The Deloitte Swiss Watch Industry Study 2025

How 39% tariffs affect the US market, China collapses and India and Mexico boom, Gen Z and women reshape demand, pre-owned goes mainstream, and more.

The Swiss watch industry entered 2025 with cautious optimism, but by mid-year, that sentiment had been thoroughly put through the wringer. Deloitte’s eleventh annual study of the Swiss Watch industry1, surveyed 111 senior executives and 6,500 consumers across twelve markets between June and July 20252. This timing is important because the research happened before Trump raised US tariffs on Swiss watches to 39% in August. This means the industry’s mood was already negative, facing “only” 10-31% tariffs, and the 39% slap just made the bad sentiment even worse.

Off the bat, 43% of industry executives viewed the outlook for their main export markets as negative, and just 23% of them felt positive; this chart explains it better:

On that note, I shall state the obvious and inform you that all charts, images and statistics are taken directly from this report unless otherwise stated3.

Estimated reading time: ~21 minutes … or skip to the end for a TL;DR summary list and commentary.

On Tariffs

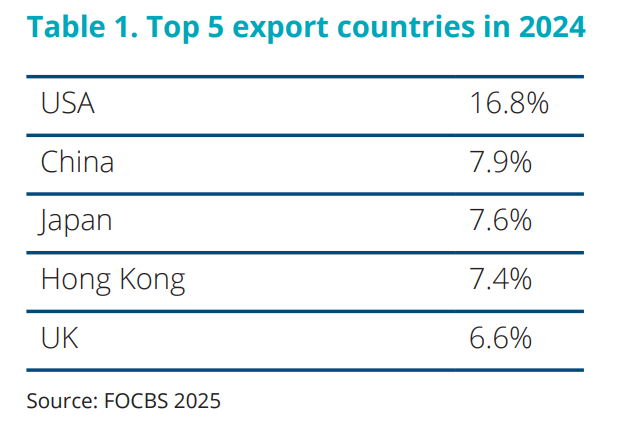

We’ve covered tariffs several times on SDC, so I am sorry in advance to do it again, but I am trying to be thorough. The US became Switzerland’s largest export market for watches in 2021 (overtaking China) and by 2024, exports to America hit CHF 4.4 billion (~17% of all Swiss watch exports). Watches themselves account for 9.2% of all Swiss exports, second only to pharmaceuticals. So when Trump announced tariffs, this was a Swiss national crisis more than a watch industry problem.

In April 2025, a 31% universal tariff was imposed, with a grace period allowing only 10% to apply whilst negotiations continued. As we now know, those negotiations failed, and on 7 August, the tariff jumped to 39% which is much higher than anyone expected. The industry’s response was pure panic, in that exports to the US surged 150% in April and 45% in July as brands and retailers frantically front-loaded inventory to beat the deadline.

