SDC Weekly 46; Psychological Pitfalls; Brain Hemispheres

Sotheby's stupidity, Wei Koh the investor, OnlyWatch (yet again), The 1916 Company for sale, More shade in Monaco, Rexhep Rexhepi's upcoming collaboration, and much more.

Welcome back to the SDC Weekly; insights, musings, and a dash of irreverence in the world of watch collecting.

This week, we’re exploring psychological pitfalls which may ensnare even the most seasoned collectors - courtesy of Howard Marks. We’ll also explore the fascinating interplay between the left and right hemispheres of our brains, and how embracing curiosity can lead to a richer, more meaningful horological journey. That’s not all – we’ve got updates on the latest auction shenanigans, a peek into the shifting fee structures at Sotheby’s, and a glimpse into other random bits from our ever-fascinating, sometimes frustrating, but always captivating hobby.

You can catch up on the older editions of SDC Weekly here. Remember, free subscribers receive the full newsletter via email - 2 weeks after publication - so if you’re not subscribed already, that’s a good reason to do so!

Small stuff

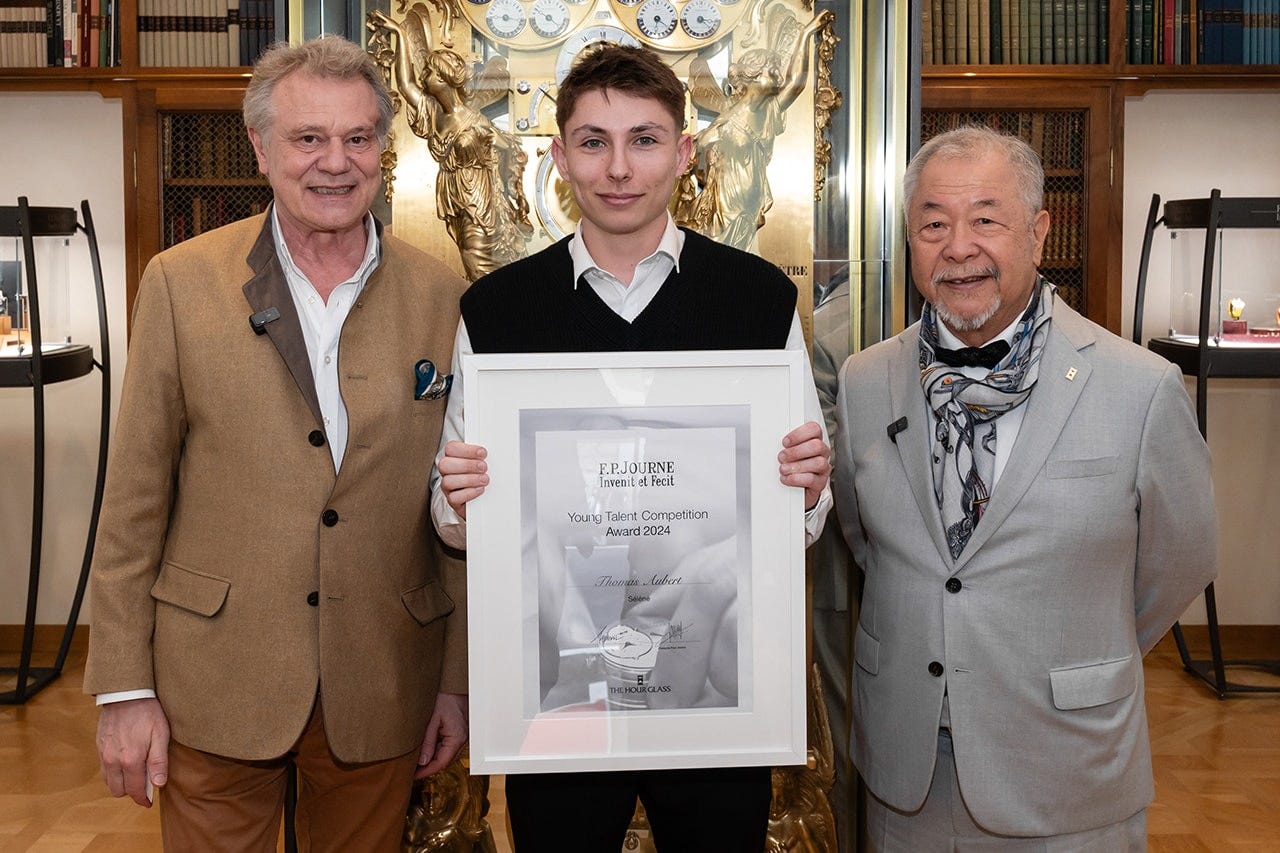

2024 F.P. Journe Young Talent Competition

Thomas Aubert, a 23-year-old graduate from the Lycée Edgar Faure Morteau school in France won F.P. Journe’s 2024 Young Talent watchmaking Competition.

His piece is housed in a 43mm stainless steel case, with a silver dial, partially intersected by a tourbillon. Apparently Aubert is into astronomy… He named the watch Séléné, after the Greek goddess of the moon, and his caseback depicts an engraving of the Pisces constellation. Read the full story here.

Wei Koh the fund manager

Fair warning… this is an unsubstantiated rumour, but I have it on good authority that Wei Koh is planning to start an investment fund to invest in independent watches. The ramifications of such a move would, I think, be worse than the usual “watch media company becomes an authorised dealer” BS which seems normal nowadays. It is one thing to publish puff pieces about watches or brands which are sold via your online shop. It is however an enormous spike on the conflict of interest barometer, to create a more formal financial investment vehicle to invest in the very thing which your personal media empire has the power to promote. Again, these are just rumours… and perhaps Wei knows better. Here’s hoping 🤞

Federation of the Swiss Watch Industry - March Update

Swiss watch exports experienced a significant setback in March 2024, falling by 16.1% year on year (YoY). The total export value reached 2bn Swiss francs, with China and Hong Kong contributing substantially to the overall decline. As a result, the first quarter of 2024 saw a 6.3% decrease YoY.

The downturn affected all product categories and price segments:

Steel watches saw a 28.2% drop in value and a 23.2% decrease in the number of units exported.

Precious metal watches dropped 11.6% in value.

Bimetallic watches fared slightly better, with a 6.6% decline.

Watches priced over 3,000 francs (export price) fell by 9.9%, and watches under 500 francs dropped 18.8% (MoonSwatch anyone?).

