

This is an hour-long video which really resonated with me as a ‘creator’ of sorts. Marques Brownlee aka @mkbhd talks about how he built his empire, his creative process, and most interestingly, the topics of power, responsibility & conflicts of interest. The YouTube video has bookmarks in the description, but the relevant section starts around 3:45.

I have followed his channel for over 15 years, and what I have found most impressive is how I have, consistently, never felt he didn’t have my best interests as a viewer in mind when creating his videos. I never once felt he might be saying things he didn’t truly believe, solely to make me buy a product, or that he was pulling punches with his criticism to prevent falling out with a brand.

This is the exact problem Hodinkee is facing, and the main reason for their decline. One point in the video which hit home was how he reflected on his attendance of an Apple event for the first time - and him being the only YouTuber there. The following year there were 3 of them, the next year there were 5, then 9… and today, Apple sets up the event to cater to all sorts of creators like MKBHD. He explains how Apple had the realisation that these people are here to stay and it was clearly a phenomenon to embrace. There was no punishment for saying something is bad, because Apple realised feedback is a gift. If companies don’t like negative reviews, they should make better products!

Seems logical. So why don’t we see this in the watch industry? The answer is one we’ve heard countless times. The media is too afraid to bite the hand that feed them, and the hand that feeds them, apparently loves to bite. The brands hate bad press, and punish media for having an honest, unbiased opinion… So they either mislead with biased positivity, or at best, simply say nothing at all.

This is why ‘independent’ opinions are a good thing, and are successful in the long term. MKBHD’s success proves this hypothesis. Everyone should think carefully about the content they consume, and the repercussions of not supporting objective and unbiased content if they would like to see more of it. It doesn’t help to lament the hypocrisy of Hodinkee’s business model, but also refuse to spend a measly some on the very model we claim to prefer.

In a world where people have become accustomed to reading content for free, it becomes more important to differentiate between ‘stuff’ and ‘good stuff.’ Most people don’t buy luxury shoes and use cheap, low-quality polish on them; Why then, would they indulge in an expensive hobby but allow themselves to read advertorial, biased content which might influence them negatively or worse, misinform them?

To be clear, I am not talking about SDC here, and given what I said in the introduction, it may seem that way; But it’s not5! This is an important topic, which addresses a problem in the industry that leads to outcomes like we see with Hodinkee, and what causes Ariel Adams to write a blog post every other week about the subject6. Something needs to change, and the power lies with you, the readers of said content.

On a related topic, this article Let’s Just Admit it: The Algorithms Are Broken by Ted Gioia is on point.

