SDC Weekly 124; Blancpain Grande Double Sonnerie; Rolex patents a self-correcting mechanical movement; US market update

The 1916 Company launches pre-owned handbags, an interview with Ondřej Berkus, Patek-Lémania legacy, the psychology of interest vs. prestige, the rise of "New Vintage", how jet engines work, and more!

🚨 Welcome back to SDC Weekly!

Admin note: Upon opening the draft for this week’s newsletter, The Unofficial Editor took a deep breath, closed their laptop, and immediately walked into the forest to live as a moss-covered hermit. We respect their journey. Please click here to read this post online and ensure you see all corrections made after publishing.

If you’re new to SDC, welcome! If you have time to kill, find older editions of SDC Weekly here, and longer posts in the archive here.

Estimated reading time: ~22 mins

🗽 US market update

This subject is getting dry, but for posterity I will share some thoughts post-15%-reduction for now. Two weeks ago, the US and Switzerland finally reached a deal to reduce tariffs from the absurd 39% rate down to 15%. If you’ve been following along on SDC, you’ll know this has been dragging on since April when the initial tariff threats disrupted Watches & Wonders. The Swiss government had actually thought they had a deal locked in over the summer - and then got blindsided when the 39% rate landed anyway. Johann Rupert called the 39% rate “potentially devastating for the whole of Switzerland” during Richemont’s media call around the same time.

So what does this 15% actually mean? Before Trump’s second term, Swiss goods faced tariffs of around 0% to 2.5%. So really, even though 15% feels like a victory relative to 39%, it’s still a serious structural cost increase that brands will need to absorb, pass on, or split somehow. The Swiss government acknowledged as much, noting that “overall tariffs remain higher than before the additional tariffs were introduced in April.”

The deal basically comes with strings attached; Swiss companies have pledged to invest $200 billion in the US by the end of 2028, with at least $67 billion arriving in 2026. Although much of this will in fact come from pharmaceuticals and life sciences, the symbolism kinda matters.

For the watch industry specifically, this puts Switzerland on equal footing with the European Union at 15%, and that’s meaningful because it closes the competitive gap that had opened up before this all exploded. Under 39%, a German or French competitor would have enjoyed a 24% advantage on identical products, and that disparity has now been deleted.

