SDC Weekly 33; Morgan Stanley Report on Swiss Watches; Rolex Pricing; External exposure

Fighting watch crime, Earliest automatic chronograph in the world, Stolen Picasso recovered, Bitcoin isn’t anonymous, Global Risk Map, WoS store delayed, Fujitsu’s woes, and how to be happy.

Also known as This Is Not a Pipe, The Treachery of Images is a 1929 painting by Belgian surrealist painter René Magritte. He was 30 years old when he painted it.

The famous pipe. How people reproached me for it! And yet, could you stuff my pipe? No, it's just a representation, is it not? So if I had written on my picture “This is a pipe”, I’d have been lying!

— René Magritte1

This masterpiece of Surrealism creates a three-way paradox out of the conventional notion that objects correspond to words and images. Why am I telling you this? I will explain later…

Hello 👋 and welcome back to the SDC Weekly. You’ll find the older editions of SDC Weekly here.

Argentinian President Javier Milei took the stage at Davos last week and delivered one of the most compelling articulations of free market libertarianism you will ever see in your lifetime. Marc Andreessen described it as the “speech of the 21st century” on X. Elon posted this image showing Milei speaking, with the caption: “So hot rn”:

Milei passionately advocates for free market libertarianism, emphasising its role in unleashing prosperity. He draws on data and personal experience to argue against collectivism, urging Western nations to prioritise economic freedom, limited government, and sound property rights. Milei expresses optimism about ongoing progress but cautions against jeopardising it with misguided economic and political experiments. Now you might be wondering why this matters in a watch newsletter?

Well, technically, it doesn’t - but inspired by the insane captions over at Hairspring, allow me some creative license… this is the watch-world equivalent of Ben Clymer giving a speech as Dubai Watch Week, telling everyone to stop producing microbrand shitters, urging watch brands to reward collectors and stop bundling to sell undesirable products. Whilst that will never happen, I thought it was amusing to imagine.

Let’s dig in.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

⚠️ NOTE TO SUBSCRIBERS: Some email applications may truncate this post. If so, or if you’d prefer, you can read it all online here. Alternatively, click on “View entire message” at the bottom, and you’ll be able to view the entire thing in your email app.

Thanks for reading!

📈 Rolex Pricing

Interesting news cycle this week… Watches of Switzerland cut their sales and growth forecasts causing their shares to drop 33%, while Richemont surged reporting sales gains for the holiday shopping season. As fate would have it, I was reading the first of two Morgan Stanley Research notes; this one was specifically about Rolex, kindly shared with me by Hamza Masood. I thought it would be useful to summarise and discuss it here.

The note discusses the price evolution of Rolex watches, particularly focusing on the suggested retail prices communicated to third-party retailers in January. They note that due to the lack of publicly available information on individual model sales and country-specific sales, precise calculations of a “weighted average worldwide price” increase for Rolex are challenging.

To estimate the global price increase, the paper employs an arithmetic average for some of Rolex's best-selling models and uses an approximate weighting by country. In the US2, Rolex experienced a minimal price increase of +0.1% in January. This contrasts with a compound annual growth rate (CAGR) increase of +4.8% between 2020 and 2023 and +2.4% between 2009 and 2020.

The global estimate for January suggests a price increase of about +2.9%, compared to a CAGR of approximately +4.2% between the full years 2020-23. The paper speculates on Rolex's cautious pricing approach in 2023, considering three factors:

A slight contraction in Rolex's outperformance relative to the industry;

An industry-wide deceleration, with Swiss watch exports growing by +4.3% YoY in 4Q23 compared to higher increases in previous quarters; and

A narrowing premium of Rolex's second-hand models compared to new watches, possibly influencing the decision to implement a relatively moderate price increase.

The cautious pricing strategy is attributed to maintaining Rolex’s market share in a changing landscape, where the premium on second-hand watches has decreased. The paper highlights the symbiotic relationship between new watch sales and the secondary market, suggesting a moderate price increase aligns with Rolex’s strategic considerations.

The paper concludes the luxury goods industry has experienced above-average growth in average selling prices (ASPs) since early 2020, primarily driven by both price increases and changes in product mix. This ASP growth has been a significant contributor to the majority of total industry sales growth, estimated to be about two-thirds on aggregate… but anticipates a shift in total ASP growth, ranging from mid-single digits to a slight decline, depending on different scenarios.

The recently announced moderate price increases by Rolex for 2024 align with the expectation of a slowdown in ASP growth. This is noteworthy given Rolex’s continued outperformance compared to the rest of the Swiss watch industry (their conclusion). Despite Rolex models maintaining a premium on the secondary market and the brand’s strong performance, the paper points out that Rolex is not implementing notable price increases in its key market (US) for the year, in contrast to the +4.8% compound annual growth rate observed between 2020 and 2023. This strategic decision by Rolex suggests a cautious approach in the face of changing market dynamics and a potential shift in industry trends.

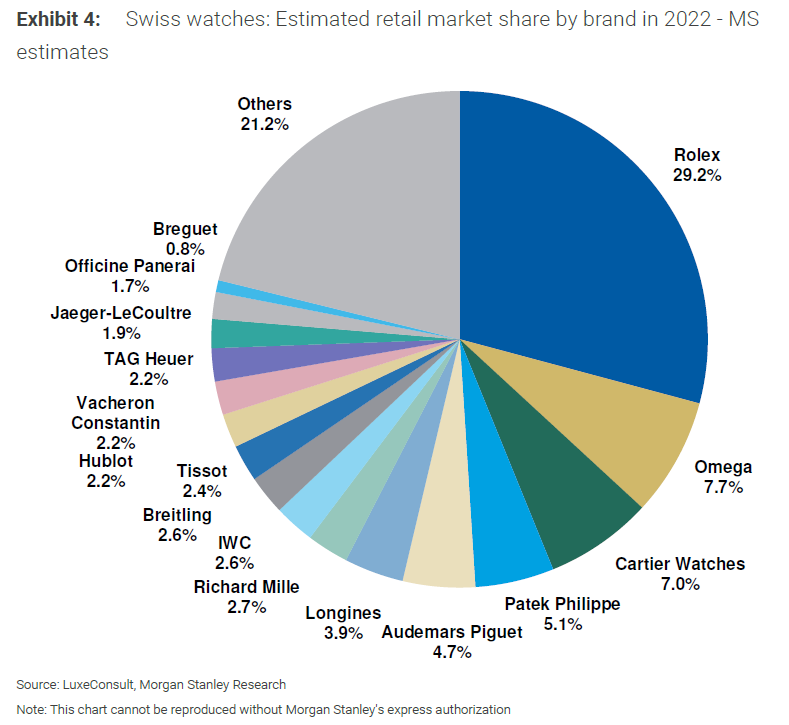

I saw the footnote on the chart, and couldn’t help myself - if anyone wishes to claim copyright and have me remove it, please reach out. Anyway, pettiness aside - I accept there are exceptions to every rule, but fundamentally Rolex performance is a type of barometer for the Swiss watch industry because of their market share and ubiquity as a luxury brand.

The chart above therefore seems to suggest we’ve levelled out following the pandemic boom in watches, and will now see less volatility in the market prices of luxury watches. I remain on the fence about this hypothesis for two reasons - one is intrinsic, and the other extrinsic.

The former is related to the hubris of brands (other than Rolex) in the middle of that peak shown on the chart. They hiked retail prices so aggressively, it has become a source of comic relief for many collectors. Now that we’re firmly into tough times - who is going to buy these watches without a discount? I have heard rumours about some brands’ arrogance in turning their noses up to people who ask for discounts… will this steer people away permanently, such that when the brand management finally do come to the realisation they must reduce prices, nobody will be around to buy at all?

The latter is related to the global economy and spending power of luxury consumers. Over the past 6-9 months, people’s mortgage payments have gone up, inflation has gone up, cost of living has soared and in such times, it is easiest to curb spending on things like watches. This doesn’t necessarily mean people do not have the money to spend, this speaks more to their sentiment when spending - people are going to open their wallets less easily and so, value retention and liquidity become more important than ever. This is the beauty of the analysis I shared above - Unlike many other brands, Rolex seems to know this too well, and sets their policies accordingly.

Combining these two points, there is certainly room to argue the prices of many watches will continue to fall further than their pre-pandemic levels, and only the blue chips will withstand further declines… I won’t bother naming watches because if you’re reading this, you should know what I mean!

Even Rolex understands this shift - so much so, this is precisely what seems to have, in part, driven the WoS crash:

Watches of Switzerland Group CEO Brian Duffy told financial reporters yesterday that it had downgraded forecasts for its 2024 financial year, which ends in April, in part because its allocation of Rolex’s more expensive watches was lower than expected when he gave a far more bullish trading update last November.

He clarified that Rolex is still supplying the same number of units, but there was more steel and less gold in the key holiday season, which lowered average transaction values for the entire group, and he has no reason to believe that gold/steel balance will change this financial year.

Many will suggest this is merely a shift of allocations from WoS to Bucherer given the Rolex acquisition of Bucherer … I don’t think this is the case. Lower priced watches (steel) will be easier to sell, so Rolex is shipping out more of those to keep their sales unit volume as steady as possible. Speaks for itself, right?

📊 Morgan Stanley Report on Swiss Watches - 4Q2023 / 1Q2024

The other banger from Hamza Masood was the latest Morgan Stanley Report covering the entire Swiss watch industry; 40 pages of data to geek out on, but here is a summary for you instead. Usually I would share it here, but I want to keep receiving future reports so I will avoid annoying him by sharing it publicly!

Market Trends

The luxury watch market witnessed a challenging fourth quarter in 2023, with secondary market prices falling an estimated -3% quarter-on-quarter. This marked the seventh consecutive quarter of declining prices, reflecting an overarching trend in the industry. Notably, the Big Three brands - Rolex, Patek Philippe, and Audemars Piguet - played a significant role in leading this decline, with Rolex consistently outperforming its counterparts.

For the entire year of 2023, prices across all brands experienced a considerable decline of about -13%, compared to a decline of -9% in 2022 and a notable increase of +39% in 2021. Despite the industry-wide downturn, Rolex prices only fell by -8% in 2023, showcasing a relatively resilient performance. Total supply levels for Rolex, Patek, AP and Vacheron remained flat or decreased in 2023, after major sell-offs by market speculators in 2022 caused inventory levels to reach all-time highs. However, inventory levels remain historically elevated, while absorption rate (sold inventory/total supply) remains depressed compared to 2021 levels as a result of the increased supply.

Brand Performances

Rolex: The report emphasizes Rolex's continued outperformance, with prices declining by only -8% in 2023. The brand maintained a positive value retention trend, even in the face of the industry-wide challenges.

Swatch Group: Swatch experienced the most substantial decline in prices in 2023, with a loss of -18%, making it the worst-performing brand for the year. They also issued an ad hoc announcement yesterday if you’re interested - telling a different ‘story’ of course.

Patek Philippe, Audemars Piguet, and Vacheron Constantin: All three brands suffered double-digit losses for the year, with PP seeing a -15% decline, AP experiencing an -18% loss and VC -13% down.

Other Best-Performing Brands: Frederique Constant (+8%), Hamilton (+4%), and Jaeger-Lecoultre (+2%) emerged as some of the best-performing brands in 2023.

Market Share Shifts: The Big Three brands lost market share in 2023, a deviation from the trend observed from 2020 to 2022 when their combined market share increased from 58% to 68%. In 2023, their market share dropped to 66%, indicating a decline of two percentage points compared to 2022.

Industry Developments

Rolex Daytona Refresh: The new Rolex Daytona debuted on the secondary market after being refreshed in March 2023, contributing to market dynamics.

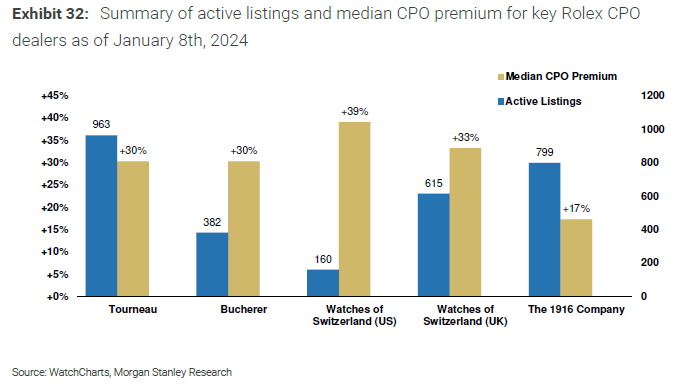

1916 Company and Rolex CPO Program: The 1916 Company joined the Rolex Certified Pre-Owned (CPO) program, following major players like Bucherer/Tourneau and Watches of Switzerland. The CPO program's expansion was notable, with over 3,600 active listings tracked, though a few major players held the majority of inventory.

Price Increases: Cartier and Tudor increased US retail prices in January 2024, while Rolex increased prices internationally, excluding the US. The report refers readers to a separate note on Rolex price increases for more details.

Value Retention and Market Index

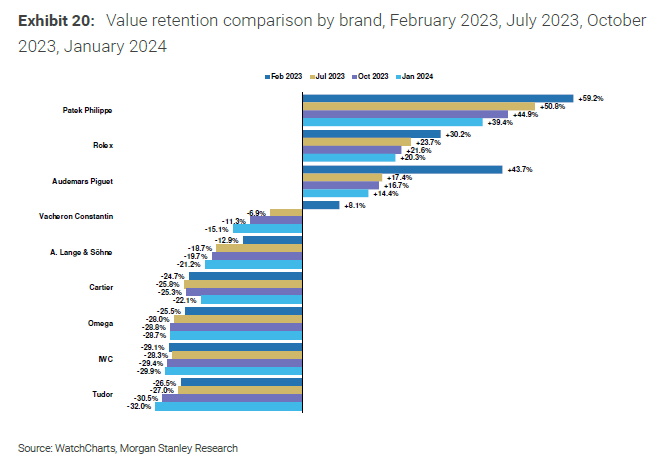

Big Three Value Retention: Despite declining prices, the majority of Big Three watches continued to trade above retail. Rolex models showed a 68% value retention, Patek Philippe had 48%, and Audemars Piguet had 66%, with premiums in the secondary market.

WatchCharts Overall Market Index: The index dropped -2.8% in the fourth quarter of 2023. While this marked the seventh consecutive quarter of declining prices, a temporary stabilization occurred in December 2023, with a +0.5% increase.

Individual Brand Insights

Rolex Daytona Collection: The refreshed Daytona collection entered the secondary market, with new models commanding premiums. The stainless steel reference 126500LN notably had a premium of +114%.

Integrated-Bracelet Sports Watch Struggles: Brands heavily invested in integrated-bracelet sports watches, including Audemars Piguet, Patek Philippe, Vacheron Constantin, Girard-Perregaux, Chopard, and Bulgari, continued to face challenges.

Cartier's Performance: Cartier experienced a small rebound in prices, primarily attributed to strong performance from the Tank collection. The brand ended the year with prices increasing by +1.0% in the fourth quarter.

Rolex Certified Pre-Owned (CPO) Program

CPO Program Expansion: The Rolex CPO program expanded, with more than 3,600 active listings tracked from at least 33 Rolex authorized dealers globally. Major players such as Bucherer, Tourneau, Watches of Switzerland, and The 1916 Company held the majority of CPO inventory.

CPO Premiums: Rolex CPO dealers continued to charge significant premiums, with pricing for Tourneau, Bucherer, and Watches of Switzerland typically between +30% and +40% higher than non-certified dealers. The 1916 Company had a more competitive median CPO premium of +17%.

Group Indexes and Supply Levels

Group Indexes: The report introduced Group Indexes to track the performance of Swiss luxury watch groups based on the brands they own. Swatch Group performed the best in 2023 among the four tracked groups.

Supply Levels: Total supply levels for the Big Three and Vacheron Constantin remained flat or decreased in 2023, despite major sell-offs in 2022. However, inventory levels remained historically elevated.

Age of Inventory and Value Retention

Rising Age of Inventory: Despite a relatively stable absorption rate, there was a notable increase in the median age of inventory for the Big Three brands in 2023. This rise was particularly evident for Rolex, Patek Philippe, and Audemars Piguet.

Value Retention Trends: Value retention (VR) remained a key metric for assessing brand desirability. The Big Three brands continued to command secondary market premiums despite decreases in VR since the October 2023 analysis.

Brand-Specific Analyses

Rolex: A detailed analysis of 140 in-production Rolex models showed a weighted average value retention of +20.3% above retail. The analysis included insights into the performance of the Daytona collection.

Patek Philippe: The report analyzed 96 in-production Patek Philippe models, showing a weighted average value retention of +39.4% above retail. Notably, Patek Philippe remained the leader in value retention, albeit with a decrease compared to the October 2023 analysis.

Audemars Piguet: A detailed analysis of 73 in-production Audemars Piguet models revealed a weighted average value retention of +14.4% above retail, with insights into the Royal Oak collection.

Vacheron Constantin: The analysis of 40 in-production Vacheron Constantin models showed a weighted average value retention of -15.1% below retail. The Overseas collection continued to experience a decline in value retention.