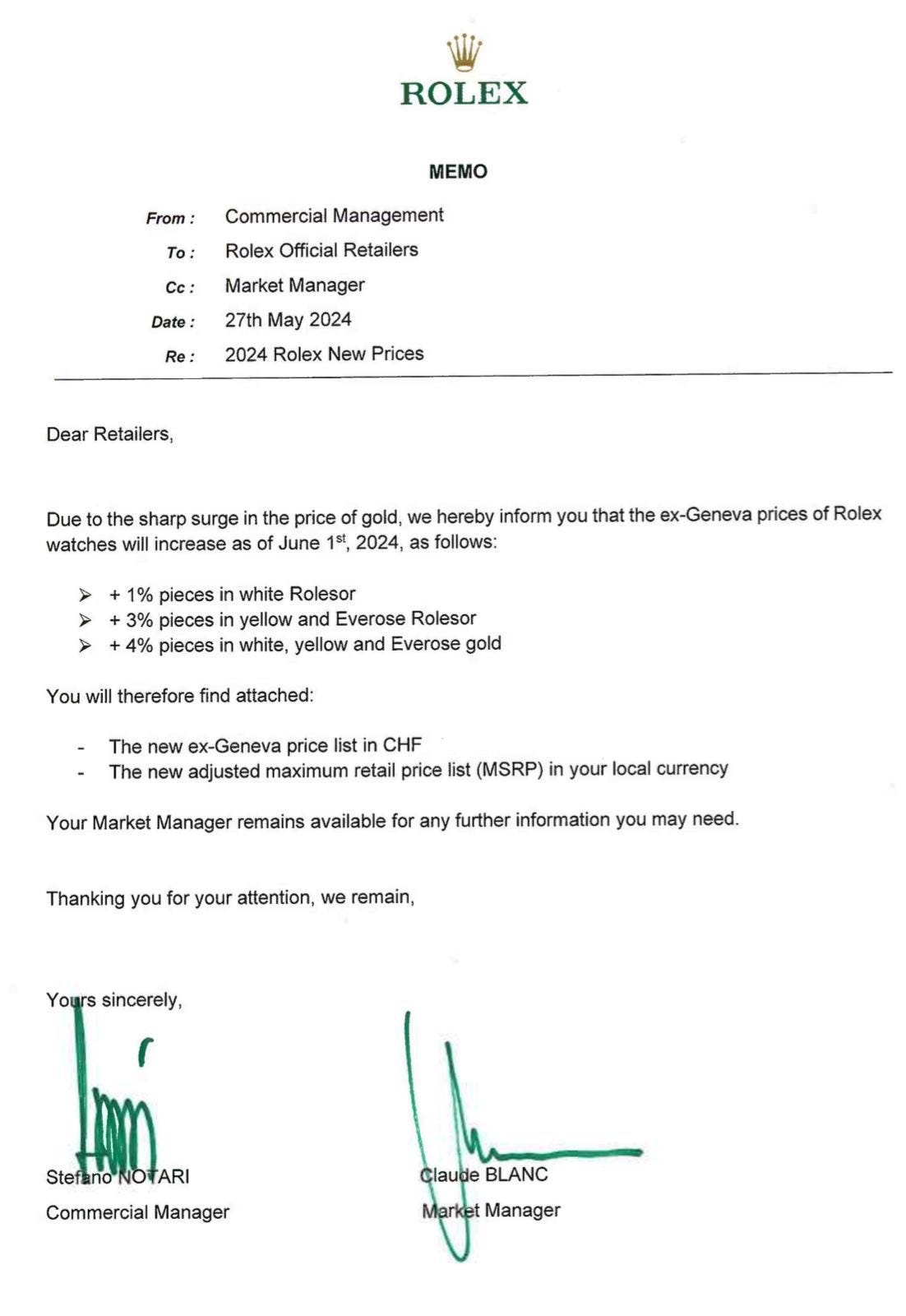

Rolex Price Increases

Thanks to the folks who shared these docs:

Bloomberg’s Andy Hoffman also covered the price increase on Sunday, here’s a chart from the article:

WatchPro also covered the increase on Monday, sharing this useful table:

Pretty wild to see a white gold Daytona has shot up by 19.3% since 2022!

Hypercars and Investment

This FT article discusses the growing trend of hypercars - elite, limited-edition vehicles built to racetrack specifications but sold for road use. The reason I am bringing this up here, is the article focuses on these cars’ ability to appreciate in value – some have sold for millions more than their retail price before even being delivered. Seemed like a useful read as this is, in some regards, not dissimilar to the top 0.1% of the watch market.

As one collector put it, “My biggest gain was on a Pagani Zonda, which I bought for $1.68mn and sold for $4mn.” With price tags exceeding £2 million, hypercars are not for poors7, but for those who can afford it, the rewards can apparently be both exhilarating and financially astute! There’s even a section at the end about “Flipping a four-wheeled asset!”

“Heaven forbid [the manufacturer] offers more cars than people want,” says Banks. “Making a success with a new hypercar is about producing the right volume at the right price so that no one gets cold feet, as well as producing something that sets hearts racing. Ferrari is the master of this.”

Does Rolex Own a Newspaper?

Having discussed authentic content a moment ago… This is nuts.

This article discusses how Le Temps, a French-language Swiss daily newspaper, came to the defense of Rolex when Peru’s first female president, Dina Boluarte, was embroiled in a corruption scandal nicknamed “Rolexgate.” The scandal involved luxury watches worn by the president at public events, leading to police raids and political upheaval.

Le Temps argued that Rolex was a victim of its own success and influence, as only one of the 14 watches in question was a Rolex. The newspaper is supposedly funded by the Hans Wilsdorf Foundation, which is the sole owner of Rolex - this ownership is via the Aventinus Foundation, which was established in 2020 to support independent, high-quality media.

The article also mentions that luxury brands financially backing newspapers is not new, citing LVMH's acquisition of Les Echos in 2007. Le Temps publishes articles in partnership with Rolex and Bucherer, the world’s largest Rolex retailer (which Rolex acquired in August).

