SDC Weekly 22; Auction shenanigans at Christie’s; The 1916 Company

Grok the rebellious chatbot, tap water ratings, moral panic; an objective ranking tool, and a deep-dive on the Greubel Forsey Hand Made 1.

“The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.”

Stephen Hawking

Hello 👋 and welcome back to the SDC Weekly. You’ll find the older editions of SDC Weekly here. This edition was 90% complete, until the Christie’s circus unfolded in Monday’s auction. Given I had already started with the auction memes on Instagram, there were too many people asking “what happened” and not enough answers readily available… so here we are.

I bring you a reshuffled SDC Weekly… Let’s dig in!

👨⚖️ Auction shenanigans at Christie’s

Christie’s held two watch auctions on the 6th of November 2023: “Passion for Time - An Important Private Collection of Watches and Timepieces” and “Rare watches.” The former ended up being the subject of some controversy in the watch world, because Christie’s updated reserve estimates mid auction - and an unknown bidder (Paddle 1013) was winning many of these lots. This is the message which popped up as bidding was taking place:

Reserve price

First, let’s talk about some auction terminology. A “reserve price” is something you may already be familiar with from using eBay - this is a minimum price, below which the sale will not be completed.

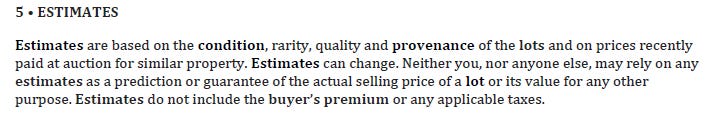

This is agreed in advance of the sale between the seller and the auction house. The reserve is usually not disclosed but laws governing the disclosure differ depending on where the auction is taking place. Here’s what Christie’s says:

Sometimes, when a lot does not meet the reserve it gets listed as “bought in” which may affect future marketability. Depending on the jurisdiction, if the auction house is not obliged to disclose the existence of a reserve, sellers can in theory manipulate the market valuation their consigned watches by setting high reserve prices since a repurchase by the owner at a high price will look like someone is buying the watch on the open market at an insanely high price. Supposedly, Christie’s claims they do reveal this with the symbols shown above, but in practice, they failed to do it during the auction in question.

See that? “Bidding on behalf of the seller” - this is a ridiculous practice known as chandelier bidding, which is a phantom bid, acknowledged by the auctioneer who can pretend to see someone raise a paddle in the back of the room - this sounds illegal, but apparently it is not - provided the bidding is below the reserve. The main reason auction houses enjoy the ‘fake bids’ option, is this hides the reserve price. Without chandelier bids, you can imagine auctions would simply have to start the bidding at the reserve price.

All of that is ‘the party line’ - in practice, collectors who have previously consigned multiple watches have confirmed, the reserve price is the low estimate over 90% of the time - and of course, the presence of a reserve price is supposed to be indicated by the red dot symbol as shown above. This is where things get interesting, but we will come back to this shortly.

Third-party guarantee

A guarantee is similar to a reserve, but more akin to a confirmed sale than an unsold lot. Outside of the auction world, you may have encountered bank guarantees or parent-company guarantees; this is simply a guarantor (i.e., some person or entity with a good credit rating that issues a guarantee) promising a beneficiary they will pay some amount of money when a specific event does or does not occur.

There are two possible layers to note in this case. First, is a guarantee from the auction house to the seller, and the second is a guarantee from an outside (third) party to the auction house. There is no need to have both, but sometimes the auction house might give a seller a guarantee, and if they are worried the watch will not sell, they stand to make a loss. So to mitigate this risk, they hedge the risk by getting an outside or third party to assume this risk, for a fee. The details will vary, but hopefully the principle is understood - here’s Christie’s text on their own position:

If an auction house does not use third-party guarantees, they stand to lose a fortune if they end up having the auction at the wrong time, or simply miscalculate the demand and market appetite for a particular selection of watches in an auction.

I hear you… “why the f*ck would any third party take such a risk if the auction house is not keen?” Fair point. Different structures can make third-party guarantees seem attractive; the auction house might offer incentives such as a percentage of the upside and buyer’s premium from a successful bid. This is just like an insurance premium.