A. Lange & Sohne, Cartier, Omega, IWC, Tudor: Similar detailed analyses were provided for these brands, offering insights into their respective performances in terms of value retention.

Conclusion

In conclusion, the report was a fun read - I wouldn’t say it contains any riveting insights which you didn’t already know loosely, but it does provide a detailed overview of the specifics with each brand… highlighting trends, brands’ relative performances, and industry developments. The analysis extends to value retention, inventory levels, and the expanding Rolex Certified Pre-Owned program, offering interesting insights for enthusiasts and collectors who have even a passing interest in the market dynamics of the industry. Thanks again for sharing it, Hamza Masood!

🎢 External exposure

Ok, after all that data-overload, I thought I needed something less data-centric to end off… This section was inspired by a conversation with a friend about how much exposure we have to things which can influence our moods and perceptions, and in turn, impact how busy, stressed, or anxious we might feel. As always, I will focus on how this affects us as watch collectors but need not be limited by the collecting lens.

Typically, the broader your external exposure, the greater the effort required to sustain it. What do I mean by ‘external exposure?’ Life itself constitutes an external exposure, a facet many overlook in terms of its energy consumption. I am referring to all the connections, obligations, considerations and requirements which are naturally present due to our existence on this earth.

Owning a home is exposure, which is contingent on factors like its age and size. Easy example: I got back from holiday to find my fence is leaning and will require repairs. Owning a second home expands this external exposure, not linearly but slightly beyond; It entails the same tasks… and more.

Being in a relationship is more exposure. You may have children to raise, and bills to pay, or houses to maintain… but your relationship will not nourish itself. It will require time and effort to maintain it.

Friends represent another external exposure. Your time with friends is finite, and having more friends will mean less time for building strong individual connections with each one.

Money, too, embodies a form of external exposure. More wealth necessitates managing, tracking, protecting and investing various assets and investments.

It goes without saying, but watches are also a form of external exposure. When you’re as deep into watches as we are3, you probably spend a noteworthy amount of time considering your collection, your budget, your future purchases and the market in general, to understand what your ‘portfolio’ is doing. This is true even if you don’t plan to sell any of it. Only the wealthiest collectors will buy any piece without any regard for price/value over time.

So, when external exposure becomes unwieldy, people enlist help to scale. Assistants, property managers, family offices, preferred watch dealers – they help you scale, but also the external exposure of responsibility. This, however, merely conceals our expanding external exposure through abstraction.

By the way, our beliefs also constitute a form of external exposure. Don’t agree? Consider the recent 100+ days of bombardment on Gaza following the October 7th attacks - this represents a significant burden - whichever “side you are on” - you cannot deny that seeing an “opposing view” will have caused the viewer some form of mental turmoil - turmoil which would definitely not exist, were it not for them holding certain beliefs.

That’s the challenge with external exposure: its demand on you for defense and upkeep. The larger our external exposure, the greater the burden for upkeep, both mentally and physically.

Considering external exposure, it's apparent why we grapple with anxiety, stress, and perpetual lag. We often think we need more time for something, but what we truly crave is more focus to dedicate to things we actually care about – a reduction in… that’s right: external exposure.

External exposure intertwines with our identity too. We become the ‘busy person’ engaged in every project, the individual with multiple residences, the collector with every reference from a particular brand, or the authority on vintage watches.

Competition can also fuel desires for expansion. Individuals aspire to a larger or more valuable collection to rival someone else’s. Our tribal instincts drive this on a group level, which makes the ‘rewards’ seem palpable; but on an individual level, it can often breed discontent.

Some of the most content people I know seem to have limited external exposure. My closest friends maintain 3-4 close connections, while treating others as friends in a more broader sense. Over the years, the most productive colleagues I have worked with have demonstrated extreme focus on one or two key areas, instead of juggling five to a mediocre level of success.

With watches, perhaps this means curating our exposure by being more selective about what we care about, and how much regard we have for a particular brand or complication. I accidentally but of course fortuitously found myself doing this quite early in my collecting journey… let me explain. I happened to know a guy who liked AP watches, and he was an utter cvnt. Everything about this guy irritated me, and I somehow associated AP with this sort of character going forward. Over the years, perhaps through confirmation bias or the spotlight effect, this belief continued to be reinforced, and even after learning more about AP’s history and the infamy of Genta’s design… I simply have no desire to own a watch from AP.

