SDC Weekly 61; Where Do Culture Wars Take Us?; The Monty Hall Problem

Sotheby’s $1Bn Deal, Bremont's Woes, AP Shenanigans, What Exactly is Studio Underd0g?, Chronext goes bust, Middle finger history, Seinfeld Economics, EsperLuxe Debunking, and Mario de Andrade.

🚨 Welcome to another edition of SDC Weekly. Estimated reading time: ~45 mins

We’re back! Today we’re covering deals in the Middle East, more Rolex patents, the financial tribulations of ambitious watchmakers, the intersection of technology and tradition with the rise of digital fashion, and the philosophical implications of probability theory on watch collecting.

If you’re new here, welcome! You can read older editions of SDC Weekly via this link.

Small stuff

Sotheby’s $1 Billion Deal with Abu Dhabi

Last Friday ADQ1, an Abu Dhabi-based sovereign wealth fund, investment, and holding company, has entered into a definitive agreement to acquire a minority stake in Sotheby’s. The deal, valued at approximately $1 billion, will see ADQ purchasing newly issued shares of Sotheby’s. Concurrently, Patrick Drahi, the current majority owner of the auction house, will supposedly invest additional capital, which is bizarre given he was supposedly cash strapped. What does it mean?

Middle East Market Expansion: The partnership with ADQ is likely to solidify Sotheby’s presence in the Middle East, which is currently one of the fastest-growing markets for art and luxury goods.

Financial Strengthening: A portion of the funds is expected to be used for strengthening Sotheby’s financial position, providing the company with more resources to pursue its strategic goals.

Real Estate Expansion: Sotheby’s has ambitious real estate expansion plans, which this investment is likely to support. Recent initiatives include the recently opened Maison in central Hong Kong, a new building on Rue de Faubourg in Paris (set to open in October 2024), and the iconic Breuer Building in New York (scheduled for completion in 2025).

Innovation and Client Services: Sotheby’s CEO, Charles Stewart, emphasised the investment will enable the company to accelerate its strategic initiatives, expand its commitment to excellence in the art and luxury markets, and continue to innovate in client services.

Earlier in 2024, Sotheby’s announced a radical new fee structure, indicating efforts to adapt to changing market conditions. The investment from ADQ comes at a time when Sotheby’s is clearly focused on expansion and innovation in the luxury market. It is still unclear whether the fee structure was a good move, but the upcoming auction season will be telling.

The transaction is anticipated to close by the end of 2024, subject to regulatory approvals. This timeline suggests a complex deal structure that may require scrutiny from various regulatory bodies. As the auction world continues to evolve, this partnership will possibly set a precedent for future collaborations between established auction houses and sovereign wealth funds in the region. More on this ‘evolution’ below!

Bremont’s Buffoonery v2

Covering Bremont two editions in a row, is undoubtedly a low point for this newsletter, but here we are. The financial year ending 30 June 2023 has been, to put it mildly, a challenging one for Bremont. The headline figures are stark: a £14 million loss, coupled with an 8% drop in sales.

Turnover has declined across most regions, with the UK market - Bremont’s bread and butter - taking a particularly hard hit. A near 10% drop in their home turf, which accounts for three-quarters of their revenue, is worrying. The fact that this occurred before the broader industry slowdown suggests internal issues rather than merely external market forces at play.

The substantial increase in cash on hand - from £3 million to £17.7 million - is noteworthy. While liquidity is generally positive, such a dramatic increase raises questions. Is this a result of the Hellcat investment2, or perhaps unsold inventory? Speaking of which, the £5.7 million in exceptional costs, primarily related to stock provisions and credit note provisions, paints a picture of a company grappling with overproduction and channel stuffing.

The rise in headcount from 141 to 172 employees, accompanied by a commensurate increase in the wage bill, is curious given the drop in sales. This expansion during a period of contraction suggests either misplaced optimism or a strategic repositioning that has yet to bear fruit. Just this week, they announced the appointment of Martin Parker to the board, who said:

“It is an exciting time to join Bremont,” adds Mr Parker. “This unique British brand boasts a world-class management team, a highly skilled workforce, committed investors and a promising future. I look forward to working with the entire team as they continue to create a British national champion in the global luxury watch market.”

Clearly a delusional chap. He will fit right in, I suppose.

The accounts make mention of “significant resources” committed to the ENG 300 movement development. While the exact figure isn’t provided, we can infer it is substantial given its prominence in explaining the loss. This bet on in-house manufacturing appears to have come at the expense of other product lines, a gamble that, at least in the short term, has not paid off.

Bremont’s situation is a cautionary tale of the perils of vertical integration in the watch industry. The allure of in-house movements is strong - they promise prestige, independence, and potentially higher margins. But the road to self-sufficiency is paved with the bones of many an ambitious brand.

The ENG 300 project seems to have become a noose around Bremont’s neck. The constraints it placed on other product lines suggest a lack of operational flexibility which is crucial in today’s uncertain market.

The decline in UK sales is particularly troubling. Bremont has long positioned itself as a quintessentially British brand, leveraging its heritage and connection to aviation and adventure. So now, if they are losing ground in the home market, one must question whether its brand narrative is still resonating with consumers.

The increase in headcount during a period of declining sales is bonkers - not to mention the near doubling of directors’ remuneration. While it could represent an investment in future capabilities, it also risks creating a bloated organisation ill-suited to nimble market responses. The watch industry, despite its love of tradition, requires adaptability in the face of changing preferences and economic conditions.

Bremont’s situation bears some resemblance to other independent brands that have attempted to punch above their weight in terms of manufacturing capabilities. Parmigiani Fleurier comes to mind3 - a brand that invested heavily in movement manufacturing but struggled to translate that into commercial success for many years.

Looking ahead, Bremont faces a critical juncture. The arrival of Davide Cerrato, known for being a grim reaper at almost all the previous brands he’s served, coincides with this worrying status quo. That’s no accident. The lukewarm reception to recent releases like the Terra Nova (and the associated rebranding) indicates that any turnaround will not be immediate or easy.

The broader context here is the ongoing consolidation in the watch industry. As larger groups like Swatch, Richemont, and LVMH continue to dominate, independent brands like Bremont face an uphill battle. The resources required to develop in-house capabilities, maintain global distribution networks, and create compelling marketing narratives are substantial.