Most markets were impacted by weaker demand, with the United States (-6.5%), Japan (-3.5%), and the United Arab Emirates (-3.6%) being less affected than the average. China (-41.5%) and Hong Kong (-44.2%) on the other hand, experienced substantial declines, with China falling below its March 2020 level (when the sector basically shut down due to the pandemic).

Bloomberg covered it last week, and you can review more data here, here, and here - plus, WatchPro also has some commentary here and here.

Sartory Billard SB08

I don’t usually get into new watch releases, but this caught my eye because of a pdf document circulating about the new watch.

I have never seen an independent watchmaker put out a nerdy document to accompany a release, and I must applaud Armand and his team for taking the time to create it. Take a look for yourself:

Greubel Forsey update

Back in February, I shared a short update on Greubel Forsey. On Friday, Andy Hoffman posted a fresh article about GF. It turns out, they will not be scaling up to 500 watches per year as originally planned, and instead its looking like they will aim for ~ 250 pieces instead. As a fan of the brand, this is a relief. GF are also in the process of reducing the number of retailers from 22 to as few as 12, as they start opening boutiques in key markets. NYC and Japan are open, Dubai is a given… then perhaps Singapore, and a couple in China and a few more around the US… curious to see how they tackle Europe. Perhaps they should also consider Nigeria and/or Angola too?! African natural resource billionaires love a good flex. Keep an eye on Greubel in the coming weeks 😉

OnlyWatch… again 🤦♂️

This keeps coming up… despite discussing it several times, most recently with a recap from The Fourth Wheel which I posted here. Before I wrap this up for the final time1, here are some words from @Santa_Laura, shared with his permission:

Many individuals have inquired about my thoughts regarding the resurgence of OnlyWatch. Having reviewed their published audit report, I find it replete with gaps that raise further questions.

Their assertion of being on the brink of a cure appears wholly deceptive. They have only just completed phase 1 clinical trials for a therapeutic, whereas there are already multiple FDA-approved drugs available for the same disease using similar treatment methods.

Understanding OnlyWatch for what it truly is renders this moot.

OnlyWatch essentially serves as a platform for brands to showcase unique timepieces, and it is very evident that their primary motive for participating is not to benefit any worthy cause, but to gain exposure. This transforms the entire enterprise into nothing more than a vast - and from the brands' perspective - cost effective, marketing operation.

When I highlighted the shortcomings of OnlyWatch, numerous brand owners implored me to desist. It became evident that their interest in charity was superficial; the real attraction was always the exposure they gained. This industry is riddled with greed and corruption. Brands compensate bloggers to endorse and propagate falsehoods, completely undermining journalistic integrity.

My stance resulted in personal losses. Longstanding friends and associates chose to sever ties with me — relationships that were clearly, with hindsight, opportunistic. These Authorized Dealers (ADs) accepted my patronage willingly but distanced themselves when association with OnlyWatch became a liability, even if only temporarily.

While one may still appreciate the watches, it is increasingly difficult to respect the individuals behind these brands, and the bloggers that suck from their teats. For me, the allure of the industry is diminishing, though my appreciation for the craftsmanship of the watches remains unaffected.

Peace out

There is not much more to the story as far as I’m concerned. OnlyWatch is a fun event for watch collectors, and as Ali says above, it is a superb marketing opportunity for the brands involved. They submit a watch - and their work/brand is publicised far and wide, even featuring on Bloomberg and other MSM - coverage which some brands can otherwise only dream of getting, given their ‘cost’ is merely one watch.

This is all ‘in the name of charity’. Fine. The fact that Luc Pettavino stands to personally benefit if a cure is found via his shareholdings in the research companies which receive OnlyWatch money, appears to be glossed over by most. I don’t really care, as I don’t participate in these auctions and this doesn’t affect me. The point here is to make no mistake where this issue has closed out:

The OnlyWatch audit has not ‘cleared’ anyone of wrongdoing. It has simply confirmed the OnlyWatch books are supposedly in order2.

The shareholding of the companies which benefit from OnlyWatch funds, are majority owned by Luc Pettavino, and while there are policies to address the fact that he is not paid dividends and will not be paid dividends in the future, there is no mention of what might happen if the company finds a cure and his shareholding becomes incredibly valuable as a result of a cure being found.

Because these beneficiary/recipient companies are ‘one step removed’ from OnlyWatch itself, many are happy to just ‘go with it’ and carry on like all is well. Let’s be clear: it is not. For now, while there is no cure, Luc doesn’t seem to have improperly enriched himself and I am happy to go along with the idea that this is all being done in good faith, but there is clearly a potential conflict of interest being overlooked by most.

There has been no serious effort by Luc or OnlyWatch to actually offer full transparency. Why doesn’t Luc go the extra mile and publish shareholding information for SQY and other companies which get money from OnlyWatch? Then explain how this would be handled in the event a cure is fund. Why not place his ownership in a trust, which, in the event of a cure being found, will divert the OW money towards a different research cause such as Alzheimer’s or anything else? This whole issue started because of a lack of transparency, and for me, it has ended exactly as it started.

Meanwhile, SJX appears to be best mates with Luc, and burning bridges with all who disagree. Btw… Speaking of OnlyWatch - Patek dropped their piece on Monday… not bad I guess!

Auction shenanigans

This weekend at the Monaco Legend Auctions (MLA) Exclusive Timepieces event, John Goldberger’s watch achieved a record sum of €3,284,000 for a Rolex 4113 Split-Seconds Chronograph. Such a good result, even Bloomberg covered it. It is truly astonishing how Goldberger has any credibility given what has already been revealed about him:

In recent years, Goldberger, whose real name is Auro Montanari, has come under scrutiny after it became clear he had sold a totally made-up Frankenstein vintage Daytona in white gold featuring fake parts for USD 6 million, the infamous ‘Unicorn’. In addition, he also authenticated a number of fakes and made-up watches for a major auction house. It has also become a big question mark whether the watches said to be part of his collection are actually owned by him or if he is a just vehicle to lend provenance to watches that do not have any.

In fact the article I am quoting here, “When Monaco Gives You Lemons, Make Lemonade” explains how this record-breaking watch seems incorrect:

The article also discusses lot Lot 47, which is a frankenwatch Daytona which was sold despite the auction house being alerted to the fact the watch is incorrect - they opted not to updating the listing either. See the comments on this post for Monaco Legend Group’s sarcastic response:

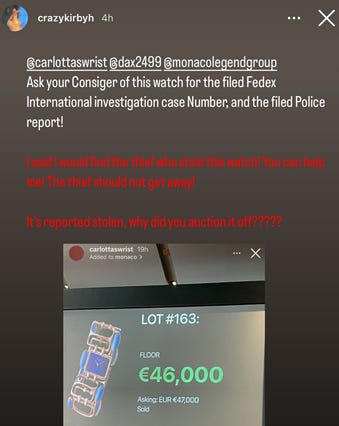

To make matters worse, it turns out MLA is also happy to auction stolen goods - here’s a story shared on Instagram about Lot #163 from the same auction:

A f*cking circus if you ask me.