K-shaped problem

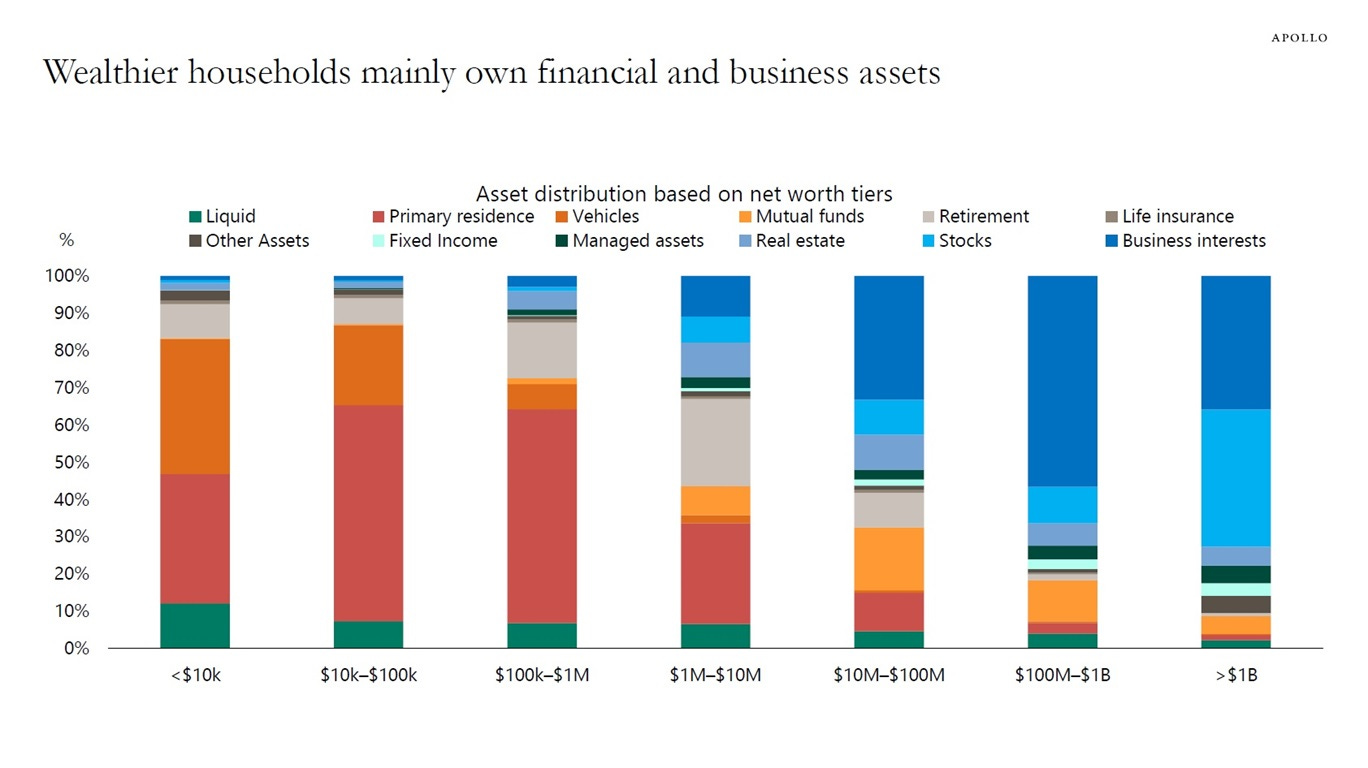

The tariff reprieve arrives against an economic backdrop that should concern anyone selling luxury goods in America. Recent Federal Reserve data analysed by Moody’s Analytics shows the top 10% of American earners now account for nearly half of all consumer spending. For the bottom 80% of households, spending has merely kept pace with inflation since the pandemic.

What this means for watches may not be obvious at first; the “top 10%” bracket starts at roughly $175-200k household income. This is comfortable, for sure, but that’s Tudor and Omega territory, as opposed to Vacheron Constantin Overseas Perpetual territory, for example. Your actual haute horlogerie buyer probably sits in the top 1-3%, and that cohort exists in an almost entirely different economic reality. The person buying their fifth Patek isn’t checking their credit card balance. The person stretching for their first Rolex at $10k, absolutely is!

This creates a peculiar situation for watch brands given that the ultra-wealthy segment remains insulated, but the aspirational buyer i.e. the engine that drives entry-luxury volume, is getting squeezed from multiple directions.

The other problem is that the economy is balancing on one leg. If stock markets wobble significantly, or if tech layoffs accelerate, even that top 10% could in fact pull back, and because they’re the only ones keeping the lights on right now, it’s somewhat unnerving - or at least, it should be.

The credit data is also rather alarming; “during the first nine months of 2024, lenders wrote off more than $46 billion in delinquent credit card loans” - this is a 50% increase from the prior year and is now at levels approaching what we saw during the 2008 financial crisis. Auto loan delinquencies have also hit a decade-long high of 3.32% by the end of 2023. Granted, these are perhaps lagging indicators; so the situation may have improved or worsened since… but the trend is pretty clear.

Meanwhile, the August jobs report showed the US economy adding just 22,000 jobs against expectations of 75,000, youth unemployment at 10.5% (which is double the national average) and manufacturing has also lost 78,000 jobs this year... In other words, the archetypal aspirational buyer who happens to be the person stretching to purchase their first Rolex or Omega, may simply exist in smaller numbers going forward.

And yes, I know I am inferring watch demand from general consumer credit stress here… I don’t know of a source for granular data on first-time luxury watch buyers specifically. But secondary market prices for entry-level Rolex have softened considerably over the past eighteen months, and anecdotal reports from ADs and watch collectors suggest waitlists for non-hype pieces have shortened dramatically; so for now, all the (admittedly circumstantial) evidence points in one direction.

All of this is to say: nothing is screaming “go buy a luxury watch!”

China

I know this is about the US, but that market doesn’t exist in isolation, and the global picture matters for how brands will behave. China dropped ~30% for Swatch Group last year, and this created a 750 million CHF shortfall that even 15% US growth couldn’t offset. Richemont and others have reported similar weakness in mainland China and Hong Kong.

This makes the American market (relatively) more important to Swiss brands now. The US was actually growing before the tariff shock, and so, brands may therefore absorb more of the 15% tariff cost than they otherwise would, just to protect volume in one of their few remaining growth markets. That’s another thing to consider if you’re expecting prices to rise by the full 15% - they really shouldn’t, unless there is an imbecile at the helm.

Brands’ plans

If I were advising watch brands right now, I’d suggest three things.

Absorb as much as you can afford. The 15% tariff still creates price differentials with Europe and Asia, and brands hate that anyway. Rather than passing through the full cost increase to US consumers, take a hit on your margin to maintain global price parity. You’ve spent enough time building brand equity with relatively consistent pricing… why throw that away now?

The calculus will vary by segment, of course. Swatch Group’s volume brands (Tissot, Longines, Hamilton) operate on thinner margins and will feel the squeeze more acutely than Richemont’s specialist watchmakers, for example. A 15% tariff on a Tissot PRX is a very different proposition to a 15% tariff on a six-figure Lange Zeitwerk. Entry-level Swiss under £5k is facing margin pressure, so brands will probably need to decide whether to absorb, pass through, or exit certain price brackets altogether.

Lean even harder into the ultra-high-net-worth segment. The person buying their fifth Patek doesn’t give a damn about any of this. The aspirational buyer stretching their budget is a dying breed, and that’s exactly where demand drops will show up because that group of consumers is shrinking.

Don’t confuse a tariff reprieve with a market recovery. If you look at some of the data a lot of decline predates the August tariff implementation. This means demand weakness is real (even before tariffs) so really, the 15% deal does nothing to address those systemic weaknesses.