The coming year will be crucial in determining whether Bremont can right the ship, or whether its foray into in-house manufacturing will be remembered as a bold but ultimately misguided venture - objectively, after looking at their historical performance, it would seem the most valuable decision might be to shut the business down. I don’t mean to be flippant about the 172 people who would lose their jobs, but this company appears to be a simple case study on throwing good money after bad.

Rolex Patents

I don’t know how I came to be so obsessed with Rolex patents, but another week, another section on Rolex patents!

The first patent, describes what seems to be a method for producing a smoother surfaces on clock or watch components made of ceramic materials. The invention aims to improve the manufacturing process for by addressing challenges in creating smooth, geometrically accurate surfaces on ceramic parts.

The method involves a two-step process - 1) Machining with a femtosecond laser beam, and 2) Tribofinishing, which is basically polishing the surface to further reduce roughness and achieve the final desired surface quality.

The patent also discusses the application of this method to various watch components, including balance staffs, escapement wheels, and other parts of the watch movement, meaning there is potential for creating components with improved performance such as better resistance to wear and more stable operation over time.

The second patent describes a method for strengthening components made from micro machinable materials, particularly silicon. The invention aims to improve the mechanical properties of these components while maintaining their precision and dimensional stability.

The process also involves two main steps (seems to me a trend with them) - 1) Producing an unfinished component and 2) Performing a smoothing treatment comprising hydrogen smoothing on at least one portion of the component's surface.

This almost sounds like a joke! The patent emphasises the use of an oxide layer with a thickness larger than 1 micron on at least one portion of the component’s surface. This oxide layer is intended to increase the mechanical strength of the part. They claim this method can produce components with a mean strength of about 3000 MPa and a minimum strength higher than or equal to 1000 MPa which is pretty insane4!

One of the key advantages of this method is its ability to smooth out surface defects and sidewall roughness that can occur during the manufacturing process, particularly when using deep reactive-ion etching (DRIE) techniques which we’ve covered before. These defects can lead to stress concentration points and potential failure of the components under normal use.

The patent also discusses comparative tests performed on different batches of components, which seem to demonstrate the improved strength and reliability achieved through this process. This was rather technical, but I know a handful of readers love this stuff, so hope it was worthwhile for you nerds.

How AP is Playing Chicken with the Market

On the face of it, Audemars Piguet (AP) seems to be doing well, and I even had some positive things to say about them in the last edition. That said, I recently learned how they appear to be playing a dangerous game of chicken with the market. Their strategy, born from the dizzying heights of pandemic-era resale prices, is amusing if nothing else.

When AP saw the eye-watering grey market prices for their hot pieces during the pandemic, rather than seeing this as a fleeting moment of market madness, they decided to go all in. It was essentially a two-pronged approach; First, gradually increase retail prices, because why let those pesky resellers have all the fun? Then, use inflated grey market prices to shift their unwanted stock.

Many talk about ‘bundling’ - but that’s like calling a Great White Shark a slightly toothy fish. Here’s how their circus act works:

Produce more watches than the market can stomach.

Force collectors to buy less desirable pieces to get the hot ones.

Prohibit reselling for two years5, effectively handcuffing buyers to their purchases.

Profit from things you can't sell. (In theory, because who doesn't love a good fairy tale?)

AP obviously didn’t purposely set out to categorise their watches, but these categories emerged naturally, and are now officially embraced by the brand (my own naming of course, but these represent the three categories being used by AP):

The Duds: Watches that couldn’t sell if they came with a free Rolex. Think Code 11.59, the dad bod in a speedo.

The Hot Stuff: Pieces like the Royal Oak 16202. The popular kids of the watch world.

The Unicorns: Gem-set pieces or special editions like the Travis Scott or John Mayer.

What’s crazy about this, is AP is basing the strategy on Chrono24 listings. Here’s how it works: If a Royal Oak 16202 retails for £50k and resells for £100k on Chrono24, AP thinks they’re ‘giving you £50k’ in value. So, they expect you to buy something from the dud watches category to the value of £50k because you ‘owe it to them.’ Of course, the ‘spend expectation’ gets worse, the more desirable your watch is on the grey market. This is not bundling; this is hostage taking!

In the short term, AP thought they’d cracked the code (11.59!). Offload unpopular watches at full retail price while keeping their stars artificially high. Genius! Or so they thought.

As the market cools, we’re now seeing the first cracks in this façade. Residual values are dropping, consumer confidence is waning, and AP is now cold-calling clients who’ve lost interest (including some who have been blacklisted!).

This strategy is a masterclass in short-term thinking. They’ve confused scarcity with value, and control with loyalty. The strategy works in a bull market and falls apart in a bear market.

As a result, we’re seeing a flood of “less desirable” models in the secondary market, prices realigning closer to true market value, as people stop holding for fear of blacklisting, and probably a painful period of brand rehabilitation on the horizon.

In the end, AP might learn the hardest lesson in luxury: True value can’t be manipulated; it can only be created. They took a gamble, betting they could rewrite the rules of supply and demand, but the unforgiving logic of the free market seems to be prevailing.

Don’t get me wrong - Rolex AD’s do this too, and they also seem to have a similar categorisation system, but they don’t directly link it to grey market values. For example, they might say you should buy a precious metal watch before being allocated a Daytona, GMT or Sky-Dweller - but they don’t nitpick. You will probably still end up ‘breaking even’ by selling the piece you don’t want at a loss, meaning customers are more likely to keep coming back for more. With AP, my point is they are being extremely arrogant about the ‘value’ of their watches (monetary and perceived), and if they shun too many customers it’ll be difficult to get them back. Besides, Rolex is a law unto itself - brands who copy them eventually learn why they should not do so.

Democratising Auction Guarantees

Guarantees in high-end auctions have long been a tool reserved for the most valuable lots, providing a safety net for sellers of multi-million dollar lots. A new startup is aiming to extend this protection to modest lots too, potentially reshaping the auction landscape – and the implications for the watch market could be significant.

In today’s auction market, guarantees are primarily the domain of blue-chip artworks and the most coveted collectibles. These financial arrangements come in two main flavours: direct guarantees from the auction house itself, and third-party guarantees where an outside party agrees to purchase the lot at a set price if it fails to meet that threshold at auction.

