SDC Weekly 27; 400k G-Shocks, Dufour again!

Breitling buys Universal Genève, Patek price hikes + margin drops, Jean-Christophe Babin drops a doozy, Watch market decline ... and much more!

Hello 👋 and welcome back to the SDC Weekly. This is a long edition, and it doesn’t even begin to properly opine on Breitling’s acquisition of Universal Genève… so let’s skip the intro blurb! Remember, if you’re a free subscriber, you will be receiving the full post in the week following it’s publication.

Sorry you didn’t win Time’s Person of the Year and sure, it hurts that Barbie, a fictional character, was nominated over you, a real person. The good news is the Oxford University Press crowned an internet-slang term its word of the year:

⚠️ NOTE TO SUBSCRIBERS: Some email applications may truncate this post. If so, or if you’d prefer, you can read it all online here. Alternatively, click on “View entire message” at the bottom, and you’ll be able to view the entire thing in your email app.

Thanks for reading!

👨⚖️ Auctions and value perception

I didn’t even know the meaning of rizz until I saw this news… but speaking of rizz, let’s talk about the most ridiculous result we saw over the weekend:

A few excerpts from the Phillips listing of the watch (emphasis mine):

The new G-Shock “Dream Project #2” G-D001 is a one-of-a-kind G-Shock crafted from 18k yellow gold with an exterior case designed with the assistance of generative artificial intelligence (AI). Forty years of G-SHOCK data was provided to a custom AI system that generated a three-dimensional model optimized for factors including structural strength, material characteristics, and processing methods.

The unusual precision-molded construction of the bezel and strap were crafted using a lost-wax casting process most often found in the world of jewelry. The components – all crafted from 18k yellow gold with zero resin buffering – were then hand-polished to achieve a gorgeous luster.

The present watch, photographed and presented to the public, is a functional prototype. Bidders acknowledge and agree that the Lot received by the buyer will be a new watch that may differ from the prototype available for inspection prior to the Auction.

The final version of the G-D001, customized for the buyer’s location, is expected to be delivered to the buyer during the first quarter of 2024.

One hundred percent of proceeds from the sale of this watch will benefit The Nature Conservancy (TNC).

So, someone bought a G-Shock for $400k - and many suggest this was only possible because “it was for charity, and therefore tax deductible.” Really?

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Paid subscribers get access to this newsletter when it drops. Free subscribers usually get it a week later.

Phillips notes (emphasis mine):

The buyer of this Lot may be entitled to claim a charitable contribution deduction for the hammer price, but such deduction will be limited to the excess of the hammer price paid for the lot over its fair market value. In accordance with applicable IRS regulations, Phillips has provided a good faith estimate of the fair market value for each lot which is the mean of the pre-sale estimates relating to that lot. Buyers will have until December 31, 2023, inclusively, to indicate to the Nature Conservancy in an email to jan.mittan@tnc.org expressing their wish to benefit from this charitable contribution deduction.

The way this works is straightforward… after bidding went over 140k, any amount paid above 140k would be tax deductible, i.e. on this watch, the taxable income of the buyer will be reduced by $260,0501. Even in the highest US tax bracket at 37%, this is just under $100k of avoided tax. Now, even if the buyer is in some region with a 60% tax rate, the ‘avoided tax’ would be worth 150k - and so, even after buying it for 400k, and ‘saving’ 150k via avoided tax, they would still have paid 250k for this watch! In the current market, that is an epic result to witness.

And then there was that Dufour Simplicity I mentioned a few weeks ago - it sold for $558k or £444k; so, 12% higher than the recent HK sale.

