SDC Weekly 53; Anoma, Escale and Innovation in Design; The Role of Serendipity in Watch Collecting

Market Updates, Watch Auctions, News at Chanel, World Happiness Report, Birkenstock and Luxury, Albert-Gustave Piguet, Aristotle vs The Stoics, Dunhill Namiki and much more.

Welcome back to SDC Weekly. First up, the usual fodder from auction highlights to market updates. Then we explore the age-old question: How much of our success as watch collectors comes down to skill, and how much is just dumb luck?” Finally, we dive into the world of watch design, looking at the polarising Anoma A1 and the new LV watch released just yesterday.

You can catch up on older editions of SDC Weekly here. Free subscribers receive the full newsletter (and other ad-hoc posts) via email - 3 weeks after publication. If you’re not subscribed already, that’s a good reason to do so! If you’re a student or peasant, feel free to email me and request full access. 😁

Small stuff

Sam Hines back at Sotheby’s

Sam has been around the auction block, and … he’s coming back around once more. It was only two years ago that he left Sotheby’s to join Loupe This - and as of last week, he’s moved back to Sotheby’s again:

“Sam and Geoff are two of the most respected figures in the watch community and I’m delighted for them to be taking on these new roles. Their combined talent, vision and energy will drive us to new heights in the watches category globally and is an affirmation of Sotheby’s commitment to innovation, best-in-class client experiences and industry leading expertise.”

Josh Pullan, Global head of luxury at Sotheby’s via WatchPro

The article I linked above, mentions Sam Hines was a shareholder in Loupe This - not sure whether LT bought back his stake… but if he had any sense he would keep the equity because LT seems like it’ll only get more valuable over time. Eric Ku please comment if you can share more information.

Stallone Saga Continued

This seems to be an ongoing joke in the watch media, but if it is news to you, I’ll bring you up to speed. Sylvester Stallone sold his Patek Philippe Grand Master Chime at a Sotheby’s auction for a staggering $5.4 million. The sale, which took place just a couple of years after Stallone acquired the watch, has apparently angered Patek Philippe’s president, Thierry Stern (WatchPro on 6 June).

If you think I am kidding about this being a running joke - WatchPro wrote this utterly pointless article yesterday to repeat the point about Stallone’s decision being classic “flipper” behaviour. 😂 Ok mate, understood.

Thierry Stern expressed his disapproval of Stallone's actions, stating, “It's not fair for a client that may have been waiting for the piece for many years and then sees it being sold.” He also mentioned how he receives emails from people complaining about watches being sold to certain individuals who then resell them.

There is speculation that Stallone’s actions may have consequences for his future ability to purchase watches from Patek Philippe at retail prices. The article quotes Stern, who said, “Patek Philippe’s retail partners have also come under fire for the suspicion that Hollywood celebrities receive preferential access to the hottest watches.”

Astonishingly, Stern did not explicitly state whether Stallone would be cut off from future retail purchases! I’m sure he will never get another special watch, but isn’t it interesting to observe how it is handled publicly?!

Market and Trends - Update

In their June 2024 market update, WatchCharts explains how the secondary watch market continues to experience a slow decline, as evidenced by the -0.4% drop in the Overall Market Index in May 2024. This follows a similar trend from the previous month. While Rolex prices saw a slight +0.3% increase in May, it was not enough to compensate for the significant -1.6% decline in April. Other major brands, such as AP (-1.1%) and Patek Philippe (-0.2%), also experienced further price drops.

Although Rolex’s performance might seem to indicate a slowing rate of decline, they suggest a closer examination of market fundamentals points to a more concerning outlook. Seasonal trends, slower sales, and increasing inventory levels all indicate there is more pain to come in the short term. Rolex’s supply has increased by 17% year-to-date, primarily due to weaker sales rather than a decrease in listed volume.

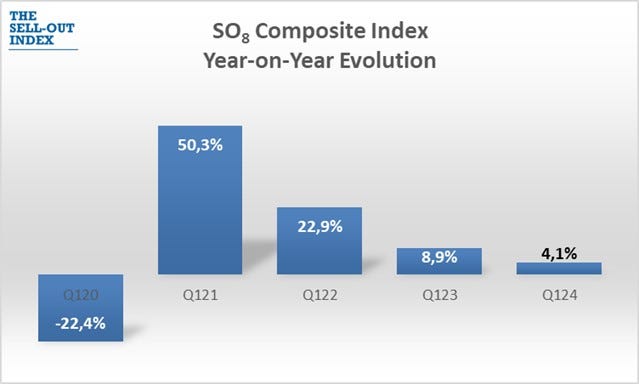

The Sell-Out Index shared an update too. The first quarter of 2024 saw mixed results for watch and jewellery sales across eight key markets (USA, China, Hong Kong, Japan, Singapore, UK, Germany and France). While overall sales rose 4.1% compared to Q1 2023, growth has slowed significantly from the post-pandemic highs.

Overall takeaways:

Japan saw record sales, jumping 19.8% thanks to a resurgence in tourism exceeding 2019 levels. The weak yen has made Japan an attractive destination.

Singapore also maintained double-digit growth of 12.3%, outpacing overall retail. Increased tourism from mainland China starting in February boosted demand.

The US market accelerated, rising 6.8% in March for a healthy Q1 growth of 4.4%. However, more consumer spending on services may limit retail growth going forward.

After a strong rebound in 2023, Hong Kong and Macau saw lackluster results, with Hong Kong sales down 0.4% and Macau dropping 18.7%. Tourism spending has not fully recovered.

