SDC Weekly 54; The Mandela Effect; Lessons from Bernard Baruch

Panerai Elux, John Lennon's 2499, Rexhep to increase production, Luxury in Asia, Jean Daniel Nicolas update, Swatch Group Shake Up, LVMH slave trade, and The Martini Glass Puzzle.

Welcome to another edition of SDC Weekly, and dare I say, it’s a banger 😝

Today, we change things up a little. We’ll start with Panerai’s Submersible Elux. Then move on to the intriguing story behind John Lennon's rare Patek Philippe 2499, the hidden watchmaking gem of Porrentruy, the low down on Daniel Roth’s cryptic letter, and some other small talk topics.

Then, we will examine the Visual Mandela Effect in watch collecting and glean some lessons from the life of Bernard Baruch. As always, we will end with some fun links to keep you busy when you’re done reading.

If you’re new here, welcome! You can catch up on the older editions of SDC Weekly here. Free subscribers typically receive the full newsletter (and other ad-hoc posts) via email - 3 weeks after publication - so if you’re not subscribed already, that’s a good reason to do so!

Illuminating Innovation

I always said I wouldn’t bother with watch reviews but, in light of the ‘innovation’ discussion in last week’s SDC, this felt like a worthwhile release to discuss. So, with reluctance, let’s get it over with.

Panerai, known to make watches with Lume[inor] in the name, unveiled a new piece which pushes the boundaries of … yes, lume. The Panerai Submersible Elux LAB-ID PAM01800 is, we are told, the culmination of eight years of research and development by Panerai’s ‘Idea Lab’ (LAB-ID), resulting in a watch that features an unprecedented on-demand mechanical lighting system. Mechanical lighting, yes.

The watch is housed in a 500m-rated 49mm case crafted from Panerai’s patent-pending Ti-Ceramitech material, ha ceramised titanium which is 44% lighter than steel and boasts a fracture-toughness ten times higher than traditional ceramic; at least, that’s what they claim, and it is likely nobody will ever test the veracity of these claims. The deep blue hue of the case is achieved through a process called Plasma Electrolytic Oxidation, which gives it that colour, and apparently also enhances the case’s hardness. Again, I am telling you all this for completeness, but remain convinced you don’t care - I know I didn’t.

Inside the case, you’ll find a P.9010/EL movement, a modified version of Panerai’s own P.9010 calibre. The automatic movement features two mainspring barrels dedicated to timekeeping, providing a robust three-day power reserve. The real magic, and the reason we’re discussing this at all, lies in the additional four barrels which store energy solely to power this watch’s pièce de résistance: the Elux Power Light system.

The Elux Power Light system is a bunch of mechanical wizardry that converts mechanical energy into electricity, to power an array of LEDs throughout the watch. By pressing the pusher at 8 o’clock, which is protected by a dedicated flip-up cover, the wearer activates the lighting system, instantly illuminating the dial, hands, and even the bezel pip. The pip was, itself, a separate challenge, given the bezel still needs to move freely - SJX notes:

According to Panerai, the LAB-ID team developed a patent-pending system. Under the bezel is a fixed array of 60 LEDs, but the system only transmits electricity to the 15 LEDs positioned below the bezel marker, lighting up just that section and conserving energy since the rest of the LED array is not illuminated.

The LEDs are powered by a microgenerator measuring just 8mm x 2.3mm, which utilises custom-made coils, magnets, and a stator to generate an electrical signal of 240 Hz, all without the use of batteries or active electronics.

When the Elux Power Light system is activated, the indices, hour and minute hands, small seconds counter outline at 9 o’clock, and the bezel pip all glow with an intensity that is reportedly ten times brighter than an incandescent light bulb. Again, SJX notes:

The light comes primarily from LEDs under the dial (bringing new meaning to “sandwich” dial) and bezel… both the dial and hour hand also feature Super-Luminova X2, a luminous compound that glows brighter than most Super-Luminova formulations.

Panerai claims that the Elux Power Light system can provide a continuous 30 minutes of illumination when fully charged, though some reviewers have reported up to 45 minutes of glowing glory. To replenish the light power reserve, one simply needs to wind the crown, which is neatly tucked away beneath Panerai's signature crown protector.

Despite its complex lighting system, and unlike many other Panerai watches, this piece is actually a true dive watch, boasting a water resistance of 500 meters and a unidirectional rotating bezel.

The Elephant in the Room: While the watch itself is undeniably an impressive feat of horological engineering, it’s impossible to ignore its gargantuan proportions and eye-watering price tag - some sites are saying it costs $100k, or CHF 92,800 - but the UK site shows it on sale for £76,800.

With a diameter of 49mm and a thickness of 21.6mm, this watch is not for normal people. It’s a behemoth that unapologetically demands attention, and wearing it may feel akin to strapping a dinner plate to your arm.

At this price, it is accessible only to the most well-fed and well-heeled dive watch enthusiasts, and even then, it is unclear how many would be keen to buy a watch just because it can light up like a Christmas tree at the push of a button.