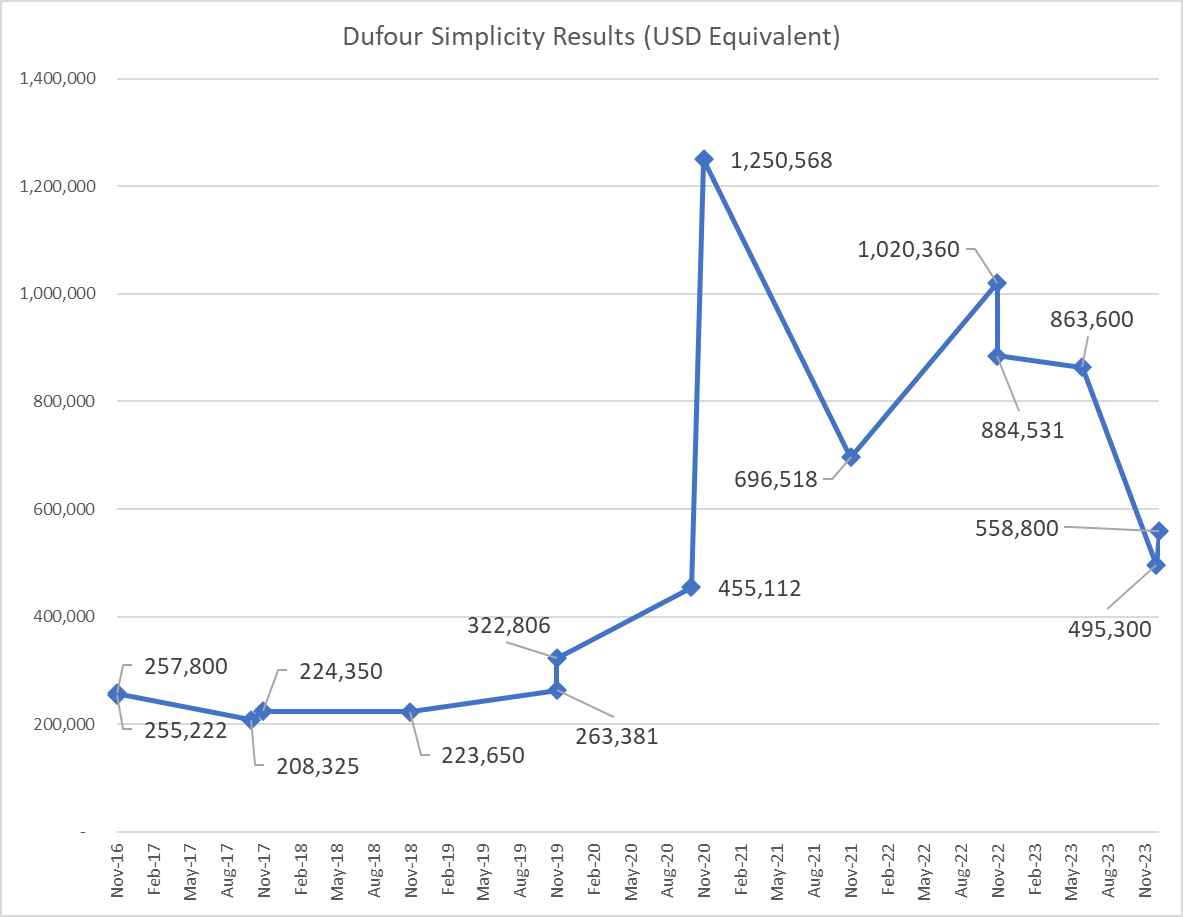

Here’s an updated version of the chart you might have seen in my old post about Dufour - and note this excludes this watch which went unsold:

Tomfoolery is evident between ~2020 and early 2023, but it seems we’re back to slightly less bizarre territory with the pricing of these watches. Some suggest this is a result of several owners ‘cashing in’ during the boom, which resulted in several pieces circulating (higher supply)… which led to lower prices. Possible, sure - but there is more to explore.

In recent months, I have heard from increasing numbers of collectors who have started questioning their perception of value in watchmaking. As I explained in the Dufour article, Mr. D is best known for his finishing skills. Most Dufour enthusiasts will describe his importance in this way too - i.e., he breathed life into, and thereby preserved, classic finishing techniques which were supposedly at risk of being forgotten forever. I am no historian, so let’s assume this belief is completely true… so what? This line of reasoning implies the watches he made himself, are a symbol of the preservation of artisanal skill, and of an era which arguably laid the groundwork for independent watchmaking as we know it today. The real question is, will anyone care over time (pun intended)?

What is the value these collectors now question? Input versus output. You have heard people recently regurgitate the fact that Roger Smith used Omega calibers in his some of his watches- which is the exact opposite of the “Daniels Method”2 - this is not news at all. Same for Roger Smith’s use of CNC - this fact is plastered all over his website. It is what allows Smith to produce more watches, and ironically, he now charges more for them - we will come back to this in the next sections… but the question remains…

Where is the value?