The UK had a challenging start, with sales dropping 5.2% in Q1 after a 4.1% decline in 2023. Domestic demand remains the key driver with tourist spending limited.

Overall, the watch and jewellery market is seeing growing polarisation in performance. Ongoing economic uncertainties and shifting tourism patterns are leading to very different results across geographies in 2024.

Chanel updates

This article, published last week, explains how the Wertheimer family, owners of the Chanel brand, have received dividends totaling $12.4 billion over the past three years. These payouts have contributed to a 19% increase in the family’s net worth… now estimated at $108 billion, collectively.

Notably, the family’s private office, Mousse Partners, has been diversifying its portfolio beyond the luxury industry, investing in various startups across digital advertising, biotechnology, and healthcare. Remember, Chanel also owns 20% of F.P. Journe and 20-25% of Romain Gauthier (I stand corrected on these % stakes).

The article also highlights the favorable tax treatment the Wertheimers enjoy due to the geographic structure of their empire, with the Cayman Islands and UK offering advantageous dividend policies.

There was another update from Miss Tweed which has nothing to do with watches, but fit into this section so I thought I’d share it anyway. The piece covers the sudden departure of Virginie Viard, Chanel’s creative director.

It is clear that Viard left the brand on her own initiative. She had had enough, industry sources say.

The announcement supposedly came as a surprise, given it was made just three weeks before their haute couture show and without a clear succession plan in place. Viard’s exit is seen as a sign of an ongoing revolution at Chanel under the leadership of CEO Leena Nair, who has been pushing out many of the brand’s old guard since taking the helm in January 2022. The next high-profile departure is expected to be Anne Kirby, president of Chanel fragrance and beauty, who is set to retire at the end of 2024 after 35 years with the company. Bruno Pavlovsky, who is in charge of Chanel’s fashion, could also be on the chopping block due to his resistance to Nair’s plans.

The catalyst for Viard’s departure appears to have been the negative reception of Chanel’s cruise collection in Marseille, which was heavily criticised on social media. This marked a significant shift in the brand’s previously untouchable status and left Viard, known for her sensitivity, badly bruised. The criticism also highlighted the declining sales that Chanel has been experiencing, particularly in mainland China, where revenue is down by more than 27 percent since the beginning of the year.

Viard’s tenure as creative director was always going to be a challenging one, given the enormous shoes she had to fill following Lagerfeld’s death in 2019. While she remained faithful to Chanel’s heritage, her shows were not as pertinent or grandiose as those of her predecessor. The search for a successor is expected to take up to a year. Several high-profile names have been mentioned as potential candidates, including Hedi Slimane, Marc Jacobs, and Pierpaolo Piccioli.

World Happiness Report

I got a chance to review the World Happiness Report 2024 - Here are a few takeaways:

Finland remains the happiest country, followed closely by Denmark. The Nordic countries dominate the top 10, with eight European countries overall. The U.S. and Germany have fallen out of the top 20.

Happiness rankings differ significantly between the young (under 30) and old (60+). In some countries like the U.S. and Canada, the old are much happier than the young. In parts of Europe, the opposite is true.

From 2006-2010 to 2021-2023, the biggest increases in happiness occurred in Eastern Europe, East Asia, and Sub-Saharan Africa. The biggest decreases were in South Asia, the U.S./Canada/Australia/New Zealand group, and the Middle East/North Africa.

Inequality in well-being has increased over 20% in the past decade globally and in most regions.

COVID led to worldwide increases in benevolence, especially among Millennials and Gen Z. Social support remains more common than loneliness globally1.

While well-being tends to rise again after middle age, there are generational effects, with Boomers happier than Gen X who are happier than Millennials/Gen Z.

Well-being declines from childhood through adolescence, with the decline more pronounced in girls and in lower-income countries. Gender gaps emerge by age 12.

Higher well-being earlier in life is robustly linked to lower dementia risk later, suggesting that increasing well-being may be a dementia prevention strategy. Well-being focused policies can also improve quality of life for those living with dementia.

In India, life satisfaction increases with age, more so for men. Education, caste, living arrangements, health, and region influence life satisfaction among older Indians.

If you happen to read it yourself, I’d be curious to hear what you think and whether I missed any pertinent points from the report.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Watch Auctions

Phillips

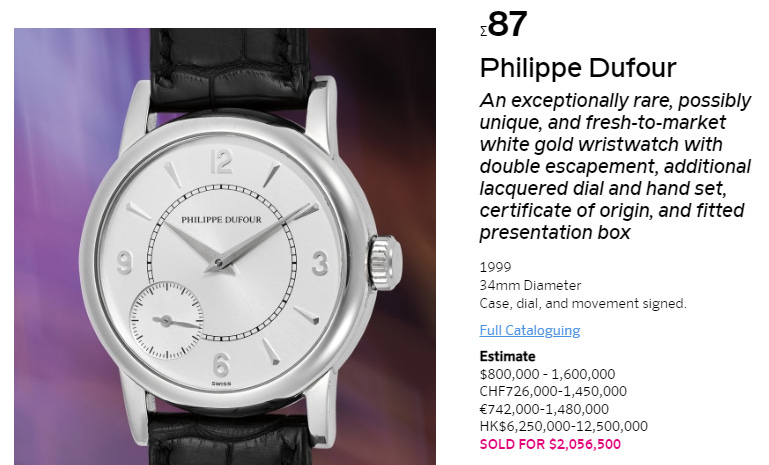

Arguably the most anticipated result of the week, was this Duality fetching over $2m at The New York Watch Auction: X by Phillips. It’s little brother, the 37mm Simplicity sold for $533,400, which isn’t bad either, as you can see from the historical performance chart:

Apart from that, Cartier performed well too - there was yet another Cartier Mystery Clock which sold for just over $1m, and this Cartier Baignoire Allongée sold for a staggering $387k! A few Journes also fared well given what is supposedly a ‘weak market,’ including this Centigraphe Souverain “F” for $482k, this Tourbillon Anniversaire Historique “T30” for $330k, this fourth series T-Tourbillon for $305k, a Vagabondage III for $279k, a Chronomètre à Résonance Anniversary for $254k and a Chronomètre Souverain “Holland & Holland” for an eye-watering $178k.