This is the sort of watch people would be happy to buy at ~ 25 cents on the dollar in the secondary market - because let’s be honest, it is pretty fvcking cool. That said, I can safely say it won’t be flying off the shelves at over £70k, and you know what? That’s ok! I’m here for it. I love seeing innovation as a watch enthusiast, and I can’t wait to see this watch in person. It is disappointing to see people talk sh*t about the watch just because of its price or its size, while completely ignoring the fact that this brings something new to the proverbial horological table. Nobody needs mechanical lighting, sure. Nobody asked for it either. But seeing as you technically don’t need any watch at all, this line of questioning is just stupid - so kindly stop it already.

Edit: Following a comment, I felt obliged to post this! I somehow missed the fact that DeBethune has done this before - in a smaller case too. Check it out:

Small stuff

Random quote of the week - Andy Hoffman asked Rexhep Rexhepi: Will you try to increase production to meet demand? Here’s what he said (emphasis mine):

One thing that is very important for us is that we are independent. We are doing all the drawings and designs. We are developing the movements. We are doing more and more of the components in-house, not all of them, but more of them. We are doing the cases and the dials. We are doing the straps now.

When you invent a movement, that involves some big numbers. It’s not taking an ébauche [a near-complete movement] and decorating it. You are developing a movement—you have to test it and make sure that it works. This is a big cost.

Since I was 16, I have had this dream to be independent. Every choice I made was for this, having my philosophy and having my watch. I feel very, very lucky and don’t want to lose this. I will do whatever to keep this. So if I have to do a little more, and I can do a little more, I will try to do a little more.

Rexhep Rexhepi

John Lennon’s Patek Philippe 2499

In this thoroughly enjoyable article for The New Yorker, Jay Fielden unravels the intriguing story behind John Lennon’s rare and valuable Patek Philippe 2499; This perpetual-calendar chronograph, one of only 349 made between 1952 and 1985, was a fortieth birthday gift from Yoko Ono to Lennon in 1980, just two months before his tragic death.

Fielden’s investigation reveals that the watch remained hidden for decades, only to resurface in a mysterious photograph around 2011. The photo taken by Bob Gruen on Lennon’s birthday, sparked a frenzy among watch enthusiasts, with estimates of its potential auction value ranging from $10 million to $40 million.

The article traces the watch from Lennon’s locked room in his Dakota apartment after his death to its theft by Ono’s former chauffeur, Koral Karsan, around 2005. Karsan later used the watch as collateral for a loan from a friend, Erhan G, who eventually consigned it to the now-defunct digital auction platform Auctionata.

A private sale was arranged with a collector known as Mr. A, but when he attempted to have the watch appraised by Christie’s, Ono was notified, and a legal battle ensued. Swiss courts have ruled Ono is the rightful owner, but Mr. A has appealed the decision to the Swiss Supreme Court.

Fielden’s article delves into the personal lives of Lennon and Ono, providing context for the significance of the watch and the events surrounding its disappearance. The watch bears a poignant secret engraving from Ono to Lennon, making it a symbol of their love and the precious little time they had left together.

This piece is a must-read for watch enthusiasts, music lovers, and anyone who appreciates a well-investigated and well-written story of mystery, intrigue, and the enduring power of a watch cherished by horology nerds.

As for the watch itself - Ideal outcome is for it to end up in the Patek museum. While it would be nice if Stern negotiates a private sale, it is likely he would want the prestige of this breaking records at auction. So my prediction, despite nobody asking: This watch will hit an auction catalogue before long, and through the patronage of a ‘friendly buyer’ such as Zach Lu, find its way to its rightful home in the Patek museum.

Porrentruy: the Hidden Gem of Swiss Watchmaking

In this article, Pierre Maillard takes us on a journey through the lesser-known watchmaking hub of Porrentruy, located in the Canton of Jura, Switzerland. Despite its late arrival to the watchmaking scene in the mid-19th century, Porrentruy has supposedly made significant contributions to the industry, boasting a rich history and a thriving network of artisanal and industrial businesses.

I found Maillard’s in-depth exploration of Porrentruy’s watchmaking heritage both informative and engaging. He sheds light on the region’s key players as well as the numerous specialist suppliers that have contributed to the industry’s growth. The article also introduces Christian Etienne, a watchmaker-restorer, and creator of his own eponymous brand - unclear whether this was the purpose of the article, but even if it was, I still learned a lot, and I’m sure you will too.

Sotheby’s Future

In this article from December 2023, the FT reported on bankers approaching potential buyers1 for a minority stake in Sotheby’s auction house. The owner of Sotheby’s, Patrick Drahi, was facing pressure to sell assets at his indebted telecoms group Altice, which had a $60bn debt problem. At the time, people close to Drahi said he was reluctant to offload Sotheby’s.