The article further highlights how Le Temps defended Rolex and its founder, Hans Wilsdorf, when a new book suggested that Wilsdorf might have been a “fervent admirer of the Hitler regime.” The newspaper sought the opinion of a historian who ‘minimised the allegations’ as a footnote, while other media outlets reported the findings without questioning them.

The article concludes:

If Rolex’s reputation is today the brand’s biggest asset, the discreet purchase of the newspaper Le Temps through an intermediary foundation has been one of the brand’s boldest move[s] of the past five years, a move that has continued to pay dividends if and when the Crown is unwittingly embroiled in global scandals.

Enough small talk… Let’s dig in.

🤑 Die With Zero

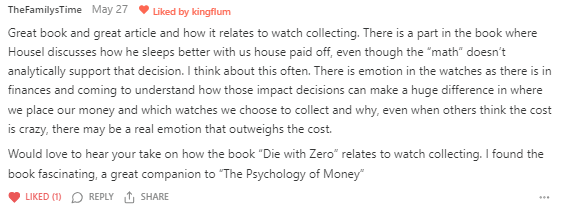

The other day TheFamilysTime commented on an old post about the Psychology of Money:

I am always asking for feedback and suggestions, so I suppose it behooves me to actually do something with feedback when I get it! Here’s hoping this motivates you to do the same…

As watch collectors, I think its fair to say we are naturally drawn to objects which symbolise the passage of time. Watches can be functional tools, sentimental heirlooms, or prized possessions, and there is no denying how a watch collection also represents money… Yet, despite how considered we are about spending money, do we give as much consideration to how we spend our time?

The book Die With Zero by Bill Perkins challenges us to rethink our relationship with money to perhaps focus more on experiences.

Invest in Experiences, Not Just Watches

One of the main arguments in Die With Zero is that we often focus too much on accumulating money and not enough on spending it meaningfully. Perkins advocates investing in experiences, especially when you’re young, to accumulate “memory dividends” which compound over a lifetime.

As a watch collector, it’s easy to get caught up in chasing the next acquisition, but there are other watch related activities you could pursue too. What if you used some of your watch budget to attend an exclusive brand event, visit a your favourite watchmakers’ manufacture, or take a watchmaking class? These experiences will likely be more memorable than one more watch in your box, which will reduce wrist time for every other watch you already own. As Perkins says:

“We all get one ride on this roller coaster of life. Let’s start thinking about how to make it the most exciting, exhilarating, and satisfying ride it can be.”

Strike While the Iron is Hot

Another point in Die With Zero is how our ability to enjoy experiences declines with age, even as our wealth typically increases. Perkins emphasises how, as we age, our health and energy inevitably decline. He urges readers to pursue their dreams while they still can.

“There’s another, less obvious truth about ‘dying’ that has important implications for how you should live your life… We all die a multitude of deaths throughout our lives.”

Watch collectors can relate to this sentiment. Our tastes and priorities evolve over the decades, and so, this could suggest being a bit bolder in your purchases (within reason). If there’s a special watch you’ve been lusting after, consider taking the plunge sooner rather than later. As we get older, our tastes and priorities change. The steel sports watch which made your heart race at 30 may leave you cold at 60. Carpe diem, anyone?

Another quote which stuck with me was this one:

“Consider at what ages you want to give money to your children, and how much you want to give. The same goes with giving money to charity. Discuss these issues with your spouse or partner. And do it today! Be sure to consult on these matters with an expert such as an estate planner or a lawyer as well.”

While he is talking about money, you can probably tell the same applies to your watches! I hear many people talking about leaving their watches to their kids - but it is more likely they will enjoy the watch even more if you gift it to them while they are young and can enjoy it more. Granted, many parents want to avoid ‘spoiling’ their kids, and therefore withhold lavish gifts like luxury watches… But perhaps there is a better balance to be found. Maybe consider sharing the collection with them, provided they can be trusted to treat the watches responsibly. Each child is different of course, but this one hit home for me.

Budget for a Lifetime of Collecting

Having said that, let’s do a complete 180! Perkins acknowledges the need to balance a YOLO attitude with prudent financial planning. He recommends creating “time buckets” to allocate money for different life stages.

Watch collectors can apply this by setting collecting goals and budgets for the short, medium and long term. In your 20s and 30s, you might prioritise buying versatile pieces suitable for daily wear, given you do crazy things like rock climbing, and raising children. As your career progresses, you can set aside funds for higher-end acquisitions to satiate your mid-life crisis. Then, in your golden years, you may shift to preserving your collection for posterity. This will vary for everyone, but it does require some thoughtful planning. Indeed, you can’t plan for things you have never seen (future releases) but hopefully you get the general idea, and expect to have a buffer fund for the occasional impulse buy!

