SDC Weekly 118; Gold crosses $4,000/oz - what does this mean for watches? Is China’s luxury recovery real?

MING’s 3D Printed “Bracelet-Strap”, Jerome Lambert returns to JLC, Luxury watch asset manager establishes base in UAE, Six negotiation mistakes, and much more!

🚨 Welcome back to SDC Weekly! This is a long one, so strap in!

On Sunday, thieves broke into the Louvre Museum and made off with priceless jewels in a brazen, seven-minute heist… they used a portable elevator and angle grinder to access and saw through a window to steal royal artefacts. Not sure why I’m mentioning this here, but it felt important 😂

Today’s edition is heavy on macroeconomics and geopolitics… and I appreciate this might not be for everyone, so I’ll share some context on how this edition came to be.

I started out, as I do with most SDC topics, chatting to some watch buddies. Everyone had a different take on what gold prices would do next, and how gold prices might affect the watch industry, so I decided to look into it. What you will read below is simply one view of the world. I am obviously not in possession of a crystal ball, and there is a reason people liken economists to weather forecasters; they can sometimes be right, but are mostly just… wrong.

As humans, we love to opine on future possibilities and likely outcomes; just think about all the speculation about Rolex novelties we enjoy every year! When you read the section about gold prices below, just know that the ultimate purpose was to offer some food for thought, and to generate additional insights from the discussion which follows. I asked my cousin who is an investment manager to proofread the post, and he said:

“Very nicely written… the 5 year Manhattan type project is tenuous in my opinion but when it comes to the future of a commodity it is mostly opinion.”

Indeed, cuz 😂!

The subsequent section on China was developed a few days after the section about gold, and really, these two sections (Gold + China) could be split into two entirely separate posts. I debated doing so, to make each post ‘more digestible’ (plus it would also be more beneficial to me from a ‘content generation’ perspective, as I could appear to offer more value by increasing the frequency of posts) - but that just doesn’t sit well with me! I like to think that when you receive an SDC email, you know it will be interesting enough not to delete or skip. These two subjects are strongly intertwined, and they deserved to be linked in one post. If that means you need to read this edition with a break in-between, so be it. (Come to think of it, I’d actually recommend doing that!)

I say all of this as a pre-warning for those who prefer to read about collector psychology and horological history. Rest assured, those subjects will reappear very soon.

Now, enough preamble; let’s begin.

Admin note: The Unofficial Editor was unavailable — they hired a sloth to speed up proofreading. Results have been… slow to arrive, so click here to read this post online and ensure you see all corrections made after publishing.

If you’re new to SDC, welcome! If you have time to kill, find older editions of SDC Weekly here, and longer posts in the archive here.

Estimated reading time: ~47 mins

📏 MING’s 3D Printed “Bracelet-Strap”

MING released something exceptional last week; the Polymesh is what they’re calling a bracelet-strap hybrid which comprises ~1700 individual components, all printed from grade 5 titanium using selective laser sintering. Each piece hooks into its neighbour in a closed loop with no pins, screws, or traditional bracelet assembly whatsoever (aside from manually installing a springbar).

The technical achievement is, I think, remarkable; so remarkable, in fact, that even WIRED wrote a story about this thing. MING worked with Sisma in Italy and ProMotion in Switzerland to create something that simply couldn’t exist using traditional manufacturing methods. The production process takes several hours per bracelet because it involves building up hundreds of individual layers of (sintered) titanium. The tolerances between individual components sit at just 70 microns, and everything needs to articulate smoothly to achieve that fabric-like drape of the metal.

You’ve probably already heard enough about this bracelet by now, so I’ll share some funny drama instead. Michael Holthinrichs posted this 2018 article about Uniform Wares and Betatype creating a 3D printed titanium watch strap; this was in his Instagram story, immediately preceding his next story sharing MING’s announcement of their bracelet. Now, he didn’t make any outright accusations, but he was indirectly implying that MING’s claim of “being first” was, at the very least, questionable.

I get why he might feel annoyed, though. The guy has built his (good) reputation around 3D printed watches, so seeing another brand drop something this cool in “his territory” probably stung a little bit... Maybe a lot!