The article also mentioned how Qatar had shown interest in auction houses in the past, with the then emir Hamad bin Khalifa al-Thani expressing interest in bidding for Christie’s in 2010. Slightly old data, but in 2022 Sotheby’s revenue rose 8% to $1.4bn compared to the previous year, but they still posted a net loss of US$515m. Random fun fact which reminded me of OnlyWatch: The article noted “Sotheby’s accounts also showed that it paid out more than US$26m to Drahi’s main Luxembourg investment vehicle in 2021 and 2022 for ‘strategic advisory and other executive-level services’.”

If you’ve followed recent auctions, you will have noticed some Cartier sales at Phillips auctions have sold for incredibly high prices - click here and here to remind yourself.

I understand these high-value Cartier pieces are from a particular collector who plans to offload his entire collection. He has many other rare watches and clocks, and he intended to do a deal with an auction house to get rid of everything.

Here’s the crazy part: it was reportedly Sotheby’s who originally landed this client, and just before they sealed the deal, Sotheby’s decided to change the fee structure - covered in a prior SDC here. The client got irritated with them, and took the entire collection to Phillips instead. I told you back then, it was a stupid change. This proves it.

To conclude… The loss of this client, apart from being amusing, is a problem for Sotheby’s because Drahi needs the cash. At this point his IPO idea may prove to be less lucrative than private (Qatari ?) capital - but who knows… this is mere speculation.

Luxury Insights From Asia

👜 A reader shared this video with me last week (Thanks T!). It is 4 months old, but extremely insightful - I will cover the key points here.

The video delves into the cultural factors driving the high demand for luxury goods in East Asia, particularly among the younger generation. It highlights how the consumption of luxury items in countries like South Korea, Japan, and China is influenced by cultural values such as interdependence, face culture, social hierarchies, and conformity.

In East Asian cultures, individuals often have an interdependent sense of self, meaning their identity is closely tied to their social roles and relationships. This leads to a strong emphasis on face culture, where people strive to maintain a positive social image and gain respect from others. Luxury items, with their associations of wealth and success, become a means to enhance people’s social standing and conform to societal expectations.

The video also explores the phenomenon of the “strawberry generation” in Taiwan and the increasing pressure on young people to own luxury items as a way to demonstrate their status and fit in with their peers. This pressure is so intense that many young consumers are willing to go into debt to finance their luxury purchases.

The concept of “ambish shuma” or ambivalent consumption is also discussed, describing the behaviour of individuals who spend excessively on luxury goods while being frugal in other aspects of their lives. In short, outward appearances in East Asian cultures are a priority, even at the expense of personal financial well-being.

The video also touches on the irresponsibility of luxury brands in perpetuating this obsession, as they purposely target younger demographics in their marketing strategies. The societal pressure to achieve success, often narrowly defined by wealth and status, further fuels the demand for luxury items among the youth.

Finally, the video mentions recent efforts in China to curb the excessive display of wealth and promote a more moderate lifestyle through policies like “common prosperity.” This has led to a shift towards “quiet luxury,” where consumers still pay a premium for high-quality items, but prefer subtle branding.

Fashion Industry Faces Challenges

Another one from Miss Tweed, who reckons the fashion industry is currently navigating a tumultuous period, with numerous brands and retailers facing financial difficulties due to declining global demand, payment delays from major retailers, and the ongoing (!) impact of the pandemic. As a result, many fashion investors and M&A bankers are preparing for an influx of brands hitting the market in the coming months, seeking new investors or buyers to help them survive.

Perhaps following neatly from the previous section, China, once seen as a major growth engine for the fashion industry, has specifically become an increasingly difficult market. Luxury brands such as Stella McCartney have closed their boutiques in the country, while demand for luxury goods has significantly declined. The US market is also struggling, with major luxury brands experiencing decreased sales at department stores since the beginning of the year.

From a watch industry perspective - there’s the discretionary spending angle to this; People buying high end fashion brands are buying things they ‘don’t need.’ At the same time, one could argue that the people buying a lot of very expensive watches are not going to be suffering financially, and so that high-end segment should be immune. The correct answer is somewhere in between for most big brands. Richard Mille, for example, will probably still have a great year. Journe also seems to be sold out for the foreseeable future, and the waiting list for the FFC is many years, even at a million bucks retail price!

Swatch Group Shake Up

According to a recent article by Andy Hoffman, Swatch Group announced changes to its executive management committee amidst a challenging period for the industry. Peter Steiger, a 35-year veteran of the company who served as Chief Controlling Officer, will retire and depart from the group.

Damiano Casafina, CEO of ETA, and Sylvain Dolla, CEO of Tissot, have been appointed to the executive group management board. These changes come as Swatch shares hit a 52-week low on 7 June, with the company's profit impacted by reduced demand in mainland China and Hong Kong, as well as a strong Swiss franc. Swatch stock has fallen by approximately 18% in 2024, in contrast to a 28% gain for rival Richemont.

The article also mentions that call in January between CEO Nick Hayek and investors who criticised Swatch’s lack of shareholder engagement. Hayek, now infamously, maintained Swatch is in the business of selling “watches, not shares.” The Hayek family owns ~25% of Swatch equity but controls ~43% of the voting rights.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

Jean Daniel Nicolas… Wait, who?