Returning to Dufour; there are probably going to be no more than 4003 Simplicity watches in existence by the time Philippe Dufour leaves us - many of these will have been made by Mr. D himself, and some of the newer pieces I understand were not even made by him - so let’s assume the newer ones are worth significantly less; Call it 200 watches for the sake of argument, which are dated to imply they were worked on by Philippe. Are there 200 people out there who would buy into this nonsense that this watch is worth that much, because of the history? Probably, yes! Rich people tell themselves all kinds of tales to justify how they blow money. Hell, that’s what this whole hobby is about. So I don’t think these watches will decline too much more, if at all.

I know a couple of people who own Simplicity watches, so here’s what I think is useful insight: The straight shooters will tell you, Simplicities not worth more than ~150k in this market - maximum! They are of course happy to have one, especially after purchasing their pieces under 100k - but they see no point in keeping it except for the outside chance it becomes a million dollar watch in the near future. Other less forthcoming, and more self-serving Simplicity owners continue to talk up the watch, and spread BS about how ‘important and valuable’ it is, claiming it to actually be a million dollar watch which just hasn’t reached its potential. The market will decide, as always - but you should be wary of those Simplicity owners in the same way you would be wary of grey market dealers - they are sitting on these watches as assets, so trust your gut if you find yourself wondering whether you should buy one - hold it, examine it, study the history, and then decide for yourself. Trust nobody.

May might have missed this online auction which closed this week, but there seemed to be some decent deals! Lucky for us, we have another auction starting in London, as well as this one which is open for another week or so… wonder what stories those will bring…

The reality is, for laypeople, the market is in for a tough time. While the US S&P 500 Index is up over 20%, the so-called Magnificent 7 stocks (Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA)) make up just under 30% of the index's weighting. These stocks are up an average of 102% year to date, with Apple's 47% returns being ‘the worst’.

For a different perspective, look at the S&P 500 Equal Weight Index which is equally divided by all 500 companies in the index. Smaller companies with a few billion market cap are weighted the same as Apple with its $3 trillion market cap. While the S&P 500 is up under 20%, the equal weight index is up just under 5%!

This means, when (not if) these magnificent stocks pull back from their rally, that will pull the whole market lower with them. If that doesn’t convince you, then look at how much cash Buffett is sitting on (Hint: it is over $150 billion… with a B). This is the guy who famously said: “Our favorite holding period is forever.”

This isn’t to say it is all doom and gloom - when it comes to genuinely prized watches, the numbers are so large, the prospective buyers are ones who don’t panic buy or panic sell - they just buy whatever they want, as it becomes available. Still, fear in the market is a weird thing, and it drives irrational thinking. That’s when people look for more excuses not to buy, even when they can afford to buy.

Why did I bother discussing this at all? Well, content creation will move towards being AI-generated, and this might drive the cost of content towards zero. This would also mean the value of trusted relationships will increase over time.

So if you subscribe to this newsletter to get interesting perspectives on the world of watches, I suppose it helps if I explain in more detail what sort of facts and considerations drive these opinions I share… and perhaps give you more reason to attach some value to it… assuming you agree with the logic. If you don’t, that’s fine too - at least you’re making more informed decisions!

⚡ Breakage

Building on the topic I started earlier… By now you will have heard how Roger W, Smith increases his retail prices while customers wait for their orders… I know a handful of collectors who cancelled their orders in protest. A. Lange & Sohne used to do this as well; Take a deposit, and despite doing so, would not lock the retail price - so if your watch is ready in a year, and the retail prices have gone up, the remaining balance you owe will increase to ensure your total payment cover the new, higher price.

To be clear, my view on this is simple: no deposit should be taken, until the seller is willing to lock the price in. Taking any deposit, implies a buyer is willing to make a commitment to purchase something at a particular price. Of course, the sellers can keep increasing the price because of market values rising - but how arrogant is that?! They do not reduce it when the market values go down, so this arrogant abuse of customers is out of order. That was not really the point of this section… the purpose was to talk about this concept of breakage.

In a normal business context, customers want something, so they buy it or use it, and the transaction is completed. You want a Fanta, you go to the store, buy one, and drink it. Easy. Your thirst is quenched, the store owner has been paid, and that’s all ideal.