Closing Thoughts

Die With Zero boils down to the notion that money is a means to an end. For watch lovers, collecting is about so much more than the financial value of each watch. It is about the hunt, the joy of learning, the satisfaction of curating a collection we can be proud of, and above all, the relationships borne out of the hobby which we get to foster and cherish.

Ultimately, I think Perkins’ point was that memories and experiences are the true measure of a life well-lived.

“In the end, the business of life is the acquisition of memories.”

For watch collectors, it is a matter of recognising the value of experiences which collecting brings; From the thrill of tracking down a rare piece, to the camaraderie of going on watch-inspired trips with fellow collectors - these memories will endure long after your eyesight declines to the point you can’t even see the watches themselves.

By all means, everyone should be sensible in their spending; But also remember to savour the experiences along the way, at every stage of your collecting journey (and life!).

“Don't cry because it’s over, smile because it happened.” - Dr. Seuss

Here’s a tangential post if you have time.

🚁 Visiting Switzerland

Speaking of trips and memories, last week I found myself in Switzerland again, for what might just be the most memorable watch-related trip to date.

I started this section, but it became too long, even before I had finished it! I have copied it across to a new standalone post, which I will share once I have uploaded photos and finished editing. 😂

👑 The Prix Gaïa and the Grand Prix d'Horlogerie de Genève (GPHG)

In the world of horology, most people know about the Grand Prix d'Horlogerie de Genève (GPHG). Most, however, have never heard of the Prix Gaïa (i.e., Gaïa Prize)! A couple of weeks ago I met with someone who happens to be a judge for this prize, and I figured it was worth sharing! (Thanks S!)

In theory, both awards celebrate the art and science of horology, but they differ in their focus, scope, and of course, their impact on the industry.

The Prix Gaïa

The Prix Gaïa was established in 1993 by the Musée international d'horlogerie (MIH) in La Chaux-de-Fonds, Switzerland, to recognise Maurice Ditisheim, a key figure in the establishment of the MIH. Named after the ancient Greek goddess of the Earth, the award recognises outstanding contributions to the field of horology in three categories:

History and Research in watchmaking and timekeeping,

Workmanship and design in watchmaking, and

Entrepreneurship in watchmaking.

The award is presented annually by the MIH, which is one of the world’s leading museums dedicated to the art and science of timekeeping.

A key differentiator between the Prix Gaïa and the GPHG is the nomination process. The Prix Gaïa cannot be simply subscribed to; instead, nominations are submitted to the management team of the MIH, who then pass these onto the Awards Committee. The Awards Committee, chaired by the MIH Curator and consisting of 10-15 people from the MIH management team and the wider horological world, selects the winners. Three people on the Awards Committee are replaced each year. Here’s a link to the official rules.

Apparently The Prix Gaïa is highly respected within the watchmaking community, as it honours individuals who have made significant contributions to the advancement of horology. By recognising achievements in craftsmanship, research, and entrepreneurship, the award is meant to celebrate the diverse aspects of the watchmaking industry and to promote the exchange of knowledge and expertise among professionals. The thing is, most folks have not even heard of it, so really, it feels much less about the marketing value (like it is with GPHG), and more about recognition amongst peers.

Over the years, the Prix Gaïa has been awarded to numerous luminaries in the world of horology, including François-Paul Journe, Philippe Dufour, Derek Pratt, George Daniels, Kari Voutilainen, Anita Porchet, and Suzanne Rohr in the Workmanship and Design category, and Nicolas Hayek, Robert Greubel and Stephen Forsey, Jean-Claude Biver, Philippe Stern, Max Büsser, and Richard Mille in the Entrepreneurship category.

The Grand Prix d'Horlogerie de Genève (GPHG)

The Grand Prix d'Horlogerie de Genève (GPHG) was founded in 2001 to celebrate the excellence and creativity of the watchmaking industry. The award supposedly recognises the best watches of the year across various categories, such as men’s watches, women’s watches, complications, and artistic crafts. The GPHG is often referred to as the “Oscars of the watchmaking industry” due to its prestigious status and global recognition, but I have repeatedly made fun of it as the most elaborate circle jerk in the hobby, due to how badly it is riddled with conflicts of interest. Brands also pay a fee to nominate themselves, and the whole exercise is so extensively covered by the watch media, it is essentially nothing more than a marketing exercise with a bonus prize at the end for any watch which happens to win.