Before we begin - if you don’t know who Daniel Roth is, or the story behind the brand JDN… A short primer: Daniel Roth is an important master watchmaker now in his late 70’s (read more here). JDN is his own brand, and the company name is a combination of his own name, with his son’s and wife’s names.

With that out of the way, let me state upfront: This entire section is based on hearsay. I have not spoken to any of the parties mentioned below, but have spoken with people I trust would not willingly lie to me. Still, make of this what you will, but do your own verification of facts if you want to act upon this information.

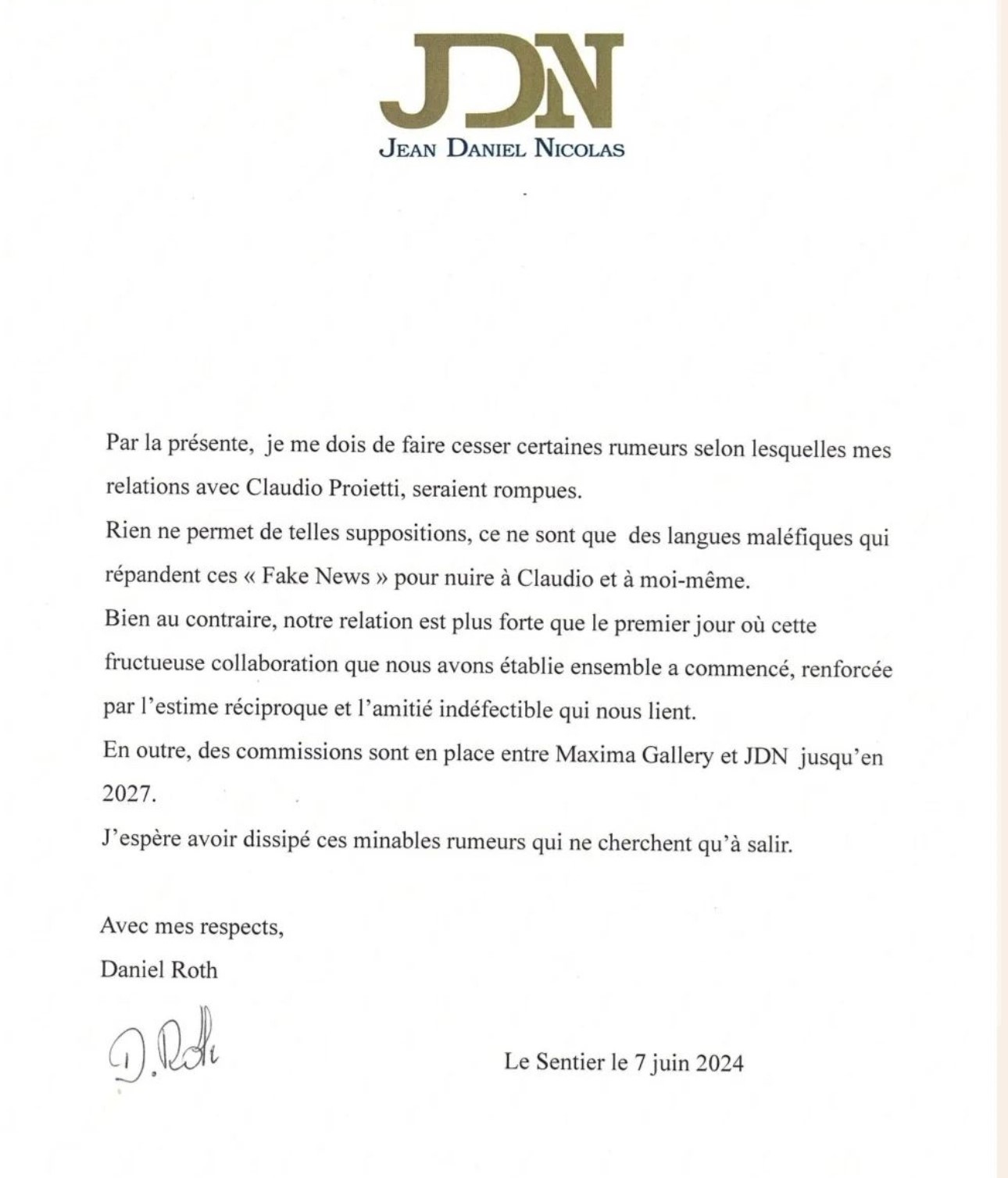

The image above shows a letter written in French, purportedly by Daniel Roth himself. ‘Roth’ states he must address certain rumours regarding his relationship with Claudio Proietti, and dismisses these suppositions as malicious “Fake News” meant to harm Claudio and himself.

‘Roth’ affirms that their relationship is stronger than ever, since the first day their fruitful collaboration began, and mentions this is reinforced by their mutual esteem and unwavering friendship which binds them. ‘Roth’ reiterates that commissions are in place between Maxima Gallery and JDN until 2027.

We will discuss the rumours mentioned in the letter below, but before we do, some further context is necessary.

