SDC Weekly 120; Wealth migration and the watch market; Breguet’s evolution

JC Biver delivers a sermon, Goldman Sachs explains why we're not in a bubble, Trump’s tariffs in the supreme court this week, Rolex's philosophy of precision, refuelling a nuclear reactor, and more!!

🚨 Welcome back to SDC Weekly!

Love him or hate him1, J.C. Biver appeared on a podcast for the first time in a long time as far a I can recall; for me, it’s always a treat to listen to him speak… he’s so energetic. One thing which stood out to me was JCB’s claim that his brand made 100 watches last year… this struck me as odd, given the amount of hand work they claim to do in each watch. I reached out to Pierre Biver who cheekily told me: “He is largely exaggerating as per usual” … 😂

Pierre and I had a short chat and clarified a few things. First, the Biver brand made 14 repeaters and 8 Automatiques last year; not 100 watches. They have grown their team to 8 decorators and 5 watchmakers, and will therefore produce a few more watches in the next year. It is true, however, that the brand does aspire to produce up to 100 watches per year, but Pierre explained it was specifically hand work which was limiting their growth. Anyway, enjoy Biver’s sermon:

Admin note: The Unofficial Editor is recovering from a legal misunderstanding with a kangaroo over “jumping to conclusions”, so click here to read this post online and ensure you see all corrections made after publishing.

If you’re new to SDC, welcome! If you have time to kill, find older editions of SDC Weekly here, and longer posts in the archive here.

Estimated reading time: ~25 mins

🗺 Wealth migration and the watch market

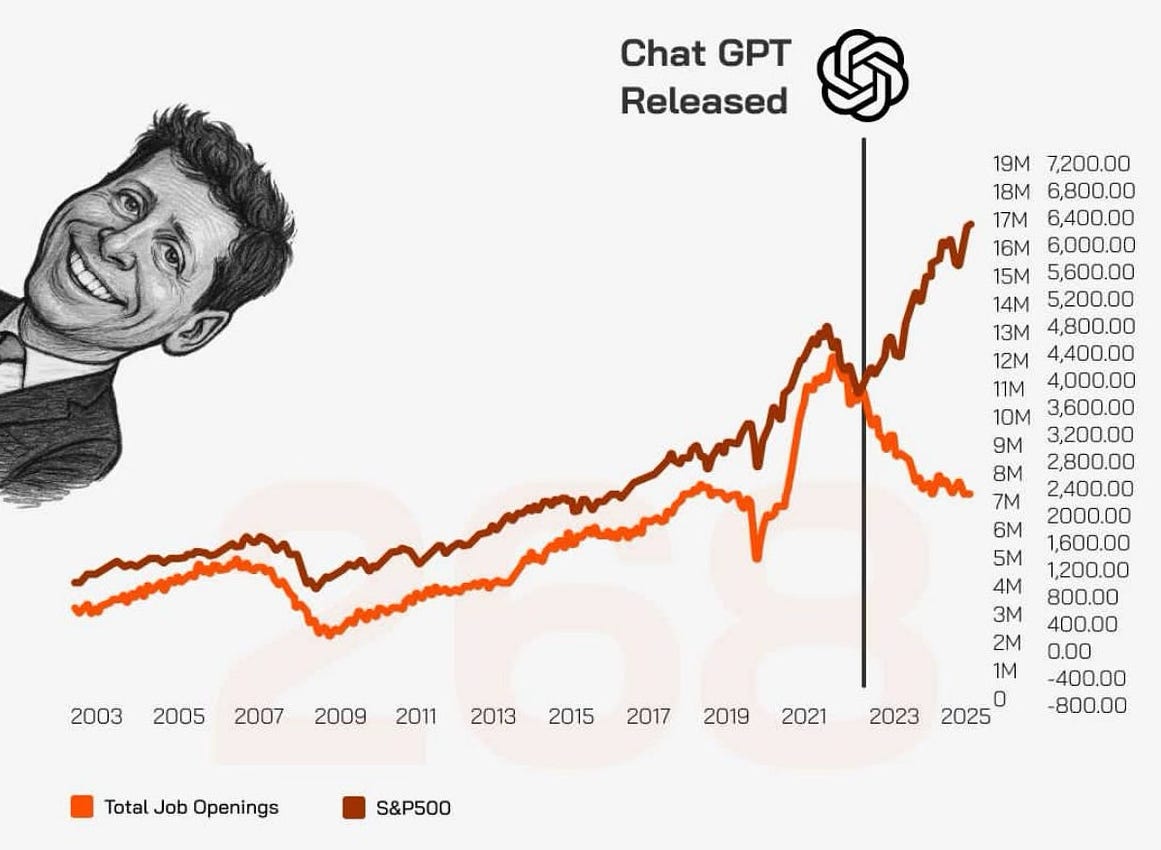

There’s a particular chart that’s been doing the rounds lately, one that Derek Thompson called potentially “the scariest chart in the world” - here it is:

Since November 2022, when ChatGPT launched and kicked off the AI craze, the S&P 500 has rallied ~70% and job openings have collapsed by about 30%. Nothing like this divergence has happened in modern economic history.

At first glance, it might be tempting to conflate correlation and causation, but really, this backdrop speaks to the economic landscape we’re faced with right now. In this section, we will assess how this can be used to explain both what’s happening in the watch market today, and where opportunities might emerge in the years to come.

And no, this isn’t specifically about “AI destroying the economy” or any of that stuff; it’s more about the bifurcation of wealth and opportunity happening in the world, and how this will affect luxury spending… which of course includes luxury watches. Before we get to that, let’s recap on the topic of bifurcation.

K-shaped economy

You may have heard the term “K-shaped” before, and if not, the above chart is a simple example; note how the lines form a “K” as they diverge. Economic trends currently suggest that this gap will widen rather than narrow. Last month CNBC reported on how this “bifurcation”2 is taking place in multiple sectors. Coca-Cola’s CEO said high-end products are driving sales growth, and that they see higher demand for expensive products (protein shakes etc). McDonald’s CEO literally mentioned a “two-tier economy” where upper-income consumers serve them well, and lower and middle-income traffic “is down double digits.”

Two food and beverage examples do not a trend make… but there’s more, because this framework extends beyond F&B. Delta (airline) says they expect to make more revenue from “premium offerings” that their economy cabins next year. Hilton’s (hotel) CEO admits to seeing a bifurcation too (but suggests this won’t continue for very long due to treasury decisions). Then there’s the auto market, with average new vehicle prices topping $50,000 for the first time ever, supposedly helped by wealthier households; and meanwhile, car-loan defaults and repossessions are on the rise for those with ‘fair’ or ‘poor’ FICO scores3 i.e. not wealthy people.

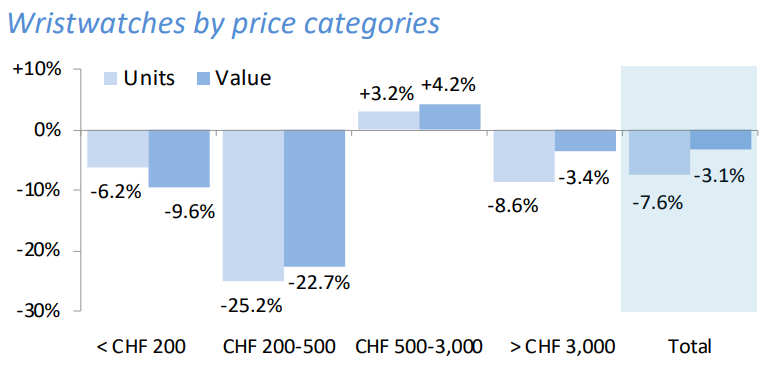

The watch market, in my opinion, seems to mirror this trend of bifurcation. Patek and Rolex seem to have become “safe haven” brands now, and are performing relatively well in a difficult market. Meanwhile, the cheaper watches (under 500 Swiss Francs) show the worst performance in FH export data (August was even worse for the sub-200 category):

I wrote the following in October, covering the Morgan Stanley Q3 report:

Omega, Cartier, and IWC all showed strong secondary demand in Q3, with rising absorption rates and stable-to-improving fundamentals. The thing is, this “strength” is almost certainly being driven by the widening gap between retail and secondary prices.

When you can buy an Omega at -38% below retail on the secondary market, or a Cartier at -31% off, you’re naturally going to see demand shift away from boutiques. Is this a sign of health, or a sign that retail prices have become completely disconnected from reality?

I’d argue it’s the latter.

Anyway, hold your thoughts a little longer…