The 2018 Uniform Wares collaboration with Betatype produced a woven mesh bracelet from T5 titanium with 4,000 interlocking links. The design featured asymmetric links with different “bend radii” on each side, plus a directional clasp with microscopic teeth. Betatype used laser powder bed fusion technology and also controlled everything down to the micron level for optimal mechanical performance. The strap weighed 10.5 grams and supposedly sold for £250 standalone… BUT, I have no idea whether that was ever commercially produced and sold. Given I have NEVER seen one in the wild - not even on social media - I will assume it never moved beyond the prototype phase.

This is why I think MING still deserve a lot of credit, as their approach is, in fact, innovative. Yes, Uniform Wares and Betatype did something similar in 2018, and no doubt, that collaboration seemed impressive. The idea of 3D printing a flexible titanium bracelet clearly existed seven years ago. MING’s Polymesh uses an entirely different topology, though. They engineered more motion into the radial axis than the lateral one, and this changes how the bracelet behaves on the wrist.

Innovation need not mean “being the first to try something.” Innovation is about taking any idea and pushing it forward, refining it, making it better, or approaching it from a different angle. MING’s Polymesh certainly shares DNA with the 2018 Uniform Wares bracelet, but the execution is sufficiently different that implying it is “derivative” feels a little harsh.

I have no doubt Michael Holthinrichs will be catching up soon, since 3D printing is his domain after all. I think this would benefit all of us, by the way. The watch industry seems to be reaching a point where 3D printing has matured beyond “novelty.” Apple’s 2024 titanium cases use 3D printing with zero visual tells. MING’s Polymesh shows additive manufacturing has now created solutions which are basically impossible using traditional methods.

If you’re wondering what this costs… at CHF 1,500, MING’s Polymesh feels expensive for a bracelet, until you remind yourself that some people pay even more for leather straps… so yes, it’s expensive, but this stuff is all relative. It’s fair to assume the price reflects the manufacturing complexity and current limitations in producing them; not to mention the R&D that went into developing them in the first place. As the technology matures and production scales up, prices will surely come down. For now, you’re paying for innovation and a manufacturing process that is pushing boundaries. Seems worthwhile, to be honest. I wish I could offer you a discount code, but I’d like to try one first!

Imagine when the future of watchmaking uses additive manufacturing to make insanely small watch components? Ultra-thin will get a whole new meaning, and I can’t wait for that.

🥇 Gold crosses $4,000

Let’s talk about gold, shall we? Gold passed $4,000 per troy ounce this month, which puts it over 50% up in the last year.

Paul Krugman is not exactly known as a gold enthusiast, yet he recently wrote something he admits he never expected to write: “The price of gold may be telling us something important.” This is coming from a bloke who typically dismisses gold as a “barbarous relic” (per Milton Keynes himself).

The standard narrative goes like this… gold rises when inflation fears spike, or when real yields (inflation-adjusted interest rates) fall (and vice versa). But that’s not what’s happening right now; real interest rates are actually up and treasury inflation-protected securities (bonds with future payouts linked to the Consumer Price Index) show higher returns than they did during the pandemic. So by conventional logic, gold should be falling, but instead, it’s going up.

It’s worth clarifying something upfront; real yields are a powerful predictor of gold prices. But… what drives real yields? Real yields don’t exist in a vacuum; they’re determined by monetary policy, inflation expectations, economic growth expectations, and importantly, risk premiums.

If real yields are falling because the Federal Reserve is being pressured to keep rates low despite inflation (political interference with monetary policy), that’s qualitatively different from real yields falling because of a recession. Both produce lower real yields, but the implications for gold might be different in each instance.

Keep this question in mind as you read this post.

What’s driving gold up?

Ken Griffin, a hedge fund billionaire and former Trump supporter, thinks the world is losing faith in America. Not in some vague, philosophical sense, but in the concrete “I don’t trust my money to be safe in US assets“ sense.

Foreign central banks are shifting holdings from US debt into gold. When you dig into why, the reasoning gets a little dark. I’m talking about fears that once seemed absurd, like what if the administration manipulates inflation statistics? What if reserves held by “unfriendly” governments get frozen or seized? What if the Fed gets politicised beyond recognition?

From that perspective, gold at $4,000 isn’t primarily an inflation hedge, but more like a “trust collapse indicator.” Still, there’s another layer to this story that makes the situation even more complex, and it’s playing out right now in the industrial heartlands of China, America, and everywhere in between.

While everyone’s been watching gold prices, China made a move that explains why those prices might stay elevated for years. This month, China announced export restrictions on rare earth materials, gallium, germanium, and antimony. These aren’t household names, but they’re critical for everything from semiconductors to military hardware to, yes, the high-tech manufacturing that produces modern watch components.