Who is Claudio Proietti and what is the Maxima Gallery? You can read more about Claudio here. Maxima Gallery is his own gig, and he acts as a retailer for independent brands like Daniel Roth, and Hajime Asaoka etc. He also associates with Phillips in Association with Bacs & Russo - which already tells you what sort of character we’re dealing with.

Claudio approaches brands and tries to secure exclusivity as their sales representative. For someone pushing 80, Daniel Roth probably benefits from the assistance of someone like this. The problem I am told, is that Claudio simply bullies his way into receiving a cut from the watchmakers’ product, even if this is to the watchmaker’s detriment. When other resellers attempted to place orders with JDN, they had their orders allegedly cancelled by Claudio’s influence. Claudio has also allegedly taken deposits for several watches which are unlikely to be made on time; In light of Roth’s poor health and recent cataract operation, is seems less likely the list of orders will be fulfilled anytime soon.

In the meantime, Claudio is sitting on a lot of Roth’s money from deposits, and pushing Daniel Roth to produce watches only for the clients which he brought in - while pushing away clients which are making direct approaches; This is supposedly because Claudio will not receive a cut, and Roth will receive more money.

Now - the rumour being referenced in the letter, is about people saying Daniel Roth doesn’t want to deal with Claudio anymore, and that Claudio is not his formal representative. I have been told this letter is a fake, by someone who I believe confirmed it with Roth himself. I am not a native French speaker, but I am told by others this letter appears to read like something fabricated by someone aligned with Claudio, rather than Roth himself - because of course, if the rumours are true, then all the deposit money which Claudio is holding, will need to be returned! People in the know, have confirmed that Daniel has no interest in dealing with Claudio anymore, but we have no way of knowing for sure - other than asking Daniel Roth himself.

So, fully appreciate this story is probably irrelevant to anyone reading this post… but, if you or someone you know has placed a deposit with Claudio, it may be worth following up with JDN yourself, to better understand the status of your order. Beyond that, it’s just a bit of watch industry gossip 🤣

Enough small talk…

💡 The Mandela Effect: False Memories and Their Implications

If you’ve ever had a vivid memory of something, only to discover that it never actually happened… You’re not alone! This phenomenon was dubbed the “Mandela effect” based on a widespread false memory that Nelson Mandela died in prison in the 1980s!

The Visual Mandela Effect

A recent (2022) study delved into the Visual Mandela Effect (VME), which focuses on false memories related to visual icons, such as logos and characters from popular culture. Their research provides empirical evidence for the existence of the VME and explores its characteristics.

Key Findings

Specific and consistent false memories: The study found certain images elicit consistent and specific false memories across individuals. For example, many people falsely remember the Monopoly Man wearing a monocle, even though he has never been depicted with one. Ace Ventura, anyone?

Low accuracy despite high familiarity: Participants in the study were bad at identifying the correct version of VME-affected images, despite reporting high familiarity with the image.

False memories in both recognition and recall: The VME occurs not only in recognition tasks but also during free recall, where participants spontaneously generated the false memory without prompting.

No clear attentional or visual differences: The study found no significant differences in how participants visually inspected VME-affected images compared to control images, suggesting the false memories are not driven by attentional or low-level visual factors.

Potential Explanations

The researchers discuss several potential explanations for the VME, including:

Schema theory: False memories may arise when the incorrect detail aligns with people’s expectations or mental schemas of the image. Example: Someone may falsely remember a particular Rolex Submariner having a red bezel, even though the model has always had a black bezel. This false memory could arise because they associate Rolex with the iconic red and blue “Pepsi” bezel on the GMT-Master II. This person’s mental schema of Rolex includes “a red bezel,” and this leads to a false memory.

Incomplete perceptual experience: For some images, the false memory may be driven by filling in perceptual gaps with schematic knowledge. Example: Your older mate might recall a Daytona having the subdial centres aligned with the 6 and 9 o’clock indices; in fact, since they moved away from the Zenith calibre, they do not align. This false memory could be driven by their incomplete perceptual experience of the watch, having only seen older examples. Their mind may fill in the gap with the expectation that it would be silly to misalign a watch as part of a future redesign, and therefore all Daytona’s have the subdials aligned at 6 and 9.

Source confusion: In some cases, people may have encountered the false version of the image before, leading to confusion about the source of their memory. Example: A collector may falsely remember an Omega Speedmaster having a tachymeter scale on the dial, when in reality, this is found on the bezel. This false memory could arise from them having seen images of the Speedmaster’s dial and bezel separately, leading to confusion about the source of the tachymeter scale memory. They may have simply combined separate images in their mind, creating a false memory of the scale being on the dial.

Intrinsic properties of the image: The false version of the image may be more memorable due to inherent properties of the image itself. Example: The Daytona example could also apply here! Alternatively, someone may falsely remember a mental image of a Romain Gauthier HMS with a crown - because that’s what you’d expect on a watch. Instead, this watch has a fairly uncommon winding mechanism at the back - and therefore, no crown:

Anyway, the study concluded there might not be a single, universal explanation for the VME, and different factors may contribute to false memories for different images - kinda like the Daytona example fitting two of the above alternatives.