It is interesting to note how the market is finally shifting to acknowledge something I have been saying for years… The Résonance is quintessentially Journe, and over time, it will perform better than the Tourbillion on a like-for-like basis. In this auction, there was only a ~$12k difference between two comparable 38mm R ($241k) & T ($229k) (variants, but the Résonance sold for more. In this instance it may be due to the rarity of the rose gold case, but it will take time to shift completely. I still believe this will happen, despite how many people disagree with me. Time will tell!

Honourable mentions for this stunning Haldimann H1 Flying Central Tourbillon which seems like a relative bargain at $248k, this Tourbillon PURA by Hajime Asaoka which went for $362k, and this Charles Frodsham repeating grande sonnerie clock watch with tourbillon, perpetual calendar, and moon phase, which sold for $533k.

The MB&F HM5 at $25k seemed cheap, so did this Urwerk UR103 at $38k and this Romain Gauthier Prestige HMS Stainless Steel at $48k. This L951.1 Lange Datograph seemed to be a strong result at $95k, in this market.

Sotheby’s

Next up, Sotheby’s Fine Watches New York auction, with nearly 350 lots! This Journe Tourbillon Souverain à Remontoir d'Égalité avec Seconde Morte 'Joaillerie' had an estimate of between $400,000 and $800,000, and what struck me was despite the volume of watches for sale, only six lots had high estimates in the six-figure range. The auction wasn’t done at the time I was finishing this off - but it did hit $420k with 2 bidders.

Christie’s

Finally, Christie’s Important Watches New York Auction. Out of 118 lots, they had 10 Journes, including a Chronomètre à Résonance Anniversary like the one at Phillips which sold for $227k ($27k less than Phillips). This Ruthenium Tourbillon was perhaps the best of the bunch and it sold for $353k. The quartz Elegante sold for $44k, which feels high for this market.

Richard Mille’s role in money transfer without moving money (Hawala) was demonstrated once more - this RM56-02 sold for $3m and this RM52-01 sold for $1.2m.

Meanwhile, you could have snapped up Romain Gauthier’s ‘Insight Micro-Rotor’ for $63k, a Greubel Forsey Signature 1 for $113k, a Datograph Perpetual in rose ($60k!) or platinum ($69k), or an MB&F HMX Blue for $25k.

The takeaway from this round of auctions was: buy at Christie’s, but sell with Phillips!

Bonham’s

Keep an eye on this Fine Watches Auction at Bonham’s starting next Wednesday at 14:00 UK time. It includes a Journe Résonance and Cartier Crash Paris, but my pick is probably this Vacheron Constantin Saltarello or thsi Breguet Perpetual Calendar Tourbillon.

Enough small talk… Let’s dig in.

🔮 The Role of Serendipity in Watch Collecting

In our pursuit of grails, we watch enthusiasts often credit our successes to acumen, taste, intelligence, foresight and dedication. We pride ourselves on scouring auctions, developing relationships with brands or dealers, and having the gumption to take risks on timepieces others overlook. When a watch we acquired for a song goes on to become the toast of collectors, many are quick to pat themselves on the back for their prescience and astonishingly good judgment.

What the fvck? How many of these triumphs truly come down to skill, and how much to sheer dumb luck? As much as it may pain us to admit, fortune plays an immense, often unacknowledged role in any collector’s journey.

Consider the tale of the late Albert-Gustave Piguet, whose great-grandfather was the co-founder of the famous “Piguet Frères” house in the village of L’Orient. In the 1970s, with the Quartz Crisis in full swing, Piguet made what seemed a daft decision: He bought up the nearly worthless stock of new-old-stock Lemania 2310 ébauches before Lemania was sold to Nouvelle Lemania (which no longer produced the caliber). His cohorts thought he was nuts to sink capital into these movements, but providence favoured Piguet. Those movements went on to power the Speedmaster and Breguet Type XX, becoming collector darlings and skyrocketing in value. Piguet emerged looking like a prophet.

Ok, tangent time… In researching for that story, I found this old document, which is a short biography of Albert-Gustave Piguet (1914-2000) - it was too good not to share, and given it’s in French, I took the liberty of picking out a few key points:

Piguet came from a distinguished family of watchmakers. His great-grandfather co-founded the famous “Piguet Frères” house specialising in high-quality repeaters, chronographs, and calendar watches.

He studied at the watchmaking school in Le Sentier and created a double balance wheel movement entirely by hand. In 1934 at age 20, he joined the technical department of Lemania, becoming its head a few months later. (Romain Gauthier studied here as well, I believe!)

In 1948 he was appointed Technical Director of Lemania, overseeing 300 people in manufacturing, research and development.

He is most famous for designing the Lemania chronograph movement used in the Omega Speedmaster, the watch chosen by NASA for the Apollo moon missions after rigorous testing.

