Morgan Stanley's Q1 2025 Swiss Watch Market Report

Analysis of Key Trends, Challenges, and Opportunities for Watch Brands and Watch Collectors from Q1 2025

Another quarter… another report from Morgan Stanley… and another SDC post about it!

Estimated reading time: ~20 mins

Honestly, the message from these reports is getting repetitive, given that we are now 12 quarters – that’s THREE YEARS – into this “market correction’ which really ought to be accepted as a permanent ‘realignment’ of the Swiss watch market. At this point the only thing more consistent than watch prices dropping, is the number of brands trying to convince everyone that they have “finally found the bottom” 🤣

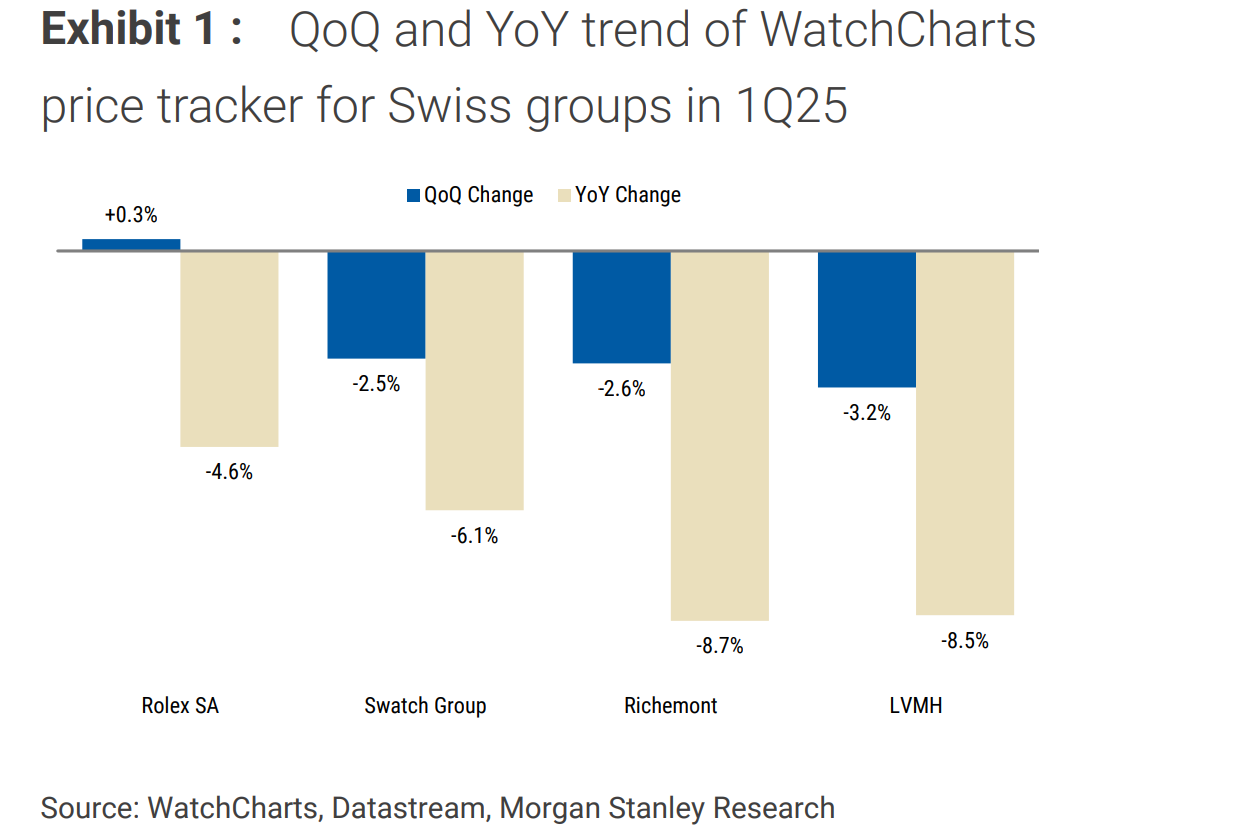

It’s not all bad, though. The WatchCharts Overall Market Index dipped by -0.4% quarter-on-quarter, but this was less bad than the -1.6% drop in Q4. Just two days ago in fact, the Federation of the Swiss Watch Industry (FHS) published their March 2025 report which said:

Swiss watch exports returned to positive territory in March, recording growth of 1.5%. The trend for the first quarter as a whole, however, was slightly negative, with a decline of 1.1%.

