SDC Weekly 127; Rolex 2026 Prices; November Swiss Watch Market Update; “Kidults” and Watches; Living Tomorrow; What 2026 Demands

Kidult culture meets haute horlogerie, Heidegger on the irony of collecting time-measuring devices, and why the middle market needs to find its story before 2026 runs out of patience.

🚨 Welcome back… this is the final SDC Weekly of 2025!

Admin note: Our Unofficial Editor is currently on a culinary business trip and refused to look at this draft. He said he really kneaded a break, and honestly, we didn’t want to get a rise out of him. Please click here to read this post online and ensure you see all corrections made after publishing.

If you’re new to SDC, welcome! Please find the older editions of SDC Weekly here, and longer posts in the archive here.

Estimated reading time: ~35 mins

Rolex 2026 Price Hikes (US)

Rolex’s January 2026 US price list is out, and while there are more details at the end1 for those who want to pore over every reference, here are the high-level takeaways.

$10,000 Submariner - the no-date Submariner (124060) has crossed the five-figure threshold, moving from $9,500 to $10,050 (the date version (126610LN) goes from $10,650 to $11,350). This is one of those psychological barriers that probably matters more in conversation than in practice - if you were prepared to spend $9,500 on a watch, you’re probably not walking away at $10,050, fine. But it does mark something, don’t you think?

The Submariner was, for a long time (which admittedly might now seem like a long time ago), the “accessible” Rolex sports watch. This was one which anyone could theoretically save up for. At five figures, it kinda feels like it’s moved to “luxury asset” territory as opposed to “expensive tool” territory. Whether that distinction means anything to you, probably depends on how you think about these things.

Gold is up more than steel - the pattern across the entire catalogue seems to be that steel models are up ~5-6%, and gold models are up ~8-9%. The gold Daytona breaking $50,000 is also kinda notable. You might be wondering whether this jump reflects gold prices, margin expansion, or just Rolex testing how much the market will bear... I’d say it’s probably all three.

Entry sports keep creeping up - the Explorer (124270) moved from $7,500 to $7,900, and the Air-King (126900) went from $7,750 to $8,150 - so they’re both now “almost $8,000” for time-only steel sports watches. This essentially creates more breathing room for Tudor in the $4,000-6,000 bracket, which is presumably the point. The “affordable Rolex” is increasingly a contradiction in terms - until it disappears entirely.

The overall picture - Rolex has enough brand equity to push prices upward without worrying about demand; plus they can afford to turn down production to ensure they don’t flood the market and achieve a favourable supply/demand balance. Steel increases roughly match inflation, and gold increases exceed it for the reasons we discussed. In today’s market, the practical implication is likely that the secondary market premiums should compress slightly as retail catches up - as opposed to before, when the premium would stay constant The main takeaway is that Rolex continues to move upmarket, and this leaves more space below for Tudor and everyone else fighting over the lower-end of the price spectrum.

November FHS Update

We kinda covered this in last week’s long read, so you will already know that the November Swiss watch export data is a right mess. For posterity, I wanted to cover the FHS November report in more detail.

Total exports dropped 7.3% to ~2.2ish billion francs, and the headline number that everyone’s focused on is the United States, down -52.3%. Swiss watch exports to America plunged by more than half in a single month, and as WatchPro points out, this is Trump’s tariff chaos coming home to roost. They wrote:

“Luxury watch prices are higher by double-digit percentages in America than for any comparable wealthy nation, and the chaotic rollercoaster of tariff rates has shaken confidence within the world’s biggest watch market.”

I suppose when the US market effectively ‘closed’, all those watches still being made needed to go somewhere. So brands did what they had to do, and redistributed stock to markets that were still functioning. The numbers seem to tell that story, anyway.