The idea of a 'breakage business model’ works in reverse; in other words, the business makes money when you do not use what they are selling. Breakage is actually an accounting term which identifies revenue from services that are paid for but not used.

You see this all the time… gift cards are a big source of breakage, because people pay for them, and many go unused or get lost. Gym memberships are another huge one - I remember an old friend in South Africa who owned a gym, and cursed me as one of his worst customers because I used the gym too often. He said, at that time, 75% of his paying members never came to the gym after January… and less than 10% of members used the gym daily. This blew my mind!

Another obvious one for watch companies is a warranty - apart from brand like A. Lange & Sohne who regularly try to weasel out of their warranties, many others don’t even need to fix anything in the first few years. I’d bet Rolex probably does warranty work on maybe 5% of their watches? No idea, happy to be corrected.

Breakage-based business models can be very profitable of course…

Blockbuster was known for charging customers a fee for every day they were late returning a movie rental. In fact, Blockbuster said it made $800 million in late fees, or 16% of its revenue, Quartz reported. This frustrated many customers, including Netflix founder Reed Hastings.

The obvious problem with the breakage business model is that it aims to receive value from customers without customers receiving any value in return. Obviously, customers would not appreciate this.

So when Netflix first started, they used a subscription-based mail business, where, for a flat fee each month you could keep the movies you rented for as long as you wanted. They directly targeted Blockbuster’s most profitable customers: the ones who begrudgingly pay late fees… and this ultimately bankrupted Blockbuster.

What is my point? Selling watches on the pretext you are offering some upside or value which is intangible or false - is a form of breakage… people just don’ t realise it yet.

You have probably never heard of Fleury Manufacture, but the irony of this becomes clear if you have heard of brands like Petermann Bedat or Theo Auffret. The latter use companies like Fleury to make their parts, and then claim to do ‘finishing and assembly’ while touting their creations as being ‘hand made’ and crucially, tend to avoid correcting people who seem to think this is done by themselves or made “in house.” I discussed Remy Cools in a recent newsletter too, similar story. Other like Simon Brette and MB&F openly admit and celebrate their collaborations… and they still do pretty well. So why do some disclose, and others not?

As I have said many times before, I attach no value to the “in-houseness” of a watch, but unfortunately, the market does. So when we have so many new brands peddling BS about doing things themselves, this creates what I am describing as ‘breakage.’ This is because they are charging higher prices for watches on the basis of said watches being painstakingly created in-house at a higher cost, when in fact they do no such thing - and ought to be charging lower prices for the same watches. Ultimately, when the market later discovers something was not ‘fully in-house’ - it should result in valuations declining, right?

In terms of independents, there are a handful who make most of their movement components as opposed to outsourcing their production (Voutilainen, Soprana, Haldimann etc). The 2020 watch market boom caused many random individuals to emerge as ‘alternatives’ but I think this craze has gone too far, and this is what I was alluding to earlier when discussing Dufour. People now use the term ‘watchmaker’ quite loosely, and it feels exploitative. Just like sellers taking advantage of a breakage business model, hot new indies are coming up with fabulous stories about their new brands, all while simply running a simple sourcing and assembly shop. What the f*ck?

I was speaking with Ondřej Berkus about this, and he shared some useful insight into the watchmakers’ perspective. Ultimately, when starting off, watchmakers might be introverts and are certainly relative ‘nobodies’ in the world as they know it. They have hopes and dreams… but they are still nerds who like tiny mechanical objects. Suddenly, they are discovered, and it can take one by surprise - to the point where you find yourself being flown around in private jets, chauffeured around, receiving incredible gifts from wealthy people who want to become your client… it can be intoxicating, and it requires an insane level of introspection and self-belief to turn down the possibility of rapid scale-up by outsourcing a lot of your own work to be mass-produced. I don’t want to make this about the mental anxiety for new independent watchmakers, but thought this glimpse into the other side was useful food for thought.

This ‘low hanging fruit’ never lasts long, just as it didn’t last with blockbuster. People will simply stop buying these so called ‘indies’, and this realisation by the owners of these brands will be an Emperor’s New Clothes moment. Which then begs the question, how many ‘established indies’ like Dufour will retain their old valuations when it becomes clear that the perceived inherent value was never there to begin with?