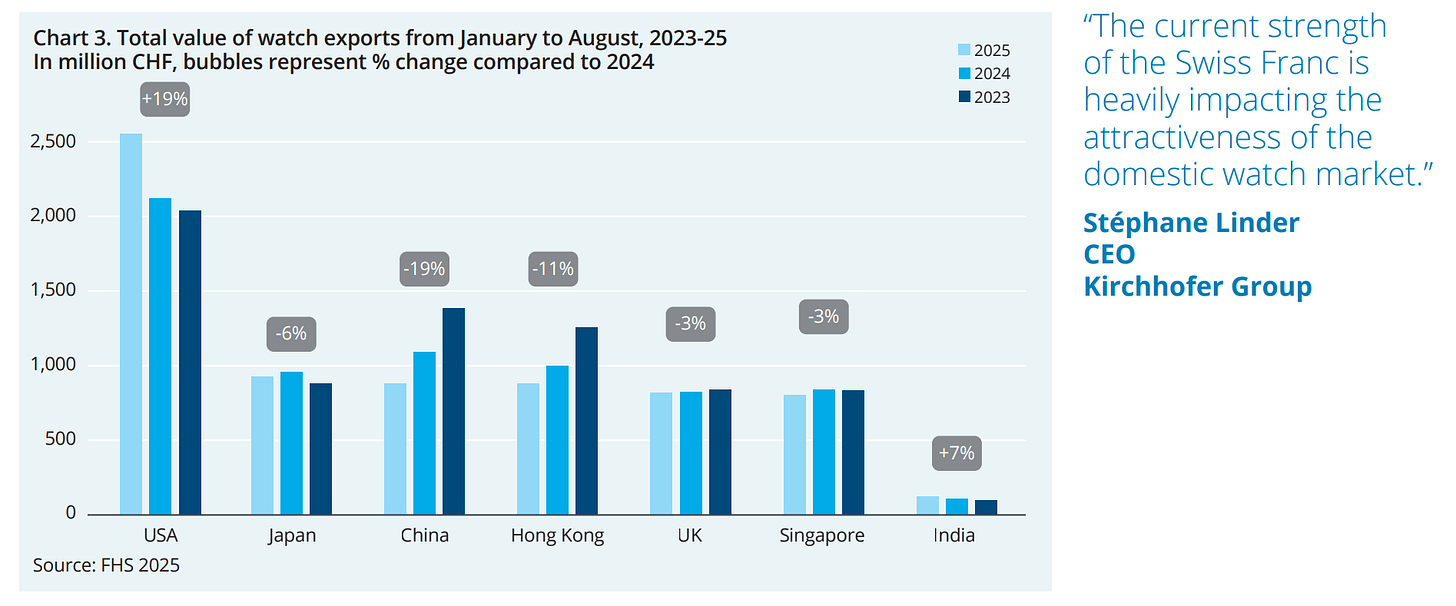

What we need to understand is that this artificial surge made the headline numbers look healthier than reality. In the first eight months of 2025, exports to the US rose 19% year-on-year – but when you strip out the pre-tariff stockpiling and exports, they would have been down nearly 1% in July alone. August saw exports fall again, and this resulted in an overall decline of nearly 1% for the first eight months of 2025.

Major brands have since responded by raising prices; Rolex, Patek, and several Swatch Group and Richemont brands announced retail price increases in the US. Other brands have attempted to absorb costs temporarily, but Deloitte’s report makes clear this can’t last if tariffs remain as they are.

Geographic Rebalancing

Whilst the US surged (artificially) and then contracted, Asia was a different story. China and Hong Kong combined, represented 15% of Swiss watch exports in 2024, down from much higher levels in 2021. Exports to China fell to CHF 2.1 billion in 2024, which is a 26% year-on-year decline and 31% below 2021 pandemic levels. Hong Kong dropped 19% compared to 2023, reaching CHF 1.9 billion.

The contrast is pretty nuts, because in 2016, Swiss watch exports to the US and to China+Hong Kong combined, were roughly similar! By 2024, the US had doubled and China+Hong Kong had returned to 2016 levels.

China’s Q1 2025 GDP rose 5.4% year-on-year, but Deloitte warns that structural concerns, particularly around housing markets and financial stability, could restrict domestic demand. This means that the recovery everyone hopes for in Asia, is still quite uncertain.

Japan and Singapore posted annual declines of 6% and 3% respectively in the first eight months of 2025, with fragile consumer sentiment and unfavourable exchange rates dragging down these numbers.