In the early 1940s, at Omega’s request, Piguet hand-built a new thin chronograph movement, the 27 CHRO C12, which later evolved into the famous Calibre 321 used in early Speedmasters. Here’s a whole deep dive on that calibre, by Wei Koh.

The tribute notes his tireless 47-year commitment to Lemania and Omega, describing him as one of the great dignitaries of contemporary watchmaking, an unparalleled technician whose immense modesty was equal to his actual skill.

Still, for every Albert Piguet, there are scores of would-be sagacious collectors who bet on the wrong horse and lost it all. The watch forums are rife with tales of those who sank fortunes into once-hyped models or brands that then faded into obscurity. Their mistake was assuming their wagers were somehow immune to chance.

Even the wisest enthusiasts among us, if honest, will concede the immense role kismet has played in their journey to date. We’ve all seen those shows on TV where a chance encounter at a flea market or storage locker unearthed a rare gem, or heard stories about someone meeting a pivotal mentor or dealer at just the right time. Let’s not forget, some of us had the good fortune of coming into the hobby at a moment ripe with opportunities that vanished in the blink of an eye. We’ll come back to this.

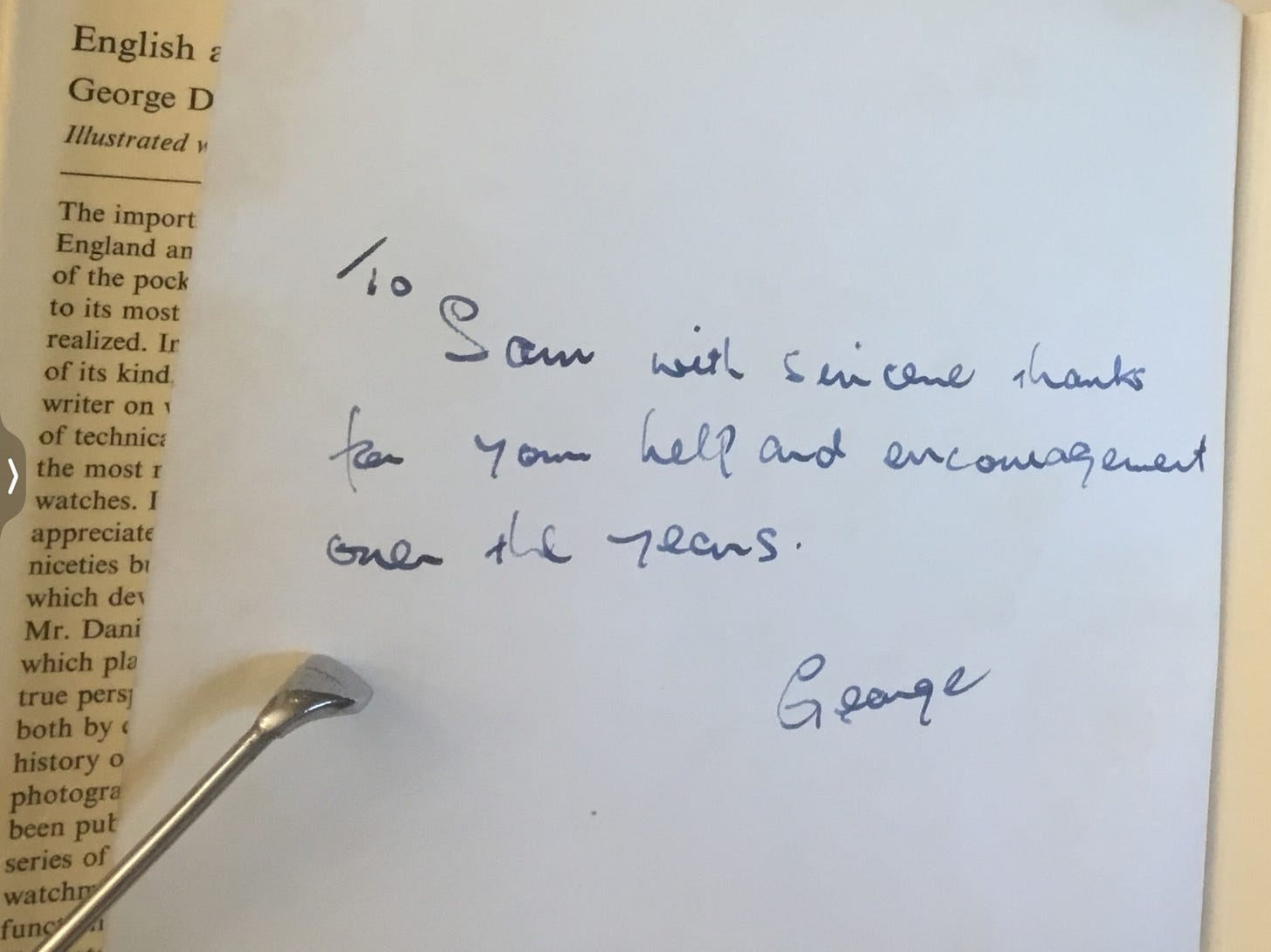

“I decided to show one of my early watches to Sotheby’s, hoping they would be interested in offering it for sale. I was introduced to the general manager, Mr. Hobson, who was much impressed by the watch and asked me to leave it with him for further consideration. I was subsequently introduced to Sam Clutton, a director of the firm, who was to become a lifelong friend and client. Sam was a kindly and discerning man who appreciated the finer things in life, particularly the work of the great French goldsmiths and watchmakers of the eighteenth century.”