I like the idea of customers receiving good value for what they pay. It’s a good thing to profit from really happy customers who are thrilled to do business with you, and perhaps that is exactly what these new indies believe is happening... but the specific problem is: lying by omission. If you buy all your parts from somewhere else, say so. Don’t call your movement the “in-house calibre REF: mybrandname001” because this is what leads people to believe you’re making it yourself. You aren’t, and so you’re selling ‘false value’ to customers. Sure, it can be appealing to make easy money, but is your reputation and honour really that cheap?

Profiting from breakage is not sustainable… Stop it!

🔝 The thinking ladder

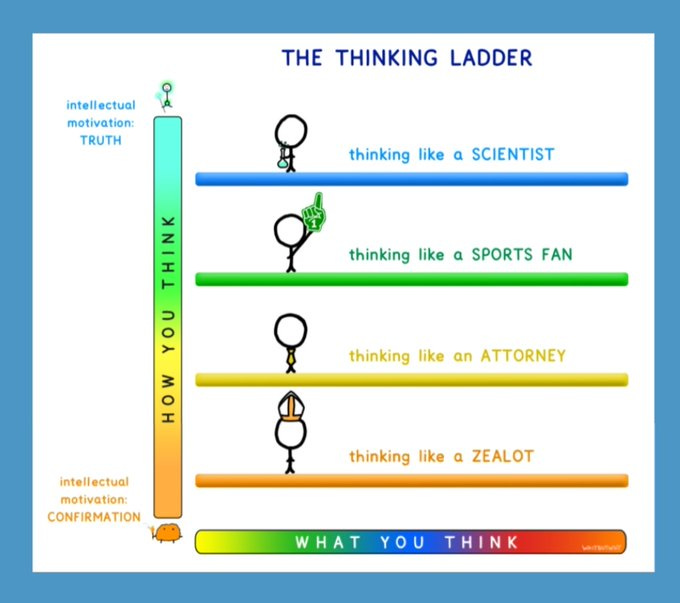

By now you have probably worked out, I like to reference random books, and sometimes write summaries too. What's Our Problem?: A Self-Help Book for Societies is a book by Tim Urban, and one of the book’s core principles is about distinguishing what we think from how we think.

What we think is about our beliefs or positions, which we can view on the traditional left-to-right spectrum. How we think is about how we form those opinions as well as our willingness to change them. Urban asserts that our traditional horizontal ideological spectrum is complemented by a vertical dimension: “the ladder.”

As the image suggests, there are four rungs on the ladder, and it is generally ‘better’ to be on the top two - this is what Urban calls high-rung thinking.

The Scientist sits at the highest rung, and actively seeks out opinions which challenge their ideas, subjecting their beliefs to rigorous scrutiny to ensure their validity. A scientist enjoys being proven wrong, because only once their theories and concepts have withstood attempts to disprove them, can they be regarded as valid. They welcome challenges, and enjoy having flaws identified in their thinking, because they understand this is the only way to discover the truth, and to improve their understanding of the world.

The Sports Fan passionately supports their own team and they generally desire fairness and objectivity. As you watch your favourite sports team, you revel in their victories because you believe the games are won fairly. You probably would not enjoy their victories as much if you knew they were paying the referee. A sports fan is biased, of course - they’ll enjoy a few fouls or free kicks going in their team’s favour - but they are still open to having their views challenged and generally want everyone to have a fair say.

The Attorney is the first low-rung thinker, and has one goal: to defend their idea or point of view at all costs. They do this by highlighting information which helps their case and minimising information which hurts it. The Attorney will not bother acknowledging evidence to the contrary, and worse, would be happy to bury it.

The Zealot tends to have no regard for factual information and passionately presents their viewpoint with the unwavering conviction of a Hublot fanatic. Zealots tend to become entrenched in their positions, usually to the detriment of rational discussion or evidence-based reasoning. Zealots will often respond to arguments against their beliefs by name-calling and attempting to silence or discredit their critics.