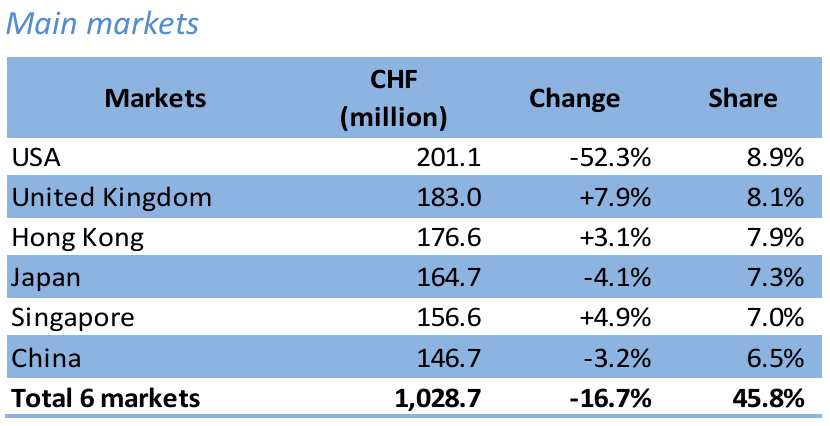

For November specifically:

WatchPro also mentioned that UAE grew 21%, Canada 18%, and Saudi 12%. I think the problem with this ‘solution’ of redirecting inventory is that it creates artificial demand in markets that may not have actually wanted those particular pieces at that particular time. If brands are forcing watches onto markets based on logistical necessity instead of consumer appetite, it’s fine as a short-term fix - but yet again, it stores up problems which will worsen the future (longer inventory days, close-out sales for old stock, eroding brand equity and so on).

According to Oliver Müller who is involved with the Morgan Stanley/Luxecosult report, Rolex, AP, Patek, RM, and Cartier account for 55% of Swiss watch industry value, and they are expected to have grown 3% to 5% in 2025. If you do the maths on that, the consequence is straightforward. If the total industry is down 2.2% and the top players (more than half the value) grew by several percent, then everyone else must be getting hammered! (Müller suggests around 8% down for the rest).

This bifurcation2 has been building for years, but it’s accelerating hard. Demand is concentrating into fewer brands, and that concentration is becoming more extreme. The watch industry is developing a “winner takes all” dynamic that’s brutal for anyone outside the top tier. The retailers speaking to WatchPro confirm this i.e. demand in America remains robust, but it’s concentrated into those same five names.

—

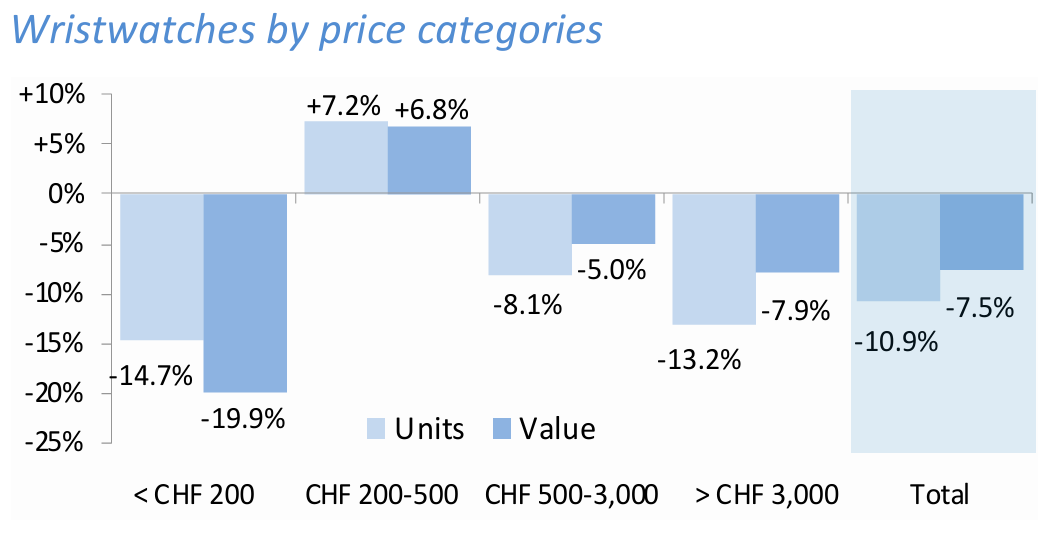

The FHS breaks down performance by export price category, and there’s only one segment showing growth: watches in the CHF 200-500 bracket grew 6.8%. Everything else declined.