This wasn’t a spontaneous decision either. China has spent decades positioning itself as the dominant processor of rare earth materials. To be clear, it’s not because other countries lack the raw materials, but because China was willing to endure the environmental damage and invest in the complex processing infrastructure that everyone else found too messy or unprofitable. As a result, China now control roughly 70-90% of global processing capacity for many critical materials. With these new export restrictions, they just announced they’re willing to weaponise that control.

China is essentially telling the world “we’ve cornered the market on materials essential to your economies and your militaries, and we’re willing to cut you off.” It’s the economic equivalent of revealing you’ve got an automatic machine gun under the table during a poker game. Sure, you might win this hand, but everyone’s going to remember you pulled a weapon, and they’re going to adjust their behaviour accordingly.

This connects directly to gold prices in ways that aren’t immediately obvious. Academia suggests gold prices should correlate with global required yields; essentially, the return investors demand to compensate for economic growth and inflation expectations. A 2005 paper by Faugère and Van Erlach showed that gold’s real price moves inversely with stock market P/E ratios, meaning it functions as a hedge when financial assets lose value. Their model explained 88% of gold price movements from 1979-2002, and the key insight was that gold prices rise when the “required yield” from other assets falls, or when confidence in those assets erodes.

Right now, we’re seeing the latter, and China’s strategic materials play is accelerating that erosion because it’s forcing everyone to recalculate what they thought they knew about global economic stability.

It’s worth noting a counterpoint, that since 1975, during 11 major stock market drawdowns, gold rose in eight instances and declined in three (though less than stocks)1. That’s decent diversification value, but it’s not “foolproof protection.” Gold clearly does provide some crisis protection... the data says this is true 73% of the time. Put another way, in about ~25% of major equity drawdowns, gold failed to serve as an adequate hedge.

So, what’s driving gold up? Well, going back to the other question, what drives real yields? The perspective I am presenting is that a collapse in trust and large institutional concerns are explaining WHY real yields are where they are, and this is what drives gold prices up. The geopolitical narrative and the more financial “real yields” argument might just be two sides of the same coin.

Five-year window

According to analysis from Doomberg (who’s been tracking these industrial dynamics extensively), China knows their strategic advantage is temporary. The United States is embarking on a Manhattan Project-style effort to rid itself of Chinese inputs within a decade, and when America gets into this mindset, it usually succeeds. Think about the shale revolution; everyone said America couldn’t become energy independent, and within a decade it became an energy superpower.

China is pressing its leverage now for maximum effect precisely because they know their advantages are fleeting. They’ve got maybe five years before alternative supply chains come online in America, Australia, Argentina, the Democratic Republic of Congo, and various other countries that are suddenly very motivated to develop their own processing capabilities.

This five-year window maps almost perfectly onto potential gold price trajectories, and understanding why requires thinking about what’s actually happening beneath the surface of these geopolitical moves.

A great decoupling

What we’re witnessing isn’t just a trade dispute or a temporary political spat. It’s the breakdown of the post-Cold War consensus that economic integration would prevent major power conflicts. For thirty years, the assumption was that if everyone’s supply chains were sufficiently entangled, nobody would risk disrupting them because mutual economic dependence would create mutual restraint.

China just showed everyone that assumption was wrong. They’re willing to weaponise economic interdependence, which means that interdependence has to end. That, in turn, is absolutely massive for gold prices because the entire modern financial system was built on the assumption that global trade would remain relatively open and predictable.

Think about what happens when that assumption breaks down... Companies that built business models around just-in-time delivery from Chinese suppliers suddenly need to hold larger inventories, find alternative suppliers, or vertically integrate production. Countries that assumed they could always buy what they needed on global markets suddenly need strategic reserves. Financial models that assumed smooth international capital flows suddenly need much larger risk premiums.

All of this creates uncertainty… and gold thrives on…. uncertainty!

Actually, it’s more specific than just general uncertainty. What’s happening is a bifurcation2 of the global economy into competing systems which won’t surprise anyone reading this. On one side, you’ve got the United States, Europe, Japan, Australia, South Korea, and much of Southeast Asia; these are essentially the democratic market economies that are now united in seeing China as untrustworthy. On the other side, you’ve got China, Russia, and various countries in the global south that either align with them ideologically or simply see opportunity in a multipolar world.