ScrewDownCrown is a reader-supported guide to the world of watch collecting, behavioural psychology, & other first world problems.

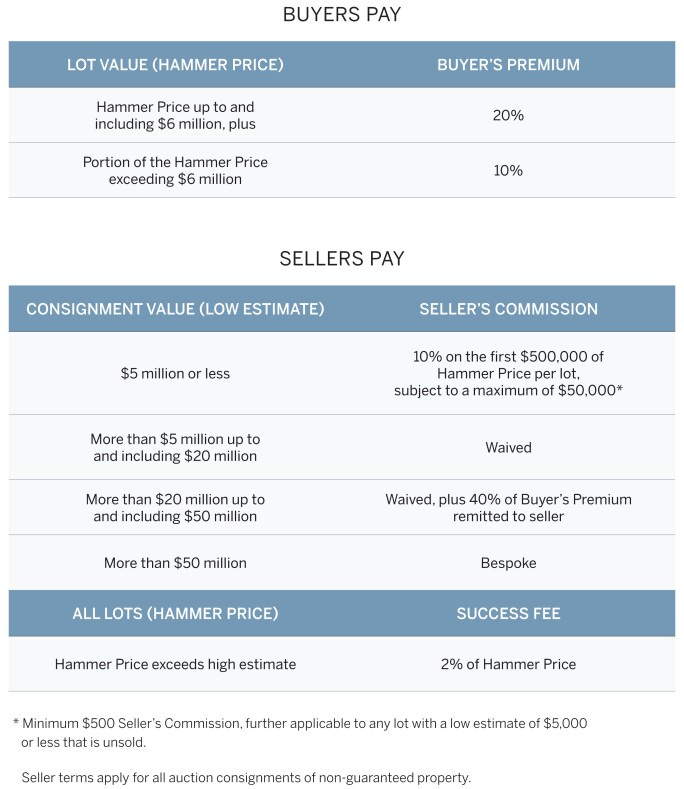

Sotheby’s fee structure

Speaking of circuses… Back in February, Sotheby’s announced a new fee structure:

This topic is doing the rounds again, probably due to the auction season ramping up.

What is happening? Two excerpts from their website:

The new rate will be 20% on purchases of a hammer value up to $6 million – and 10% of the portion of the hammer price above $6 million. An object that sells for $10 million, for example, will carry a 20% premium on the first $6 million and a 10% premium on the remaining $4 million…

Sotheby’s will introduce across all categories a uniform seller’s commission rate of 10% on the first $500,000 of the hammer price per lot. Sotheby’s will not charge a seller’s commission on the portion of the hammer price above $500,000 per lot…

Sotheby’s will waive the seller’s commission for consignments valued above $5 million low estimate.

Lastly, for consignments with a total low estimate in excess of $20 million and up to and including $50 million, sellers will receive 40% of Sotheby’s Buyer’s Premium in addition to the hammer price.

Sotheby’s is also implementing a new success fee of 2% on all lots where the hammer price exceeds the high estimate.

For guaranteed works, Sotheby’s will introduce a fixed guarantee commitment fee of 4% of the guarantee amount, chargeable to the seller, to align with this new structure.

What does this mean, in practice?

Watches are hardly the ‘stars’ of the auction world, so it is worth remembering we’re talking about a rarefied world which extends beyond watches; a world where Picassos and Warhols change hands for astronomical sums which far exceed what we’re used to seeing with watches. Still, as covered a few weeks ago, Sotheby’s ranks third amongst auction houses - this means they are not exactly a shining example which others might copy, nor are they such market leaders that their ‘brand’ will carry them through this change if it proves to be a shit idea (likely).

Let’s go back in time, to understand how this all began. This New York Times article from September 1982 discusses the then-controversial introduction of the buyer's premium by Sotheby’s and Christie’s (in 1975).

The buyer’s premium (charged to successful bidders) caused a 7-year dispute between the auction houses and dealer associations in Britain. The associations took legal action and the British government investigated potential collusion (they have since been paid hush money, apparently!3).

The fee (varied by auction house and country) ranged from 8-16%. It allowed auction houses to reduce seller’s commissions - from 12-30% down to 2-10%.

In resolving the dispute, Christie’s lowered its London buyer’s premium to 8% while Sotheby’s kept it at 10% in London and NY.

The practice spread to other major auction houses globally, and other houses like Phillips adopted a 10% buyer’s premium in the following years.

So why was this so surprising to everyone at the time? Turns out, prior to 1975, auction houses primarily relied on seller’s commissions to generate revenue.

In the early days of auction houses seller’s commissions were often negotiated on a case-by-case basis. Going Once: 250 Years of Culture, Taste and Collecting at Christie’s, documents how James Christie, the founder of Christie’s auction house (1766), typically charged a seller’s commission of 5% for most auctions. This seems to have been fairly standard for the time period.

Sotheby’s: Bidding for Class explains how, in the early years of Sotheby’s (mid-1700s), they charged seller’s commissions ranging from 2.5% to 7% - which is unsurprisingly aligned with Christie’s ~ 5%. By the early 1800s, Sotheby’s had established a standard seller’s commission of 10% for most auctions.

It wasn’t until 1958, when Peter Wilson became chairman of Sotheby’s, that they began to lower seller’s commissions to try and attract high-profile consignments. This put pressure on other auction houses to follow suit. This is a major point in the story - lowering seller’s commissions is how you get good stuff to auction, and how an auction house remains competitive.

By the early 1970s, competition between the major auction houses had driven seller’s commissions down to as low as 1-2% for high-value lots, which ultimately led to the introduction of the buyer’s premium in 1975 - as explained in the NYT article above. Why? The lower seller’s commissions were putting pressure on auction house profits, and they needed another way to make money!

Now that we understand the game - how does this apply to the Sotheby’s announcement from February? In practical terms, when someone buys a piece, they can look up the buyer’s premium in advance, and be aware they will be paying 20% or 25% above the hammer. When they bid £10,000, they know this means they are bidding to pay £12,000 or £12,500 “all-in”. It is straightforward, and the market will decide what something is ‘worth’ in accordance with these premia.

