SDC Weekly 14; Rolexes getting cheaper; Sistem51 trash; Thinking differently

Measurement vs Evaluation, Tim Mosso's best video ever, Extreme poverty and help with watch purchase decisions.

The clock strikes newsletter time, and it’s jam-packed. LFG.

Thank you for subscribing - if you’re new to SDC, please find the older editions of SDC Weekly here, or browse the archive of other posts here.

Last week we covered the Swatch x Blancpain collaboration, and a collector DM’d me on Instagram to point out a perfect summary of the watch was in fact, captured on the crown (Thanks Naval Chopra!):

That’s it - its “BS”! Other than the 50+ others who quipped “IBS” describes the feeling this watch gives them, I only have a few more thoughts to add to what I said last week:

It is disposable… trash!

Blancpain missed a trick.

Collabs remain good business for the Swatch Group.

As explained here, “the Sistem51 in the above watch is hermetically sealed … not designed to be a repairable movement … the caliber Sistem51 is considered to be a disposable movement.” This watch is over £300, and yet, it is disposable! Sure, even Adrian Barker said in the he plans to get one in his video on the topic, but he also admits this is a cheap piece of garbage. Here’s another link, diving into the movement (Thanks Ronnie Teja!)

Arguably, the dive watch category is not the area where Blancpain is falling short. For those who know the brand, it is already doing relatively well in the dive watch category if you compare this with, say, the Villeret or Métiers d'Art collections. Perhaps it is debatable whether these collections would lend themselves to a collaboration with Swatch, but perhaps it was a missed opportunity to promote the less-successful offerings from the brand.

That said, I still think these collaborations represent very good business for The Swatch Group, and the wild queues (here, here, here) at Swatch Stores around the world prove that. Unfortunately, this also means there will probably be another Swatch Group brand getting the Swatch treatment before long… c'est la vie.

Measure or Evaluate?

I am sure you’ve heard the saying “if you cannot measure it, you cannot improve it.” This can be true at times but often… it isn’t! Parents will recognise how fallacious the phrase “you cannot improve something that you have not measured” can be. I know I am improving as a parent, despite measuring nothing specifically. I just know, and in particular areas I can tell my own performance is just… better. Sure, but how am I able to do that?

Well, I am evaluating how it’s going! I may not be able to specifically measure the quality of an afternoon with my kids, but I can reasonably evaluate how it went and rate any given afternoon as being a positive or negative change, relative to previous but similar sessions.

This brings me to the point of this section: there is a difference between evaluating performance and measuring performance.

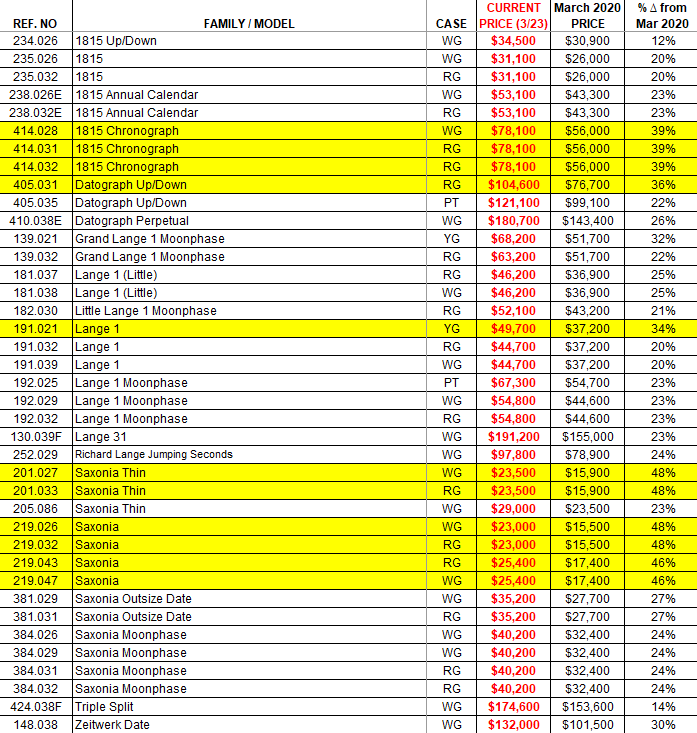

I mention this because there is something to be said about watch brands’ performance over time, and collectors’ general attitude towards them. Here’s an interesting list of several A. Lange & Sohne watches, and their corresponding prices/increases over the last 3 years:

I highlighted a few standout pieces, and thought it was worth comparing to Rolex for a better understanding:

This might sound bonkers to some, but according to this table, Rolex watches have become cheaper over the last 3 years, in relation to the purchasing power of one USD.1 Hopefully this clarifies why the yellow highlighted rows in the Lange table are more relevant. In short, only a handful of Lange’s watches have had true price increases, while the others are basically just stayed the same, generally speaking.

Sometimes when we try to measure something, the measurement can be focused upon and then improved; but in doing so, the underlying thing which needs to be improved, is not improved at all.