Retailers

ADs and retailers in the US are caught in the middle of all these problems because they have to absorb partial costs from brands and at the same time, try to maintain relationships with increasingly price-sensitive customers.

A 15% tariff that brands only partially absorb means retailers either take a margin hit themselves, or risk losing sales to foreign competitors and the secondary market. For mono-brand boutiques owned by the maisons, this is manageable - it’s all the same P&L ultimately. But for independent multi-brand ADs, particularly those without Rolex, AP or Patek allocations to subsidise the rest of the business, the math gets difficult.

I’d expect to see some rationalisation of the American retail footprint over the next 18-24 months, particularly among mid-tier retailers in secondary markets. Essentially the strong will consolidate and the marginal ones will just exit.

Pre-Owned

One significant area which the tariff situation will accelerate is the pre-owned market, because these watches become relatively more attractive than new ones. If new watches carry a tariff-inflated premium (even partially absorbed), pre-owned inventory already sitting in the US faces no such burden. A two-year-old Rolex Submariner or Omega Speedmaster suddenly looks like great value versus its tariff-loaded new-equivalent.

So in actual fact, the dynamics here might actually support pre-owned prices at a time when they should otherwise continue softening. It also shifts more volume toward platforms and the various auction houses. Brands obviously won’t love this; they’d rather you buy new, but collectors should recognise the option exists and will probably look more attractive over time.

Collectors’ plans

If you’re an American collector, the 15% deal removes a bit of your immediate panic, sure… but prices are unlikely to drop either way. Brands that raised prices to offset the 39% tariff will probably maintain those higher prices and enjoy improved margins now that the burden has eased and even though a few brands have acquiesced, I’d be surprised to see meaningful rollbacks.

The ‘travel arbitrage’ opportunities have shrunk, but they still exist; a 15% price differential between the US and Europe or Dubai remains material on a five or six-figure purchase. On a £50,000 watch, you’re looking at potential savings of £7,500 which is more than enough to justify building a trip around it. Yes, it’s no longer the slam-dunk it was at 39%, and brands will work hard to close that gap through global adjustments.

Just continue to buy what you love, when you can comfortably afford it. The economic backdrop is too uncertain to try timing the market. The Fed is likely to cut rates, but unemployment is ticking up, consumer confidence is cratering, and the job market looks super-weak. If you’re sitting in that top 10% position and you want a watch, buy the watch. If you’re stretching, perhaps 2026 isn’t the year to stretch.

Indicators to watch

Over the coming months, I’d keep an eye on monthly Swiss watch export data for the US market. We need to wait and see whether the tariff reduction translates into actual recovery or whether demand weakness persists regardless. The Federation of the Swiss Watch Industry releases this every month.

Holiday retail numbers will also tell us a lot; The National Retail Federation expects sales to top $1 trillion for the first time, but how much of that is legit volume versus inflation? The divergence between Walmart’s success (sales blew past estimates, raised profit outlook twice) and Target’s struggles (lowered profit outlook, continued softness in discretionary categories) tells you everything about where the average consumer’s head is at.

“The core story is the same as it’s been for several quarters. Walmart is gaining market share with a range of incomes due to its value proposition and product mix, while Target is struggling due to its greater reliance on discretionary goods, even as it strives to add more affordability and newness to its assortment.” - Retail Brew

Needless to day, stock market performance matters a huge amount too. So much of the wealth effect driving top-tier spending is paper wealth in equities. A sustained correction would immediately impact confidence among the very demographic that luxury watch brands depend upon.

Not wanting to sound like a doomsday prophet, it’s worth saying that the flip side is also true; if markets stay strong and the wealthy keep spending regardless of broader economic weakness, luxury watches could muddle through this mess just fine. The bull case exists for sure, I’m just not keen to bet on it just yet.

Final thoughts

The tariff deal is, to be clear, unambiguously “good” news as it stopped an immediate crisis. The underlying problems, however, haven’t gone away; the economy is being held aloft by the spending of a very small percentage of the population. For luxury watches specifically, I suspect we’re looking at a… wait for it… bifurcated future 😂.

The ultra-high-end (independent makers, grand complications, repeaters, etc) will continue finding buyers who live in a different economic reality. The mid-market (i.e. entry-luxury segment that depends on people trading up and stretching budgets) is where the worries lie, and might compound over time.

If I had to make a specific prediction, the segment most at risk is Swiss watches priced between $5,000 and $15,000 from brands without cult followings or strong secondary market support. Think mid-tier offerings from Longines, Oris, TAG Heuer, Breitling etc. These are decent watches, but their value proposition will be squeezed by tariffs on one side and pre-owned alternatives on the other. That’s where I’d expect to see the most pressure over the next ~12 months.

The 15% tariff kinda makes the maths work again, but whether customers show up to buy is another question entirely. Maybe I’m being too pessimistic, and this is my nature to be sure… wealthy people have a remarkable capacity to keep spending regardless of headlines. But right now, the structural cracks in the American consumer are real, and they won’t be fixed by one trade deal.

I suppose we’ll find out over the next few quarters, and I really hope I’m wrong!