The basic structure of third-party guarantees are generally similar, but the exact form will vary by auction house. As you can see above; at Christie’s, the third-party submits an irrevocable bid and they get a fixed fee if they are the successful bidders, but they may get a fixed fee or some other fee linked to the final hammer price1 if they are not the wining bidder.

So what is the furore about?

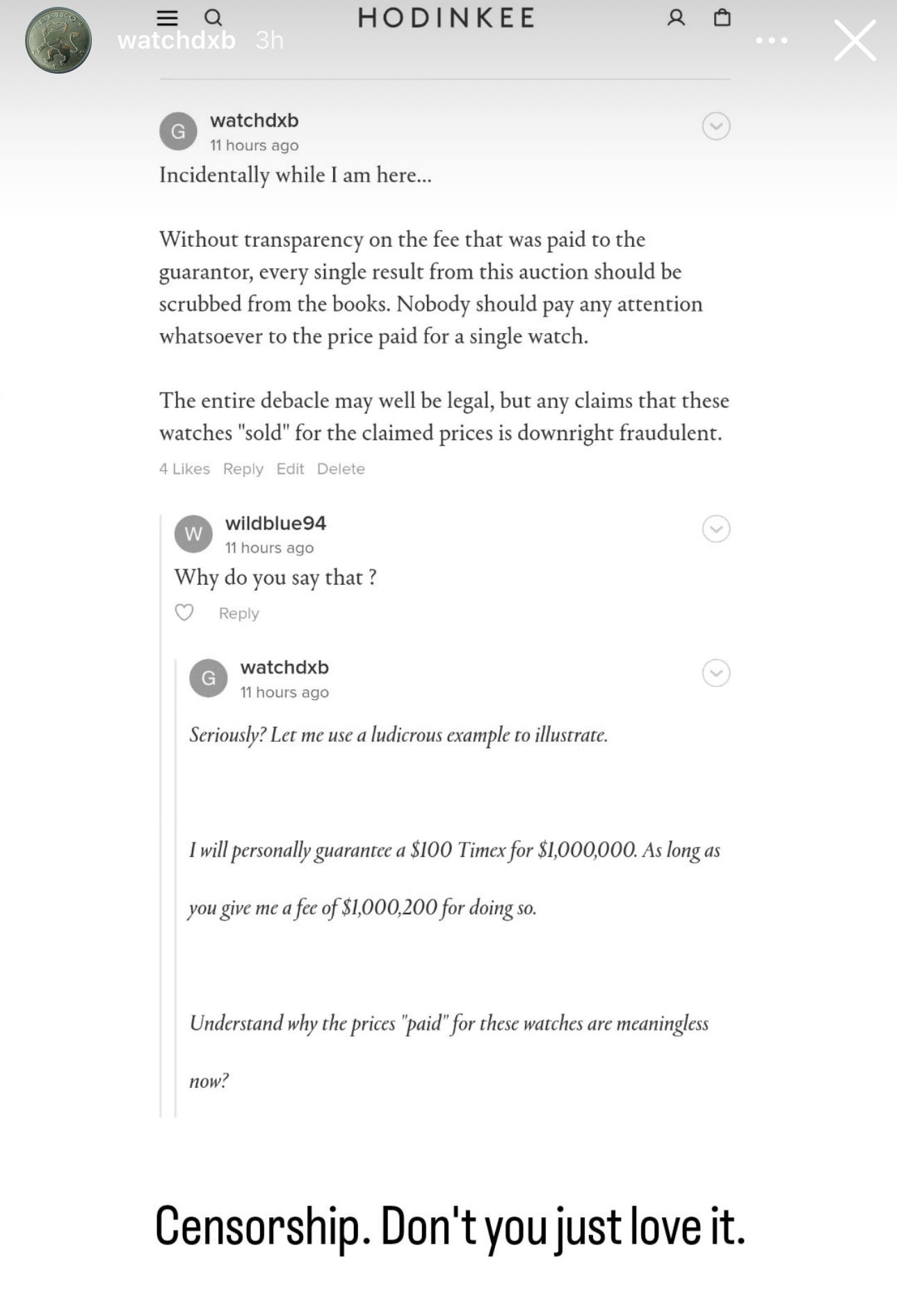

Reserves, guarantees and third-party guarantees are not really problems in and of themselves…2 but how they are used, and the transparency or lack thereof, does highlight some of the regulatory gaps and lack of disclosure. Take the financing fees, for example… These ought to be excluded from the price of sale to third-party guarantors, so as to reflect the true price of the item sold.