This isn’t like the Cold War, where the Soviet bloc was economically isolated; China is the world’s largest trading nation and deeply integrated into global supply chains. Untangling that takes years, probably costs trillions, and creates massive disruption along the way. During that entire process, gold will serve as the one asset that neither side can manipulate, neither side can freeze, and both sides recognise as valuable.

Five possible pathways

So, where could this go?

1. Melt-up continues

Gold breaks $5,000, then $6,000. This happens if China’s five-year window becomes a bigger crisis rather than just a period of adjustment. Maybe they move on Taiwan, maybe the rare earth restrictions trigger cascading supply chain failures that are worse than anticipated or maybe the US response is slower or less effective than expected.

In this scenario, the weaponisation of economic interdependence creates a general scramble for tangible assets that can’t be frozen, sanctioned, or manipulated. Central banks would accelerate their shift from dollar reserves to gold reserves, and private investors would follow. With $27 trillion of above-ground gold stock globally, even small percentage shifts in institutional holdings create massive price pressure.

The precedent exists, given that gold went from $35/oz in 1971 to $850/oz by 1980 (roughly $3,200 in today’s money, so we’re already beyond that in real terms)… but granted, that was driven primarily by inflation and the collapse of Bretton Woods3. This would be driven by something potentially more fundamental i.e. the breakdown of the assumption that international trade happens under a rules-based system that everyone generally respects.

2. Higher plateau

Gold settles into a new range between $3,500-$4,500. The initial panic buying exhausts itself, but the underlying concerns don’t disappear. This becomes the new normal; elevated gold prices reflect a permanently higher risk premium on traditional financial assets.

This is probably the most likely path, and the strategic materials fight explains why. The US and allies will successfully develop alternative supply chains over the next five years. It will be painful and expensive, but it gets done. China’s leverage diminishes, but the damage to trust would be more long-lasting. Everyone now knows that economic integration can be weaponised, which means everyone maintains higher reserves, more redundancy, and larger safety buffers.

In this scenario, gold maintains a hefty premium over its 2020-2023 trading range not because of any immediate “crisis” per se, but because the world has fundamentally repriced political risk for the long term. The post-war international order didn’t collapse entirely, but it’s clearly fraying, and that fraying has a price measured in higher gold valuations.

3. Sharp correction

Political conditions stabilise, dollar confidence returns, and gold drops to $2,500-$3,000. This requires major policy shifts; restored faith in institutions, reduced political interference in economic policy, and a return to relative predictability. It also requires China to back down from its strategic materials play, either because they calculate they’ve pushed too hard or because alternative supply chains develop faster than expected.

Is this even possible? Maybe, but is this likely in the near term? The current environment doesn’t exactly scream stability. For this path to unfold, you’d need both American political dysfunction to decrease significantly and Chinese strategic calculations to shift dramatically. I’d say both seem implausible, but hey, stranger things have happened!

4. Volatility nightmare

Gold whipsaws violently between $3,000 and $5,000, tracking every little political crisis, central bank announcement, the tiniest hint of policy uncertainty and each escalation or de-escalation in the strategic materials fight. Trading gold becomes less about long-term positioning and more about reading political tea leaves and supply chain news.

This is exhausting for everyone except traders, but it’s somewhat plausible in an era where a single presidential announcement (US or China) can move markets 5% in either direction. Imagine gold spiking every time China hints at further export restrictions, then retreating when the US announces a new domestic processing facility coming online. It could be up when geopolitical tensions flare, and back down when they ease. The fundamental drivers would still be “elevated uncertainty”, but the day-to-day price action becomes almost absurdly volatile.

In some ways, this might be the worst scenario for gold owners who are trying to make rational long-term decisions about their holdings. At least with a clear uptrend or downtrend, you know where you stand. With massive volatility, every decision would feel like outright gambling.

5. Super-spike crisis

Gold explodes past $6,000-$8,000 as a major financial crisis unfolds. This is the scenario nobody wants; we would see a combination of sovereign debt problems, currency collapse fears, a scramble for tangible assets, and possibly a hot conflict over Taiwan or some other flashpoint.

In this scenario, China’s five-year window becomes the trigger for a broader systemic crisis. Maybe the US can’t develop alternative supply chains fast enough, which leads to critical shortages in strategic industries. Maybe the financial strain of building out redundant infrastructure triggers a (worse) debt crisis. Maybe the political tensions escalate beyond economic competition into actual military confrontation. Who knows.