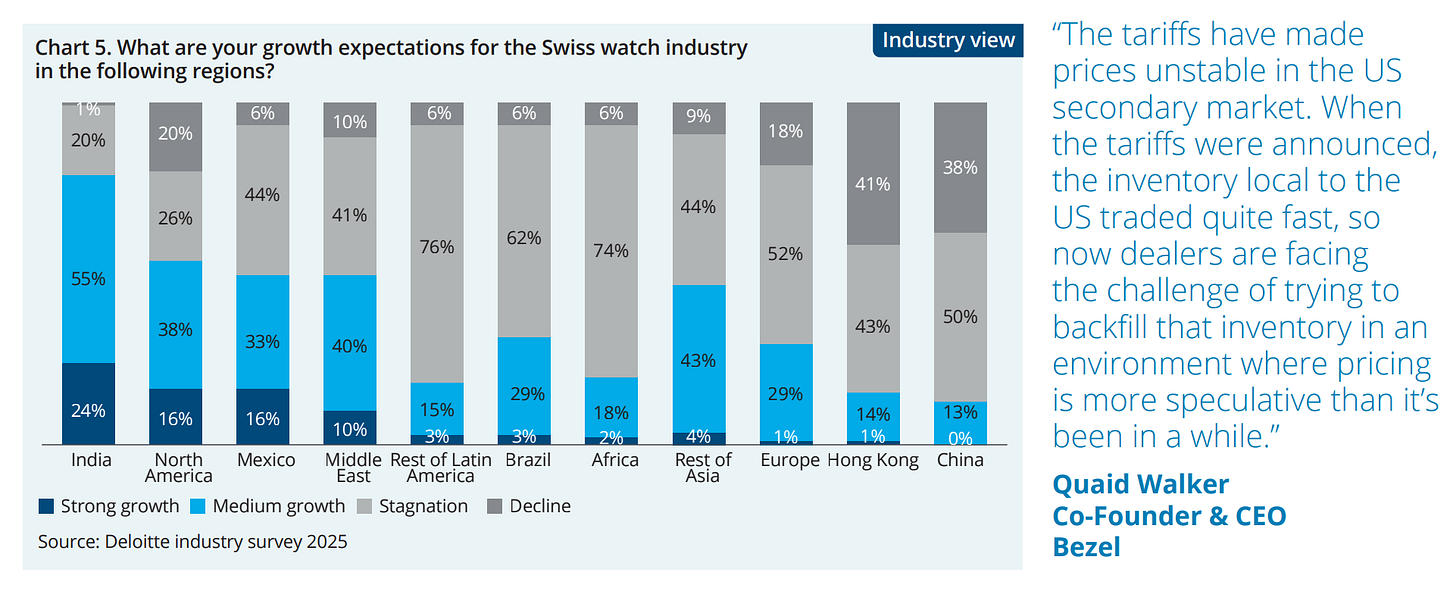

The bright spot in all this mess, is that India is booming. Exports to India from January to August 2025 rose nearly 7% compared to 2024 and over 30% versus 2023. With strong domestic demand, rising affluence, and active retail infrastructure investment, India remains the fastest-growing major market. In the executive survey, 79% forecast medium to strong growth in India.

The big surprise, even called out in their executive summary, is Mexico. Half of industry executives expect medium to strong growth there, making it the second-most promising emerging market after India (for growth potential). We’ll come back to Mexico later, since Deloitte dedicated an entire chapter to it.