In Lange’s case, what is Richemont Group’s underlying asset? The Lange brand. What are collectors measuring? Price. What is not being improved? The brand! This leads to conclusions such as “the brand is just money hungry or profit-driven” when instead, they are simply running a business and neglecting the evaluation of a core delivery area i.e., customer service (for more on this, have a look at the ‘Lange Policy’ highlight on my Instagram profile). Here’s my related post about Brand Power if you missed it.

To conclude… make sure your evaluations are calibrated correctly, and perhaps focus less on measurement, especially if it is simply… for the sake of it!

Thinking differently

I posted about this on my Instagram story last week, and so many people enjoyed it, that I decided to expand on it here.

The story was about a Stanford professor named Tina Seelig who split her class into groups - She gave everyone a challenge:

Each group would be given $5 and 2 hours to make the highest possible return on the initial money. At the end of the challenge, each group would give a short presentation to the class on their approach and results.

Most of the groups took a linear, logical approach:

Use the $5 to buy a few items

Barter with those items (resell or trade them)

Repeat

Sell the final items for something worth more than $5

These groups made a modest return on their initial $5.

A few groups ignored the $5 and instead thought up ways to make money in the 2 hours of allotted time:

Made and sold reservations at hot restaurants in town

Refilled bike tires in the center of campus for $1 each

These groups made a better return on their initial $5.

The winning group also ignored the $5, but took an entirely different approach:

They realised that the most valuable asset was not the $5 or the 2 hours of time for the challenge, but the presentation time in front of a class of Stanford students.

Realising the value of this asset, they sold the presentation time to a company looking to recruit Stanford students - they sold this time slot for $650, netting a gargantuan return on the $5 of initial capital.

If you take into account that many of the teams didn’t use the funds at all, then their financial returns were infinite.

Tina Seelig Ph.D.

The losing groups thought in linear, logical terms and achieved a linear, logical outcome.

The winning group thought differently.

So how does one think differently?

When faced with a challenge like this one, where there is a clear potential for non-linear rewards, follow these three steps:

Skip distractions: Any approach which seems obvious and simple, is probably not going to constitute ‘thinking differently’. In fact, if everyone’s doing the same, it behooves you to stop and reconsider. Avoid taking the bait. In this case, the $5 was a red herring.

Get to the root: Use the Socratic Method which will stimulate critical thinking. Strip away flawed assumptions and ground yourself in foundational ones. The winning group uncovered the ‘true’ asset they held was the presentation timeslot not the $5. The rest was history!

Find your leverage: Test your findings and identify key points of leverage in relation to what you’re optimising for. Ultimately, the winning group identified the asset, but still had to sell the slot to make a profit. They could have easily and quickly sold it for a couple hundred bucks, but they leveraged the fact that they were offering something which the company could otherwise never access… so they charged a lot more and made a huge ROI. That’s a non-linear reward.