Implications for Watch Collecting

As a watch enthusiast, I find the Visual Mandela Effect particularly intriguing. Watch collectors often have a keen eye for detail and take pride in their knowledge of various watch brands, models, and designs. However, the VME suggests even the most passionate and informed collectors may be susceptible to false memories.

Imagine discussing a classic watch design with fellow collectors, only to discover the specific detail you’ve been focusing on never actually existed. This could lead to fascinating conversations and debates within the watch collecting community, as people compare their memories and try to uncover the truth behind the false memory.

Moreover, the VME could have implications for watch brands and their marketing strategies. If a significant number of people falsely remember a specific design element on a particular watch, it could influence their perception and preferences. Brands might even consider incorporating these false memories into their designs, creating limited edition watches that play on the VME to generate buzz and appeal to collectors!

Conclusion

The VME is a captivating phenomenon which highlights the fallibility of our memories and, more worryingly, the power of collective false beliefs. I thought this tied back neatly with the recent post on doing the work required to have an opinion - you’d be surprised how certain ‘facts’ you believe can turn out to be false.

The next time you find yourself in a heated debate about a specific watch issue, take a moment to consider whether you might be experiencing the Visual Mandela Effect – it could add a new layer of intrigue to your discourse. Of course, if you’re absolutely sure about your own memory, then before getting irritated with the other party, consider the possibility that they might be experiencing the VME, and introduce additional data to get everyone on the same page.

💡 Timeless Wisdom: Lessons from Bernard Baruch’s Extraordinary Life

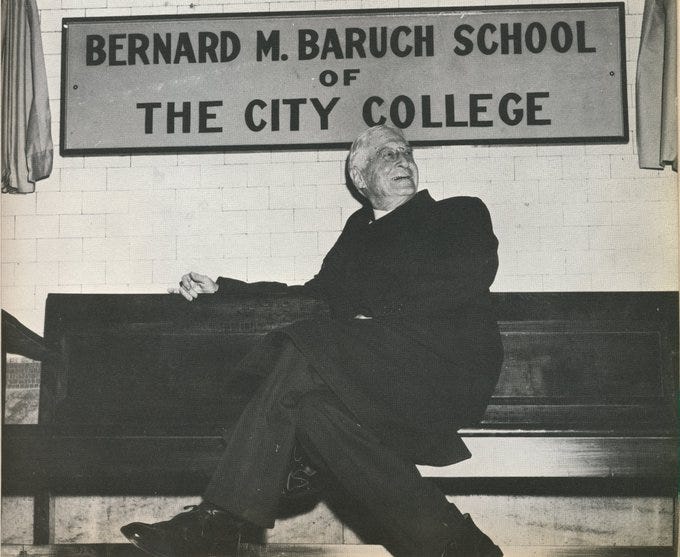

I randomly came across an article about this guy over the weekend - I’d never heard of him - which is perhaps more reflective of my own ignorance (!) - but I thought you’d like to learn about him too. Let’s take a closer look at the life of Bernard Mannes Baruch (1870-1965), a renowned American financier, stock market speculator, statesman, and political consultant.

To be clear, Baruch is not directly associated with the world of horology, but his incredible journey from a young speculator to a respected elder statesman offers valuable insights and lessons that can be applied to various aspects of life, including watch collecting. In examining Baruch’s experiences, decisions, and philosophy, I hope to inspire something in your horological pursuits. The principles of wise investing, adaptability, and the sharing of knowledge are, in my mind, as relevant to the world of watches as they are to the realms of finance and politics.

Early Life and Education

Baruch was born to Simon Baruch, a former Confederate Army surgeon, and Belle Wolfe, a descendant of a Southern aristocratic family. In 1881, the family moved to New York City, where Baruch attended public schools. At the age of 14, he enrolled in the College of the City of New York, now known as the City College of New York (CCNY).

Wall Street Career

After graduating from CCNY in 1889, Baruch embarked on his Wall Street career as a broker and eventually a partner at the firm A.A. Houseman & Co. His talent for stock market speculation quickly became evident, and by the age of 30, he had accumulated a fortune of approximately $15 million. Baruch’s success was attributed to his shrewd and bold investments in various industries, such as copper, railroads, and sugar.

By 1903, long before Jordan Belfort, Baruch had earned him the infamous nickname: “the lone wolf of wall street” - mainly because he refused to join any financial house. This wasn’t just a title; it also spoke to his unique approach to investing, which often involved going against popular opinion and trusting his own instincts. As watch collectors, and as we have discussed many times in SDC, we can learn from Baruch’s example by developing our own tastes and preferences, rather than simply following trends or seeking validation from others.