Despite being a charade, nobody can deny the GPHG is one of the most influential awards in the world of watches. Winning a GPHG award can (and has) significantly boosted a brand’s reputation and sales, as many believe it serves as a seal of excellence and quality - but really, it is simply a matter of publicity and positive reinforcement.

The award ceremony attracts leading figures from the watchmaking industry, as well as journalists and collectors from around the world - there’s no denying the whole event does have a “self-fulfilling prophecy” nature when it comes to winners’ success, but given how some major brands such as Rolex don’t even bother entering, the results should be treated with scepticism as far as I’m concerned.

Comparing and Contrasting the Prix Gaïa and the GPHG

I think this can be boiled down to a difference in focus and scope. The Prix Gaïa recognises individual contributions to the field, spanning craftsmanship, research, and entrepreneurship, while the GPHG focuses on the watches themselves.

The Prix Gaïa is more focused on the human element of watchmaking, celebrating the people behind the creations and their impact on the industry… While the GPHG primarily recognises the products, showcasing the latest innovations and trends in watchmaking. Admittedly this isn’t a scientific differnetiation, since the GPHG does have innovation prizes for example… but it is still a watch-focused event, not a people-focused one.

Despite its significance in the horological world, the Prix Gaïa does not seem to receive as much media coverage as the GPHG. This disparity in coverage is why we have a lack of public awareness about the Prix Gaïa, which is perhaps something that may change with posts like this one, or with the MIH finding a way to monetise it (which would create the inevitable conflicts of interest again!)

Concluding thoughts

For watch collectors, you could argue both of these offer useful insights. The Prix Gaïa helps collectors identify the most influential and innovative people in the industry, and this knowledge can inform collectors’ decisions when acquiring watches.

The GPHG, on the other hand, is supposed to serve as a showcase of the finest watches of of the year - but I dispute the veracity of the process, and therefore view the results as dubious. Despite this conundrum, the GPHG nominee lists can help collectors identify the popular watches of the year, as well as discover emerging brands and models which may otherwise go unnoticed. This information should not be regarded as collectively exhaustive, but does offer a lot of useful data - especially when participating brands and judges have shared interests.

I do think there is an opportunity for the Prix Gaïa to receive greater media coverage and public awareness, which could contribute to a more comprehensive understanding of the horological world and the people within it.

✨ Podcast About Finishing

I could have included as a link, but I liked this hour-long episode from Hairspring enough to give it a separate shout out. In the world of horology, the term “finishing” encompasses a wide array of techniques employed by watchmakers, and this episode attempts to give the listener a better understanding of “What good looks like.” Given how often finishing comes up in conversation, if you don’t know much, this will certainly help!8

📌 Links of interest

😥 Arrests after watch dealer assaulted during robbery.

🏃♂️ Pandemic Watch Collectors Have Left the Scene, and the Market Is Showing It.

💀 What’s the deal with Bremont? Dubai Watch Week going ham on Bremont, which was surprising. (Thanks P!)

🌟 Hands On: Patek Philippe “Extra Special” Chronometer of Henry Graves Jr.

🔨 The Top 10 Watches Headed to Sale at Christie’s on 10 June.

⭐ Up Close: Philippe Dufour Duality No. 3.

🍎 Apple is hosting their WWDC 2024 next Tuesday - Here’s what to expect: “Siri To Get Smart as Apple Readies On-Device AI Experiences”

🗳 The ANC party which freed South Africa from apartheid loses its 30-year majority in landmark election.

😖 Luxury perfumes linked to child labour.

🤖 This $525,000 Boba Fett Is Now the World’s Most Expensive Vintage Toy.

😇 22 Small Things That People Say Made Them Drastically Happier. You might find some good ideas here. Worth a few minutes of your time.

🤡 Editorial: Are Watches a Good Investment? This article is absurd. Completely ignores cost of ownership too, but aside from that,

😐 Supersharers of fake news on Twitter: “…disproportionately Republican, middle-aged White women residing in three conservative states…”

🚨 Over 2,500 documents showing how Google stores data on content, links and user interactions have been leaked.

🥗 The world’s 20 best cities for food right now - Johannesburg features!