“Above CHF 3,000” is a rather opaque way to categorise things, and I really wish they would offer more granular breakdowns so we can see the ‘middle squeeze’ in the numbers. This segment should theoretically be more resilient because buyers at the higher end in this segment have wealth that ignores market turbulence. The fact that it’s declining faster than the mid-tier by volume suggests something interesting is happening with mix - but I am not sure what.

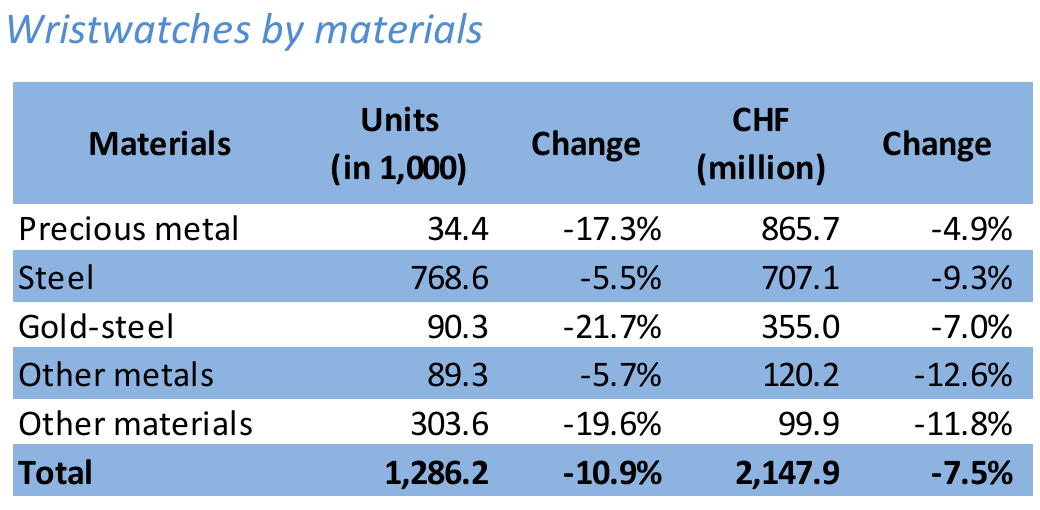

This was interesting, as I would have expected the precious metal dip to be the largest given the gold price. Maybe this supports the hypothesis that precious metal segment is skewing towards higher-value pieces, so even as volumes drop, the rich will still buy rich-people stuff.

So right now, as buyers, this environment should theoretically create some good opportunities. Brands need to move watches, retailers need to make sales targets, and the balance of power is shifting slightly towards customers with cash to burn. But you really need to be selective. The great bifurcation means that deals on top-tier pieces will be minimal, but everything else will be readily available for negotiation.

December data will only arrive in January, but given November’s trajectory, I’d guess 2025 will close somewhere around 2-3% down overall? I suppose that’s disappointing but not catastrophic... The industry has weathered worse.

Now, will 2026 begin a recovery or bring further decline? The tariff situation remains fluid, China shows no signs of rebounding, and the concentration dynamic continues to intensify. The optimistic reading is that tariff reductions will allow American demand to flow normally again, and that will stabilise the overall picture. The pessimistic reading is that fundamental demand is weakening across the board, and the tariff chaos has simply exposed that weakness, not caused it.

