SDC Weekly 104; Czapek Deep Dive incl. Performance Data; The Fallacy of Finissage

GPHG 2025 list, CPO reality check, dollars and tariffs, AP quality control problems, and more.

🚨 Welcome back to SDC Weekly! Let’s start off with a link to a 12 minute video where the guy tells a story about AP’s shoddy quality control, and shows the following factory-fresh flaw on an AP star wheel:

Not great in general, and perhaps even worse when it’s a 65k watch!

Also, check out the GPHG list of competing entries for 2025 [Update 17 July: link removed on request, apparently this was not a final list!]. The main men’s category is devoid of any serious hitters, so it’ll probably go to UJ given the Kari association.

Finally, Rob Corder asks whether Watches of Switzerland is influencing editorial decisions at Hodinkee, but also admits “I’ve produced as many PR puff pieces to please The Crown as the next man” 😂

Ok, let’s begin.

Estimated reading time: ~25 mins

Admin note: Unofficial Editor is currently detained by TSA who need him to explain why he travels with 28 watches and no change of clothes. While he sorts that out, click here to read this post online and ensure you see all corrections made after publishing.

If you’re new to SDC, welcome! If you have time to kill, find older editions of SDC Weekly here, and longer posts in the archive here.

💵 Dollars and Tariffs

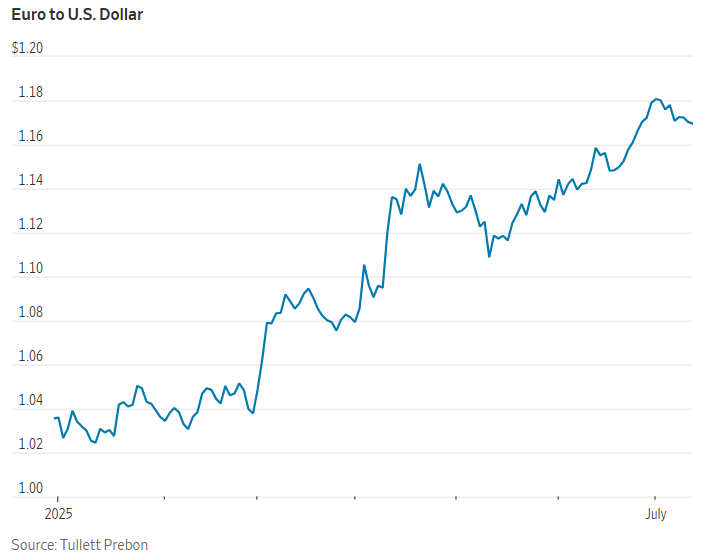

After reading a handful of tariff-related articles, I decided a short post on the subject was worthwhile. Firstly, the dollar is having a shocker this year, down 13% against the euro and 6% against the yen; this is, according to WSJ, the worst first-half performance in over 50 years. For stateside collectors, this means your European buying trips just got significantly more expensive, but there is also a silver lining if you’re buying with foreign capital for domestic consumption.

At the same time, Trump’s tariff tricks continue with fresh 30% threats against Mexico and the EU (extending his previous deadline of 1 August). The 50% copper tariffs have already caused a 13% spike in prices (but I am not 100% sure whether this would materially impact watch manufacturing costs). That said, it seems the markets aren’t believing these tricks anymore. When Trump threatens 25% tariffs on Japan and Korea, their stock markets seem to go up - possibly because everyone seems to understand it is mostly performance art at this point.

While it isn’t relevant to watches, this was an interesting development:

President Donald Trump's sweeping tax and spending legislation, known as "One Big Beautiful Bill," offers dazzling benefits for early stage investors and startup founders.

The law expands a tax benefit to investors in start-ups known as ‘Qualified Small Business Stock,’ commonly referred to as QSBS, which exempts certain capital gains from taxes entirely. Trump’s law tweaks the already lucrative tax provision to make it much more generous, expanding the definition of a qualifying small business as one with assets up to $75 million.

The new QSBS standard could unlock billions of dollars in untaxed gains for savvy venture capitalists and other investors. Auren Hoffman, the general partner at Flex Capital, gushed that the new Trump rules represent a “suitcase filled with tax-free Lamborghinis.”

That’s cool, I suppose; but people aren’t talking much about how American purchasing power abroad is now diminished. For dealers, the currency situation might actually present opportunities, in that foreign inventory has become more valuable in dollar terms. If you’re a dealer sitting on European stock, you’re probably feeling like a genius now.

—

Want more on the subject?

UBS’s Paul Donovan uses bananas as a case study on the impact of tariffs.

And here’s 22 pages of further reading from Goldman Sachs which covers the broader US fiscal deficit issue from a variety of angles.

Bad news: Break Even at the Casino? You May Still Owe Taxes.

🔍 Czapek Deep Dive

The luxury watch industry might be navigating its worst downturn since 2008, yet, Czapek recently went ahead and opened a Shanghai office! I recently managed to get hold of some juicy Czapek data, and it seems that the brand not only weathered this storm, they seem to have managed some growth too. Let’s look under the hood and review some of Czapek’s data in more detail.

China Expansion

In May 2025, Czapek opened an office in China; and at the same time, Swiss watch exports to China declined -23% in value and -37% in volume. They have already shipped their first watch through the new entity and are preparing additional shipments, stating this puts them “in a good position to grow quickly once the market picks up again.”

Fair enough.

But really, the timing warrants some further analysis. Swiss watch exports >CHF 10k continue experiencing what Czapek’s own presentation terms “sharp market correction” across all regions in Q1 2025. The other thing to bear in mind is that no major forecasting houses project Chinese luxury recovery in the immediate term.

So is this a gung-ho market entry during a competitor retreat, or capital deployment into a declining segment? Unclear, because we obviously can’t predict the future, but I suppose we can look at the Shanghai expansion through both optimistic and pessimistic lenses. What remains true for now, is that Czapek’s timing coincides with unprecedented luxury contraction in China.

Supporting Arguments:

Market entry during competitor withdrawal is easier and might offer favourable conditions for commercial negotiations etc

Reduced establishment costs during downturn, since they don’t need a large footprint

Positioning for an eventual recovery, means they will be first out of the blocks if there is a recovery

Operations will be established if demand stabilises or grows, meaning they will enjoy larger market share and consumer awareness ahead of competitors

Challenges and Risks:

I haven’t seen any major forecasts which project near-term China recovery

Domestic luxury consumption is still constrained, so this is mostly a sunk-cost betting on a recovery

Generational preference might even be shifting away from traditional Swiss brands, and Asian watchmakers will prevent them from gaining any traction

Dilution of working capital on something which offers no real return in the near term, if ever

This move is essentially a strategic ‘call option’ which assumes an eventual market recovery in China and accepts the near-term execution costs as the ‘option premium’ for doing this. The eventual success or failure of the China expansion1 will simply depend on timing accuracy and the development speed of the local market.

Performance

Ok, on to the numbers! One notable aspect of Czapek’s recent performance is its divergence from the usual industry trends we have seen in recent weeks. Their 2025 YTD results show growth - which is weird to me only because most of their peers report contraction: