SDC Weekly 98: Storytelling; Expectations Debt; Cathedrals as Time Keepers

Rolex vs 'Laulex', Patek Loses “PP” Battle, Les Ambassadeurs Update, AI Trends, Conscious Consumption and How One Company Secretly Poisoned The Planet.

🚨 Welcome back!

Estimated reading time: ~29 mins

Admin note: The Unofficial Editor is currently convalescing after an altercation with a mildly venomous creature (the lizard is said to be in stable condition). No edits this week, but click this link to read the post online in case they stage a miraculous comeback.

If you’re new to SDC, welcome! If you have time to kill, find older editions of SDC Weekly here, and longer posts in the archive here.

Rolex vs 'Laulex'

This story is a few months old, but I only learned about it today. It turns out, choosing a brand name that rhymes with Rolex won’t fly under the radar! The European Union Intellectual Property Office (EUIPO) recently handed Rolex a comprehensive victory against someone cheeky enough to try registering “Laulex” as a trademark.

What’s interesting is that Rolex didn’t even need to prove confusion - they won purely on reputation grounds under Article 8(5), which protects famous marks from others trying to piggyback on their success. The EUIPO found that whilst consumers might not confuse Laulex with Rolex, they would certainly make the mental connection. That association alone was enough to constitute unfair advantage - which also goes to show how important storytelling can be… more on this later.

Both marks featured the letters “LEX” and included crown symbols, and even though Laulex tried to differentiate itself with different styling and the “LAU” prefix instead of “RO”, the EUIPO wasn’t buying it - particularly when Rolex demonstrated their brand recognition rates of 60-97% across key European markets through surveys in Germany, Denmark, Italy, and Poland.

This decision shows the strength of reputation-based trademark protection. Rolex submitted evidence spanning over a decade, including advertising in publications like Vogue, Financial Times, and The Economist, plus sponsorship records and independent press coverage. Even older evidence was accepted because it helped Rolex show continued market presence.

The ruling essentially confirms what we all kinda knew already - when you’ve built a reputation like Rolex’s (and can afford good lawyers!), the law will protect you from chancers trying to free-ride on your success. The EUIPO explicitly called out the “free-riding” aspect, noting that Laulex would benefit from Rolex’s goodwill and commercial value without any justification.

Patek Loses “PP” Battle

No, that’s not a euphemism. I share this because it is in stark contrast to the previous ruling on “Laulex” - as Patek suffered the opposite fate in their own trademark dispute. The EUIPO rejected Patek’s opposition against a Netherlands-based applicant who wanted to register a stylised “PP” mark for watches and jewellery.

In the previous instance, Rolex succeeded on reputational grounds without needing to prove confusion. Patek tried the more traditional route of claiming likelihood of confusion under Article 8(1)(b) - but came up short.

You can see the contested mark in the image above - given both sets of marks cover identical goods, you might think Patek had a strong case, but they didn’t win. The EUIPO found the visual differences were significant enough to prevent confusion, even if the goods were identical. The bold pink styling, asymmetric positioning, and absence of the shield supposedly created a sufficiently different overall impression from Patek’s monogram aesthetic. I found that remarkably inconsistent, until I learned more about this case.

As it happens, what really hurt Patek’s case was that they didn’t hire good lawyers! They submitted evidence of their enhanced distinctiveness and reputation after the deadline, and this meant that the EUIPO ignored it entirely. As a result, the case was assessed purely on the inherent distinctiveness of basic “PP” letters, and not on Patek’s decades of brand building.

Rolex, in their case, submitted extensive evidence spanning over a decade, and showed the EUIPO that their brand recognition rates were as high as 60-97% across Europe. That evidence was crucial to their (Article 8(5)) reputation-based victory. Patek is arguably an even more prestigious brand, but they fvcked up the paperwork and lost.

In short, strong brands can protect their reputation through trademark law, but only if they follow proper procedures and submit evidence on time. 😂

Here’s one more recent case involving Louis Vuitton and Van Cleef which you can read for yourself.

Les Ambassadeurs Update

Les Ambassadeurs, the Swiss retailer with prime spots on Zurich’s Bahnhofstrasse and Geneva’s Rue du Rhône, has basically turned into a luxury watch clearance centre offering 30% discounts on Breguet, Blancpain, and Omega - the kind of public discounting that would normally make brand executives break out in hives. In this case, it is more a case of “when you’ve got nothing left to lose, you stop playing by the rules.”

Les Ambassadeurs’ chairman Renato Vanotti doesn’t mince his words about what’s happened to his business. “The big watch companies are the gravediggers of the specialist trade,” he told the media1.

The timeline of abandonment:

IWC was first to jump ship

Richemont brands followed suit

Then Audemars Piguet, LVMH, and Kering

The final blow was Swatch Group which terminated cooperation last summer

That last one was supposedly brutal because losing Omega, Blancpain, and Breguet meant a 30% drop in sales. Try financing Bahnhofstrasse rent with that kind of revenue shortfall.

Vanotti’s annoyed with COMCO (Swiss competition authority) approving Rolex’s acquisition of Bucherer without any serious scrutiny. “Bucherer has a de facto monopoly in multi-brand retail,” he argues, and I’d agree with him.

While Les Ambassadeurs scrambles for investors (some independent brands like Bovet are reportedly willing to help), Bucherer continues its transformation into Rolex’s global retail empire. I suppose the old model where retailers held any power has all but flipped entirely. Brands tend to dictate everything now, from store design to customer experience, and if you don’t comply, you’re out.

Vanotti has until mid-June to find new investors, but even if he succeeds, Les Ambassadeurs will move to cheaper locations and focus entirely on independent brands. It might actually work for them, given the indie segment has been growing - but it’s also an admission that the traditional multi-brand luxury retailer is all but extinct.