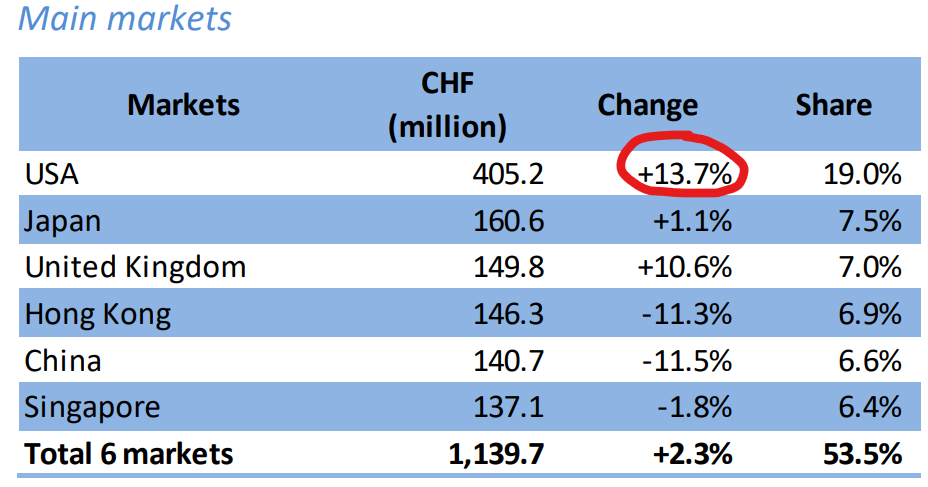

I think it is quite possible that the export spike at the end of March was due to excess imports into the US (specifically watches coming from Switzerland), trying to get ahead of Trump’s tariffs - so I wouldn’t celebrate anything just yet:

Why else would exports to the US shoot up by such a large amount in a cooling market? I suppose it could also be the bulk-import of novelties (as stock) from Watches and Wonders but I need to think about it some more; I usually do a section in SDC Weekly about each month’s FHS report so I will focus on the Morgan Stanley report today, and perhaps revisit the FHS report in SDC Weekly next week if there is something useful to add.