💀 Microplastics Are Everywhere. Here’s How to Avoid Eating Them.

🥵 Temperatures in Delhi hit 52°C.

🌲 The Moral Economy of the Shire.

⚡ There may be a simple fix for renewable projects waiting to be plugged into the grid in the US: installing new wires on existing high-voltage lines. This alone could double the size of the grid.

😨 Shoshana Zuboff on surveillance capitalism - This is a 49 minute video, which digs into the Faustian Bargain society is faced with when it comes to ease of using the internet. It is truly staggering how badly tech companies abuse people, mostly without anyone realising it. If you have the time, it is worth watching - but fair warning, it may leave you feeling a little helpless and possibly even upset!

🤯 You Think You Know How Misinformation Spreads? Welcome to the Hellhole of Programmatic Advertising.

End note

In case you missed it… here’s a fun post from last week:

I was having a random conversation with Aaron Bernstein two weeks ago, and I mentioned the upcoming travel (last week). We talked about the plans for the trip, and during the conversation he asked me whether I was waiting on a watch from Rexhep. This led to an interesting conversation about how we as collectors perceive the hunt.

Fundamentally, if we agree the thrill is in the hunt, and that we lose excitement about a piece soon after acquiring it, does this mean we lose excitement about a piece if we merely secure an allocation?

In other words, if you are dealing with someone like Rexhep who makes a handful of watches every year, you already know it will take a while to actually take delivery of a piece from him, even if you secure an allocation.

In this rare instance (perhaps only true for few others like Hajime Asaoka, R.W. Smith and other low-production watchmakers), does the thrill of the hunt end once you are promised an allocation?

I said I thought so. This is not to say one will not be excited when the piece finally arrives, but at the risk of sounding like Captain Obvious again… Once you get an allocation, you stop chasing it because, well, there is nothing left to chase! It is a test of patience at this point - no thrills, no hunt. Here’s a post about the hunt, to make up for the delayed Switzerland recap;

Until next time,

F

🔮Bonus link: Jeff Bezos and his 10,000 year clock

This monumental 500-foot-tall mechanical clock, nestled inside a mountain in West Texas, is designed to tick once a year, chime every 100 years, and unleash its cuckoo bird every millennium. There’s a specific cam in the clock to convert solar time to absolute time correctly, for the next 10,000 years - that’s the limiting factor. As Bezos explains to Lex Fridman below, it’s a challenge to humanity, a call to expand our thinking horizons and consider the long-term consequences of our actions.

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

If you didn’t get one, please email me with disdain - or check your spam folder. Also note, some folks have replied to me, and it went to my spam folders - so if I have not replied to your emails, please comment below and let me know so I can look for your email and make things right!

I am assuming a basic knowledge about the time value of money. If you don’t have this knowledge, start here.

Opportunity cost is leaving your money to earn interest or invested in something else, which offers a return greater than zero - which is what you ‘earn’ when it sits with the watchmaker as a deposit while you don’t have a watch to enjoy.

Hey Ming Watches 😝

I still release everything for free after a couple of weeks, as I think it is important to maintain greater reach. Whether SDC should be entirely exclusive to paid subs is a question for a later date. Would I do this full time? I struggle to see a volume of paid subscribers which would make this worthwhile… but who knows!

Here’s a few if you missed them.

If you follow my memes on Instagram, this ‘poors’ joke will make sense. If not, please ignore.

Here, I wanted to use the word behoove again - love that word!

Congrats on the best seller milestone. So incredibly happy for you, and inshAllah wish you continued success in all of your life’s endeavors. Wholeheartedly appreciate the learning and knowledge that you so graciously share. 👏

First, huge congratulations. The content is always first rate and what tremendous discipline it must take to deliver to such a high standard every week. I will say, don't get burnt out. I wouldn't be upset if there was a week off from time to time.

I think you had a poll a couple of weeks back about how to treat the content and I voted to make it 100% paid. There might be an option in between, where the entire content isn't given away a week later. This content doesn't seem to be particularly time sensitive to me, I think I just proved it going back through the last month that I missed. I just feel allowing people to enjoy the content free, only a week later, is too generous. You know what your stats are, so what do I know, but I might try a model where maybe one week is free as a trial but the rest remains locked. I think you might see more conversions. My 2 cents, perhaps not actually worth 2 cents :D

Ok, off to read the rest of this week. Again, congrats and thanks!