By reducing the buyer’s premium and raising the seller’s premium, what Sotheby’s have done, is reduce the likelihood of people bringing things to them to auction off. If you have a rare painting or watch to sell, why would you go to Sotheby’s instead of Phillips or some other auction house which will return more money to you?

Now you might be thinking, “sure, but Sotheby’s will still negotiate on a case-by-case basis” - according to people in the know, Sotheby’s are taking a view that these terms are non-negotiable, to the extent some consignors have already been turned away!

At this rate, they risk alienating the very people who supply the blockbuster lots which end up generating headlines and driving the market - we’re talking about the ultra-wealthy consignors who have come to expect sweet deals and white-glove treatment. In general, they can make or break an auction season with a single phone call, and most of these types are notoriously fickle. For them, the ability to negotiate a deal and ideally waive seller’s commission altogether is more a point of pride and a symbol of their clout, rather than actually saving cash. This idea of ‘standardising fees’ and removing a simple bargaining chip appears to be downright stupid.

Sure, the flipside of this argument might be they are making the auction process more ‘transparent and accessible’, so Sotheby’s could be opening up the market to a new generation of collectors who have been put off by the opacity and elitism of the old guard. This argument is weak, at best.

To date, not a single rival auction house has followed suit - recall from the history lesson, this was typically how it went down. This is not surprising to me, as they are probably tapping up all the pissed off clients from Sotheby’s. I think we’re witnessing a future b-school case study in the making, but this whole exercise still raises the question4: Why would Sotheby’s do this?

Well, in 2019 Sotheby’s was acquired by Patrick Drahi for $3.7 billion, and apparently he now finds himself in a debt hole. Unfortunately, this ill-advised move might just push him further into that hole!

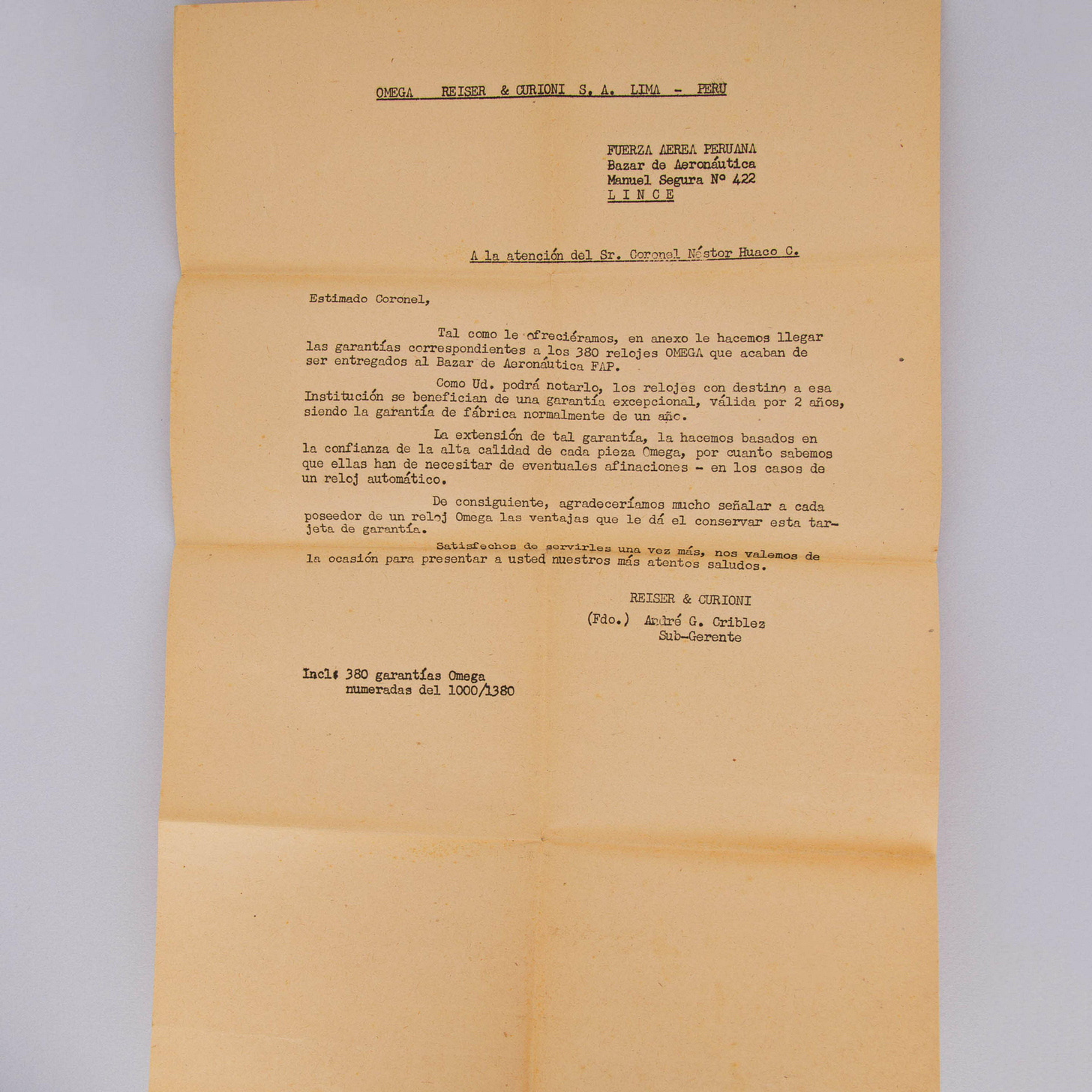

Rare Speedy at Auction

There is a particularly interesting Omega Speedmaster CK2998-3 for sale on LoupeThis via an auction ending on 26 April. Most interesting thing about this piece is the provenance, which includes the above letter from REISER & CURIONI SA, the importer for Omega in Peru. In this original letter addressed to Colonel Nestor Huarco at the Peruvian Air Force located at Bazar de Aeronáutica, the delivery of 380 Omega watches is confirmed, along with their guarantee certificates numbered 1000-1380.

How cool is that!?

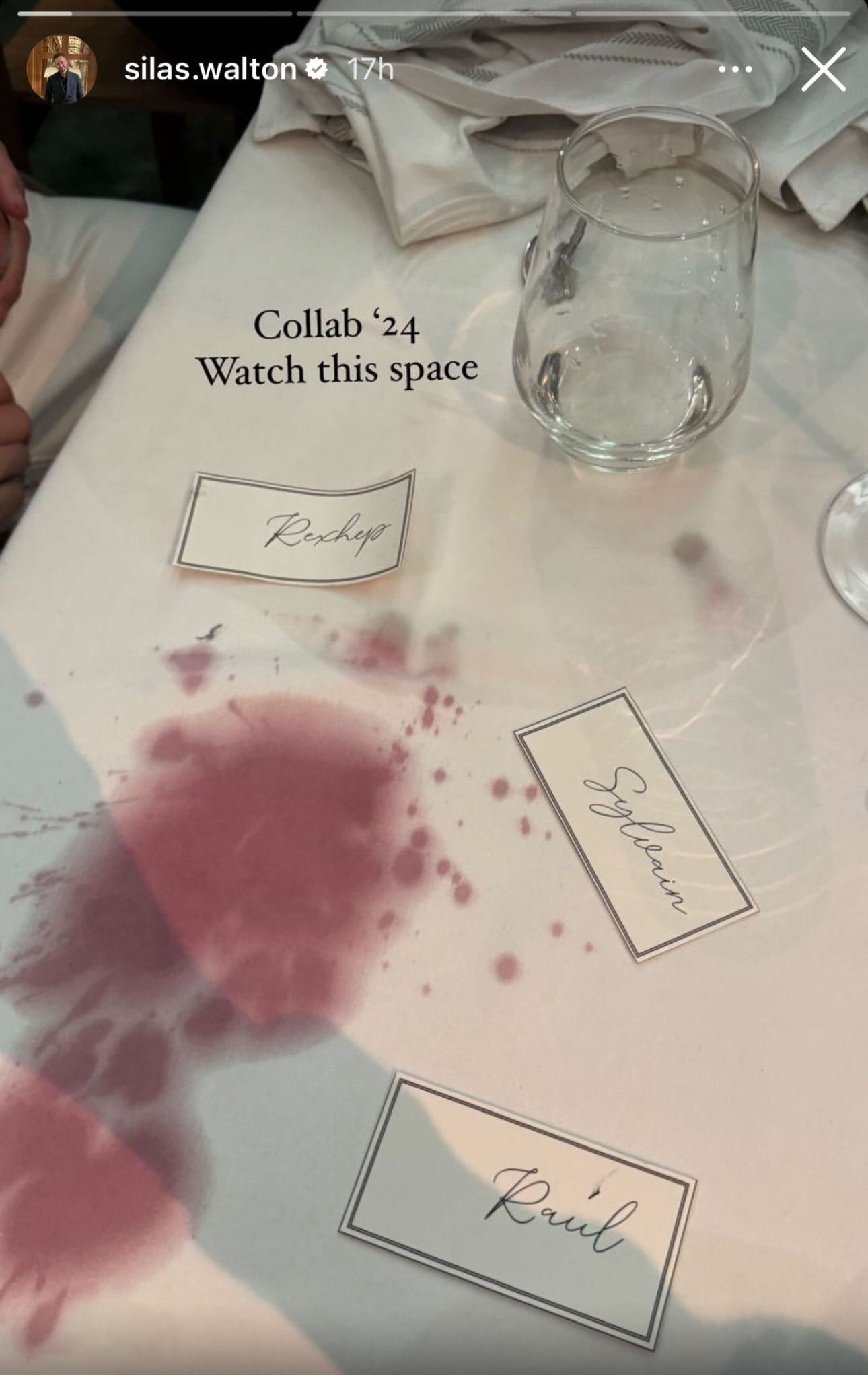

Rexhep, et al

Apparently we can expect to see a collaboration between Rexhep Rexhepi, Raúl Pagès and Sylvain Berneron - based on this story shared by Silas Walton of A Collected Man (ACM). Bear in mind, ACM is an authorised reseller for all three, so I’d guess this collaboration might be something Silas cooked up so ACM has exclusive distribution rights… 2024 he says? Should be fun!

Update (8 May 2024): Sylvain Berneron was an error. It should read Sylvain Pinaud! And apparently it isn’t happening yet, but there is some motivation to do something.

The 1916 Company for sale?

The luxury watch industry finds itself navigating turbulent waters, as several high-profile brands, retailers, and suppliers are seeking investors or buyers in a challenging economic climate. Just a few weeks ago, we discussed Parmigiani and Vaucher. The ones we haven’t touched on yet in SDC, are 1) the 20% stake in The 1916 Company belonging to Singaporean investor Chong Min Lee through his CMIA fund, and 2) Sowind5, the company which owns Girard-Perregaux and Ulysse Nardin.

As Miss Tweed reports, and as others in the industry have confirmed to me, The 1916 Company is supposedly valued at ~ $850 million and there is a 20 percent stake currently being marketed for sale. Pitch decks for this deal exist, although the valuation is probably going south with each passing week.

As for Sowind, the company claims to be stable and not looking for funding, but it is believed the CEO is covertly tapping up people for investment. No proof of this, other than the word on the street. Make of it what you will.

Enough small talk… Let’s dig in.

💡 Psychological Pitfalls to Avoid

Howard Marks is a famous investor, author, and co-founder of Oaktree Capital Management, a leading global investment management firm specialising in alternative investments. Born in 1945 or 1946 (?)6, Marks graduated from Wharton with a finance degree and later earned an MBA in accounting and marketing from the University of Chicago.

I found Marks through his insightful and thought-provoking memos, which explore a wide range of investment-related topics, including risk, market psychology, and the importance of second-level thinking. His memos have gained a large following within the investment community and are widely regarded as ‘must-reads’ for financial investors.

In addition to his memos, Marks has authored two books, and I’d like to dig into one of them: “The Most Important Thing: Uncommon Sense for the Thoughtful Investor” and run through a few psychological pitfalls he discusses in the book. He references them as pitfalls for ‘investors’ but they can just as easily apply to watch collectors in some cases.

Greed

There is nothing wrong with a desire to acquire valuable watches. Building a noteworthy collection clearly mandates the pursuit of high-quality pieces, and any active collector is, by definition, looking for timepieces that will elude most enthusiasts. It goes without saying, people who don’t care about watches generally don’t become watch collectors. A desire to own the best is healthy unless it becomes an all-consuming obsession:

“Greed is an extremely powerful force. It's strong enough to overcome common sense, risk aversion, prudence, caution, logic, memory of painful past lessons, resolve, trepidation, and all the other elements that might otherwise keep investors out of trouble. Instead, from time to time, greed drives investors to throw in their lot with the crowd in pursuit of the next big thing, and eventually, they pay the price.”

A healthy desire to pursue watches can transform into greed when the end goal is simply to accumulate pieces without any purpose. Admittedly, there is no warning light to signal you’ve reached the border between a healthy desire for a curated collection and outright greed. It is, however, fairly easy to slip into greed over time, especially once a collector has already put together a significant collection.

This is not something I have observed too often - except perhaps with people’s desire to own every colour-combination of Rolex sports watches - but how a person views and enjoys their collection can be clarifying in many ways. Nobody is immune to greed, though, and resisting it is probably a lifelong challenge for those fortunate enough to face it at all.

Willing Suspension of Disbelief

If you concoct a good enough narrative, many collectors will abandon logic and precedent.

We can go back to the Quartz Crisis, the dot-com bubble, NFTs, or the recent frenzy surrounding certain independent watchmakers for examples of the willingness of collectors to suspend their better judgment when they see prospects for easy money or acquiring the next big thing. The desire for the unobtainable will always exist, even for people who think they are not susceptible to such desires.

A key ingredient to get people to buy into a false narrative is some plausibility to the argument. If a prestigious brand, big collector, or well-loved watchmaker is involved, even better.

“It’s spun into an intelligent-sounding theory, and adherents get on their soapboxes to convince others. Then it produces profits for a while, whether because there’s merit in it or just because buying on the part of new converts lifts the price of the subject asset. Eventually, the appearance that (a) there’s a path to sure wealth and (b) it’s working turns it into a mania.”

When I read this explanation, it sounded like a perfect analogy for the watch bubble in recent years. Clever marketing and the desire for status created a situation where collectors were willing to suspend their disbelief in large enough numbers to inflate prices of certain watches.

Conforming to the View of the Herd

The desire of collectors to seek comfort in the warmth of a herd is probably one of the primary culprits responsible for how dysfunctional the watch market is. What is the real purpose of brand ambassadors or the practice of watch journalists all fawning over the same timepieces? This may sound cynical, but I think that the real reason all the BS media still gets any views at all is they give comfort to collectors… Comfort in the knowledge that if they adopt the view of the herd, they only ever risk being wrong in the company of most of their peers... who have the same view!

How about dealers vs collectors? Being wrong along with every other dealer won’t damage your reputation as a dealer. Contrast this with holding a non-consensus view - no matter how well-reasoned - that turns out to be mistaken. The problem in the watch market, is there there is no upside to be earned within the herd. Dealers must take non-consensus stands and be right more often than they are wrong, if they are to ‘unearth the next Journe’ or make serious money, rather than competing for scraps with other dealers. This causes the bigger dealers to take a non-consensus view, which they are incentivised to promote and perpetuate.

But then, you have collectors who also care about conforming to the herd. Despite the fact that discussing your watches is an optional decision, individuals are heavily influenced by so-called experts. If Tim Mosso is saying the Moser Streamliner is criminally underrated, and potentially the best sports watch he has seen in his career, the collector who owns it becomes less likely to openly criticise the watch because they risk looking foolish if their peers all hold Tim Mosso and his opinions in high regard.

So the dealers and industry players who have incentives to stay within the herd end up influencing individual collectors due to a mistaken respect for authority, and the collectors’ misguided respect ends up helping the non-consensus dealers’ perspectives become true. A good example is Mike Nouveau, a US-based dealer who has been pumping the heck out of Cartier - it works!

Envy

I wrote a whole post on envy here, but this was covered in the book so might as well mention it again! This problem has been amplified in recent years by social media. It used to be considered in poor taste to flaunt one’s wealth in public, yet, today, collectors regularly post photos of their latest acquisitions all over the internet.

Envy is a really stupid sin because it’s the only one you could never possibly have any fun at.

Charlie Munger

Now, this isn’t a bad thing, in and of itself… but as I wrote in the post linked above, it is incredibly challenging to withstand the poison of envy. As Marks states:

“People who might be perfectly happy with their lot in isolation become miserable when they see others do better. In the world of investing, most people find it terribly hard to sit by and watch while others make more money than they do.”

A simple way to alleviate your envy is to ask yourself whether you would trade places with someone who has more than you - with one caveat: you are not able to choose which aspects of their life you will take and which ones you will not.

For example, if you envy a famous collector because you want access to their vast collection, consider whether you also envy the fact that they are decades older than you and closer to the end of their collecting journey, and life!

Ego

Watch collecting can sometimes manifest as an arrogant act, especially once you move away from the herd. Once you curate a collection, the moment it ceases to be your own private pride and joy, and you decide to share it with the outside world… there is a risk of (mis)perception. There is some ego required to follow your own tastes despite how poorly they may be perceived by the herd. At this point, your taste and curation skills are in the limelight too. One could argue, a healthy ego is not even a handicap but in fact a prerequisite for successful collectors.

You might have heard of hormesis - in relation to physical consumption, it refers to substances which produce a positive response in low doses but end up causing harm in high doses. Ego is perhaps a psychological equivalent, in that a little bit of ego is healthy for any collector, but too much is surely toxic.

Fundamentally, however, it all comes down to to whether a collector keeps score inwardly, or outwardly. Do you collect primarily for yourself and rarely seek validation from others (inward), or do you find yourself sharing your collection and seeking regular validation from other collectors (outward)?

While there are limits to the concept of an inner scorecard in life, to the extent possible, it is important for individuals not to seek glory in their collections. After all, for most individuals, watch collecting is a means to personal satisfaction, not an end in and of itself.

Capitulation

A reminder - the book is about financial investing, and I am going out on a limb trying to apply it to watch collecting! This is not to say I advocate for watch investing - I absolutely do not… but we’re looking at this from a psychological standpoint so please view it as such.

“Markets can remain irrational longer than you can remain solvent.”

John Maynard Keynes

In a similar vein, watch markets can remain irrational for long periods of time, and many collectors cannot stand appearing to be “wrong” indefinitely. Especially for people who collect watches with others’ perspective in mind, the prospect of being perceived as having poor taste relative to their peers for multiple years can result in dumping pieces at the worst possible time. Even if you aren’t perceived as having poor taste, but you crave the approval of fellow collectors, you become more susceptible to ‘tending towards the herd’ and capitulating on your own preferences.

Conclusion

No one is immune to psychological influences. As a reader of this newsletter, these may seem obvious to you - but there are hordes of people who deny they are susceptible. For those new to collecting, it is safest to assume that all of the pitfalls will apply to you unless you prove otherwise (to yourself) over a sustained period of collecting.