“I could not forget my father’s look the day I proudly informed him I was worth a million dollars. The kindly, quizzical expression told me, more clearly than words, that in his opinion, money making was a secondary matter… Of what use to a man are millions of dollars unless he does something worth while with them”

Public Service and Political Influence

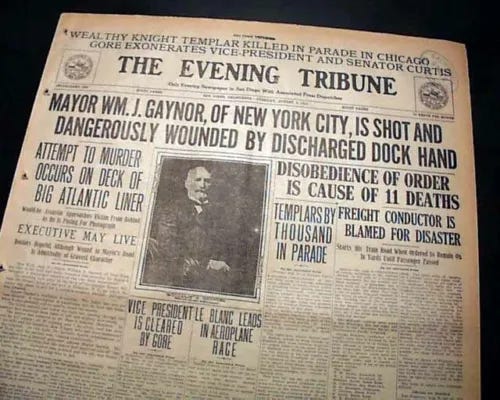

Inspired by his father’s wisdom, Baruch began to focus on public service. In 1910, New York City Mayor William Jay Gaynor appointed him as a trustee of CCNY. Baruch’s involvement in civic affairs led to his acquaintance with influential figures, eventually propelling him into the national and international spotlight.

During World War I, Baruch served as an adviser on the Council of National Defense and later as the chairman of the War Industries Board. After the war, he attended the Paris Peace Conference as an economic advisor to President Woodrow Wilson.

Throughout his life, Baruch maintained close relationships with numerous presidents and world leaders, including Winston Churchill and Franklin D. Roosevelt. His informal advisory role earned him the nickname “Park Bench Statesman,” as he often held meetings with representatives on a bench located across from the White House.

“At the age of forty-nine, I had already enjoyed two careers – in finance and, much more briefly, in government. The war had taken me out of Wall Street, often described as a narrow alley with a graveyard at one end and a river on the other, and plunged me deeply into the broad stream of national and international affairs”

Coining the Term “Cold War”

In 1947, during a speech at the South Carolina House of Representatives, Baruch popularised the term “Cold War” to describe the tensions between the United States and the Soviet Union. The term quickly gained traction and became a defining phrase of the era.

“Let us not be deceived—we are today in the midst of a cold war. Our enemies are to be found abroad and at home. Let us never forget this: Our unrest is the heart of their success. The peace of the world is the hope and the goal of our political system; it is the despair and defeat of those who stand against us. We can depend only on ourselves.”

Legacy and Lessons for Watch Collectors

Bernard Baruch’s life serves as an inspiration, demonstrating the importance of civic responsibility, adaptability, and the pursuit of knowledge. For watch collectors, Baruch’s experiences offer some valuable lessons:

Invest wisely: Just as Baruch carefully studied companies before investing, watch collectors should thoroughly research watches and the watch market to make informed decisions about what they buy, and when they buy it.

Diversify your collection: Baruch’s success stemmed from his investments in various industries. Similarly, watch collectors may benefit from diversifying their collections, exploring different brands, styles, and eras.

Share knowledge: Baruch’s informal advisory roles exemplify the value of sharing expertise. Watch collectors can contribute to the community by sharing their knowledge and experiences with fellow enthusiasts.

Adapt to changing circumstances: Baruch’s ability to navigate the tumultuous events of the 20th century highlights the importance of adaptability. Watch collectors should be open to evolving trends and technologies in the world of horology.

Pursue your passion with purpose: Baruch’s dedication to public service demonstrates how personal success can be channelled towards a greater good. Watch collectors can find fulfilment by engaging in philanthropic activities or supporting horological education and preservation - arguably needed now more than ever before.

Anything you’d add?

📌 Links of interest

😮 If I asked you to name the top 3 Rolex watches in terms of retaining value, I bet you’d never have guessed these three? That’s according to WatchCharts, who incidentally put the Panda Daytona close behind at ~116%, the Black Daytona at just over 90% and the Pepsi GMT Master 2 at just under 90%.

🤡 Robin Swithinbank suggests it is time for luxury brands to embrace the potential of quartz to sell more watches in this era of belt-tightening. What a spectacularly sh*t idea! 😂

💎 Rare Patek Philippe 5004s And The Private Collection Of Tony Kavak.

🎪 LVMH’s unit put under court administration in Italy over labour exploitation. The Dior investigation focuses on four small suppliers employing 32 staff in the surroundings of Milan, including two illegal immigrants and seven workers without the required documentation. Prosecutors allege that one of the Dior suppliers charged as little as €53 to supply a handbag that the brand sells for €2,600 in its boutiques.

🤑 Former Hodinkee managing editor, Danny Milton, cozies-up to Teddy B.

🖼 Wikipedia’s list of the most expensive paintings is quite interesting. Dmitry Rybolovlev seems to have most of the good stuff!

🍎 Apple Intelligence is Right On Time - Stratechery

🗣 You probably have a voice in your head when you read, but why – and is it helpful?

📺 Why Tubi CEO thinks ad-supported ‘Free TV’ can win again - Tubi isn’t just competing with Netflix for your time — it needs to beat TikTok, too. My take: without a competitive advantage on the content, they’re fkd. YouTube will copy their ‘USPs.’

☘️ Do plants have minds? A treatise on “soul blindness” if you’re feeling arty.

🔻 The video games industry set the record for most layoffs so far this year.