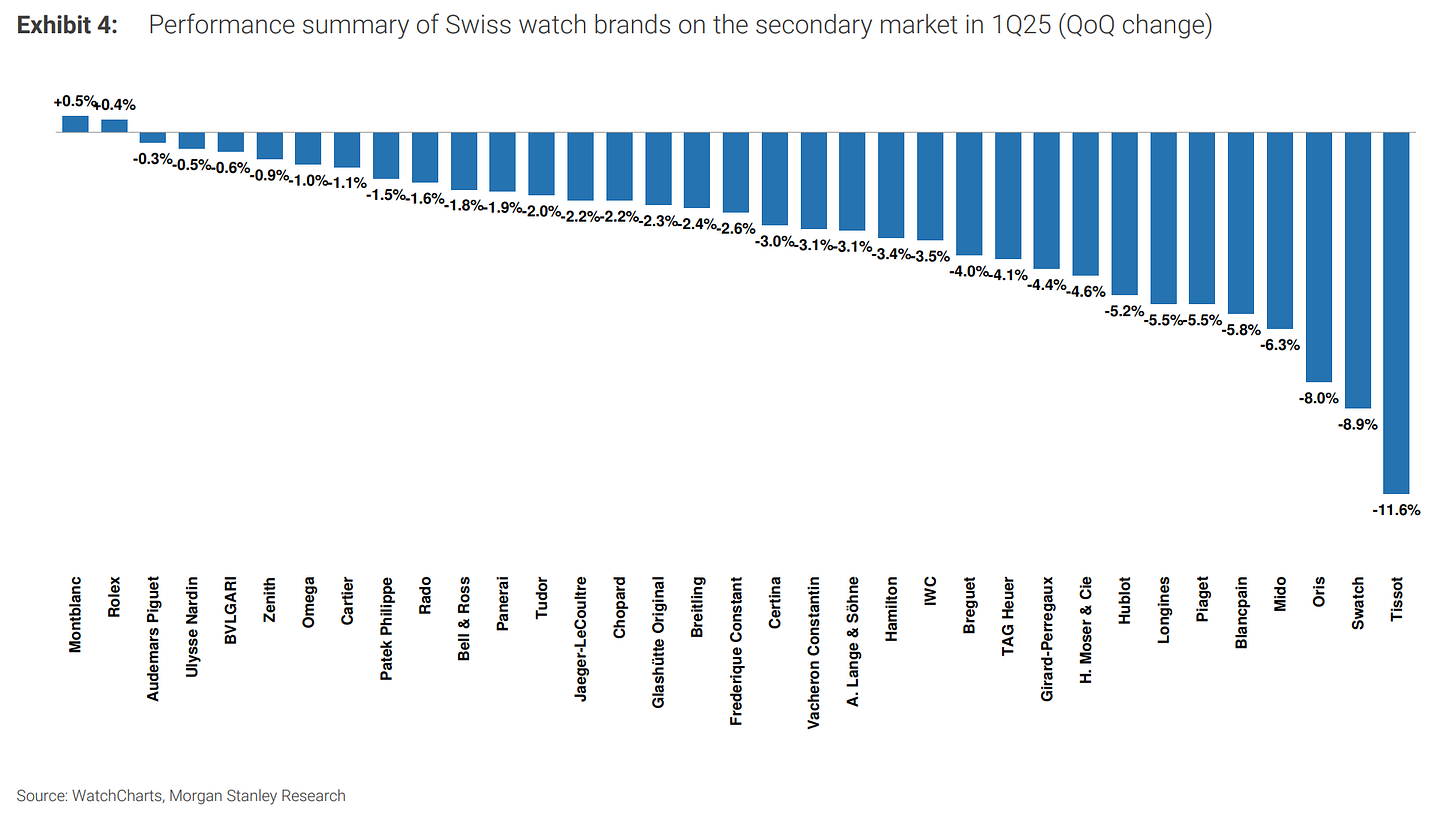

We can get into the nitty gritty in a moment, but of the Big Three (Rolex, Patek, and AP), only Rolex came out as winners, up +0.4%; AP was down -0.3% and Patek was down -1.5%. Montblanc, of all brands, was the best performer but the report also added (about Montblanc):

…the brand has an extremely limited secondary market presence and thus equally little impact on Richemont’s broader performance.

So really, nobody gives a sh1t about the performance of Montblanc watches; not even Morgan Stanley. The listed groups are getting hammered – LVMH as a group is down -3.2%, Richemont group (but not Cartier) down -2.6%, and Swatch Group down -2.5%.

Speaking of Swatch (brand, not group), did you spot them on Exhibit 4 above? All the way to right, down -8.9% and -11.6% respectively, this quarter alone. Fvck me. That MoonSwatch hype train has derailed, crashed, and is now being melted into plastic pellets.

That’s the long and the short of it; below I will lay it all out in sections for the nerds.

Once again, thanks to Hamza Masood and WatchCharts for sharing this quarterly update. If you missed the previous reports you can review the ones for 2024 Q4 here, Q3 here, Q2 here and Q1 here.

Disclosure: WatchCharts provides all the data in the report. They don’t pay SDC for advertising, and SDC does not pay WatchCharts for this report. Since they're kind enough to share, and I enjoy bringing readers fresh info - I am happy to recommend you check out their website here. (Not an affiliate link, but if you want a discount or a free trial, send a DM to Hamza Masood - he may or may not oblige, and I didn’t ask him whether I could write this here 😂)

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Key Findings

For completeness, I will repeat a couple of things I’ve already mentioned above, but these are the main takeaways (charts shared in the sections below).