Historical parallels exist (Weimar Germany, various hyperinflation episodes), but they all required catastrophic breakdowns in social and economic order. This scenario requires not just the US-China competition to go badly, but for it to also trigger cascading failures across multiple systems, simultaneously. We obviously hope this one stays theoretical, but it’s less implausible than it would have seemed five years ago, which really sucks.

Enter the watch world

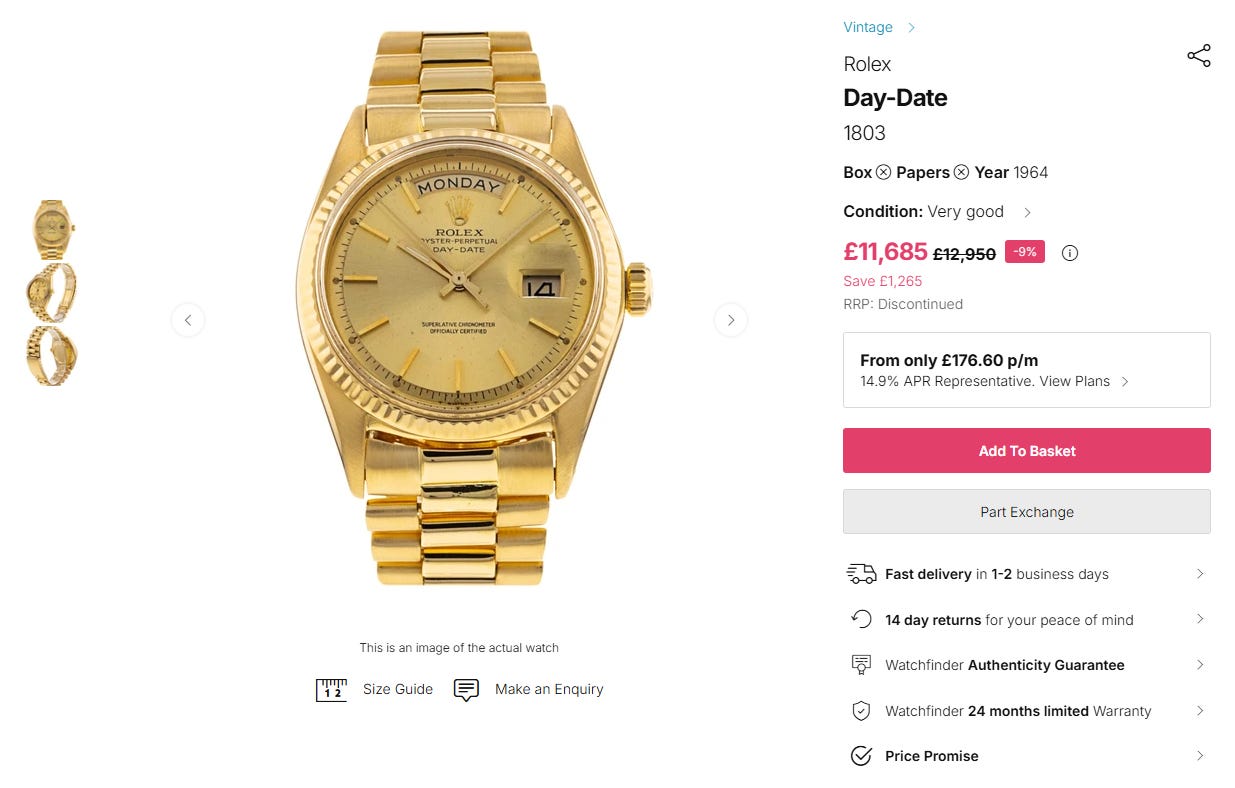

Why should you care? Well, this gets personally relevant if you’re into watches, and perhaps are sitting a collection of gold watches. Maybe a lovely 1970s Omega Constellation in 18k yellow gold, or a gleaming Rolex Day-Date. Heck, maybe just a nice Longines dress watch your grandfather wore.

Suddenly, the calculation changes.

An average 18k gold watch case weighs ~75 grams, though heftier watches with precious metal bracelets can weigh up to 250 grams. In the low-end, that’s roughly ~45 grams of pure gold (18k is 75% pure). At $4,037 per troy ounce (31.1 grams in 1 troy ounce), you’re looking at around ~$5,800 in pure melt value.