Even biographies of ‘winners’ in all walks of life often reveal just how often fortune has shaped their paths. Consider the late George Daniels, a watchmaker who perhaps single-handedly resurrected the art of crafting watches by hand. Daniels’ entrée into the upper echelons of horology was supposedly also serendipitous, if you can believe that! In the 1960s, on a whim, he brought one of his early pocket watch creations to Sotheby’s, where it caught someone’s eye. Impressed, they introduced Daniels to Sam Clutton, who would become Daniels’ most important patron, commissioning the very watches which ultimately started his reputation. Without that initial connection, might Daniels have toiled into obscurity? Perhaps.

The same holds true for the revered watchmaker Philippe Dufour. After leaving watchmaking school in 1967, Dufour joined Jaeger-LeCoultre where Dufour had the good fortune to work under the tutelage of the legendary Gabriel Locatelli, one of the few remaining masters of traditional complications at the time. That apprenticeship, born of sheer happenstance, gave Dufour the foundation to become regarded as one of the greatest watchmakers of his generation.

As I said before, luck doesn’t only manifest in chance meetings or mentorships. It is also present in the fortuitous timing of a collector’s entry into the hobby. The landscape of watch collecting has shifted tectonically in recent decades, and again in recent years, with prices for once-overlooked brands and models soaring as tastes evolve and new collectors flood the market. I know a handful of collectors (myself included) who happened to find F.P. Journe just before they popped. That was mostly luck, although I will say I had them in my ‘watch list’ for about a 18 months before actually buying one - and I only pulled the trigger when I saw supply drying up rapidly as WatchBox started hoovering up all the inventory in the market 😂

Those prescient (or lucky) enough to start acquiring vintage Longines or Universal Genève in the early 2000s, for instance, built collections at a fraction of what those same watches command today. Similarly, niche collectors who bought into independents like Dufour, Voutilainen or Roger Smith a decade ago now look like oracles, sitting on watches that have multiplied in value many times over. It doesn’t matter that they didn’t buy it for the potential investment value - the point is how they are perceived today because of these collections.

Where some see luck in this, others might simply see the efficient market at work. As more information about once-obscure watches and makers comes to light, the cognoscenti2 bid up their prices accordingly. In this view, the “lucky” collectors were simply faster to spot value than their peers.

There’s some truth to this efficient market perspective. The watch market, like any other, does tend toward greater efficiency over time. As scholarship advances and collectors grow savvier, the odds of being able to buy an underpriced gem will diminish. Today, a trove of books, websites, and forums has made it harder than ever to stumble upon a true “sleeper.”

I still believe, even in an increasingly efficient market, luck still plays a role. After all, the most successful collectors aren’t just knowledgeable; they’re also decisive. When serendipity presents them with a rare find, they have the balls to pull the trigger, even when the value of said piece isn’t widely recognised. In that split-second moment, fortune still favours the bold.

Moreover, no amount of expertise can fully account for the capricious shifts of horological ‘fashion.’ Who could have predicted, for instance, the meteoric rise of vintage Heuer chronographs in the wake of the brand’s revival as TAG Heuer? Or the craze for neo-vintage Cartier sparked by Kanye West and Kim Kardashian of all people? The collectors and dealers who rode those waves to profit did so more by luck than by prescience, at least in the beginning. Granted, dealers today are outright manipulative, but this came later.

Perhaps the greatest luck of all, though, is simply to be born in a time and place conducive to watch collecting. To have the means and leisure to indulge in this passion is a privilege not available to all. And to come of age as a collector in an era of global prosperity, with a thriving auction market and a connected community of enthusiasts, is itself, a stroke of fortune indeed.

Philosophical context

Another tangent, if you’ll indulge me…

Aristotle believed that while cultivating virtue and excellence of character was necessary for eudaimonia (flourishing or fulfillment), it was not sufficient. He acknowledged the important role played by “external goods” like health, education, friendships and resources in providing the foundation for developing and expressing one’s potential for excellence.

The Stoics, in contrast, held that the quality of one’s character alone determined happiness, regardless of external circumstances. They introduced the idea of “preferred indifferents” - things like health and wealth that might be desirable on their own terms, but are ultimately irrelevant to one’s capacity for virtue and contentment. For the Stoics, even in the face of adversity, one can achieve eudaimonia by focusing on what is within one’s control - namely, the integrity and rationality of one’s own mind and actions.

I thought this philosophical context added some useful nuance to the discussion of luck in watch collecting. In some ways, the Stoic view aligns with the perspective that a true collector’s satisfaction comes from the inherent joy of pursuing and appreciating watches, rather than from serendipitous encounters which might bring a rare find or a windfall sale.

At the same time, Aristotle’s acknowledgment of the role of favorable circumstances seems validated by the stories of pivotal encounters, timely acquisitions, and positive turns of fate that have shaped many collectors’ journeys. Access to resources, mentors, information, and opportunities - matters often outside our control - undeniably influences one’s trajectory in the hobby.

Perhaps the key, in light of these insights, is to cultivate a “philosophical” approach to collecting that takes the best of both the Aristotelian and Stoic positions. We can strive to find contentment in the intrinsic rewards of horological knowledge and passion, while still recognising and appreciating the role of fortunate external factors when they arise.

We can aim for the Stoic ideal of remaining indifferent to the probability (or lack thereof) of being lucky, while still embracing the Aristotelian awareness that our individual paths are inevitably shaped by circumstances not entirely of our own making.