What Keeps Executives Awake at Night

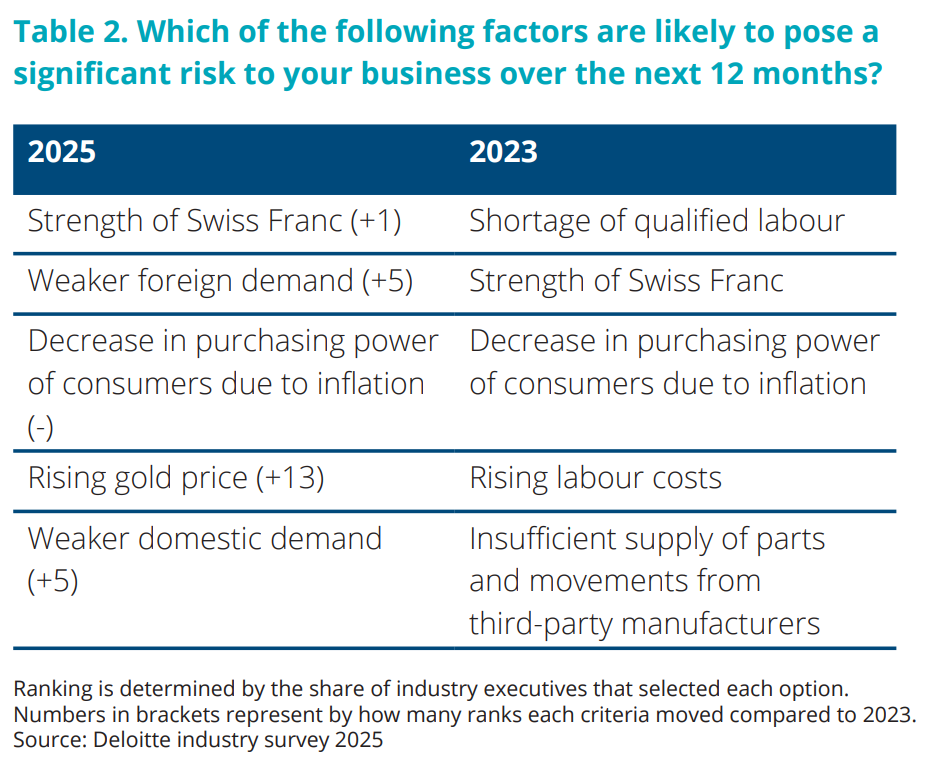

The top risks identified by executives have shifted a lot since 2023:

Strength of the Swiss Franc (ranked #1, up one place from 2023)

Weaker Foreign Demand (ranked #2, up five places)

Decrease in Purchasing Power of Consumers Due to Inflation (ranked #3, unchanged)

Rising Gold Price (ranked #4, up thirteen places from 2023)

Weaker Domestic Demand (ranked #5, up five places)

The gold price surge is particularly insane; in fact, just this morning, gold has exceeded $4000 an ounce! Gold was up 44.5% year-on-year as of early September 2025, and this signals market uncertainty which will directly impact production costs for high-end brands. So apart from being an economic indicator, this is another reason for forcing price increases on customers while they are already dealing with tariff-related rises.