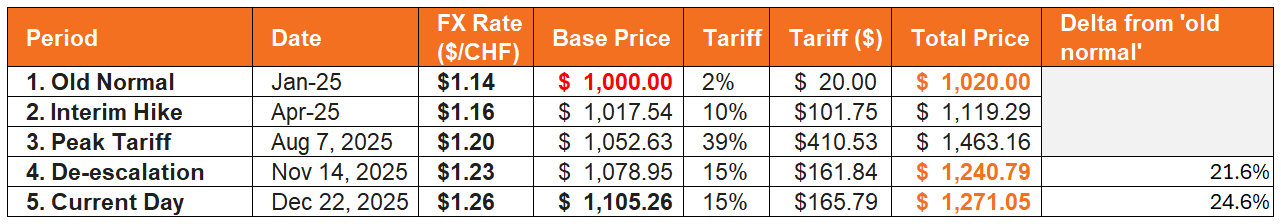

I lean towards the pessimistic reading mainly because people have underestimated the macro effects in the USA - here’s an example of the currency effects - and this is just one of the problems which has arisen due to the tariffs:

The one thing I’m confident about is the great bifurcation 😂 - by this I mean, 2026 will see further divergence between winners and losers. If you’re in the big five club, you’ll probably be fine. If you’re not, you need to figure out what makes you different, or you’ll keep getting crushed. The best solution right now, would be to cut production, and start downsizing. Protect your brand by preventing a supply glut.

The watch industry’s old playbook - make nice watches, tell a good story, build relationships with retailers - doesn’t work anymore when demand is concentrating so heavily. You either need to be in the mega-brand club, or you need to find a genuinely defensible niche. The middle ground is sinking fast.

Maybe that’s too grim a conclusion from a single month’s data, and December may yet surprise us all. Hey, who knows, the tariff reduction might unleash pent-up American demand and everything will bounce back beautifully!

But, fvck, I highly doubt it!

🧸 “Kidults” With More Money?

I’ve been reading a lot about the “kidult” phenomenon in recent months, and I couldn’t help but wonder how (or how much) this applies to the watch industry. Kidults are essentially adults who buy toys - that’s the short version anyway. The longer version involves $1.5 billion spent by over-18s on toys in Q4 2024 alone, which means grown-ups are the toy industry’s most valuable demographic - not toddlers. Circana reports that kidults now account for 28% of global toy sales, and that number has climbed 2.5% in the past two years. In the first half of 2025, US toy sales to adults rose by 18%.

“I have been following the toy market for many years and cannot recall the last time all countries Circana tracks were growing at the same time. The surge in sales can largely be attributed to consumers aged over 12-years-old, who have shown unprecedented growth and are consistently outperforming traditional kids’ trends. Products such as building sets, trading cards, games, plush toys, and collectibles are seeing increased demand from both teens and adults.”

The main products driving this trend range from the obvious (Lego, which now has 142 sets designed specifically for adults) to the viral (Labubu, those fuzzy monster dolls that generated $423 million for Pop Mart in 2024) to the nostalgic (Jellycat, whose plush toys helped the company double its profit last year). Lady Gaga loves Squishmallows, Rihanna clips Labubus to her handbags, and a 50-year-old toy industry marketer named Bob Friedland moved out of his condo because he needed more space for his Lego collection.

“The children’s market has turned into a playground for brands aligning with nostalgic franchises from the 1980s to the 2000s. They have a special allure for Millennials, Gen Z and children today. Offering collectible toys and games steeped in nostalgia will capitalise on this multi-generational appeal. By 2027, the global toys and games market is anticipated to grow by $70.12m. Collectible toys are predicted to skyrocket to a market value of $35.3bn by 2032.”

The reasons given for this explosion are consistent across every piece of research I’ve read. Melissa Symonds at Circana reckons: adults buy toys for “positive mental health benefits, as they spark nostalgia and bring escapism from global turmoil.” The FT’s Anjli Raval offered a more sobering take: “For many, that thrill of ownership can be a substitute for bigger life milestones. When owning a home or starting a family can feel out of reach, completing a toy collection is relatively achievable.”

So, to summarise, toys offer stress relief, nostalgia, escapism, the dopamine hit of a successful hunt, community belonging, display culture, and a collectors’ journey from casual interest all the way to obsession.

Does any of this sound familiar?!