SDC Weekly 79.5; Rolex 2025 Price Hike; Sotheby's Fee U-Turn; Bucherer Backstory; LVMH Watch Woes

Rolex's 2025 Price Hikes, Sotheby's U-Turn in Fee Structure, Bucherer's Billion-Dollar Deal, LVMH's Watch Woes and the Swiss Watch Industry - November Update.

🚨 “SDC Weekly again?” … “Wtf happened to final edition of 2024?”

J. F. Christ, please bear with me…

Estimated reading time: ~18 mins

Perhaps you were relieved to hear you could rest easy until next year, not having to read all my drivel - I’m sorry to disappoint you. A bunch of newsy things came up in the last couple of days which I wanted to cover before the holidays. Fret not! This edition will be much shorter than the average SDC Weekly, as there are no longer essays, just the news-type updates. Hence the “x.5” naming convention (more on this later).

Of course, if you’re new here, welcome! This edition of SDC Weekly is not at all reflective of the usual format, so make sure you check out the older editions of SDC Weekly here to get a better feel for them. If you’re a free subscriber, you’ll need to look further into the archives to find such examples- around edition 63 is a good place to start.

Ok, let’s get on with it!

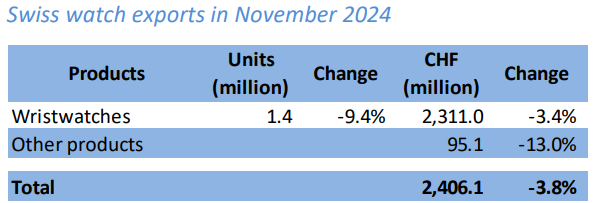

📊 Federation of the Swiss Watch Industry - November Update

In the October update, we said the -2.8% decline was “slightly less terrible” than September, and some thought it might be a glimmer of hope that the bleeding was slowing down. It turns out, November’s figures suggest there is no such glimmer to be hopeful about. Swiss watch exports fell -3.8% compared to November 2023, and totalled 2.4 billion francs. The year-to-date decline is now at -2.7%, and cumulative exports at 23.9 billion francs - this puts the industry on track to complete its first negative year since 2020, which of course was pandemic-related.

November’s data mostly reverses the trends from materials we saw last month where units and sales moved in opposite directions. Steel watches (-5.8%) are still dragging down the average, and precious metals (-2.2%) seem more resilient. Bimetallic pieces have stayed relatively stable (-0.6%), and worst of all, are the ‘other’ metals (-13.6%). As for other materials, this might have something to do with all the new editions of Swatch bioceramic pieces, but I can’t be sure.

The volume story is still concerning, as November saw nearly 150,000 fewer units shipped compared to last year (-9.4%). The ‘Other materials’ (-20.4%) and ‘Other metals’ (-27.3%) categories bore the brunt of this fall, which suggests any experimentation with alternative materials is probably not going to continue for the foreseeable future!

The price segmentation story has taken an interesting turn since October. Last month we saw the over-3,000 franc segment managing modest growth (+1.7%). November shows a reversal even in this category (-0.9%) which is usually more resilient. The crucial 500-3,000 franc segment continues to bear the brunt, only slightly better (but still sh1t) from October’s -21.0% drop to ‘only’ -14.9% in November. Per the numbers, this is an improvement, but it’s worth noting that two consecutive months of double-digit declines in what is typically a key segment clearly suggests serious problems in the mid-market.

Entry-level watches aren’t doing much better either, with sub-200 franc pieces falling -4.9% and the 200-500 franc segment down -7.9%. This is a slight improvement from October (-8.8% and -12.0% respectively), but nobody ever celebrated their boat sinking more slowly, did they?

Basically, the strategy of pushing consumers upmarket was always going to run out of steam, and this is shown by the weakness across all categories. So will the traditional response of raising prices while reducing volume continue to work in 2025? Ha!

Moving onto the various global markets, USA remains the industry’s saving grace, with a +4.7% increase - this is the only major market showing growth. In fact, the US market now accounts for nearly one-sixth of all Swiss watch exports - CHF 4 billion year-to-date, or about 17% of global exports. The US has become such a crucial market that its continued health might be the only thing preventing an industry-wide catastrophe.

Japan’s previous stellar performance has begun to fade (-2.5%) China’s free-fall continues (-27.0%) and Hong Kong’s decline (-18.8%) suggests the region’s troubles have no end in sight. The UK’s -8.3% drop suggests even ‘traditionally’ stable markets are starting to feel the pinch.

India’s performance kinda stood out (+59.7%) but perhaps context matters here - India’s total exports for the year are only CHF 250 million, compared to America’s CHF 4 billion. I suppose it is a promising growth story, but it will take a while for India to become a meaningful counterweight to Asia’s decline.

Where does this leave us? September’s -12.4% decline was followed by October’s -2.8% minor dip, and now November brings a -3.8% drop again. This isn’t the recovery pattern many had hoped for, and to me, it suggests we’re settling into a new, lower baseline.

Perhaps the main takeaway for now, is how the industry’s problems appear to be spreading upmarket. The previous resilience of the more expensive segments is weakening, with even the over-3,000 franc category showing signs of strain. This confirms, with data, something which has been obvious to us casual observers for some time now: that fundamental challenges can’t be solved by simply pushing prices higher! With workers being put on furlough and component makers struggling, the industry needs to find a new way forward.

Looking ahead to 2025, some open questions come to mind: How long can brands maintain their pricing power as demand weakens across all segments? Will the USA’s resilience continue to prop up global figures, and maybe grow even further? Is China’s decline a temporary setback or a permanent, medium-term shift? Could India grow fast enough to fill the increasing gap left by others? (I highly doubt this last one is possible!).

As always, here’s the November update for your info:

This leads nicely into the next topic…

🚀 Rolex Price Increases

So how does this work? The Swiss watch industry reports its third consecutive month of declining exports, and Rolex decides this is the perfect moment to announce price increases across their entire collection! The timing, as they say, is everything.

If you’re due to collect a Rolex, make sure you do so in the next 11 days!

Details as follows:

For non-Daytona models:

Steel, Rolesium1, and platinum pieces: +1%

White Rolesor2: +2%

Yellow and Everose Rolesor plus titanium: +5%

White, yellow and Everose gold: +7%

The Daytona gets its own special treatment:

Platinum versions: +1%

Steel models: +3%

Yellow Rolesor: +6%

White, yellow and Everose gold versions (excluding gem-set): +14%

Note: These percentages have been confirmed by a UK AD, and will be effective on 1 January 2025. I have no new information regarding other regions, but given Rolex equalises prices globally (after adjusting for currency variance) you can probably extrapolate accordingly using today’s prices in different regions. Rolex sells in CHF anyway, so I’d imagine these are increases applied at source, not UK-only. I just haven’t been able to verify this part, only the UK part.