On a societal level, we prosper in environments where people are safe to debate and agree as well as disagree on a wide range of ideas. Such thoughtful and respectful discourse helps to evolve our collective viewpoints and pressure-test ideas to ensure only the best will surface and endure. A society of low-rung thinking is dysfunctional and divided. Low-rung thinkers silence or ignore dissenting opinions, stoke tribalist fears, and as a result, hinder intellectual growth. Worse still, alternate viewpoints become vilified and existing beliefs become more extreme; we find ourselves trapped in disastrous echo chambers.

Does that sound familiar? It should. Watch collecting is riddled with tribes. If you find yourself engaged in an “us versus them” narrative, take pause. Everyone is free to choose how they position themselves on this ladder - try to emulate the Scientist and Sports Fan, and more importantly, criticise the Attorneys and Zealots on your side of the ideological spectrum—low-rung thinking should be outlawed in a healthy society, even if… no, especially when, the perpetrators are in your tribe.

Do you behave like a Scientist, seeking contrary information and engaging with people who disagree with you? Do you perhaps behave like a Zealot in some instances, shutting down ideas which conflict with your own? Try and keep Urban’s ladder in mind as you question your beliefs. In fact, when it comes to this idea of independent watchmakers and the extent to which they actually make their own watches (as opposed to assembling them) - pay close attention to how you receive and process this information.

📌 Links of interest

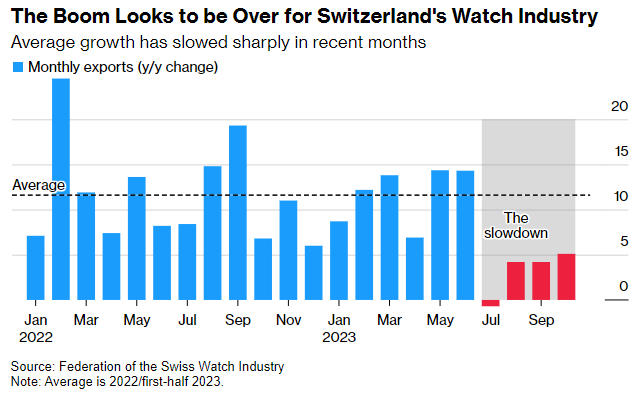

This image, taken from Andy Hoffman’s piece on the end of the boom cycle, speaks for itself. The article includes this ominous quote from Francois-Henry Bennahmias:

“What we saw in 2021 and 2022 was out of the norm” … “We couldn’t even fathom that we would experience this in our lives. I believe that we will never see this ever again.’’

📉 Subdial, the creator of the Bloomberg Subdial Watch Index (pictured above), published their December market update. TL;DR: “if you’re perhaps willing to lower your price, you can move watches.”

🛍️ Jack Forsterwrites about the Patek Philippe Aquanaut Luce Minute Repeater.

🎤 This is a fantastic essay: Why Mainstream Media is Lashing Out in its Death Throes.

💔 Cartier CEO on his way out because relations with Richemont Chairman Johann Rupert have soured in recent months.

📧 I’d bet you haven’t heard of this Secret Military Fortress Hidden in the Swiss Alps.

💥 The forgotten history of raves.

🐋 Scientists have spent 18 years looking for the elusive Cross Seamount beaked whale—a potentially new species they’ve heard but never seen.

💻 Google launched Gemini, its newest and most advanced AI model yet. Here’s Wired’s take on it too. Oh, and here’s Google’s “Year in 2023” too!

💀 Inside the violent world of London's luxury watch thieves (~5 min video). Worth noting Rob Corder’s take on this matter - he reckons the BBC is glamourising violent crime.

📚 Elon Musk's luck has finally run out.

End note

In case you missed it… I recently shared a short post:

Here’s the gist of it: This guy reckons people have no free will.

If you were wondering about the Patek mention in the subheading of this post - it was from an unnamed source who advised Patek is increasing prices by ~6% in February 2024, and they’re also reducing their AD margins by ~5%. Cheeky move, to say the least.

This week really had too much juicy stuff to cover… couldn’t do it all. Most interesting, was probably the news which broke just after this edition of SDC was completed… Breitling announced they were buying UG! Georges Kern will have an amusing task ahead… creating revival watches which somehow fit Universal’s iconic design language and do not p*ss off all UG fans… while continuing to modernise the brand and innovate for growth. I find all this revival sh*t pretty boring - I suppose it is easier and safer to (re)make something which is tried and tested - and the risk of trying something new is immense (e.g. Code 11.59) - but imagine a brand getting it in the Goldilocks region of being just right - we can dream, can’t we?