Conclusion

Ultimately, the luckiest collectors are those who can embrace the vagaries of fortune with humility and gratitude. They know that every hard-won grail is as much a gift of providence as a testament to their own tatse or intelligence. The ones who acknowledge this also tend to revel in this element of chance, knowing that it is often exactly what makes the hunt so thrilling.

We might as well raise a glass to the unsung co-author of every great watch collection: Lady Luck herself! May she always smile upon us as we seek our horological fortunes, and may we never forget how much we owe to her fickle favour. In this game, we are but her playthings, and yet, what a glorious game it is 😂

Special thanks to Sfwatchlover whose discussion points led to this section being created.

🚩 Anoma A1 and Innovation in Design

The case of the Anoma A1 is designed to feel like a river stone, made smooth and round by the erosion of time. It does not feature a single straight line.

The mirror polished case bends and bounces the light in playful and unexpected ways, altering its appearance based on the different angles and lighting conditions.

For what it’s worth, the above text is how the founder of Anoma, Matteo Violet Vianello, describes his first watch. Here it is:

Over the weekend, I asked for unfiltered opinions about the piece via an Instagram story. For the most part, it was nothing you haven’t already heard before. Many suggested it was a Hamilton Ventura lookalike, but only a small handful of people bothered to applaud it, even if it wasn’t to their tastes. This was a tad disappointing.

Let me start by saying, I applaud the effort. A few weeks ago I did the same for Toledano and Chan’s new B/1 which I thought was a praiseworthy effort in iterative design. This is no different. The founder of Anoma used to work for A Collected Man, who created an entire collector’s guide to asymemetrical watches (a few images below from their article):

The Anoma is as much an homage to any of these other triangular watches, as any round watch on planet earth is an homage to the first-ever round watch. The Anoma has a triangular case, but that’s about it. To me, the Anoma A1 is a blend between the aestheics of Cartier’s Crash and Pebble… and apparently, a French coffee table designed by Charlotte Perriand in the 1950s!

Do you still think this has this been done before? This attention to detail - hiding the crown beneath the case - is what truly set this watch apart.

You don’t often see this in low end products.

With an MSRP of £1300, and a Sellita SW100, this is no Cartier; But it offers a similar design aesthetic, and attention to detail, for a fraction of the price. Is it extremely well-made? No, as suggested by SJX here. However, even if you’re not into this sort of thing as a matter of personal preference, you have to at least applaud the effort.

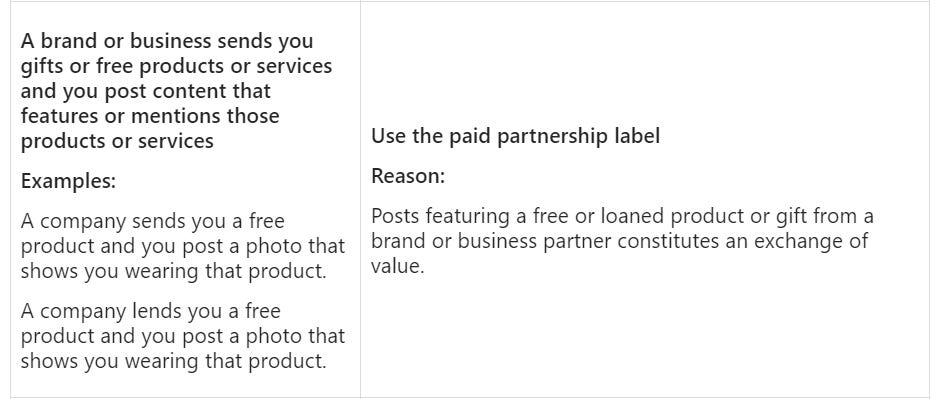

There was some controversy after several bigger accounts on Instagram posted videos on images of the watch with no explanation: Did they buy it early? Was it a free promotional gift? Was it sent to them on loan? Were they posting it because they were paid to promote it, or just because they just liked it?

As far as I can tell, the brand sent out prototypes to several collectors around the world for them to use, and to reveal on launch day - ideally with some attractive photos or videos to promote the watch. Under Instagram’s T&Cs, this is considered a ‘paid partnership’ despite no payment taking place.

Some collectors who posted images of the loaned watch were indeed happy with the prototype, and had already placed orders for a watch using their own money, and at full price. Given the watch had not been formally launched, I don’t see why the brand didn’t stipulate that everyone mentions “this watch is on loan to me from the brand” so there would be confusion?

Clearly, it looks better on Instagram when there is no ‘paid promotion’ tag, because everyone loves ‘organic’ marketing - but here, there was no doubt about the nature of these posts, and yet, there was absolutely zero disclosure until someone started asking questions in the comments section of certain posts. This was perhaps an oversight on the part of the brand, but led to a partial souring of what should have been a great announcement day.

The reason this matters, is because the collector sphere today is filled with people who tend to ask “should I like it” instead of “do I like it” - whenever they see a new watch. We’ve already established serious collectors do not care what mainstream watch media has to say about a new watch, therefore, one of the few remaining sources of helpful marketing is the voices of regular collectors who have a large audience. If a watch can get enough ‘relevant traction’ from well-known collectors in what appears to be an organic manner (unpaid), then the watch is more likely to succeed with the rest of the sheeple on the platform.

Be that as it may, Anoma isn’t the only brand doing this, so I can’t go too hard on them for doing it. Even Toledano and Chan pulled a fast one, declaring they were ‘sold out’ - only to have Mike Nouveau publish a post on his Instagram saying there were 10 available to buy from him. What jokers 😂 Sure, it’s his mate, and they probably did a deal on the side, in return for Mike promoting the sh*t out of the watch. Is this inherently ‘bad’? It isn’t a roadmap of morality, but these are cheap watches and let’s be honest, I don’t think anyone truly gives a fvck. It’s just nice not to be taken for a complete imbecile sometimes.

Edit (19 June): So @misterenthusiast reached out with some feedback worth sharing. I noted above, “Toledano and Chan pulled a fast one, declaring they were ‘sold out’ - only to have Mike Nouveau publish a post on his Instagram saying there were 10 available to buy from him…” - this is incorrect. In fact, Phil had sold these 10 watches to Mike - meaning T&C were indeed sold out. The fact that Mike then chose to actively promote the fact the watch was sold out, whilst knowing he had 10 more to sell, was the ‘fast one’ I refer to - but this was not T&C’s doing, but Mike Noveau’s. Apologies for my error!

Innovation in Design

Ranting aside… here’s the good news. What this brand (and others like Toledano and Chan) represents, is innovation in design. This is something I wish we would see more of, even in higher price brackets, and beyond just case designs.

This watch takes inspiration for the case design from 1950’s table design. Have you ever seen a watch movement designed with inspiration from outside of watchmaking? I will be honest, I haven’t had time to thoroughly research this, but I did find this:

Apparently, this Corum was inspired by the Golden Gate Bridge… a 1970s design by master watchmaker Vincent Calabrese:

Wouldn’t it be nice to see watchmakers and brands doing more to innovate with their design choices, rather than simply iterating on existing aesthetics and making incremental updates to materials in the movement?

Imagine a watch movement which is inspired by the Eiffel Tower. The R&D costs to create a new calibre which has a suboptimal architecture to accomodate for this Eiffel Tower design might be high, and it may only lend itself to certain case shapes. But have they tried? Is this even something they think about, or is it just about maximising ‘horological’ efficiency and choosing the layout which optimises for repairability and minimising friction across the whole system?

I have previously told the story of Journe regarding his creation of the Chronomètre Souverain (CS):

…he started with the dial design before thinking about the mechanics.

“First thing, I think of the dial, and then I will break my head to make it work inside.”

Gino Cukrowicz describing F.P. Journe’s approach

After positioning the smaller sub seconds dial, Journe found the most logical location for the power reserve was at 3:00, next to the crown. What made this problematic, was he also wanted the watch to remain in a slim case (unlike what we see today with brands like IWC ruining their watches with super thick cases). The gearing setup for such a layout would mean Journe would need to increase the case thickness to accommodate everything. Instead of doing that, he completely redesigned the mechanism and used ceramic ball bearings to shrink its size from 1.57mm to 0.5mm, maintaining a slim movement thickness of 4.00mm.

This is what I mean, when I say innovation in design. Just like Journe didn’t just compromise on the case height, he found a way to make it work despite the case heigh restriction. We don’t see much of this today, because everyone is in the business of using off-the-shelf movements and keeping costs low. Given how prices have gone up across the board in this hobby, I feel it is time for brands and watchmakers to do more. Great design isn’t easy. Any genuinely new watch design will, like the Anoma A1, be polarising; But I think we will all be better for it.

Unfortunately for me, this release dropped after I had completed the section above:

Jean Arnault jumped the gun on his own embargo yesterday to release four new versions of the Escale watch, with textured dials, leather straps and a new 39mm case which is just over 10mm thick. Friendly dimensions, for a dive watch. Perhaps a tad large for a dress watch?

The lugs, indices and supposedly the crown too, all take inspiration from LV’s trunks. The watch is powered by the Geneva Observatory chronometer-certified cal. LFT023 that we first saw in the recently launched Tambour. You can read more about this new watch here, but I have a question for you: Do you think there is there anything worth celebrating with this release? Or with Louis Vuitton Watches in general?

I appreciate LV is trying to build credibility as a watch brand, but it all seems rather impatiant and rushed. LV are known for those wildly expensive automata watches (like this one) and for the most part outside of their artistic watchmaking, cater to luxury buyers who are less likely to be hard core watch enthusiasts. So, they’re refreshing the product lines with average pieces like the Tambour and now this Escale… but to what end? Are they hoping they will somehow appeal to actual enthusiasts and gain genuine credibility as a watch brand, or are they trying to recreate Hublot’s success all over again, in a new series of product lines under their own brand name? It feels like the latter… and most enthusiasts are interpreting it as the former. This includes Wei Koh who, in his piece “The Time of Louis Vuitton,” waxes lyrical about Jean Arnault, about LV watches, and about the bright future for the brand.

Jean Arnault may very well possess “horological intellect” as Wei suggests, but LVMH and the Arnault family are business people, not crazed horological geniuses like F.P. Journe who are determined to deliver something grand to the world. They have shareholders and return on investment is of paramount importance. Unless LV are able to spend a lot more on R&D to come up with something actually marvelous, LV watches will remain in the niche they already reside, no matter how much Wei or others say otherwise. I don’t think these are bad watches, I just don’t understand what Wei is smoking when he compares this watch to Philippe Dufour’s Simplicity, Rexhep Rexhepi’s Chronomètre Contemporain I and II, and the Chopard L.U.C 1860 🤣

Regarding watch brands in the LVMH portfolio, this is my summary: Toyota is to Lexus, what Hublot is to LV’s watches. Just like a Lexus will never be a Rolls Royce or a Bentley, LV watches will never hit the highs which Wei describes unless something drastically changes. I don’t think it is impossible, but they have a lot of work to do, and it will. above all else, require time and patience; something shareholders are not known to have.