🦝 A Hemispheric Perspective

As watch enthusiasts, we often find ourselves captivated by the intricate mechanics, rich history, and artistic beauty of timepieces. But have you ever stopped to wonder what drives your passion for horology? Could it be more than just a mere interest or hobby? According to Dr. Ian McGilchrist, the author of “The Matter with Things,” the answer may lie in the fascinating interplay between the two hemispheres of our brain.

McGilchrist’s work delves into the nuances of the brain’s left and right hemispheres, shedding light on how they shape our perception and interaction with the world around us. The left hemisphere, known for its narrow focus, language, and logic, acts like a junior analyst, while the right hemisphere sees the bigger picture, relying on emotion and intuition, much like, say, a seasoned hedge fund manager.

In the context of watch collecting, we can see these hemispheric roles at play. The left hemisphere allows us to appreciate technical specifications, or the precise engineering, or logical design choices behind each timepiece. It enables us to analyse and compare different watches, to understand their inner workings, and to engage in discussions about their features and performance attributes.

It is however the right hemisphere of our brans which truly brings our passion for watches to life. It connects us emotionally to the artistry, the craftsmanship, and the stories behind the watches we love. It allows us to see beyond the mere functionality of a watch and appreciate its beauty, its potential legacy, and perhaps its place in grand scheme of horological history - something which Hamza Masood shared with me last week!

What McGilchrist points out, is the world is becoming increasingly imbalanced towards the brain’s left hemisphere, leading to disconnection from our environment, our bodies, and each other. In the realm of watch collecting, this disconnection can manifest as an obsession with watch specifications and features, a focus on investment value rather than personal connection, or a lack of appreciation for the artisanal spirit that defines the world of horology. If you’d like to hear more, but don’t want to read his book, here’s a 100min video which might suffice.

To truly embrace the essence of watch collecting, we must embrace the right hemispheric impulse of curiosity. As Joseph Campbell famously said, “Follow your bliss and doors will open where there were only walls.” If we allow ourselves to be guided by curiosity, we open ourselves up to a rich bonanza of experiences, stories, and connections which make watch collecting such a rewarding pursuit.

Curiosity, as McGilchrist argues, is a relational force between you and your environment. It helps guide you into a unique niche, connecting you to the world in a way that feels intuitively right. In the context of watch collecting, this could mean exploring a particular brand, style, or era that resonates with you on a deep, emotional level. It could mean delving into the history and cultural significance of a specific timepiece or brand, or connecting with other enthusiasts who share your passion.

By embracing curiosity and allowing ourselves to be guided by our right-hemispheric impulses, we will tap into a deeper, more meaningful level of engagement with the world of watches. Sure, it is amusing to debate dial colours and water resistance specs with your mates in a WhatsApp group… but when we can appreciate the artistry, the craftsmanship, and the stories behind each timepiece, and once we connect with others who share our passion in a way that transcends mere technical specifications or investment value... that’s a whole new level. Quite frankly, I am personally still working on disengaging my left-hemispheric impulses - much more challenging than you’d think!

Anyway, the next time you find yourself drawn to a particular watch, take a moment to reflect on what drives your curiosity. Is it the left hemispheric impulse to analyse and compare, or is it the right hemispheric impulse to connect and explore? By embracing the latter, the theory suggests your passion for watches takes on a new depth and meaning..

In the words of Dr. McGilchrist, “Evolution’s solution to combinatorial explosiveness is curiosity.”

So, you know, embrace your curiosity… or whatever.

📌 Links of interest

👨🎨 The Life and Passion of Nathalie Jean-Louis, Artist, Hand Beveller and Movement Decorator.

🧭 Marine Chronometers, Lemons, Longitude, And Charles Darwin's High Body Count In 'Voyage Of The Beagle' by Jack Forster .

🤑 eBay rounds-up discontinued Rolex and Patek Philippe watches into a curated page.

⌛ Coordinated Universal Time (UTC) has repeatedly jumped one second to stay aligned with the Earth’s rotation. This leap second could be put on hold and even retired by 2035.

🥿 Crocs and Pringles’ Wild Collaboration - I thought this was the funniest thing since Hublot x Nespresso.

🤡 Bentley, Porsche, Rolls-Royce see sales plunge after mandatory green plate rule on company cars - this was interesting as it highlighted the signalling value of plates!

📉 Money is being pulled out of equities and junk bonds at the fastest rate in more than a year.

🧬 101 pieces of advice from Kevin Kelly. Some bangers in here - one teaser: The cheapest therapy is to spend time with people who make you laugh.

🎬 This trailer for Joker: Folie à Deux is only two and a half minutes, but in my opinion, a cinematic masterpiece! The ending, is just… sublime. Wow.

📉 15 Stocks That Have Destroyed the Most Wealth Over the Past Decade. Most surprising to me was Schlumberger, least surprising was Twitter.

🕵️♀️ Inside Amazon’s Secret Operation to Gather Intel on Rivals.

🙏🏽The narratives of shared biology and shared experiences are shown to strengthen psychological bonds with humanity at large.

🔋 New charging algorithm could double the life of li-ion batteries.

😬 What happens when you quit Ozempic?

⚓The invisible seafaring industry that keeps the internet afloat - IMHO, one of my most fascinating long-reads of 2024, bar none.

🐎 The surprising social structures which enabled the Mongols to conquer Eurasia. (50 min podcast)

☠ The Wikipedia fundraising scam.

🦞 An AI Salvador Dalí will answer any question when called on his famous lobster phone.

🙏 From coffee to birth control, here are 101 things we take for granted.

😇 One’s Better Half: Romantic Partners Function as Social Signals.

🤔 Why do people sometimes make their admirable deeds and accomplishments hard to spot, such as by giving anonymously or avoiding bragging?

😲 Bet you didn’t know: A buttload is an actual unit of measurement.

🤯 Over the course of this article Bartosz Ciechanowski explains how to expand a cube to the next dimension to obtain a tesseract – a 4D equivalent of a cube.