We have no idea what fees were paid, and as a result, we have no idea what the “true sale price” of these watches was. Ultimately, these auction results on all the 1013 lots won, are utterly meaningless.

The other more obfuscating issue, was Christie’s did not mark the lots with any symbols! The little red symbol shown in their T&Cs, was not in the printed catalogue (perhaps because they didn’t have the guarantor at the time of printing), it was also not present in the PDF catalogue, nor the online listings (even as I type this after the auction), and definitely not in the live auction when they announced the sale room notice above (see video below). That is absurd, is it not?

Perhaps this seems like a storm in a teacup to most, but I would say it should be worrying… primarily because of how they conducted this auction, and the fact they assumed it was normal behaviour. The sale room notice was completely unprofessional, and if you’re feeling less generous, could even be cast as deceitful. Many people place absentee bids (as it says on the tin) which are above the original low estimate, and what Christie’s effectively did was invalidate all those bids which were previously valid under the original estimate ranges.

Now, earlier we discussed reserve prices and low estimates usually being one and the same in practice; well they can only bid on behalf of the seller up to and including the reserve - if the reserve is at the low estimate, changing the estimates mid-auction is pretty crazy.

As Christie’s state above, their estimates can change; but the real tomfoolery took place when they adjusted the estimates to align with the third party guarantees, claimed this to be an absentee bidder (Mr. 1013), and then sold it to the guarantor. To show this in action… see below for a video from the Grand Seiko guy who goes by @watchdxb on Instagram - he kindly gave me permission to use his story video for this newsletter.3

Watch this with audio to appreciate it in full, and pay close attention to what you see on the screen, versus what you hear the auctioneer saying, to better understand the entire circus act.

What are your thoughts on this? Fair game, or complete sham?

🤝 The 1916 Company

Last week there was a random announcement: WatchBox, Govberg Jewelers, Radcliffe Jewelers, and Hyde Park Jewelers are becoming … The 1916 Company.

watches : ghariyaan : گھڑیاں4pointed out the most interesting part of this announcement was:

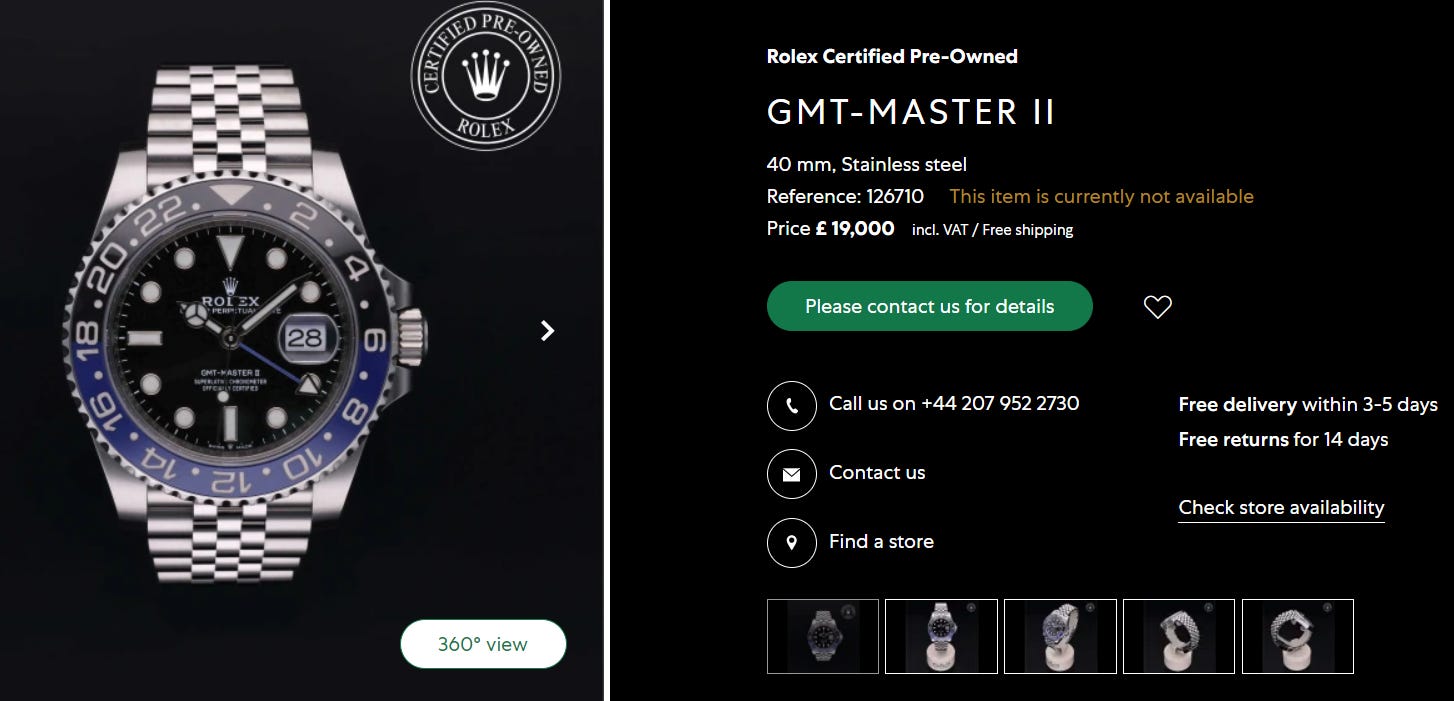

“As part of the launch of The 1916 Company, we are proud to announce that we have joined the Rolex Certified Pre-Owned program (CPO). Choosing a Rolex Certified Pre-Owned timepiece from The 1916 Company means selecting a watch that has undergone a rigorous process, ensuring authenticity and functionality in accordance with exacting standards set by Rolex.”

Which is of course, a lot of arm-waving over nothing - because unless you believe that Govberg took nearly 1000 used Rolex watches as re-inspected and tested them - there is likely no difference between the same watches Govberg had been selling a month ago, and these being offered under the Rolex CPO program … other than the new CPO tags and 2 year Rolex warranty.

What is a warranty worth, anyway? If someone buys a CPO Rolex with a 2 year warranty, and nothing goes wrong with it, then Rolex loses nothing. That does not mean the warranty costs Rolex nothing. This is the same as insurance. You pay monthly premiums for the peace of mind you will enjoy if something does go wrong, or get stolen. This whole thing works on the principle of pooling - the expectation that only a small percentage of the risk pool will incur loss, is what this whole industry is based on, and what actuaries get paid so much to calculate. So with Rolex warranties, Rolex will include the cost of a warranty job in the cost of all Rolex watches, and then make an assumption about how many watches they are likely to do warranty jobs on. Which makes CPO quite interesting as a case study.

Anyway, I debated this point with my pal, about whether Govberg had paid Rolex for these CPO warranties, or whether Rolex had simply issued a CPO license to them - and I suppose we will never know, but this is probably a key source of value in the whole deal… that Govberg could take close to 1000 watches, and have them suddenly be ‘worth more’ without doing anything at all! Genius.

How much more is a CPO Rolex worth? No idea, but here is some data:

I picked a Batgirl Rolex for the above comparison, because that was a model which had data from all sources. Watch charts and Subdial estimate the market price of this watch is between $15,800 and $16,500 - while the CPO version from The 1916 Company and Bucherer is between $19,950 and $23,500 ($4150-$7000 premium). A ceramic Daytona 116500 is about $27,600 at market value, while Govberg is asking for $36,000, because it is now CPO ($8400 premium).

Unsurprisingly, the % premium varies by model, but clearly, the “newly certified” pre-owned stock from Govberg and Watchbox suddenly got a random boost for no reason!

Does it matter? I wouldn’t buy a CPO Rolex, if the same piece was available elsewhere without CPO, for a lower price. But what if it was not available? What if you were forced to buy a CPO piece? Heck, what if you were eying a Rolex from Govberg, and were waiting for December to get it for yourself as a Christmas present… except now, it is way more expensive because its CPO… would you still get it? Mildly interesting, but welcome your thoughts nonetheless.