Links of interest

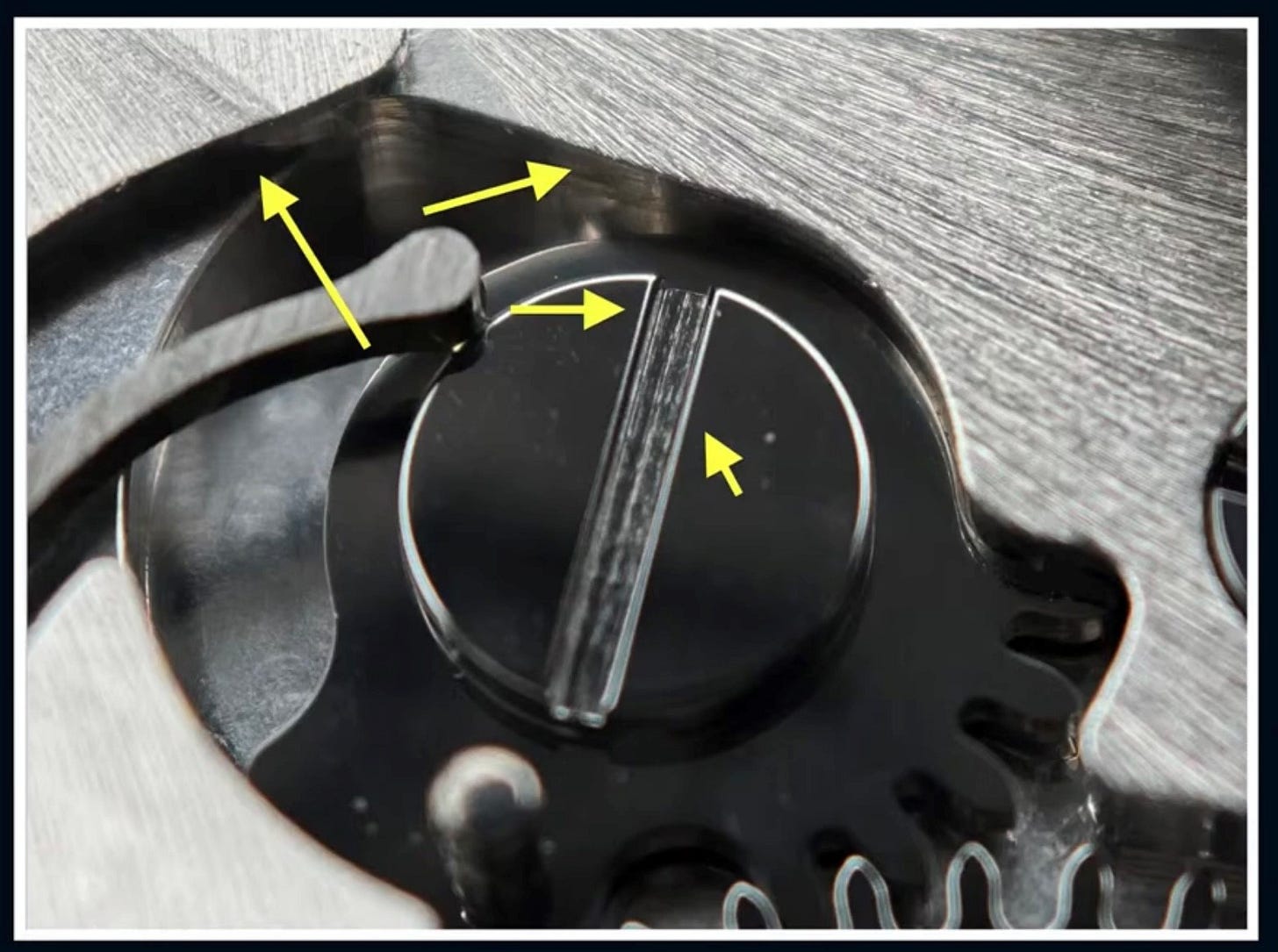

When you look at the above photo, can you immediately tell whether the finishing is objectively good or bad? If not, you’re in luck….

This outstanding video is possibly one of Tim Mosso’s best episodes ever. Quite a statement, but hopefully one which will make sense after you’ve watched it. Start around 16 minutes in, and it’ll take about 25 mins in total. Well worth it, if you have ever wondered what finishing means, and how to tell good from bad. Laurent Ferrier, Romain Gauthier, Minerva and Girard Perregaux fans will be pleased to hear what Tim says about their pieces. Enjoy, and come back and thank me later!

🐣 The world keeps getting crazier, as scientists have reproduced a model of a human embryo from stem cells.

🌚 Welcome to the new moon race.

🏺 You may want to opt out of ancient Egyptian mummy skincare.

👃 AI can predict smells from molecular structures.

💀 Why “Buy what you like” is terrible advice for watch collectors.

💸 Extreme poverty: How far have we come, and how far do we still have to go?2

End note

I updated an old post of mine a few days ago… Take a look:

“I assure you, this will trigger thoughts in your mind which you would not otherwise have taken the time to explore.”

That’s a quote from the post - and I urge you to try it out. The process of actually scoring, and relatively ranking all your desired watches is extremely difficult, because the chart doesn’t lie - and when you see the reality of your scoring in front of you, it will trigger conflicting thoughts which activate your biological desire to resolve internal conflict.

Let me know if you try it, and if you need any help with setup or calibration, please feel free to reach out. You will still have to do the scoring yourself - that’s non-negotiable!

Oh, here’s a cool feature… gift subscriptions. Feeling generous today? Treat someone:

Until next time!

F

Bonus link: Watch Analytics powered by AI

To be clear: this is not a paid ad. I tried this tool from WatchCharts, and while I did find it buggy, the tool is still in BETA - so bugs are to be expected.

I found it useful to ask basic questions about market pricing (as you would expect), but where the tool is still lacking, is in qualitative information.

For example, I asked it for the reference of a Rolex Daytona with steel case and ceramic bezel - the response I got was that it couldn’t find any exact matches, but gave me a list of 116520, 16520 and 116500 - the final one, is of course the answer I was looking for. It also neglected to mention the new 126500, launched this year, which also meets the criteria as a valid answer to my question. Needless to say, more work to be done before it can get out of BETA, but promising to see, nonetheless!

If you enjoyed this post, please do me the HUGE favor of simply clicking the LIKE button below, thank you!

Rather than trying to explain economics, I will share a resource instead: Consumer Price Index (CPI) Explained: What It Is and How It's Used (investopedia.com)

I was laughing at the inclusion of this “Extreme Poverty” article, in a newsletter for watch collectors… I pride myself on such oxymoronic activity lol!

BTW, “oxymoronic behavior/discovery is the staff of ultimate prose” .....thus sayeth I. 🙇♂️

Indeed a most excellent video by Tim Mosso, thanks for pointing it out! Some real surprises there, not all of them unexpected! 😉 ....... you can talk fast 💨, you can baffle with bullshit and flashy ads and influencers, BUT you can’t hide from a powerful loupe or lense!! The truth will out!