📌 Links of interest

💎 Patek Philippe’s Rare Handicrafts exhibition is running until June 16 at their London boutique. Book a viewing here.

✨ In an interview with Europa Star, CEO Matthias Breschan discusses three key points which he believes are crucial to Longines’ future… and how he intends to build on them.

🦹♂️ Would you dare to wear a Rolex? Luxury watch thefts surge in London as young people, influenced by pop culture, seek to own expensive watches despite the risks.

On a related topic: Bulgari and Chanel boutiques in European cities targeted in back-to-back thefts.

🛒 Will Ground Floor Watch Shops Go Extinct?

💡 Some information you never knew about the First-Gen 15202 Royal Oak Jumbo.

🟢 The Patek Philippe Reference 565 is a sought-after reference for vintage Patek enthusiasts - Check out Aircooltime’s deep dive on this reference, linked here.

👑 Top Rolex dealer says more women, young people are buying luxury watches.

🥿 How Birkenstock Became a Luxury Brand With ‘Succession-Level’ Drama. Obviously, LVMH is involved!

😥 Crisis in the Culture: An Update by Ted Gioia

🖼 How Does Art Tell Stories? A Crash Course Lesson on Art History (10 min video)

🍎 Everything Apple Announced at WWDC.

☠ Nearly 100% of content from internet portals and private websites from the first decade of China’s internet has now been obliterated.

🔬 How the Guinness Brewery Invented the Most Important Statistical Method in Science.

🧞♂️ Ikea is hiring staff for its virtual Roblox store.

🤳🏽 What happens when Starlink enters one of most isolated indigenous communities in the Amazon.

🌊 The Titan Submersible Disaster Shocked the World. The Exclusive Inside Story Is More Disturbing Than Anyone Imagined.

😋 The world’s 50 best restaurants 2024.

🥑 How Healthy Are Avocados? Here’s a highlight reel of their biggest nutritional benefits, plus delicious recipes to help you enjoy them.

💌 He Perished on Everest. His Last Letter Recounts the Harrowing Journey. A decade of correspondence offers an intimate glimpse into the life of George Mallory

End note

In case you missed them, I shared two posts since the last newsletter:

Feeling tired? You’re not alone. According to a new report from trend forecasting firm WGSN, by 2026 - we’ll all be in the throes of the “Great Exhaustion” soon – a state of collective burnout fueled by work, childcare, tech overload, inequality, unattainable life goals, politics, and the relentless drone of online marketing. You can read more about it here - but for the watch industry, their approach to marketing will need to change.

Instead of pushing product, brands could consider creating immersive experiences that celebrate the artistry and stories behind the watches they sell. They could rework their marketing copy to focus on things like mindfulness and digital detox, which positions watches as tools for savouring the moment, rather than just keeping pace with the rat race.

In a world of constant hustle and hollow hype, the mechnical watch on your wrist could become a symbol of something more – a connection to tradition, a marvel of human ingenuity, or apparently… a reminder to breathe.

Speaking of remembering to breathe… One thing which has become apparent to me in trying to maintain the cadence of writing on Substack, is the importance of avoiding burnout. Turns out, this is not about how hard I work on anything, and more related to how well I focus on rest and downtime!

Throughout history, some of the most successful and influential figures have recognised the importance of incorporating rest into their daily routines too!

Take Winston Churchill, who was known to work from his bed until the late morning, take a short nap after lunch, and then retire for another two-hour nap before dinner! Despite this seemingly relaxing schedule, he was putting in 16-hour workdays well into his old age.

Similarly, John D. Rockefeller, one of the wealthiest men in history, made it a point to take a 30-minute nap at midday, every day, no matter how pressing his schedule might have been.

Christopher Nolan apparently doesn’t use a smartphone, and uses a laptop without an internet connection. As he puts it, “I do a lot of my best thinking in that kind of in-between moments that people now fill with online activity.”

There is a rumour about Floyd Mayweather just before his fight with Juan Manuel Marquez - Instead of getting psyched up before the fight, he was relaxing on a sofa, watching a baseball game.

There is no ‘perfect solution’ and what works for each person may not work for another. As my friend Bruce likes ot say: YMMV3.

All I am saying is… don’t forget to relax.

“I never stand up when I can sit down, and I never sit down when I can lie down.”

Henry Ford

Until next time,

F

🔮Bonus link: Exploring Dunhill Namiki Masterpieces 🖋️

If you aren’t already familiar with Dunhill Namiki, you might want to check out this video first. The video above is about 3 variants currently up for sale - and they cost more than some independent watches!

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

This means, on average, people are more likely to have supportive social relationships and feel a sense of belonging than to experience feelings of isolation and disconnection.

Funny how this group has also evolved. Used to be a small few in the know. How times change!

Your mileage may vary

This has quickly become the preeminent watch insider newsletter - well done!

I am curious about a few industry rumors…

-When will the Patek Cubitus break cover? October?

-Any truth to the rumors of an AP sale to (or partnership with) Hermes? Were that to transpire, what impact would it have on Richard Mille?

As I side comment, luck is great, but means is so much more a factor… kinda like if I throw a lot of shit at the wall, something will eventually stick… limited means mean than you can’t buy it, forget it and wait for it to randomly shoot up years down the line and you will need to let it go to pick up other things… so, comes back to our favorite saying, buy what you love, wear what you buy. This is a hobby, not a vocation.