For sellers, guarantees provide a measure of certainty in an often unpredictable market. For auction houses, they can help secure high-profile consignments. And for third-party guarantors, they offer a potential avenue for profit, albeit with considerable risk.

Still, the use of guarantees has not been without controversy, as we saw last year. Critics argue that guarantees can distort the market, creating artificial price floors and potentially misleading buyers about the true demand for certain pieces. Moreover, the often opaque nature of these arrangements inevitably leads to calls for greater transparency.

Despite these concerns, guarantees have become increasingly prevalent in recent years, particularly at the upper echelons of the market. According to data from ArtTactic, guaranteed lots accounted for over 54% of evening sales in the postwar and contemporary art segment in the first half of 2023, by hammer value.

Enter The White Glove, a UK-based startup looking to shake up this established order. The company bills itself as the first online marketplace connecting sellers with guarantors. Their goal is to make guarantees more accessible and transparent, even for lower-priced items.

The White Glove’s innovation lies in creating a platform that allows sellers to negotiate minimum guaranteed prices ahead of an auction. If bids exceed this price, the profits are shared between the seller and the guarantor. This model, the company argues, reduces risk for all parties involved.

How might this new model change the game for watch auctions and collectors?

Firstly, by making guarantees accessible for lower-priced items, this system could open up new possibilities for sellers of mid-range luxury watches. Currently, guarantees in the watch world are largely reserved for exceptionally rare or valuable timepieces. The White Glove’s model could change that, providing a safety net for sellers of more modest, but still significant, watches.

This could lead to an increase in consignments, as collectors feel more confident in putting their pieces up for auction. This would lead to a potentially more diverse and vibrant auction market, with a wider range of watches coming under the hammer.

The implications probably go beyond just increasing market liquidity and bolstering authentication. This model could fundamentally change the dynamics of watch auctions. Currently, watch auctions can be unpredictable affairs. A piece might far exceed its estimate due to unexpected demand, or fail to meet reserve due to a lukewarm reception. This unpredictability is part of what makes auctions exciting for many collectors, but it’s also a source of anxiety for sellers, who can never be certain of the outcome.

The White Glove’s model could change this, and for sellers, this could be a boon. For buyers, however, it might change the nature of the auction experience. The thrill of potentially snagging a bargain will be diminished if more lots come with preset floors.

Moreover, this system could impact how we perceive the value of watches at auction. If more pieces come with guarantees, it could create a new baseline for pricing. This could be beneficial in terms of market stability, but it might also lead to concerns about artificial price support, similar to criticisms levelled at guarantees in the art world.

While the potential of this new model is intriguing, the watch market is notoriously traditional. Will auction houses and collectors embrace this approach? I think so, but I can also see how this makes auctions more susceptible to gaming.

There’s also the question of how this system would interact with the existing structures of the watch auction world. Major houses like Phillips, Christie’s, and Sotheby’s have their own systems and relationships with high-end collectors. How would the White Glove’s more democratised approach fit into this ecosystem? Would they even want to collaborate?

The White Glove’s model is still in its infancy, and it remains to be seen how it will develop and whether it will gain traction in the broader auction world, let alone the specific realm of watch auctions.

Still, this development is worth watching closely as watch collectors. It could herald a new era of more accessible, transparent, and secure auctions, but it might also change the very nature of what it means to buy and sell watches at auction.

Studio Underd0g: Thoughts?

In the stuffy world of horology, Studio Underd0g has burst onto the scene like a confetti cannon at a funeral. With their vibrant, playful designs and cheeky naming conventions (Watermel0n, anyone?), they seem to have captured the attention of watch enthusiasts and industry pundits alike - they even made it to the GPHG! But as the dust settles and the initial excitement fades, it's time to ask: Is Studio Underd0g a breath of fresh air in a stagnant industry, or merely a colourful distraction from true horological excellence?

In an industry often criticised for its lack of creativity and reliance on heritage designs, Studio Underd0g dares to be different. Their watches, with their fruity themes and bold colour schemes, are undeniably eye-catching to many6. They’ve managed to create pieces that are instantly recognisable, no small feat in a crowded market, and a trait which I have praised other watches for in the past.

Moreover, Studio Underd0g has demonstrated a commendable commitment to quality within their price bracket. The use of the Seagull ST-1901 movement in their chronographs, while not haute horlogerie, shows an appreciation for mechanical watchmaking that sets them apart from many fashion-focused brands. Their more recent move to Swiss Sellita movements in the 02Series further underscores this commitment.

The brand’s transparency and engagement with their community is mostly praiseworthy, aside from what seems to be a virtue-signalling play from the founder as he publicly cancels the orders of people who pre-order watches and flip them on eBay. In an industry often shrouded in mystery and elitism, Studio Underd0g’s approachable demeanour and willingness to share their journey is kinda refreshing.

Anyway, for all their creative flair, one must question whether Studio Underd0g is pushing watchmaking forward in any meaningful way. Their designs, while fun, often feel more like toys or novelties than serious watches. The question remains: once the initial amusement wears off, what’s left? I have heard from numerous collectors who fell for the hype, bought one, and now admit they never use it, nor do they plan to ever use it again.

The brand’s reliance on off-the-shelf movements, while understandable at their price point, means they’re definitely not contributing to the advancement of watchmaking and so, their ‘innovations’ are purely aesthetic. Not to say this is a bad thing, and this is true for many other brands too.

Furthermore, the whimsical nature of their designs may limit their appeal to a niche audience. While this has clearly worked in their favour so far, it is worth questioning whether this approach has longevity. Will the Watermel0n watch still feel fresh in a couple of years, or will it be relegated to the back of the drawer like the collectors from my small sample?

In many ways, Studio Underd0g exemplifies the very issues highlighted in my recent post: “The Decay of Luxury Watchmaking”. While they’re not positioning themselves as a luxury brand per se, their success is symptomatic of an industry where marketing and novelty often trump horological substance.

The brand’s rapid rise to prominence, fuelled more by social media buzz than watchmaking prowess, raises uncomfortable questions about what we, as consumers, truly value in our watches. Are we more interested in Instagram-worthy wrist shots than in the painstaking innovation in watchmaking?

For a serious watch collector, Studio Underd0g presents a conundrum. On the one hand, their pieces are probably fun and offer a level of creativity often lacking in more established brands. They could be seen as a playful addition to a collection, a conversation starter that doesn't take itself too seriously.

On the other hand, these watches don’t push the boundaries of horology in any meaningful way. They don’t represent a significant investment in terms of craftsmanship or innovation. For a collector focused on the art and science of watchmaking, Studio Underd0g may feel more like a distraction than a serious addition to their collection.

Then, if Studio Underd0g wishes to transition from novelty to somewhat respected watchmaker, they will need to focus on more than just quirky designs. Investing in movement development, improving finish quality, and perhaps exploring more subtle, sophisticated designs could help broaden their appeal. But of course, such a pivot comes with risks. The very qualities that have made Studio Underd0g successful – their irreverence, their boldness, their accessibility – could be lost in a move towards more traditional watchmaking values. Just look at Bremont!

I suppose for now, Studio Underd0g occupies a unique position. They’re not pretending to be haute horlogerie, nor are they content with being a mere fashion accessory. They exist in a playful middle ground, offering mechanical watches with a hefty dose of whimsy.

For the price of an alligator watch strap from Jean Rousseau, one can own a piece that brings a smile to some faces – no small feat in an industry often characterised by po-faced seriousness. In this light, perhaps we shouldn’t be too quick to dismiss Studio Underd0g as completely frivolous.

Studio Underd0g, then, is perhaps best viewed as a guilty pleasure. A bit of horological candy – sweet, enjoyable, but not to be mistaken for a substantial meal. In a balanced diet of watches, there’s always room for such treats. Just don’t mistake them for the main course.

Digital Fashion - A new Frontier?

In the world of luxury and fashion, a new initiative is making waves - The Digital Fashion Designers’ Council, a recently launched nonprofit organisation, is embarking on an ambitious journey to bridge the gap between the physical and digital realms of fashion.

For years, the concept of digital fashion - clothing and accessories that exist solely in virtual spaces - has been gaining traction. Despite significant interest from both established luxury brands and innovative startups, digital fashion has however struggled to break into the mainstream.

The reasons for this are perhaps obvious. There’s the challenge of creating truly immersive and realistic digital representations of physical goods. Then there’s the issue of interoperability - ensuring that digital fashion items can be used across various platforms and mediums. Perhaps most significantly, there’s the question of perceived value. How do you convince consumers - particularly those accustomed to the tangible luxury of a finely crafted watch or a bespoke suit - that a digital asset holds any worth?

This is where the Digital Fashion Designers’ Council (DFDC) comes in7. The DFDC has partnered with plurality network to develop a new tool called the Reality Spectrum Matrix (wtf!). This technology aims to present virtual fashion across multiple channels and platforms, including VR headsets, metaverses, social media, and gaming environments.

To demonstrate the potential of this technology, the DFDC has planned a series of events and partnerships with major luxury brands. These include a Digital Fashion Film Festival in collaboration with Nick Knight's ShowStudio, featuring brands like Balenciaga and Bottega Veneta, and a VIP reception showcasing Dolce & Gabbana’s multi-million dollar Collezione Genesi NFT project.

By now I am sure you are wondering: “What the f*ck does this have to do with watches?”

On the surface, the connection might not be obvious, unless you have seen my previous posts on AI. The tactile pleasure of a finely crafted mechanical watch seems worlds away from the intangible realm of digital fashion, sure. But consider the concept of digital twins. While not explicitly mentioned in the DFDC’s plans, the idea of creating exact digital replicas of physical items is a natural extension of their work.

For the watch industry, this could mean the ability to create highly detailed, interactive digital versions of watches. These digital twins could revolutionise how collectors interact with rare or valuable watches, allowing for close examination and appreciation without the risk of damage or wear to the physical item.

The Reality Spectrum Matrix technology could also transform watch auctions. Imagine being able to virtually try on a rare vintage Patek, examining every detail in high resolution, all from the comfort of your own home. This could make high-end watch auctions more accessible to a global audience, potentially expanding the market and introducing new collectors to the world of watches and auctions.

For watch brands, the implications are equally exciting. The ability to create immersive digital experiences around their watches could open up new avenues for marketing and customer engagement. Brands could offer virtual try-ons of upcoming models, create interactive digital museums showcasing their heritage pieces, or even release limited edition digital-only watches as collectibles.

The concept of phygital (physical plus digital) watches, similar to Dolce & Gabbana’s Collezione Genesi, could also gain traction. Imagine purchasing a luxury watch that comes with a unique digital asset - perhaps an NFT that serves as a certificate of authenticity, or a digital twin that can be worn in virtual environments. This could add a new dimension to watch collecting, blending the tangible pleasure of owning a fine timepiece with the flexibility and innovation of digital assets.

‘Could’ is true for many outcomes… I ‘could’ win the lottery tomorrow, but I probably won’t given I don’t play. The watch industry, steeped in tradition and craftsmanship, will be slow to adopt these digital innovations than the fashion world; that is, if they ever do. There’s also the question of how to maintain the exclusivity and prestige associated with luxury watches in a digital space where perfect copies can be easily created.

Really, the success of such initiatives in the watch industry will depend heavily on consumer acceptance. Will collectors, who often value the history and physicality of timepieces, embrace digital representations with the same enthusiasm? And how will the industry navigate issues of authenticity and provenance in a digital space? I have written about this already, so I will leave it with you to decide if you want to go deeper:

Enough small talk… Let’s dig in.

🎭 Where Do Culture Wars Take Us?

I recently watched this fascinating conversation, and it got me thinking about how we navigate our social landscapes. Here are the most intriguing ideas I gleaned from their discussion.

Luxury beliefs are the new status symbols

Henderson argues in our modern society, it’s no longer enough to flaunt material wealth. The truly elite now showcase their status through what he calls “luxury beliefs” - ideas that sound sophisticated but often come at a cost to others.

As an example, promoting polyamorous relationships might seem progressive, but it’s usually the well-off who can afford the emotional and financial fallout. In the watch world, the purest form of “buy what you like” seems to fit the bill quite neatly; for only the wealthy can amass a vault-full of shitters without a care in the world for resale value or the risk of becoming a social pariah.

Just as Henderson talks about luxury beliefs, we see a similar phenomenon among watch enthusiasts. It’s no longer enough to own an expensive or highly regarded watch; now, you need to have the ‘right opinions’ about watches too. “You appreciate Hublot? You must be a moron.”