The poet Robert Bly wrote that we all drag an invisible bag around with us… everywhere we go. We have spent our entire lives filling it with all the parts of ourselves which are true to us, but aren’t acceptable to people around us.

It starts with our parents: “no eating in the lounge” or “everyone in this family loves watching Rugby.” Then we have our teachers: “if only you paid more attention, you would be good at art.” Then we have our peers: “that is too nerdy” or “that isn’t going to get you a real job” or “that genre of music is so old fashioned.” You get the idea. Even in the world of watches we have the very same thing: “Hublot watches are garbage” or “Richard Mille is pretentious and unworthy of the price tag.” This list is endless…

The point being, every one of these interactions causes us to put parts of ourselves in the proverbial bag. Whatever we put in this bag, happens to be all the obvious truths we can’t admit, or that we try to ignore. I suppose I put my disdain for AP in the same bag for a while, since it continues to be a widely loved brand, and I don’t have a particularly good or objective reason for disliking it. Over time, I stopped caring, and I think my views on AP are now widely known among my fellow collectors.

I bring this up only to make a simple point: by virtue of ‘deleting’ AP from my radar of watches I care about, I have deleted one major source of external exposure for myself as a watch collector. New release from AP? Don’t care. Updated bracelets on AP? Don’t care. AP House in London doesn’t offer appointments easily? Do. Not. Care.

Can you see the appeal? Over time, the same approach has helped me retain focus - both in terms of attention, as well as funds for watches. I have similar sentiments with Vacheron Constantin as well as A. Lange & Sohne. To simplify the feeling… I think I experience cognitive dissonance every time I think about owning watches from these brands.

Whilst I am not advocating for people to go around finding excuses to cross brands off their lists, I am offering a lens through which to reduce your external exposure. There are other lenses too - for instance, one collector I speak with on Instagram has a self-imposed limit of £30k on a ‘per watch’ basis… he has a total collection value exceeding 6 figures, but has a personal preference for not concentrating value in any single piece because “he does not see himself as a guy who wears such expensive watches.” We have argued about the irrationality of this thinking, but hey, that works for him, so who are we to judge? Yet another lens is complications; I have developed a stronger taste for simpler watches which do not require much setting… so the worst option for me would be a perpetual calendar with a moonphase, and the best would be a time-only or chronograph. Guess what emerges as the ideal watch with this criteria: Journe’s Elegante which requires no setting at all! That doesn’t mean I don’t look consider owning perpetual calendars, it just means for me they will feature less seriously in my purchase considerations.

Perhaps I have laboured the point for too long, so I will conclude by saying you should consider minimising your external exposure enhance your life satisfaction. Despite the effort it demands to streamline your exposure, the happiest individuals I encounter suggest that this is a quick win if you find yourself overwhelmed with options on a daily basis.

📌 Links of interest

⭐ Undercover officers target luxury watch robbers in London’s West End and Soho. No longer reserved for cartels, drug crime, and radical groups… the MET Police in London are now deploying undercover officers to fight watch crime! Took then a while, but this is excellent news

💩 Rolex’s WoS London flagship delayed until 2025.

📈 Arnie pays €35,000 fine to gets his impounded AP watch back then sells it for €270,000.

🖼 Stolen Chagall and Picasso artworks recovered, Israeli luxury watch dealer implicated.

💰 How a 27-Year-Old Codebreaker Busted the Myth of Bitcoin’s Anonymity.

💀 How dehumanisation of Palestinians that is at the core of Israeli society.

⚠️ Visualizing the Top Global Risks in 2024.

🧠 What Makes Some Words More Memorable Than Others?

🤔 The age-old scientific debates around consciousness.

🤡 UK Post Office Scandal Wipes $1 Billion Off Fujitsu’s Market Cap. Here’s another ‘explainer’ if this is news to you. There’s even a TV show.

🌊 These Entrancing Maps Capture Where the World’s Rivers Go.

🌿 Scientists capture a video of plants warning fellow flora of a potential danger.

📺 After Netflix says no, other app makers debate a Vision Pro launch.

What is this, I hear you asking? No, I have not started posting ads - this is a post from Gerald Donovan where he has listed for sale, the earliest known production example of an automatic chronograph wristwatch in the world. Read that again. It sounds like a preposterous claim when you think about it - but he’s got the receipts. It is not often you get to see a genuine piece of watchmaking history for sale from a fellow Substacker!