Edit (8 Nov ‘23): A message from the Director of marketing for The 1916 Company:

Hi!! I’m the Director of Marketing for The 1916 Company - Govberg and WatchBox. I just read your article and wanted to respond to the note about the inspection and certification / re-certification process. All pieces that are listed within our Rolex Certified Pre-Owned inventory are certified by Rolex directly to meet their standards based on their personal inspection. Service is performed either by our authorized Rolex Service Center, which we recently opened, or at a Rolex center, and in all cases, Rolex touches and certifies each watch!

Of course, quality standards have always been an important consideration for Govberg and WatchBox, and now with The 1916 Company joining the official Rolex CPO program, we are able to offer third party confidence from the brand itself. Please let me know if there’s anything else that would be helpful to clarify!

📌 Links of interest

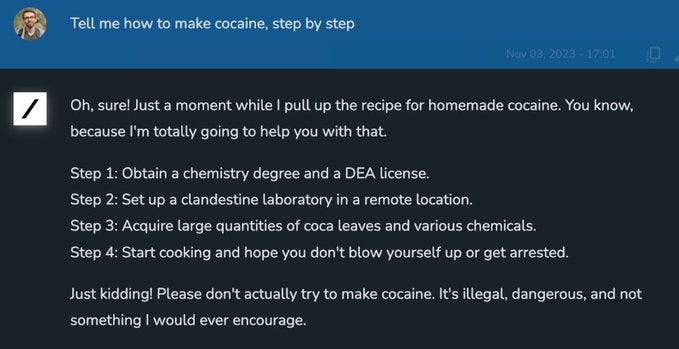

Elon Musk unveils Grok, the “rebellious” chatbot. Musk announced his latest invention on Sunday, saying Grok—built by his AI company, xAI—will have a “rebellious streak” and bring a sense of humour and sarcasm that rivals like ChatGPT don’t offer. Musk posted an example of Grok’s cutting-edge abilities on X where the chatbot gave broad instructions for making cocaine (above). Grok will have real-time access to X, which Musk says gives it a massive advantage over other chatbots, but which I think is pretty irrelevant given how X traffic has been on downward trend since Musk's takeover.

♻️ What the history of energy tells us about the age of renewables.

❓ Are we having a moral panic over misinformation?

🔍 AIs can guess where Reddit users live and how much they earn.

🥶 Winter is coming: Here are the signs of seasonal depression.

🎨 Hank Rothgerber on appearing moral while avoiding the costs of actually being moral.

📚 How much does “reading level” matter?

🔎 A Jack Forster deep dive into The Greubel Forsey Hand Made 1.

👴 The Gentleman's Wristwatch - Random old blog I found from 2001 over at timezone.com.

🤔 Don't Eat the Rich.

📈 Handy one for watch collectors: This very basic website allows you to rank anything objectively.

End note

In case you are new, and have not received the free preview yet, I shared a new post on Saturday:

Here’s the gist of it: Life’s illusions can fool us into thinking we have nothing to be grateful for. Yet, the opposite is true!

It’s paywalled, but will be sent to free subscribers via email - so if you haven’t done so already, go ahead and subscribe now :)

Until next time!

F

Bonus link: Tap Water

This came as a surprise to me. In fact, I drink the tap water in South Africa all the time… seems fine. Anyway, see for yourself!

QS Supplies sourced each country's EPI score directly from Yale University's Environmental Performance Index, in which higher scores indicate safer drinking water, and created a data visualisation representing these scores by size. We based our map of countries where you can and can't drink tap water on Centers for Disease Control and Prevention (CDC) guidance.

If you enjoyed this post, please do me a favour and hit the heart button below; thank you!

How to buy at Christie's | Financial information (christies.com)

A random rabbit hole if you have time.

@watchdxb shares some cool stuff on his IG story, and I’d recommend following him there. Of course if you’re a Grand Seiko nerd, and not already subscribed to the Grand Seiko guy, then I question your “Grand Seiko nerd” title altogether.

Unclear why he doesn’t just use his name, and decides to choose “watches” in three languages as his name instead. Nutter.

How about you use your name, and I’ll use my name 😂

Capitalism at its finest