Such beliefs often have little practical impact on timekeeping or collecting at all, but they do serve as a way to signal one’s “sophistication” within a community.

Your online world isn’t the real world

This seems obvious to you perhaps, but it isn’t to many. Have you ever felt like you’re the only person not liking a newly launched watch? That’s what Henderson calls “terminally online brain.” This is when you spend so much time in online echo chambers that you lose touch with reality.

I was struck by a study they mentioned: only 1% of social media users create most of the content, while 90% just lurk. So that outrageous opinion you saw trending might just be the vocal minority making all the noise. Again, we see this in the watch world all the time, until the ‘usual contrarians’ pipe up with honest criticism, only to be labelled ‘haters’ because the tribe wants to protect their own.

If you’ve ever spent time on watch forums or Instagram, you know how easy it is to get sucked into a “terminally online mindset” about watches. Suddenly, you’re convinced that everyone has a Journe, and your modest Speedmaster is practically worthless.

Remember that 1% rule? It really does apply here too. The folks posting multiple wrist shots a day aren’t representative of all watch owners. I have never seen a Journe ‘in the wild’ … ever. I have seen them at watch meet-ups, and I saw a handful at Dubai Watch Week, but that’s it. Most people are just quietly enjoying their watches without feeling the need to broadcast them to the world.

We are not built for this information overload

Here’s a sobering thought: our brains evolved to handle a small tribe’s worth of information, not a global news feed. No wonder we’re all feeling a bit frazzled.

They shared a fascinating tidbit about social media engagement. Apparently, using negative words in a post can increase engagement by 15%. It’s no wonder our feeds often feel like a doom scroll - negativity sells, but at what cost to our mental health?

With new watch releases happening with what feels like a weekly frequency, and these followed up with a constant stream of reviews and opinions, it is too easy to feel overwhelmed. I’ve found myself obsessing over the minutiae of so many watches I never wish to own, all because they are trending on social media - in my case, it helped to make memes about them and now, perhaps write about them. Still, it’s not ideal for the casual enthusiast!

This information overload can lead to analysis paralysis. I’ve known collectors who spend years researching their “perfect” watch, only to find that their tastes have changed by the time they’re ready to buy. This is not to say you should therefore rush in to purchase something, rather it is a suggestion to restrict the information you allow into your bubble, to prevent overload from ever being a concern at all.

The pronoun revolution started in a Twitter bio

Remember when you first saw pronouns in someone’s social media bio? Henderson does. He recounted his bewilderment at discovering this trend, which has since become mainstream.

This is a perfect example of how online phenomena can shape real-world interactions. Who would have thought that a few words in a Twitter bio could spark such widespread cultural change? Well, watch collectors know this all too well, don’t they?!

In-house movements were never a thing… until they were. Some of the most revered watches from Patek Philippe and Breguet are powered by ebauches - and yet, the allure of an in-house calibre seems to persist in the modern narrative.

Real conversations beat online arguments every time

One of the more powerful anecdotes from the conversation was about Henderson's experience with protesters at a university speech. Instead of dismissing them, he engaged in respectful dialogue and even invited them for further discussion.

This reminded me of the importance of face-to-face interactions. It’s easy to demonise someone online, but much harder when you’re looking them in the eye and hearing their story. The same applies in collecting, too. I learned this the hard way, given the crude nature of my Instagram account. Eventually, I had to face all the people I made fun of, and although this didn’t stop me doing what I do, it did help me take a more measured and objective approach over time, ensuring I could stand behind my comments even when having to explain myself in person.

Just as Henderson found value in face-to-face conversations with protesters, there’s something special about meeting fellow enthusiasts in person. I’ve attended watch meetups where online rivals became fast friends once they started chatting about their shared passion.

These real-world interactions often provide a much-needed reality check. That watch you’ve been lusting after online might look completely different on your wrist, and that’s something no amount of Instagram wrist shots can prepare you for.

We’re all susceptible to these trends

As I listened to Henderson and his interviewer discuss these societal shifts, I couldn’t help but reflect on my own behaviour. How many times have I formed an opinion based on my social media feed rather than real-world experiences? Admittedly, writing these weekly posts have helped me form a more rounded view, particularly as I am conscious of my words being ‘immortalised’ here for all to read later on…

It is, nevertheless, a humbling realisation, but an important one. We’re all swimming in the same cultural currents, and it takes conscious effort to step back and gain perspective.

On the topic of trends, I thought it was worth mentioning how easy it is to fall into the trap of collecting watches to impress others rather than for personal enjoyment. I’ve seen collectors become obsessed with acquiring the latest or the most hyped pieces, losing sight of what drew them to watches in the first place. This was easier when things were all trading above retail, but many continued the charade for fear of losing their status as the ones with the best access.

Remember, at the end of the day, a watch is a personal item. It should bring you joy when you look at your wrist, not stress about what others might think of your collection.

There’s hope in human connection

Despite the challenges of our digital age, the conversation left me feeling oddly optimistic. Yes, we’re facing unprecedented social and technological changes, but at our core, we’re still the same humans who crave genuine connection and understanding.

Whether it is engaging with protesters or simply having a heart-to-heart with a friend, real human interaction remains our best tool for bridging divides and fostering understanding.

When it comes to buying or trading watches, especially in the pre-owned market, character evaluation becomes crucial, and there’s no better way to do this than in person. I’ve learned to pay attention to how people communicate, not just what they’re saying about the watch. Are they patient with questions? Do they provide clear, honest descriptions? These traits often tell you more about the reliability of the transaction than the specs of the watch itself.

—

Anyway, this conversation was a great reminder for me. It can be easy to get caught up in online drama and lose sight of what really matters. Our watch collecting world isn’t immune to the societal trends Henderson discusses. By staying aware of these dynamics, we can navigate the hobby more mindfully. After all, watches should be about more than telling time; Ideally, we should make them about how we choose to spend our time.

The next time you find yourself caught up in online watch drama or obsessing over the latest release, take a moment to step back. Remember why you fell in love with watches in the first place. Your wrist - and your peace of mind - might thank you for it.

And who knows? Maybe the next time you see a heated online debate, you’ll be inspired to take the conversation offline.

That, I’m told, is where the real change happens.

🐐The Monty Hall Problem

So you’ve arrived at Geneva Watch Days. Your palms are sweaty, your heart races, and your wrist feels naked and bereft. You’re here on a mission to acquire that one watch which will elevate your collection from merely impressive, to truly legendary.

But wait! The suite of your favourite maison is offering a game; a chance to win one of three mystery watches hidden behind velvet curtains. Your synapses fire rapidly, your collector’s instinct tingles.

You make your choice, pointing with trembling finger to curtain number one.

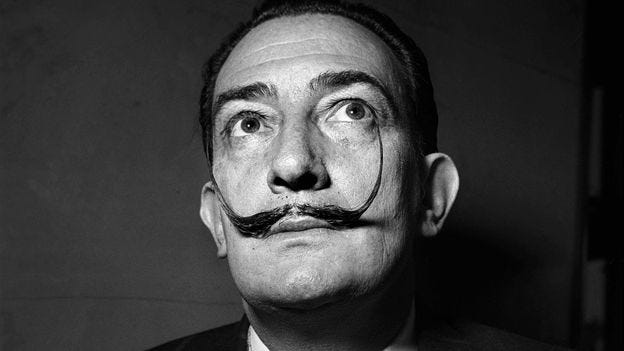

The booth attendant, a dapper gentleman with a waxed moustache that would make Salvador Dalí weep with envy, nods sagely. Now, just before he reveals your prize, he dramatically sweeps aside curtain number three, exposing... a Casio F-91W.

What. The. Fvck!

“But wait,” says Monsieur Moustache, his eyes twinkling with mischief, “would you like to switch your choice to curtain number two?”

And there you stand, frozen in indecision, as the weight of probability bears down upon you like a Cybertruck.

Welcome, my friends, to the Monty Hall problem.

Now, if you're anything like the vast majority of people, you’re probably thinking, “Switch? Why bother? It’s 50-50 now, right?”

WRONG!

If only you knew, how maddeningly wrong you are. In that wrongness, however, lies a lesson so profound, so counter intuitive, that it has the power to transform not just your watch collection, but your very approach to life itself.

The correct move here is to switch. Always switch. Switch like your life depends on it. By switching, you double your chances of walking away with that grail watch. Don’t believe me? Well, buckle up, buttercup.

When you made your initial choice, you had a 1 in 3 chance of picking the correct curtain. Simple enough. The probability that the prize is behind one of the other two curtains was 2 in 3. Now, when our mustachioed friend revealed the Casio he didn’t just eliminate a curtain – he literally condensed the entirety of the “2 in 3 probability” into the remaining unopened curtain.

Your initial choice never affects the other curtains – it affects you. You, with your limited human perception, your biases, your emotional attachments. You, who are now faced with a decision that flies in the face of everything your intuition is screaming at you.

Funny that. Isn’t it just like the world of watch collecting? How often have we found ourselves clinging to our initial assessments, our first loves, our vintage grails, even as the market shifts beneath our feet? The Monty Hall problem teaches us a valuable lesson: sometimes, the path to success lies in being willing to switch gears, to adapt, and to embrace the counter intuitive.

Consider the parallel to watches. How many times have you convinced yourself that the piece you managed to snag at retail is, definitively, the best of the bunch; even when the secondary market tells a different story? The illusion of choice is a powerful thing. Just as in our game, the real value may sometimes lie in what you overlooked, rather than in what you initially choose.

How about the psychology of rarity and perceived value? We watch collectors are a peculiar breed. We fixate on the limited, the exclusive, the hard-to-get. Yet, the Monty Hall problem reminds us that rarity alone does not equate to value. Sometimes, the real treasure is hiding behind that second curtain, overlooked and underappreciated.

Finally, let’s not forget the role of expert knowledge in our hobby. Just as understanding the Monty Hall problem gives you an edge in the game, so too does horological expertise give you an edge in the watch market. That said, even experts fall prey to confirmation bias. How many “expert collectors” have clung stubbornly to their initial assessments, refusing to switch even as new information comes to light?

The parallels are endless. The Monty Hall problem is a microcosm of the watch collecting world, a mini model of the decision-making processes we engage in every day. It teaches us about risk assessment, about the fallacy of sunk costs, about the importance of adapting our strategies in the face of new information.

Perhaps most importantly, it teaches us about humility. The humility to admit that our first instincts might be wrong. The humility to change our minds in the face of evidence. The humility to switch curtains, even when every ounce of our being is screaming at us to stay put.

The truth is, we don’t collect watches as rational investments. There’s an emotional component to this hobby that can’t be denied. Just as contestants in the Monty Hall game might stick with their initial door choice out of a misplaced sense of loyalty, collectors can let emotional attachments cloud their judgement. Maybe this is holding onto your first ‘serious watch’ long after it no longer suits your style or needs. Or perhaps you passed up an objectively better deal on a grail watch because you’ve developed a solid relationship with a different dealer. The Monty Hall problem reminds us of the importance of trying to separate our emotions from our decision-making process. It’s okay to love our watches – that’s why we collect them – but when it comes to making sound collecting decisions, a dose of Monty Hall-style rational analysis does go a long way.

The next time you find yourself at a crossroads in your collecting journey, remember the lessons of Monty Hall. Be willing to switch. Be willing to adapt. Be willing to embrace what seems to be counter intuitive. For in that willingness lies the potential for greatness, for discovery, for that one perfect piece that will make your collection truly sing.

📌 Links of interest

👮♂️ Counterfeit watch seller must pay £10,000 in legal fees in 28 days, after court orders forfeiture of 2,300 fake watches.

💀 Loss-making German pre-owned watch specialist Chronext, failed to attract investment earlier this year, prompting CEO Frederike Knop to tip the company into self-administration.

🦹♂️ Billionaire Sir Jim Ratcliffe says “I can’t wear a watch in London, and I just need to be a bit wary, a bit careful.”

🤡 This FAKE Rolex “Pepsi” Could Fool An Expert. (13 min video)

🔎 Crystal Clear: More Than You Ever Wanted To Know About The Watch Crystal by Tony Traina

🚀 Reservoir of liquid water found deep in Martian rocks - this is the first time liquid water has been found on the planet.

🍗 Chicago-area school worker who stole chicken wings gets 9 years 😂

🤬 Google, Meta hatched secret deal to target teens on YouTube with Instagram ads.

😲 When did the middle finger become offensive? Building on my Instagram story the other day. Thanks Eddy!

⛪ Gaza’s Historic St. Porphyrius Church Struck Again by Israeli Missile.

🍎 Apple’s AI Features Rollout Will Miss Upcoming iPhone Software Overhaul.

💉 The Five Big Drug Trends Defining Summer 2024.

🐮 One Misconception About 64 Different Animals: Cows have only one stomach, toads won’t give you warts, and sloths aren’t lazy.

❄ Air conditioning causes around 3% of greenhouse gas emissions. How will this change in the future?

🏢 Expert Explains the Hidden Crowd Engineering Behind Event Venues. (7 Min Video)

🏦 12 of the world’s most fascinating abandoned buildings. Croatian one is nuts!

🗣 Epic corporate jargon alternatives - this is hilarious! Open communication = Regular intercourse 😂

🎻 The Cellist of Auschwitz - A profile of Anita Lasker-Wallfisch, a Holocaust survivor who was nearly 100 years old at the time of writing.

😁 Lessons in financial economics from Seinfeld - You will love this - save it for a read with your morning coffee.

👽 Your Facial Features Gradually Change to Go With Your Name, Researchers Find.

⚠ Who Caused the Ukraine War? An excellent piece by John J. Mearsheimer - one worth reading if you still don’t understand why “Ukraine has effectively been wrecked.”

😐 She’s a Four-Time Olympian. Her Parents Want Her to Get a Real Job.

🪐 The Story of the Rings - From the Journal of Olympic History (This is a 33 page pdf with awesome images and stories - I considered summarising it, but honestly if you’re into history and the Olympics, this is a phenomenal find.)

End note

In case you missed any… here are a few posts since the last edition of SDC:

Today I’m not feeling particularly philosophical, so I’ll spare you the mumbo jumbo. This edition was, for me, the worst experience I’ve had to date with Substack. I returned from holiday to a fairly busy calendar, and realised I had to get this edition mostly done on Monday. So I did! By 6pm, it was topped and tailed, and ready for the addition of an end note and any extra links I might find on Tuesday. Then, as I went back into the draft to add a link, I saw it was all gone. Everything I had spent Monday working on, had simply vanished. Joy.

Substack has a ‘version history’ feature, but it seemed to have ‘lost its memory’ between 10am and 6pm on Monday. I didn’t spend 8 hours on the post, but I’d say it was 4 hours at least, with a break for meetings, food and the restroom. So there I was, staring at a near-blank screen, wondering what to do. Tuesday ended up being as busy as anticipated, but unsurprisingly, the second time around didn’t take as long as the first. I wouldn’t say I rushed this post, but I definitely had more footnotes in the first version, and to be quite honest, I am quite happy with how this turned out given the circumstances. So much for the holiday de-stressing. Anyway, “fvck your problems”, I hear you thinking… Fine. Fvck you too.

So I read this article the other day from Esperluxe , and it got me thinking. In the grand scheme of things, five years flies by. Reading that post, EsperLuxe would have us believe the past half-decade has been nothing short of a revolution in independent watchmaking. There’s no denying seismic shifts have occurred, but I reckon we ought to approach these sweeping declarations with a healthy dose of scepticism and a firm grasp of historical context.

The narrative he painted is one of meteoric rise, a golden age of indie horology bursting from the constraints of niche obscurity. And indeed, there’s some truth to to this. The auction results he’s cited are a matter of public record, and the increased presence of independent makers in major sale catalogues is indisputable.

But but but… Come on! We can’t forget the seeds of this ‘revolution’ were actually sown long before 2019. The likes of François-Paul Journe, Kari Voutilainen, and Philippe Dufour had been crafting horological masterpieces for decades, building reputations that would eventually catapult them into the spotlight. The groundwork laid by these maestros, coupled with the ceaseless efforts of early champions like Max Büsser and Felix Baumgartner, created the fertile soil from which the recent growth has sprung.

Esperluxe’s recounting of the market’s ascent during the pandemic years rings true, but to me, lacks context. The watch market, particularly at the high end, did not exist in a vacuum. As traditional avenues for luxury spending were curtailed by global lockdowns, many a deep-pocketed collector found themselves with surplus capital and a dearth of options for deploying it. The independent watch market, with its limited production numbers and growing cachet, presented an attractive proposition.

The current cooling of the market is presented here as a return to normalcy, a boon for the true collector. While there is some merit to this view, it perhaps underplays the potential for overcorrection. The flood of new makers entering the field, each vying for a slice of a pie that may not be growing as rapidly as before, is more likely to result in a saturated market where only the most exceptional or well-marketed pieces thrive.

Moreover, the comparison to the Quartz Crisis seems a touch glib! While it’s true we are not witnessing a wholesale decimation of the mechanical watch industry, the challenges posed by smartwatches and changing consumer preferences should not be dismissed out of hand. The mechanical watch, independent or otherwise, will continually need to justify its existence in an increasingly digital world. Anyone who disputes this probably has the middle name: Naïveté .

In the end, what we're presented with is a snapshot, a moment in time captured through a lens tinted with a rosy hue of hope and optimism. It’s a perspective worth considering, for sure, but one that should be weighed against the long arc of horological history and the capricious nature of luxury markets. I suppose I’d expect nothing less from a dealer of independent watches!

The true test of this ‘revolution’ will not be measured in five-year increments, but in decades. Will these new independent makers still be crafting their art in twenty, thirty, or fifty years? Will their pieces stand the test of time, both mechanically and aesthetically? Then and only then, can we truly speak a revolution in watchmaking.

For now, we can appreciate the creativity and craftsmanship on display, while maintaining a clear-eyed view of the challenges and uncertainties that lie ahead. The world of independent watchmaking is undoubtedly in a period of flux, but whether it’s an endless golden age or merely a glittering moment in time remains to be seen.

Until next time ✌

F

😊 Bonus: MY SOUL HAS A HAT by Mario de Andrade

I counted my years

& realized that I have

Less time to live by,

Than I have lived so far.I feel like a child who won a pack of candies: at first he ate them with pleasure,

But when he realized that there was little left, he began to taste them intensely.I have no time for endless meetings where the statutes, rules, procedures

& internal regulations are discussed, knowing that nothing will be done.I no longer have the patience

To stand absurd people who,

Despite their chronological age,

Have not grown up.My time is too short:

I want the essence,

My spirit is in a hurry.