This 1964 gold day-date weights around 167 grams and so, it might have about 140 grams of 18k gold. which equates to ~ 106 grams of pure gold. That much gold is worth ~$13,700 with gold trading at $4000 an ounce, and that equates to £10,200. If gold hits ~ $4600, this watch would ‘break even’ on gold price.

In reality, many people are now doing this sort of math. Right now. I shared a video on Instagram the other day, showing a dealer melting down a gemset AP Royal Oak and making an overall profit because they were able to re-sell the movement and diamonds, but also cash in on the melted gold. From a watch collecting perspective, history is literally going into the furnace.

This connects back to the broader geopolitical story; just as China’s strategic materials play is forcing countries to recalculate their economic assumptions, gold at $4,000 is forcing watch collectors to recalculate their collecting assumptions. Something that seemed purely aesthetic or horological suddenly has a substantial commodity value component that can’t be ignored.

This creates a rather interesting dynamic, because as less-desirable gold watches get melted, surviving examples become rarer. In theory, scarcity drives value, but there’s an obvious catch, in that scarcity only matters if there’s some sort of underlying demand.

If nobody particularly wanted that old Corum watch before, making it rarer doesn’t suddenly make it desirable, it just makes it a rare thing nobody wants. So current logic would suggest that the watches most at risk of being melted are the ones which are least likely to benefit from scarcity value at all.

I will add that gold is expensive on historical metrics and likely to produce poor returns over the next decade, so buying gold watches primarily because they contain a lot of gold is probably a mistake. You’d effectively be buying expensive gold with a watch attached, which is worse than just buying expensive gold.

Plus, gold at $4,000 is volatile. It might go to $3,000 or $5,000 before settling wherever it’s going long-term. If you’re buying gold watches, you need to be comfortable with that volatility in the material value component. The watch might be “worth” $15,000 today and $12,000 next year, purely because of gold price movements (even if collector demand is stable).

Middle market thins out

What we’re likely to see is a hollowing out of the middle market. The “nice but not spectacular” gold watches, the ones from decent brands, in nice condition, but not particularly rare or historically significant, now face an existential threat. Sure, some will survive because their owners value them sentimentally or aesthetically, but many won’t. In a few years, we might look back and realise that entire categories of mid-tier gold watches have simply vanished.

The survivors could then gain value through a combination of factors. First, there’s the material value floor; they still contain gold, which provides a baseline nobody can argue with. Second, artificial scarcity kicks in as many similar pieces were melted, making the remaining examples genuinely rare rather than merely “not that common.” Third, and most interestingly, surviving gold watches might gain increased cachet as markers of quality, since only the good ones made it through the culling period. When collectors in 2030+ look at older gold watches, they’ll be looking at a pre-selected group of survivors, which might create a kind of halo effect.

Of course, this only works if gold prices stay elevated. If gold crashes back to $2,000/oz, the watches are gone, the scarcity value evaporates, and you’re left with rare examples of things nobody particularly wants.

Collectors’ dilemmas

Edit 21 October 2025: This section applies to those whose collecting decisions would be impacted by material deviations in the market price of their watches. Ultimately, if you never cared about values and planned to keep all watches until you die, then this entire section on “impact of gold prices on watches” is of course, academic at best.

If you own gold watches right now, you face some tricky decisions. The most conservative approach is to hold everything, banking on scarcity value developing while accepting the risk that you could have sold near peak melt value. This makes sense for pieces you love or that have clear collector value independent of gold content. You’re essentially betting that your emotional attachment or the watch’s inherent quality will be vindicated by the future market.

Alternatively, you might sell the mid-tier stuff now, taking the elevated market prices while they last, before either gold crashes or so many pieces hit the market that premiums disappear. This is the more rational move for watches you’re ambivalent about, because you’d be converting a potentially declining asset into cash while the conversion rate looks favourable. It’s not romantic, but it’s logical, financially.

If you’re a dealer, the more aggressive “investment” play is to buy good examples of mid-tier gold watches if you think gold will stay high and many pieces will get melted. You’re essentially betting that future scarcity will drive values above the current levels. It’s risky, because it requires both gold prices to hold and collector interest to develop for newly-scarce categories, but potentially lucrative if you’re right about both trends.

Finally, and this is where I sit, you could simply ignore gold entirely; focus on steel sports watches, complications, brand prestige, which are factors orthogonal to material value. This would be the “traditional collector” approach, but it feels harder to sustain when melt value exceeds market value.

Gun to my head, I don’t expect explosive appreciation in gold watch values from here.