That would be better than simply copying other brands. Brandan Cunningham shared this little slip from J.C. Babin which was promptly taken down:

Jean-Christophe Babin is the Chief Executive Officer at Bulgari - and given this was posted over the weekend… likely the most accurate glimpse we will get into the mind of a luxury brand CEO. Turns out, they are human too!

Anyway, back to Breitling and UG - this deal will be analysed to death in the coming months and years… unlikely anything drastic will happen immediately:

"Rebuilding a brand with such a rich narrative is not a quick endeavour—it is a meticulous labour of love that we anticipate will unfold over the coming years. A dedicated team will be brought on board to allow Breitling and Universal Genève to operate as separate maisons"

Breitling CEO, Georges Kern

Talking about the ‘end of the boom cycle’ while also opining on the weak practices of newcomers to the independent game, left me recalling Howard Marks’ letter dated January 2, 2000, wherein he recalls the folly of smart men like Sir Isaac Newton:

The South Sea Company was formed in 1711 to help deleverage the British government by assuming some of the government's debt and paying it off with the proceeds of a stock offering. In exchange for performing this service for the Crown, the company received a monopoly for trading with the Spanish colonies in South America and the exclusive right to sell slaves there. Demand for the company's stock was strong due to the expectation of great profits from these endeavors, although none ever materialized. In 1720, a speculative mania took flight and the stock soared.

Sir Isaac Newton, who was the Master of the Mint at the time, joined many other wealthy Englishmen in investing in the stock. It rose from £128 in January of l720 to £1,050 in June. Early in this rise, however, Newton realized the speculative nature of the boom and sold his £7,000 worth of stock. When asked about the direction of the market, he is reported to have replied “I can calculate the motions of the heavenly bodies, but not the madness of the people.”

By September 1720, the bubble was punctured and the stock price fell below £200, off 80% from its high three months earlier. It turned out, however, that despite having seen through the bubble earlier, Sir Isaac, like so many investors over the years, couldn't stand the pressure of seeing those around him make vast profits. He bought back the stock at its high and ended up losing £20,000. Not even one of the world's smartest men was immune to this tangible lesson in gravity!

This was pretty much the overwhelming theme of this edition… which is how significantly perception and reality can diverge… “the madness of people” as Newton says. That is pretty much why the market has been flooded with complete garbage from Kickstarter watches, to dogsh*t collabs by Massena and others… People do not have infinite money, and the notion of genuine value is going to be the theme of collectors in 2024 … can’t wait.

Btw, It costs you nothing to hit the heart button below… Just do it, wtf?! These ‘engagement metrics’ help more than you’d think.

Until next time!

F

🔮Bonus links: How long is a day on Mars

This 18 minute video which delves into sidereal time is a must-watch for nerds.

If you enjoyed this post, please do me a solid and hit the heart button below; thank you!

Selling price of 400k, less the 140k high estimate.

All Daniels’ watches were made by hand entirely under one roof and without assistance. George Daniels was the first watchmaker to achieve sufficient mastery of 32 of the 34 skills and techniques requisite in creating a watch entirely alone and by hand. This is now recognised as ‘The Daniels Method’. Every component was made from raw materials in his Isle of Man studio without the use of repetitive or automatic tools. Thus, no two watches are identical. Source

Generous guess at the top end?

Always enjoy your observations Sir. Highly entertaining! 👑🫡👏🏾👏🏾👏🏾 I expect to see a shocking number of micro brands (and not so micro brands) which popped up over the last few years, will go out of business as the market consolidates further. On the bright side...10, 15 years from now a number of models from these extinct brands will have a bit of a renaissance. Call it Pandy or “Pre AI” nostalgia. They will become highly coveted and the prices will go off the charts. 😁

BLOCKBUSTER edition! And I mean it with no irony. Just chock full of yummy crunchy goodness of thought provoking ideas and insights and a joy to read (several sections several times) .... some juicy scandals or hints thereof and just stuff that so many more of us “collector philosophers” should be pondering 🤔

(And stop pulling those punches 🥊!) 😉🤣

Got it mate!!! Do it again! 😝