🤖 A Home Assistant user hooked up GPT-4 Vision with their security cameras and now can do things like find items in their home. What could go wrong?

♟️ A YouTuber evaluates over 5 billion chess games and finds the rarest move in the game. This is possibly the geekiest thing I’ve seen all year, and it’s not even close. I stopped understanding at some point, and still carried on watching. 😂

⌨ AI took their jobs. Now they get paid to make it sound human.

🤨The Pentagon ran an anti-vax campaign – obviously, China was involved!

💡 Thread of photographers who patiently waited to capture the shot of a lifetime.

🪂‘As Lonely as a Man Can Get’: The True Story of D-Day, as Told by Paratroopers

🖼 The 25 Photos That Defined the Modern Age (Epic read!)

End note

In case you missed it… here are two posts I shared in the last week:

In other news, if you were wondering how LVMH balances the books, paying for all the influencer content - here’s a clue:

They sell these things for €240,000 apiece - excluding taxes! While SJX thinks that pricing is ‘fair’ I’m going to go ahead and say, this is egregious.

Ordinarily, I’d probably put that Panerai chat here in the end note, but I wanted to keep it free so I found myself with an empty end-note. So I got thinking about something I read recently regarding how we treat our time. Seemed relevant, and I hope you agree.

In this fast-paced, hyper-connected world, we tend to treat our time like a scarce currency, and it feels like the right thing to do. We meticulously budget our minutes, always seeking the highest ROI for our precious hours… But are we really as smart as we think?

Life is like a cosmic bank account - every experience, every connection, every breath… Is like a small loan from the universe. Just like your credit score, neglecting these loans will have serious consequences.

Skipping a quality check to ship a product out on time? Prepare for the public-relations disaster when the product fails. Too busy grinding at the office to hit the gym? Good luck bouncing back from that heart attack. Can’t squeeze in date night? Better start researching divorce lawyers. Too tired to spend quality time with your kids? All the best with your reationship when they’re older.

We act like misers, hoarding our time like Smeagle and his ring, but in reality, we're often just shortsighted investors. We fail to see that the greatest returns come from the intangible assets - relationships, health, personal growth, and joy.

An hour spent laughing with mates, a day dedicated to learning a new skill, a weekend building a new Lego set with your kid - these are hidden dividends which will compound over time… They yield a life of profound richness and meaning.

Think of your time as a garden. You can either plant the seeds of meaningful pursuits and watch them blossom into a vibrant, fulfilling life, or you can let the weeds of your ‘busyness’ and distraction choke out your potential. The choice is yours.

In the grand scheme of things, our lives are basically like a Netflix subscription - we’ve got a finite amount of time to binge-watch the episodes we like the most. Why would you waste precious time on watching garbage?

Instead, be the master chef of your own time buffet. Fill your plate with activities and relationships that feed your soul. Savour each morsel of laughter, love, and learning. Don’t be afraid to leave the empty calories of pointless meetings and toxic people on the serving tray.

In the end, our lives are not measured by the number of emails we answered or the size of our bank accounts, but by the depth of our connections, the breadth of our experiences, and the impact we have on others.

Don’t be afraid to spend your time extravagantly on the things that truly matter. Invest in the people and pursuits that make your heart sing, because when the final ledger is tallied, it’s not the miserly minutes you’ll cherish, but the moments of unbridled love, laughter, and wonder.

In this wild and precious life, the greatest risk is not spending too much, but spending too little on what really counts. So go ahead - be a time billionaire, lavishly spend your hours on the joys and dreams that make life worth living.

Until next time,

F

🍸 Bonus link: Can You Solve The Martini Glass Puzzle?

A simple illusion that fools most people!

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

Including European billionaires and the Qatar Investment Authority (QIA)

VME discussion was interesting 👏🏽. Surprised you didn’t bring up the DeBethune light up watch in the beginning Panerai section!

Another great issue, still don’t understand how you have time to create this level of content! Especially the last week to 10 days!

Timeless and invaluable advice about how we spend our time!

To me this was the “sine qua non” of the issue and likely could be part of the banner below the title of this account….. Probably would take up too much room to tattoo on a forearm, however, but I think we all need to be reminded frequently of how we spend each moment

Wide range of interesting topics! I actually got through most of the links.

The 25 pictures that defined the modern era was good, but I would take issue with a few of them that I think would take a backseat to a number of other ones I can think of. The falling man is absolutely haunting! 😱🫣😦

Had not seen that before and will probably have a hard time getting it out of my head.

I have long been interested in the area of plants sentient possibilities….was trying to find a link to a study done once that showed plants reacting to shrimp being put into boiling water nearby but could not find it…. Here were a couple other ones I noticed recently.

https://www.newscientist.com/article/mg25534012-800-the-radical-new-experiments-that-hint-at-plant-consciousness/

https://www.theguardian.com/environment/2013/feb/21/bees-flowers-electric-fields-communication

VME was thought provoking

Was unable to view past the first photo of the thread of photographers who waited to capture the shot of a lifetime (perhaps needed subscription) but that first one was good enough alone