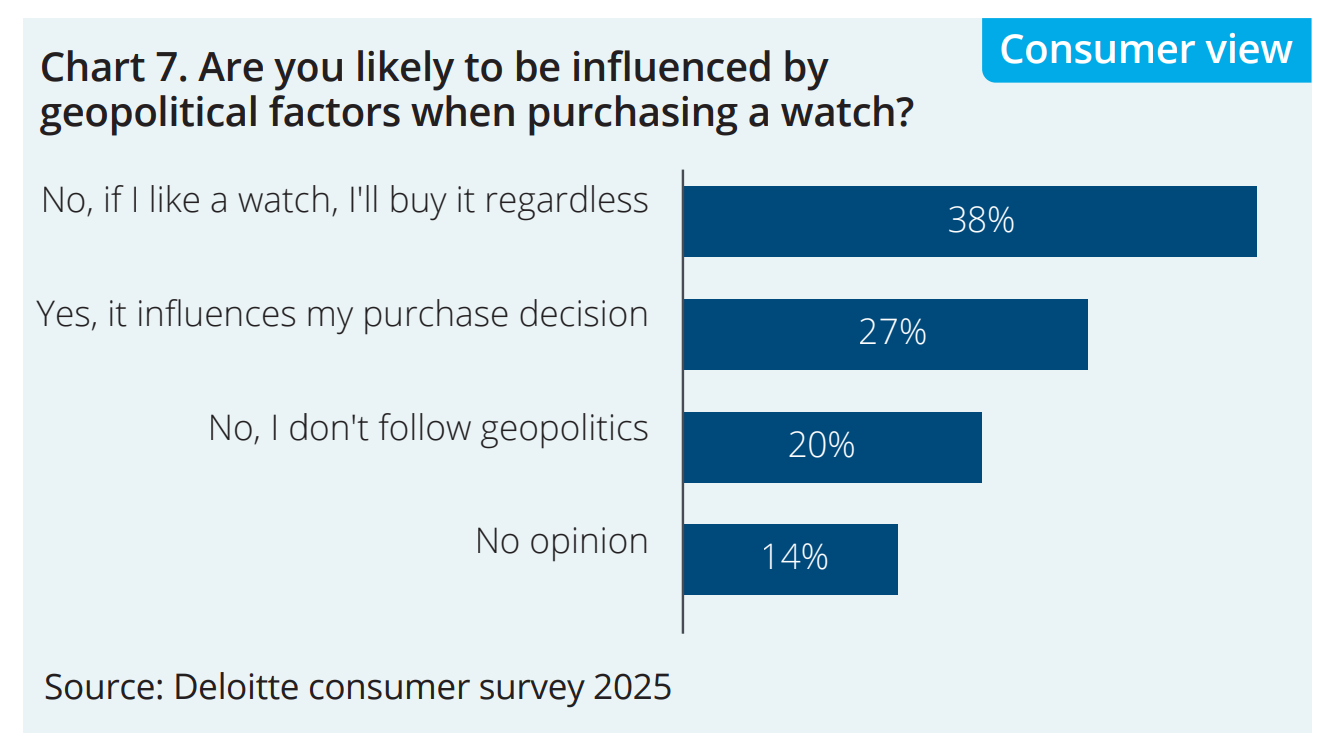

Labour shortages and rising labour costs dominated the 2023 survey, but these seem to have receded as concerns as companies are now focused on external pressures not internal operational challenges. When asked about external factors, over 80% judged trade measures as having a negative influence on business, and over 90% saw geopolitical tensions as even more disruptive. Consumers however, seem to be divided; 27% say geopolitics influences their purchase decisions, and 38% insist they’d buy a watch regardless.

Again, the surveys were conducted in July, before the 39% tariff was confirmed - thus, the views may be even more pessimistic if you ran the same survey today. And really, whilst consumers claim geopolitics doesn’t affect them, the real test comes when higher prices filter through to retail.

Premiumisation

All these different percentages tell a general story that the industry isn’t uniformly pessimistic, and that sentiment varies wildly by price segment. For high-end watches with retail prices over CHF 50,000, 64% of executives see the economic outlook as positive. These are ultra-luxury pieces which are nearly immune to general economic concerns.

“The outlook for luxury watches (CHF 10,000 to CHF 50,000) is a bit more reserved with 38% of executives neutral while 32% judge the outlook to be positive. It is in entry-level (less than CHF 1,500) and mid range (CHF 1,500 to CHF 10,000) timepieces that the mood is overwhelmingly pessimistic: around 60% of executives rate the outlook negative in these segments.

This divergence reflects the premiumisation trend that has shaped the market in recent years. Higher-end models are proving resilient, little affected, it would seem, by rising inflation or geopolitical and macro trends”

Karine Szegedi, Deloitte Switzerland’s consumer industry and luxury & fashion lead, told WatchPro:

“If these tariffs persist, they will push the Swiss watch industry even further into the luxury category. That’s fine for the high end, but problematic for entry- and mid-level brands already under pressure.”

So from a consumer perspective, the mid-market squeeze isn’t exactly new, but tariffs and the strong Swiss franc are accelerating it dramatically.

Innovation and Adversity

What surprised me was despite the negative outlook, 61% of executives still plan to make new product introductions a priority over the next year.

Grégory Affolter, Chairman of AFDT and Director of Affolter Group SA, said:

“We are experiencing a slowdown in activity, but the influx of new projects handled by our production planning department makes us confident about the sector’s recovery.”

Component manufacturers are regarded by many as the industry’s early warning system, and they are under notable pressure. Many have cut investment or relied on short-time working schemes (RHT), which the Swiss government extended to 24 months, and yet, 74% prioritise cost efficiency, 61% focus on new product development, and 70% plan to invest in Industry 4.0 and automation over the next year.

The takeaway seems to be that brands are battening down the hatches operationally and doubling down on creativity and R&D. Innovation becomes the buffer against macroeconomic uncertainty.