I do not have much candy

In the package anymore.I want to live next to humans,

Very realistic people who know

How to laugh at their mistakes,

Who are not inflated by their own triumphs,

& who take responsibility for their actions.

In this way, human dignity is defended

And we live in truth and honesty.It is the essentials that make life useful.

I want to surround myself with people

Who know how to touch the hearts of those whom hard strokes of life

Have learned to grow, with sweet touches of the soul.Yes, I’m in a hurry.

I’m in a hurry to live with the intensity that only maturity can give.

I do not intend to waste any of the remaining desserts.I am sure they will be exquisite,

Much more than those eaten so far.

My goal is to reach the end satisfied

And at peace with my loved ones and my conscience.We have two lives

& the second begins when you realize you only have one.

Mario de Andrade (Saõ Paolo 1893-1945)

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

ADQ is a prominent sovereign wealth fund based in Abu Dhabi, United Arab Emirates. It was established in 2018 as Abu Dhabi Developmental Holding Company (ADDH) and rebranded to ADQ in 2020. This partnership marks ADQ’s first venture into the cultural sector, reflecting its strategy of diversification and commitment to bolstering arts and culture domestically.

In November 2022, Bremont announced that it had secured a £48.4 million investment from Hellcat LP, a fund managed by Bill Ackman’s Pershing Square Capital Management. This was a substantial injection of capital for the company, which at the time was reported to value Bremont at more than £100 million.

The investment was meant to fuel Bremont’s growth plans, including expanding its manufacturing capabilities in Henley-on-Thames and supporting its global expansion.

At the time, this was seen as a vote of confidence in Bremont’s potential and its strategy of bringing watch manufacturing back to British soil.

The Hellcat investment was a significant event for Bremont, as it provided substantial capital for a relatively young, independent watch brand. However, as the financial results we’re discussing show, the period following this investment has been challenging for Bremont.

Parmigiani Fleurier, founded in 1996 by Michel Parmigiani, embarked on an ambitious journey in the world of haute horlogerie. Like Bremont, they sought to distinguish themselves through technical prowess and in-house manufacturing capabilities.

In the early 2000s, Parmigiani Fleurier, backed by the deep pockets of the Sandoz Family Foundation, invested heavily in vertical integration. They acquired or established several specialised manufactures: Vaucher Manufacture for movements, Atokalpa for wheels and hairsprings, Elwin for turned parts, and Les Artisans Boîtiers for cases. This level of integration is rare even among much larger brands.

The result was a brand with extraordinary technical capabilities, producing exquisite movements and complications. However, this came at a cost. Parmigiani struggled to translate their horological excellence into commercial success for several reasons:

High production costs led to steep retail prices, limiting their market appeal.

The brand lacked the heritage and recognition of more established maisons, making it difficult to justify their price point to consumers.

Their design language, while refined, didn’t capture the zeitgeist in the way that some more successful independent brands managed.

The substantial overhead of maintaining their manufacturing capabilities weighed heavily on their finances.

For years, Parmigiani operated at a loss, sustained by the continued support of the Sandoz Foundation. It wasn't until a significant restructuring in the late 2010s, including a revamp of their product line and marketing strategy, that they began to turn the corner.

The parallels with Bremont are striking. Both brands invested heavily in manufacturing capabilities beyond what their sales volume could readily support. Both found themselves with technical achievements that didn’t immediately translate into commercial success. And both faced the challenge of competing with more established brands while carrying the weight of substantial manufacturing overheads.

It’s worth noting Parmigiani had the advantage of a patient, deep-pocketed backer in the Sandoz Foundation. Whether Bremont’s investors will demonstrate similar patience remains to be seen.

To provide some context for the 3000 MPa and 1000 MPa values, here are some relative comparisons:

Conventional steel: Typically has a yield strength between 200-250 MPa for mild steel, and up to 1000-1200 MPa for high-strength steel alloys.

Titanium alloys: Generally have yield strengths ranging from 800-1200 MPa.

Aluminium alloys: Usually have yield strengths between 200-600 MPa, with some high-strength aerospace alloys reaching up to 700 MPa.

Silicon: Pure, single-crystal silicon has a theoretical strength of about 7000 MPa, but practical strengths are much lower due to surface defects and processing limitations.

Ceramic materials: Can have compressive strengths ranging from 1000-5000 MPa, but are typically much weaker in tension.

Carbon fibre reinforced polymers: Can have tensile strengths ranging from 600-3000 MPa, depending on the specific composition and manufacturing process.

Human bone: Cortical bone has a compressive strength of about 170 MPa.

Concrete: Typical compressive strengths range from 20-40 MPa for standard applications, with high-strength formulations reaching up to 100 MPa or more.

Given these comparisons, the 3000 MPa mean strength and 1000 MPa minimum strength mentioned in the patent are super high, surpassing the strength of most conventional engineering materials.

Official AP policy.

I think they are ridiculous - but the company’s success proves there is a market for this, so who am I to argue with the free market?!

This initiative brings together some of the most prominent names in digital fashion and Web3 technology. The Council’s board reads like a who's who of digital fashion proponents, including Red Dao founding member Megan Kaspar, 3D artist Antoni Tudisco, and the founders of digital fashion platform DressX.

And this is the quick version? 🫠 Jeeeeeez

But thanks, great job :)

I spent whole morning (including links), soon I’ll just not have time for books :)

I don’t think anybody should overthink Underdog, watermelon for example is an extremely fun watch, just enjoy it (I would say it about more things in life though), especially in summer and with nice tan :D

Excellent article about Russian conflict, I wish more people could see this situation as it is (or I am biased hahah).

Another semi humongous kaleidoscope of a post!

Having gotten quite momentarily irritated just recently when composing a comment to this very same newsletter consisting of a few short paragraphs and somehow having it disappear just before I hit send , I can’t even begin to imagine the extent of your probable dismay at losing this entire and immense composition and having to re-do it! 🤯

Anyway the culture wars and poem/prose by Mario de Andrade touched me the most

Also, maybe because it’s late at night and brain is winding down for the day but I don’t understand the Monte Hall problem (yet) ….seems like it should still be just 50/50 😵💫😳