Enough small stuff!

💸 Expectations Debt

I’m a huge fan of Morgan Housel, and he recently shared an essay about a concept which is really useful to apply to the current watch market malaise2. He calls it “expectations debt” – the idea he shared is that when we achieve extraordinary success, we create a psychological liability that must be repaid before we can feel joy again.

He goes on to explain how, when Amazon’s stock was flying high in 2021, employees and investors were living in a reality where extraordinary had become rather ordinary. In fact, when results returned to merely being “good,” it felt like failure even though it wasn’t. In his words, Amazon had accumulated an expectations debt that had to be repaid through years of disappointment - even when actual performance was solid.

“Expectations are like a debt that must be repaid before you get any joy out of what you’re doing.”

As it happens, I thought this explains a lot about the watch market, too!

Back in 2021 most Rolex watches were “an investment” and people who technically couldn’t even afford luxury watches were using money they couldn’t afford to lose to form relationships with ADs as if they were buying shares in Apple circa 2007. This was a time when your mate who couldn’t tell a balance wheel from a steering wheel was suddenly an expert on reference numbers for every watch in the Rolex and Patek catalogues, and had an encyclopedic knowledge of retail prices vs secondary market prices for every reference.

Most will agree it was a ‘market’ bubble; but as Housel explains, it was also the start of an expectations debt building up. I think we are still paying off that debt.

The watch industry grew during and after the pandemic, and what came with this rapid growth was a rewiring of consumer psychology. Suddenly, buying a steel sports watch wasn’t about enjoying a well-made and reliable watch, but about making 50-100% returns, sometimes overnight. ADs went from being retailers to gatekeepers of a magical money machine. Even mediocre, entry-level pieces from a lot of mid-tier brands seemed to carry an implicit promise of appreciation. Czapek immediately comes to mind here!

The truth is that collectors spent two years living in a fantasy world where mechanical watches turned into (guaranteed) profit generation objects. That fantasy created a debt that I reckon will take a while to repay.

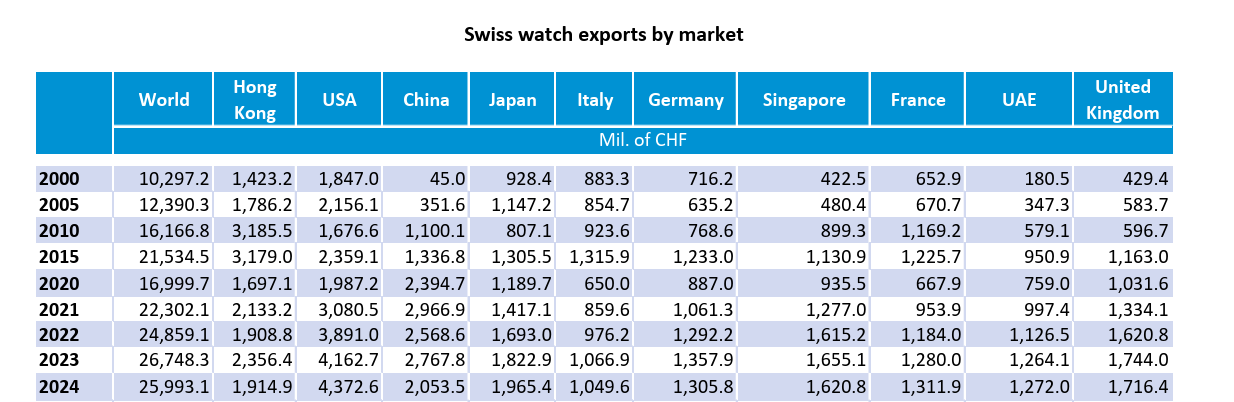

Market

Right now, Swiss watch exports are down, but to a certain extent the current levels would have seemed miraculous around 2019 (pre-bubble). Rolex’s most popular models are still not available to walk-ins, and Patek continues to perform well. By any reasonable and historical measure, the industry is doing alright.

So why does it feel like everything’s totally fvcked?

Maybe it’s just because we need to repay our expectations debt! Every watch that sells at retail instead of double retail, might still feel disappointing, and to some, it may even feel like a loss. Every waitlist that actually allows you to move up quickly, feels a bit suspicious. Every time a brand announces a new release that is not instantly sold out, it perhaps feels like a complete failure; and it’s quite possible that even the brand themselves feel this way too, which is nuts!

Housel mentioned the Japanese stock market as a historical parallel. He explained that the Nikkei’s returns from 1965 to 1990 were extraordinary – so extraordinary that it took 33 years of stagnation just to bring people’s expectations back to reality. But the market didn’t really stagnate at all; it was just repaying the debt accumulated during the boom years.

The watch market feels similar.

Collectors

Naturally, it isn’t only the brands who are carrying this debt – collectors are drowning in it too. It wasn’t too long ago when buying the “right” watches was like a separate career. Happily swiping your card for a two-tone Datejust was a straightforward investment in your AD relationship and you knew it would pay dividends in the form of desirable hype-models.

That mentality created its own expectations debt. Now, people are slowly realising they need to actually like the watches they buy. What a chore, right? The idea that you might lose money on a luxury purchase – which was completely normal for all of human history until about 2019 – somehow feels like a personal betrayal.

Someone in a group chat recently said something to a dealer, along the lines of “why would I sell this watch for a loss”. This is madness! You bought a luxury item, enjoyed it, and it depreciated slightly. Is that stupid? No. It’s quite normal, I thought! The problem is when your expectations have been warped by a few years of guaranteed appreciation, normal starts to feel like a failure.