Gen Z and Women

To understand where Swiss watchmaking is headed, it seems two groups are having an enormous impact on demand. Let me just remind you, I said this a while ago regarding women and watches, and I speak about Gen Z almost every other week, so I need not bother linking anything. Does this make me a narcissist? 😂

Gen Z

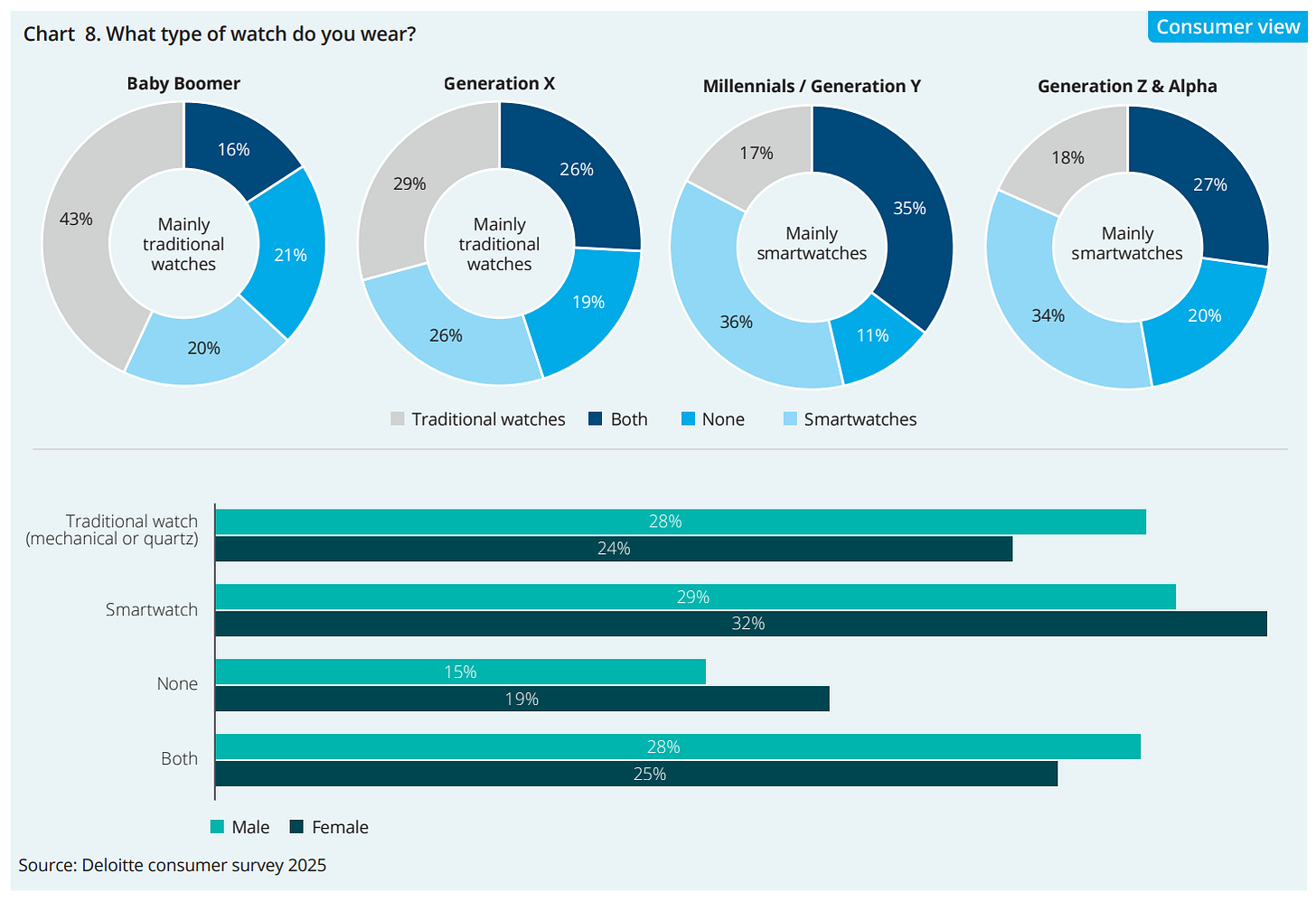

Traditional watches face fierce competition from smartwatches, but purchase intent is surprisingly strong; 54% of consumers plan to buy a traditional watch within 12 months versus 53% for smartwatches. What’s crazy is that women and Gen Z show equally strong intent as men.