End note

In case you missed it… here’s a fun post from last week:

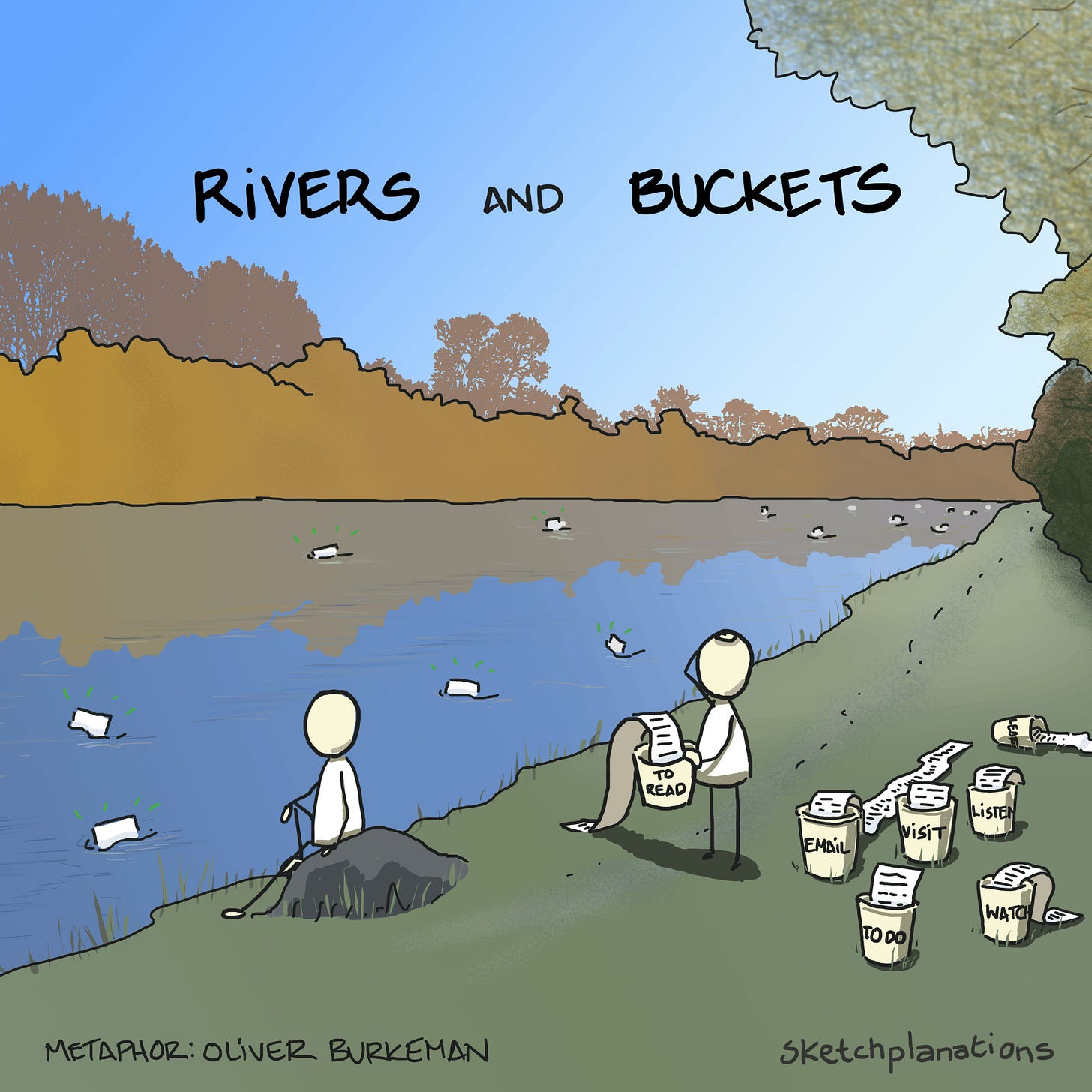

Over the last couple of months, I inundated myself with “stuff to do” … Podcasts to listen to, books to read, and articles to write… the ideas and aspirational topics were piling up, but there didn’t seem to be enough time to get through it all, despite my best efforts. Then, I came across this article, and it instantly helped me recalibrate.

The article addresses the common problem of feeling overwhelmed by the sheer amount of information, tasks, and aspirations we accumulate in our lives. It argues the issue isn’t a lack of good filters to separate the important from the unimportant, but rather an abundance of genuinely interesting and meaningful things competing for our limited time and attention.

Unfortunately, most advice on productivity and time management takes the needle-in-a-haystack approach instead. It's about becoming more efficient and organised, or better at prioritising, with the implied promise that you might thereby eliminate or disregard enough of life's unimportant nonsense to make time for the meaningful stuff. To stretch a metaphor: it's about reducing the size of the haystack, to make it easier to focus on the needle.

Fundamentally, though, just as we can’t possibly read every book or article that catches our interest, we also can’t pursue every project or fulfill every role to the extent we might like to.

The solution is to confront the reality: trying to do everything is simply impossible. This sounds simple, but perhaps I just needed to read it in these simple terms.

Instead of constantly seeking to optimise my time and productivity in an attempt to fit everything in, it was just a matter of deciding what matters most and focusing on those things, while accepting that other important things must be neglected.

The reframing of self-imposed tasks and aspirations as a river to be sampled from, rather than a bucket to be emptied, I found to be brilliant! A simple reminder that feeling overwhelmed by too many worthwhile pursuits is a natural consequence of having a rich and varied set of interests and responsibilities… not a personal failing.

Letting go of the impossible dream of doing it all, allowed for more intentional choices about where to direct time and energy, and peace in the knowledge that just like in watch collecting: you can never have enough, and you will never have it all.

If you find yourself feeling similarly overwhelmed, read that article for yourself - hope it helps!

Until next time,

F

PS. If you wanted to see all the Patek Rare Handcrafts, here are some pdfs:

🔮Bonus link: A Day in a Candle Factory

Pretty cool, although this factory seems a bit low-tech… a lot of the stuff being done manually appears to be work which can easily be automated. I watch these videos with my kid sometimes, and this helps amplify the ‘wonder’ of it all 😉

Believe it or not, that “❤️ Like” button is a big deal – it serves as a proxy to new visitors of this publication’s value. If you enjoyed this post, please let others know. Thanks for reading!

Famous last words…

For now, we shall overlook the unexplained change of auditors (a typical red flag), and the lack of sufficient digging to reach this hasty outcome of a clean bill of health.

This is a joke, to be clear.

Still can’t be sure if this BEGS the question - but I think not haha!

According to Miss Tweed: “Sowind shareholders include retailers Bucherer, now part of Rolex, The Hour Glass in Singapore and Ahmed Seddiqi & Sons in Dubai…None of them have been willing to confirm that they have invested in Sowind but many people in the industry have been gathering evidence that they have.”

Wow! You did it again! Enjoyed everything (very slow though this week🙈) !

May have to be back to 4D with fresh brains hahaha

And I find it fascinating how certain advice or idea finds you at the right time.

Thanks for the fantastic work you’ve done! 😌💃🏻

Fantastic read👏