End note

In case you missed it, I shared this post on Friday:

The article delves into the deep-seated human inclination to collect, tracing its evolutionary roots and psychological underpinnings. From survival instincts to the thrill of discovery, the history of collecting spans diverse cultures and epochs, reflecting a universal quest for meaning and connection through the accumulation of objects. I really enjoyed putting it together, and hope you enjoyed reading it.

Ok, back to the start… we can now talk about that pipe... 🎷. Harry Beck is not a well-known man, but millions of people in London enjoy his work … daily! In the early 1900s, as the London underground transport system was expanded, commuters faced confusion with the original map of the underground, which aimed to represent geographic reality. In 1931 Harry Beck introduced a groundbreaking alternative, abandoning locational accuracy and creating a conceptual representation focused on easy navigation.

Adopted in 1933, Beck's simplified diagram, devoid of geographical details, revolutionised underground mapping, proving highly effective for commuters and influencing similar approaches globally. The same is true for the Mercator Projection we all know and love - it doesn’t accurately represent reality, but it presents an improved case of usability. This tension is better known as Bonini’s paradox, and has various iterations, such as a poetic construct by Paul Valéry: “Ce qui est simple est faux, ce qui est compliqué est inutilisable” (“Everything simple is false. Everything which is complex is unusable”). Or, in the words of Alan Watts, the menu is not the meal.

The truth is, we integrate our observations into a narrative, mainly to enhance comprehension. While (actual) reality exists independently of ourselves, we can construct models of this “territory” based on our senses. Of course, modifying our internal ‘map’ doesn't alter the actual territory.

Theories may not align with reality, mental models are inherently flawed, and beliefs can be inaccurate. Reality is definitive, but our beliefs… probabilistic.

Despite this, our genuine beliefs feel like they are reality - at least from our own perspective. Yet, others may perceive the world differently, not out of obstinacy but due to distinct perspectives. We often view ourselves as protagonists, forgetting that others see themselves in the ‘same’ light. In real life, different aspects of reality hold varying meanings for different people.

This challenge results in much discourse resembling lectures to stubborn children who are unwilling to acknowledge what is supposedly evident. It's crucial to recognise being wrong feels indistinguishable from being right until subjected to experimental validation. Contrary to post-modern assertions, there are not multiple truths.

Acknowledging that our beliefs about reality might be false helps prioritise actual reality over our perceptions. Consequently, we can either cease arguing with reality and accept it or, at the very least, become aware of the distinction.

Essentially, the map/territory problem is an amplified form of confirmation bias, where individuals tend to perceive what aligns with their desires, treating those inclinations as facts and staying willfully ignorant. This inclination to fit facts, real or imagined, into pre-existing notions often leads to a skewed understanding of reality. Even when faced with conflicting evidence, we might embrace implausible views that support our existing mental maps. The challenge lies in our reluctance to actively seek and acknowledge disconfirming information, resulting in the persistent mistaking of the map for the territory.

The WhatsApp group which I kicked off in last week’s SDC has been a huge revelation. The chat blew up as I typed this, discussing the new AP x Tamara Ralph launch and comparing it to an anus… despite this example, the group isn’t exclusively for puerile banter - it is an example of a way to challenge your biases as watch collectors; a way to test your map against the territory. In only one week, thousands of messages have been exchanged, and already, I’ve learned so much. It ain’t curing cancer, so I look forward to hearing how you challenge your own biases, and the tools you use to interrogate the beliefs you hold.

Until next time!

F

PS. I purposely reduced the ‘links’ section following some complaints from last week!

🔮Bonus link: Meta Analysis - How to be happy (based on 3,438 primary studies):

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

Torczyner, Harry (1977). Magritte: Ideas and Images. p. 71.

Their leading market with approximately 40% market share and contributing to about 22% of global sales in 2022.

Yes, I am dumping ALL readers of this newsletter into the same bucket; if you disagree, you are delusional :)

At one time we partnered with Fujitsu on printers. Complete clown show indeed.

So can relate to the cognitive dissonance and animus towards a few different marques..... sharing AP with you and although I’ve tried, just never able to work up lust for a Rolex ... tried, had one recently for just a few months ( I don’t count previous Cellini pieces I could probably wear) ... too much rooting for the underdog lifetime leaning I guess ...and a couple others IDK 🤷