The generational breakdown on what people actually wear is shown in the following chart:

As you can see, Gen Z is not actually abandoning traditional watches; a large chunk are just comfortable wearing both. Plus, when asked about buying pre-owned watches in the next 12 months, 40% of millennials and Gen Z said they’re likely to, compared to just 30% of Gen X and 20% of Baby Boomers.

Sylvain Dolla, CEO of Tissot, told Deloitte:

“We know Gen Z is thinking differently. We encourage our younger designers and teams to be disruptive in the creative process.”

Female Market

The share of women wearing traditional watches has “increased slightly” compared to 2024. More importantly, purchase intent for traditional watches is now equally strong among men and women, which marks a major shift from the male-dominated collecting culture of the past.

Right now, many women still buy men’s models but are rarely represented in advertising. Deloitte’s report calls this out directly, and brands need to connect with female consumers who the industry still seems to underestimate.

What Drives Purchase Decisions

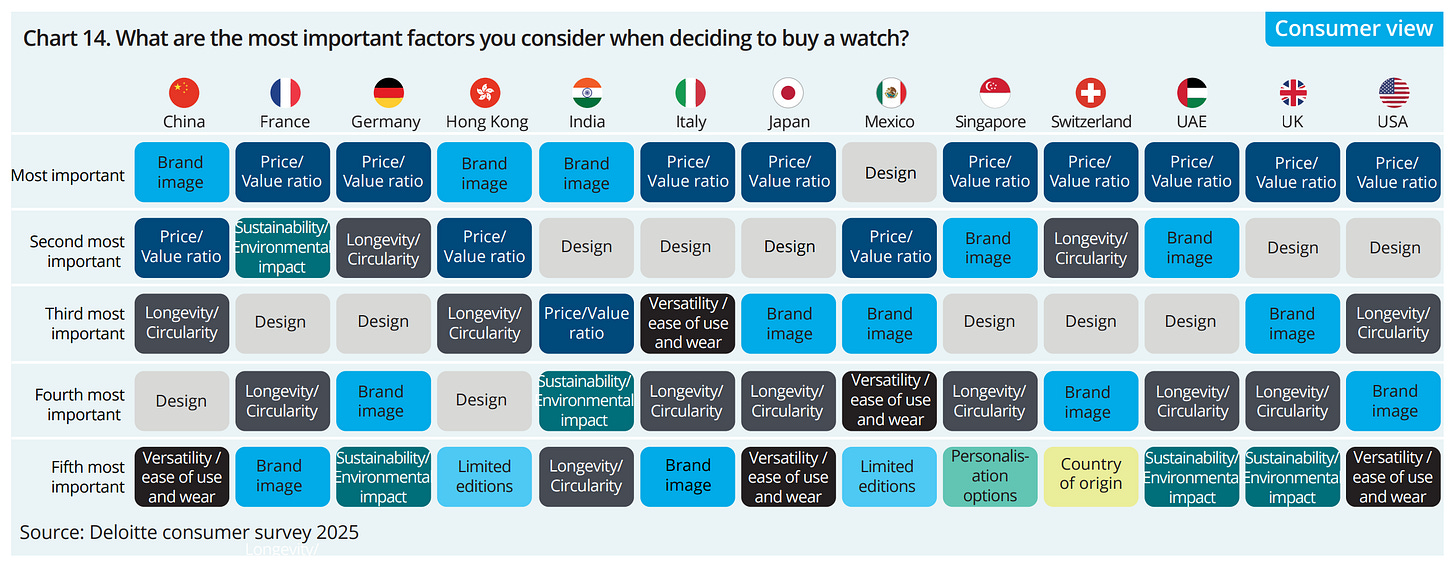

The factors consumers prioritise when buying a watch vary significantly by market, and the report shared this interesting table:

Overall, the top five factors are price/value ratio, brand image, design, longevity / circularity and versatility / ease of use and wear. I do feel there was a fair bit of virtue signalling in the survey responses, because I find the sustainability ranking difficult to believe! Isn’t it funny how Switzerland is the only country to have country of origin in their top five?